HA-0885 - Percentage Worksheet13 - Monthly

advertisement

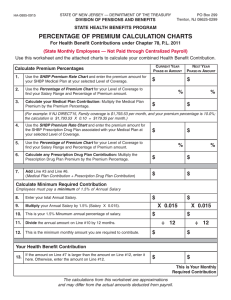

HA-0885-0912 STATE OF NEW JERSEY — DEPARTMENT OF THE TREASURY PO Box 299 Trenton, NJ 08625-0299 DIVISION OF PENSIONS AND BENEFITS STATE HEALTH BENEFITS PROGRAM PERCENTAGE OF PREMIUM CALCULATION CHARTS For Health Benefit Contributions under Chapter 78, P.L. 2011 (State Monthly Employees — Not Paid through Centralized Payroll) Use this worksheet and the attached charts to calculate your combined Health Benefit Contribution. Calculate Premium Percentages 1. Use the SHBP Premium Rate Chart and enter the premium amount for your SHBP Medical Plan at your selected Level of Coverage. 2. Use the Percentage of Premium Chart for your Level of Coverage to find your Salary Range and Percentage of Premium amount. 3. Calculate your Medical Plan Contribution: Multiply the Medical Plan Premium by the Premium Percentage. CURRENT YEAR PHASE-IN AMOUNT NEXT YEAR PHASE-IN AMOUNT $ $ % $ % $ (For example: If NJ DIRECT15, Family coverage is $1,375.85 per month, and your premium percentage is 10.0%; the calculation is $1,375.85 X 0.10 = $137.58 per month.) 4. Use the SHBP Premium Rate Chart and enter the premium amount for the SHBP Prescription Drug Plan associated with your Medical Plan at your selected Level of Coverage. $ $ 5. Use the Percentage of Premium Chart for your Level of Coverage to find your Salary Range and Percentage of Premium amount. 6. Calculate any Prescription Drug Plan Contribution: Multiply the Prescription Drug Plan Premium by the Premium Percentage. $ $ 7. Add Line #3 and Line #6. (Medical Plan Contribution + Prescription Drug Plan Contribution) $ $ $ $ % % Calculate Minimum Required Contribution Employees must pay a minimum of 1.5% of Annual Salary 8. Enter your total Annual Salary. 9. Multiply your Annual Salary by 1.5% (Salary X 0.015). 10. This is your 1.5% Minumum annual percentage of salary. 11. Divide the annual amount on Line #10 by 12 months. 12. This is the minimum monthly amount you are required to contribute. X 0.015 $ X 0.015 $ ÷ 12 ÷ 12 $ $ $ $ Your Health Benefit Contribution 13. If the amount on Line #7 is larger than the amount on Line #12, enter it here. Otherwise, enter the amount on Line #12. This is Your Monthly Required Contribution The calculations from this worksheet are approximations and may differ from the actual amounts deducted from payroll. HA-0885-0912 STATE OF NEW JERSEY — DEPARTMENT OF THE TREASURY DIVISION OF PENSIONS AND BENEFITS STATE HEALTH BENEFITS PROGRAM SHBP PLAN PREMIUM RATE CHART STATE MONTHLY ACTIVE GROUP MONTHLY RATES EFFECTIVE 1/1/2013 to 12/31/2013 PLAN/COVERAGE DESCRIPTION MONTHLY TOTAL MEDICAL PLANS AVAILABLE WITH PRESCRIPTION DRUG PROGRAM #203 AETNA FREEDOM15 #180(1) Single Member & Spouse/Partner Family Parent & Child $597.98 $1,195.95 $1,494.94 $896.97 NJ DIRECT15 - #150(1) Single Member & Spouse/Partner Family Parent & Child $592.06 $1,184.11 $1,480.14 $888.09 AETNA HMO #005) Single Member & Spouse/Partner Family Parent & Child $602.91 $1,205.82 $1,507.29 $904.37 HORIZON HMO #011(1) Single Member & Spouse/Partner Family Parent & Child $596.88 $1,193.76 $1,492.22 $895.32 PRESCRIPTION DRUG PROGRAM - #203 Single Member & Spouse/Partner Family Parent & Child $164.78 $329.56 $411.96 $247.17 MEDICAL PLANS AVAILABLE WITH PRESCRIPTION DRUG PLAN #205 AETNA FREEDOM1525 #063(2) Single