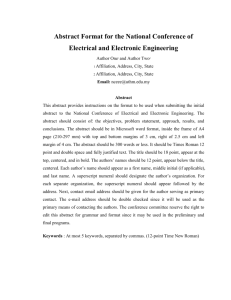

Roman Numeral Gold - Nationwide Coin & Bullion Reserve

advertisement

NATIONWIDE COIN & BULLION RESERVE presents GOLD SET TO SHINE AS DOLLAR FLOOD FUELS DOUBLE-DIP RECES SION JANUARY 2013 MISSING GOLD ROMAN NUMER AL COINS RECOVERED GOLD AMERICAN HEIRLOOMS SET FOR IMMEDIATE PUBLIC RELEASE Nationwide Coin and Bullion Reserve is pleased to announce the immediate public release of previously lost, Roman Numeral dated Gold American Eagles. These pieces of American treasure were thought for years to be gone forever. Shocking collectors across America, a forgotten vault in Florida was recently opened revealing some of the oldest dates from the Gold American Eagle series. These beautiful gold coins have proven to be some of the most lucrative and widely collected coins in American history. The first Roman Numeral dated coin was in 1907. If you had this 1907 Roman Numeral dated coin in grade PF69 today, it would be worth $2,990,000.00. Today, 1986 – 1991 Roman Numeral Dated, Gold American Eagles will be released for the incredible wholesale price of only $399.00 each. The profit potential of these low mintage, Roman Numeral dated coins is enormous. The key to having a highly profitable coin collection is to invest in the initial years of a highly collected coin series, at the right prices. The opportunity to own these gems at wholesale prices is unheard of in today’s market. For over three years, collectors have searched for these coins only to come up empty handed. That is until now! This offer will sell out immediately. Don’t delay. Call and speak with one of our coin specialists. Toll free 1 (877) 817-1220. THE MAGNIFICENT SEVEN Did you know, Roman Numeral dated coins have been minted only seven out of 218 years. The first being the 1907 $20 Double Eagle, the remaining 6 years are the beginning of the immensely popular Gold American Eagle series. The 1986 – 1991 Gold American Eagles are the only non-replica modern Gold coins to have the rare Roman Numeral dating. These beautiful works of art won every coin award in the world upon their inception. The creator, Augustus Saint-Gaudens depicts the front as the “Walking Lady Liberty”, the reverse pictures Father, Mother and Baby eagles, symbolizing unity of an American family. Truly unique. These are the only seven years these coins have been minted. For a short time they will be available to a select few who act now. Order now to avoid disappointment. These prices will likely never be seen again. Call now to order! FIVE REASONS TO OWN NOW REASON #1: Two of the most valuable coins in the world bear Roman Numeral dates. REASON #2: As gold prices skyrocket the value of these coins should also bring added value through their low mintage, design, and Roman Numeral dating. REASON #3: Roman Numeral dated gold has only been minted seven out of 218 years. This will probably be your last chance to own Roman Numeral gold. REASON #4: Low mintage and high numismatic value prevents confiscation of gold. REASON #5: These coins are graded by NGC, the top grading company in the world. Their seal of approval guarantees their grade and authenticity. The serial number on the certificate allows the coin to trade like stock, sight unseen. TOLL FREE 1.877.817.1220 • 24 HOURS A DAY, 7 DAYS A WEEK P-1 VF-30 XF-45 AU-50 MS-60 MS-65 MS-69 MS-70 COIN GRADING SCALE Poor, Barely recognizable Choice, Very fine Choice, Extra fine Almost Uncirculated Uncirculated Gem Uncirculated Superb Uncirculated (considered high-investment grade) Perfect (almost non existent) Roman Numeral Conversion Chart 1986 – MCMLXXXVI 1987 – MCMLXXXVII 1988 – MCMLXXXVIII 1989 – MCMLXXXIX 1990 – MCMXC 1991 – MCMXCI THE ROMAN NUMERAL DIFFERENCE Savvy investors and collectors understand that grade, quality, and key dates (low mintages) are critical for maximum profit potential when owning gold. Please refer to the chart below. Notice that while all these coins have done well, two of them stand out more than all the rest. The 1907 $20 Double Eagle with Roman Numerals in grade MS69 commands a price of $575,000, in grade PF69 an unbelievable $2,990,000 making it the fourth most valuable coin in the world. That is the Roman Numeral Difference. When this coin sold in November of 2005 it shocked collectors across the world. Now, two of the top ten most expensive coins bear Roman Numerals. It was then that the coin-collecting world knew having high grade Gold Roman Numeral dated coins in their portfolios was an absolute must. Collectors now diligently search everywhere looking for any coin bearing a Roman Numeral date. It seemed that word of Roman Numeral dated coins turning up would never happen again. Now, thanks to the constant efforts of the buyers at Nationwide Coin and Bullion Reserve a select few customers will have the opportunity to take part in the Roman Numeral Difference. Year 1905 1906 1907 1907 1907 1908 Type $20 Double Eagle $20 Double Eagle $20 Double Eagle $20 Double Eagle $20 Double Eagle $20 Double Eagle Grade MS63 MS63 MS63 MS69 PF69 MS63 Cost $3,850.00 $7,500.00 $25,000.00 (Roman Numerals) $575,000.00 (Roman Numerals) $2,990,000.00 (Roman Numerals) $2,250.00 WHY OWN GOLD? If you had purchased $25,000 of gold bullion coins in the early 70s and held on to it during the oil crisis, inflation, devaluation of the U.S. dollar, savings and loan scandal, recession, tech and internet bubble, cooked books, 9/11, and a real estate bubble you could sell that gold today for $524,999.00. If you had purchased $25,000 of limited mintage, certified, investment-grade gold coins over the same time line, you could sell that gold today for $1,377,257.00. That’s amazing. When comparing these two different investments it’s easy to understand why to own graded gold. But there is so much