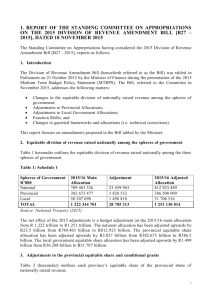

Annexure W1 - Explanatory memorandum to the division of revenue

advertisement