Collateral Haircuts & Market Value

advertisement

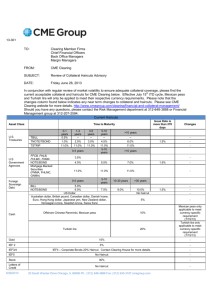

Collateral Haircuts & Market Value June 2009 Updated April 2012 A. INTRODUCTION In line with the Central Bank’s current monetary policy measures, it has become necessary to list and classify assets that are eligible to be used as collateral1 for the Bank’s lending facilities. Classifications of these assets shall be based on the risk profile of each. In addition, a haircut2 shall be applicable to the value of these collaterals in a bid to protect the Bank from the risks associated with holding them; notably market risk and credit risk of the issuer3. B. ELIGIBLE COLLATERAL Assets that are considered as being eligible collaterals against Bank’s lending, vary from instruments issued by the Bank itself to those issued by government and the financial institutions. Additionally, other assets such as balances due are also taken to be qualified. As mentioned above, classification of these assets is in three categories based on the risk profile, with category 1 having the lowest risks and category 3 the highest. Category 1 1.1 Deposit Auction Arrangement (DAA) 1.2 Central Bank Bills 1.3 Treasury Bills 1.4 Government Bonds and Stocks (Rupee denominated) Category 2 2.1 Securities issued by banks and other financial institutions (Rupee denominated) 2.2 Negotiable instruments approved by the CBS that are repayable within 180 days Category 3 3.1 Government Securities (Foreign currency denominated) 3.2 Securities issued by banks and other financial institutions (foreign currency denominated) 3.3 Negotiable instruments approved by the CBS that are repayable within 365 days 3.4 Balances due from financial institutions abroad (denominated in foreign currency) Whilst these assets may be used as collaterals against most lending facilities, categories 2 and 3 may not be used to back up any overnight to one week lending facility. 1 Collaterals are assets pledged by a borrower to secure repayment of a loan or other credit, and subject to seizure in the event of default. 2 A haircut is a percentage that is subtracted from the face value of an asset that is being used as collateral. 3 For the purpose of this paper, securities only refer to bills, bonds and stocks issued by government, Central Bank, commercial banks and other financial institutions. -1- C. HAIRCUTS & VALUE OF ASSETS a. Haircuts Since there are risks associated with the holding of an asset as collateral for the Bank, a haircut shall be applied to the value of the respective asset. This shall be a percentage of the asset value which must be deducted and shall depend on the level of risks related to the asset. Hence, taking into consideration the above assets classification, the following haircuts shall be applicable. Haircuts on assets eligible for collaterals Residual Maturities (months) Categories 0-3 4-6 7-9 10 - 12 0.0% 0.0% 0.0% 0.0% 1.1 0.0% 0.1% 0.3% 0.5% 1.2 0.0% 0.1% 0.3% 0.5% 1.3 Residual Maturities (years) 0-1 1-5 5 - 10 > 10 0.5% 1.5% 2.5% 3.5% 1.4 1.5% 3.0% 4.5% 6.0% 2 2.5% 4.5% 6.5% 8.5% 3 The Central Bank reserves the right to change the haircuts applied in order to reflect current market conditions. b. Value of assets Given the above, collateral will have a value which is equal to its market value minus a haircut. For the sake of this paper, the market value of an asset is the net present value (NPV) in the case of securities or the face value in the case of all other collaterals, prior to applying the haircut. Therefore, in the case of the securities, the haircut will apply on the NPV and not the face value and this will be inclusive of any processing fee or tax on the securities. D. MARKET VALUE OF SECURITIES a. Bills or securities with a maximum maturity of 365 days Market value of these securities to be used as collateral will be calculated using the latest respective T-bill rate. Market Value = V * [1 – (r * d/365)] Where; V = Face Value; r = latest T-bill rate d = Days to Maturity -2- b. Bonds To discount government bonds, the Bank will use the NPV function in Microsoft Excel as stated below. NPV (market rate, value1: valueN) The market rate is the rate of discount over the length of one period derived from the latest available respective market rate as compiled by the Research and Statistics division. A period is defined as the number of coupon payments made in a year. Say the coupon payment is made semiannually, then the market rate equals the annualised interest rate divided by 2. The values represent the cash flows (both interest and principal) throughout the remaining lifespan of the bond. These must be equally spaced in time and occur at the end of each period, in the correct sequence. Put another way, the NPV of the Bond equals the summation of present values of coupons plus the present value of the principal. The standard formula to calculate the NPV for both single and multiple coupon annual payments is as follows NPV of Bond = n Σ Ct / (1+r) t + (P n ) / (1+r) n t=1 for n >0 Where; Ct The cash-flow for period t; r is the market interest rate (for multiple annual payment r = the rate of interest divided by the number of payments within a year). n is the number of periods (number of coupon payments) left to maturity Pn is the principal value (or the remaining) of the bond As mentioned above, this shall be the market value of the respective Bond. -3- c. Stocks Likewise, the market value for Stocks shall equal its NPV. The NPV will be calculated based on the formula stated below: NPV of stocks = Present Value of coupon payments + + = C x 1-(1 + r)-m r Present Value of the Principal . P . (1+r)m Where; C is the estimated annual coupon payment; r is the current market interest rate; m is the remaining maturity years ; P is the principal value (or the remaining) of the bond. -4-