more. Nonnumismatic, un-certified, raw gold pieces are subject to confiscation by the U.S. government. In fact, it happened in 1933 under very similar conditions that plague our economy today. Numismatic gold was left in the hands of the public, while the bullion was ripped away. Also, longtime collectors understand that even when the price of gold drops, certified gold tends to hold its value. Why wait any longer. Order your low mintage, highly profitable Roman Numeral dated gold today. Call now to order! TOLL FREE 1.877.817.1220 • 24 HOURS A DAY, 7 DAYS A WEEK The Magical Investment Ben Bernanke Strategy “Master of Monetary Magic” A Golden The good ol’ greenback is still taking hits. To invest or not to invest, that is the question. Quantitative Easing 3 was announced on September 13th 2012. The Federal Reserve Board of Governors What separates wealthy, successful people from the rest of the general public? Well, one major voted 11-to-1 in favor of launching a new round of bond purchasing. Ben Bernanke, Chairman of the Federal difference is simply that a that large of the general public not invest any money at all. Reserve, launched a program willportion pump $40 billion per month intodoes the unstable American economy. No The fear of losing money is the major driving force behind most people’s lack of investing. If cap was put on QE3 spending. Bernanke will continue to push $40 billion out the door every month for the you were give the to average American a choice between receiving $50 per week and is$100 next… well,toaccording the press release from the Federal Reserve… indefinitely. This program goingper to week but with a 30-percent chance of receiving nothing each time, most people would take get very expensive. On the other hand, what is $480 billion dollars a year to the Master of Monetary Magic? The canwould conjurelose up money of thin air. He can do it The by merely rapping onmoney his hat the Great $50…Bernanke and they out onout a great deal of money. inherent fearhis of wand losing while saying a few magic words. Presto! The money appears and the Great Bernanke takes a bow. Magic is a major factor in people not having it. It takes an adjustment in thinking to overcometricks this are that, trickery. Even magic have get their somewhere. While the American fear.just Profits never increase in Bernanke a straightbills line andtodips andvalue pricefrom drops are buying opportunities. people attention to theapproach numeration of their dollars, The Great Bernanke was siphoning off their This is were howpaying successful people investing. dollars’ value. He shaved off a portion of every American dollar’s value and transferred it to QE3’s Bernanke Are No you a precious-metals or asavings precious-metals bills. sacred cows were spared, notinvestor, even retirement or college funds. trader? The rainy-day cash that There arehides twoinways dealfor insafe precious metals. first,Bernanke and most commonly known, way is to everyone their to homes keeping… well, The the Great found it! trade on the spot price of gold. Traders attempt to time the markets in order to buy high and sell The federal government devalues the dollar when they try to print their way out of financial problems. The U.S. low on bulk ThisOur is cherished an extremely firms, with currency is justgold, not assilver, rare asand whatplatinum. it used to be. dollardifficult only buysfeat. 80%Financial of the foreign currency entire teams of professional analysts, often misjudge the markets and suffer financial losses in that it did prior to 2007. A 20% loss is huge, but Bernanke isn’t finished with our dollars yet. the process. The dynamics involved in trading also tend to lead to some nasty financial habits. Emotional buyingofand short trading commonplace in the credit trading world. This The announcement QE3selling resultedand in Egan-Jones’ thirdare slashing of the our nation’s rating. The once mighty sovereign debt is now three points says that the Fed’seven third is why American trading has developed a reputation forbeneath being AAA highstatus. risk. Egan-Jones Some financial advisors round of quantitative easing, “hurt the U.S. economy and, by extension, credit quality. ” He added that, “In consider it to be a form of gambling. our opinion, QE3 will be detrimental to credit quality for the U.S.” No one wants to lend a nation money if it The second, and more devalues its currency beforesuccessful, repaying theway loan. to deal in precious metals is to be a precious-metals investor. Investors acquire and hold on to high-quality, certified precious-metal products for The hasCertified corruptedprecious many of the traditional methods Americans to metal’s store their assets, five Financial years orCrisis more. metals are valued for used morebythan just the intrinsic but physical gold has been the exception. Masterfully crafted gold coins have an intrinsic value that even value. When compared to bulk or bullion, certified precious-metal coins tend to hold their Bernanke’s magic hands cannot touch. The value of these coins is derived from their precious-metal content, value better during bear markets and see greater appreciation in bull markets. They also act condition, and rarity. Try as he might, Bernanke cannot make gold coins appear from thin air. as a natural hedge against inflation. Buying and holding rare, precious-metal coins for at least Bernanke conjuring up dollars to the tune of 40 billion per month. Our money’s value decreases every time five yearsis is the golden investment strategy. the Great Bernanke waves his magic wand. We all need to head for calmer waters by transferring a significant portion of our net worth into physical gold. The time to act is now! Call now to order! 1.877.817.1220. TURNER JONES VAULT MANAGER NATIONWIDE COIN & BULLION RESERVE