Member & Spouse/Partner Family Parent & Child $581.23 $1,162.47 $1,453.09 $871.85 NJ DIRECT1525 #051(2) Single Member & Spouse/Partner Family Parent & Child $575.48 $1,150.96 $1,438.70 $863.22 AETNA HMO1525 #061(2) Single Member & Spouse/Partner Family Parent & Child $586.03 $1,172.06 $1,465.08 $879.05 HORIZON HMO1525 #053(2) Single Member & Spouse/Partner Family Parent & Child $580.17 $1,160.34 $1,450.43 $870.26 PRESCRIPTION DRUG PROGRAM #205 Single Member & Spouse/Partner Family Parent & Child $149.46 $298.91 $373.65 $224.19 HA-0885-0912 STATE OF NEW JERSEY — DEPARTMENT OF THE TREASURY DIVISION OF PENSIONS AND BENEFITS STATE HEALTH BENEFITS PROGRAM SHBP PLAN PREMIUM RATE CHART STATE MONTHLY ACTIVE GROUP MONTHLY RATES EFFECTIVE 1/1/2013 to 12/31/2013 PLAN/COVERAGE DESCRIPTION MONTHLY TOTAL MEDICAL PLANS AVAILABLE WITH PRESCRIPTION DRUG PROGRAM #206 AETNA FREEDOM2030 #064(3) Single Member & Spouse/Partner Family Parent & Child $546.55 $1,093.10 $1,366.38 $819.83 NJ DIRECT2030 #052(3) Single Member & Spouse/Partner Family Parent & Child $541.14 $1,082.28 $1,352.85 $811.71 AETNA HMO2030 #062(3) Single Member & Spouse/Partner Family Parent & Child $551.06 $1,102.12 $1,377.66 $826.59 HORIZON HMO2030 #054(3) Single Member & Spouse/Partner Family Parent & Child $545.55 $1,091.10 $1,363.88 $818.33 PRESCRIPTION DRUG PROGRAM #206 Single Member & Spouse/Partner Family Parent & Child $152.10 $304.18 $380.23 $228.15 HIGH DEDUCTIBLE HEALTH PLANS WITH BUILT IN PRESCRIPTION DRUG AETNA VALUE HD4000 #092(4) Single Member & Spouse/Partner Family Parent & Child $422.18 $844.37 $1,055.47 $633.27 NJ DIRECT HD4000 #090(4) Single Member & Spouse/Partner Family Parent & Child $401.93 $803.87 $1,004.84 $602.90 AETNA VALUE HD1500 #093(5) Single Member & Spouse/Partner Family Parent & Child $601.14 $1,227.30 $1,540.38 $914.22 NJ DIRECT HD1500 #091(5) Single Member & Spouse/Partner Family Parent & Child $571.12 $1,167.24 $1,465.31 $869.19 1)Subscribers in # 150,#180,#005, & #011are subject to $15 Primary Care and $15 Specialist office visit co pay and are eligible for Prescription Drug Plan #203 2)Subscribers in #051,#061, #53 & #063 are subject to $15 Primary Care and $25 Specialist office visit co pay and are eligible for Prescription Drug Plan #205 3)Subscribers in # 052,#062, #54 & #064 are subject to $20 Primary Care and $30 adult/$20 child Specialist office visit co pay and are eligible for Prescription Drug Plan #206 4)Subscribers in High Deductible Plans #90, #92, are subject to $4,000 In-Network deductible 5)Subscribers in High Deductible Plans #91 and #93, are subject to $1,500 In-Network deductible 6)For Subscribers in High Deductible Plans #093 and #091, employer will contribute $300 annually to Health Savings Account HA-0885-0912 STATE OF NEW JERSEY — DEPARTMENT OF THE TREASURY DIVISION OF PENSIONS AND BENEFITS STATE HEALTH BENEFITS PROGRAM PERCENTAGE OF PREMIUM CHARTS For Health Benefit Contributions under Chapter 78, P.L. 2011 Note: The following charts reflect the phaseͲin of contribution levels for employees employed on the contribution’s effective date who will pay ¼, ½, ¾ and the full amount of the contribution rate during the phaseͲin years. New employees hired on or after June 28, 2011, the effective date of Chapter 78, P.L. 2011, contribute at the highest percentage level (Year 4). HEALTH BENEFITS CONTRIBUTION FOR SINGLE COVERAGE (PERCENTAGE OF PREMIUM)* Four Year PhaseͲIn Salary Range Use dates indicated or as otherwise determined by contract Year 1 July 2011 to June 2012 Year 2 July 2012 to June 2013 Year 3 July 2013 to June 2014 Year 4 July 2014 and after less than 20,000 1.13% 2.25% 3.38% 4.50% 20,000Ͳ24,999.99 1.38% 2.75% 4.13% 5.50% 25,000Ͳ29,999.99 1.88% 3.75% 5.63% 7.50% 30,000Ͳ34,999.99 2.50% 5.00% 7.50% 10.00% 35,000Ͳ39,999.99 2.75% 5.50% 8.25% 11.00% 40,000Ͳ44,999.99 3.00% 6.00% 9.00% 12.00% 45,000Ͳ49,999.99 3.50% 7.00% 10.50% 14.00% 50,000Ͳ54,999.99 5.00% 10.00% 15.00% 20.00% 55,000Ͳ59,999.99 5.75% 11.50% 17.25% 23.00% 60,000Ͳ64,999.99 6.75% 13.50% 20.25% 27.00% 65,000Ͳ69,999.99 7.25% 14.50% 21.75% 29.00% 70,000Ͳ74,999.99 8.00% 16.00% 24.00% 32.00% 75,000Ͳ79,999.99 8.25% 16.50% 24.75% 33.00% 80,000Ͳ94,999.99 8.50% 17.00% 25.50% 34.00% 95,000 and over 8.75% 17.50% 26.25% 35.00% * Member contribution is a minimum of 1.5% of base salary towards Health Benefits HA-0885-0912 STATE OF NEW JERSEY — DEPARTMENT OF THE TREASURY DIVISION OF PENSIONS AND BENEFITS STATE HEALTH BENEFITS PROGRAM HEALTH BENEFITS CONTRIBUTION FOR FAMILY COVERAGE (PERCENTAGE OF PREMIUM)* Four Year PhaseͲIn Salary Range Use dates indicated or as otherwise determined by contract Year 1 July 2011 to June 2012 Year 2 July 2012 to June 2013 Year 3 July 2013 to June 2014 Year 4 July 2014 and after less than 25,000 0.75% 1.50% 2.25% 3.00% 25,000Ͳ29,999.99 1.00% 2.00% 3.00% 4.00% 30,000Ͳ34,999.99 1.25% 2.50% 3.75% 5.00% 35,000Ͳ39,999.99 1.50% 3.00% 4.50% 6.00% 40,000Ͳ44,999.99 1.75% 3.50% 5.25% 7.00% 45,000Ͳ49,999.99 2.25% 4.50% 6.75% 9.00% 50,000Ͳ54,999.99 3.00% 6.00% 9.00% 12.00% 55,000Ͳ59,999.99 3.50% 7.00% 10.50% 14.00% 60,000Ͳ64,999.99 4.25% 8.50% 12.75% 17.00% 65,000Ͳ69,999.99 4.75% 9.50% 14.25% 19.00% 70,000Ͳ74,999.99 5.50% 11.00% 16.50% 22.00% 75,000Ͳ79,999.99 5.75% 11.50% 17.25% 23.00% 80,000Ͳ84,999.99 6.00% 12.00% 18.00% 24.00% 85,000Ͳ89,999.99 6.50% 13.00% 19.50% 26.00% 90,000Ͳ94,999.99 7.00% 14.00% 21.00% 28.00% 95,000Ͳ99,999.99 7.25% 14.50% 21.75% 29.00% 100,000Ͳ109,999.99 8.00% 16.00% 24.00% 32.00% 110,000 and over 8.75% 17.50% 26.25% 35.00% *Member contribution is a minimum of 1.5% of base salary towards Health Benefits HA-0885-0912 STATE OF NEW JERSEY — DEPARTMENT OF THE TREASURY DIVISION OF PENSIONS AND BENEFITS STATE HEALTH BENEFITS PROGRAM HEALTH BENEFITS CONTRIBUTION FOR MEMBER/SPOUSE/PARTNER OR PARENT/CHILD COVERAGE (PERCENTAGE OF PREMIUM)* Four Year PhaseͲIn Salary Range Use dates indicated or as otherwise determined by contract Year 1 July 2011 to June 2012 Year 2 July 2012 to June 2013 Year 3 July 2013 to June 2014 Year 4 July 2014 and after less than 25,000 0.88% 1.75% 2.63% 3.50% 25,000Ͳ29,999.99 1.13% 2.25% 3.38% 4.50% 30,000Ͳ34,999.99 1.50% 3.00% 4.50% 6.00% 35,000Ͳ39,999.99 1.75% 3.50% 5.25% 7.00% 40,000Ͳ44,999.99 2.00% 4.00% 6.00% 8.00% 45,000Ͳ49,999.99 2.50% 5.00% 7.50% 10.00% 50,000Ͳ54,999.99 3.75% 7.50% 11.25% 15.00% 55,000Ͳ59,999.99 4.25% 8.50% 12.75% 17.00% 60,000Ͳ64,999.99 5.25% 10.50% 15.75% 21.00% 65,000Ͳ69,999.99 5.75% 11.50% 17.25% 23.00% 70,000Ͳ74,999.99 6.50% 13.00% 19.50% 26.00% 75,000Ͳ79,999.99 6.75% 13.50% 20.25% 27.00% 80,000Ͳ84,999.99 7.00% 14.00% 21.00% 28.00% 85,000Ͳ99,999.99 7.50% 15.00% 22.50% 30.00% 100,000 and over 8.75% 17.50% 26.25% 35.00% *Member contribution is a minimum of 1.5% of base salary towards Health Benefits