Guide for Collecting and Accounting for GST and PST

advertisement

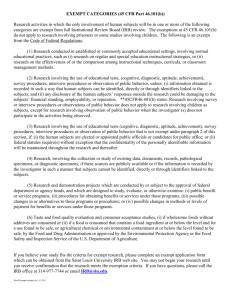

Guide for Accounting for GST and PST Introduction Ryerson University, like most individuals pays GST and PST on most of the goods and services that they buy. Ryerson University is also required to collect and remit these taxes to the Federal and Provincial governments from most of their transactions. Generally it is external transactions that will generate taxable sales. Infrequently an internal transaction may generate a taxable sale. If you have any questions regarding the taxable status of an internal transaction please contact the Senior Accountant in Financial Services. This guide is designed to provide general directions in how to deal with GST and PST. For questions regarding more complex issues relating to GST and PST, please contact the Senior Accountant in Financial Services. Table of Contents 1) GST 2) PST 3) Tax Table – GST and PST (Exempt/Taxable) 1) Goods and Services Tax (GST) Introduction The Goods and Services Tax (GST) is a federal tax that adds 5% tax to the value of taxable goods and services made available (consumed) in Canada. Any organization that provides taxable supplies in Canada and is not a small supplier is required to be registered for GST purposes. As a registered organization, Ryerson is required to charge and collect GST on all taxable goods and services that Ryerson University makes in Canada. The GST collected is then remitted to Revenue Canada on a monthly basis. Ryerson University belongs to a group of organizations known as the MUSH group – municipalities, universities, schools and hospitals. Members of this group are entitled to a partial rebate of GST paid on items purchased. Universities are eligible for a rebate of 3.35% (67% of 5%). The net GST cost to Ryerson is 1.65% (33% of 5%). Reporting GST Under Income Tax law, universities are classed as public institutions and special rules apply for the treatment of goods and services. The sale of most new goods is taxable and most sales of services are exempt. One should refer to the attached summary (Tax Table – GST & PST) to determine if the sale is 1 taxable or exempt. A sale may also be considered exempt based on the small trader status of the supplier. A supplier has that status if its sales of taxable supplies do not exceed thirty thousand dollars ($3,000.00) annually. In certain situations, GST is applicable but has not been assessed by the supplier. This is the case of foreign suppliers. Some foreign suppliers are registered and do collect GST. In addition, when goods, as distinct from services, are purchased from a foreign supplier, these items must pass through customs. Canada customs, acting as an agent for the Canada Revenue Agency (CRA), will assess and collect GST where appropriate. A copy of the invoice should be included with the shipment of foreign goods. Customs can then determine if the supplier has charged GST. If it is not clear, Customs will assess GST. This could lead to the university being charged GST twice on the same goods. Once a sale is found to be taxable, one must then consider the overriding exemption provisions found below to determine the sale remains taxable. Overriding Exemptions GST 1) The goods or services are exported outside of Canada. 2) The sale of Goods or Services to Provincial Governments and their recognized bodies (note: Federal and municipal governments will pay GST). 3) Sales are made for nominal consideration (Direct cost recovery) Nominal charge refers to an amount equal to or less than the direct cost of the goods and services purchased, less the GST rebate of 3.35%. Direct cost does not include administrative or overhead expenses or employee salaries incurred in providing taxable goods or services. If the goods and services are sold to recover the purchase price plus additional costs, GST will apply to the transaction. GST and Fundraising When the university charges admission to a fund-raising dinner or a like event, and part of the amount received represents a donation for which an official income tax receipt may be issued, the entire amount paid will be exempt from GST. Property or services supplied by the university in the course of a fund-raising activity (which excludes admissions to a gambling event) will be exempt provided that these supplies are not made available nor does the recipient receive these supplies on a regular or continuous basis throughout the year or for a large portion of the year. Admissions to gambling events (bingos and casino nights) are exempt if the University meets both of the following conditions. 90% or more of the administrative functions and taking of bets are carried out by volunteers; and 2 for a bingo or casino event, the games are not held in a commercial hall or any other place used primarily for gambling activities. If the university operates their own Bingo and Casino nights, they do not charge GST on the sale of Bingo cards or on bets taken during the event. If a commercial Bingo hall runs the event for the university, the admission fees will be taxable. GST and Research All goods and services purchased for a Research project will be subject to GST. Salaries paid to research staff or graduate students are not subject to the tax. GST will be paid on such items as travel, equipment purchases, consumable supplies and outside consultants (who have a GST registration number). 3 2) Provincial Sales Tax (PST) Introduction The Provincial Sales Tax (PST) can be referred to as the Retail Sales Tax (RST), the Ontario Sales Tax (OST) or the Ontario Retail Sales Tax (ORST). It is a consumer tax imposed on the purchaser (consumer) of tangible personal property and certain services, consumed within the Province of Ontario under the authority of the Ontario Retail Sales Tax Act (ORST). Tangible personal property is personal property that can be touched, seen, weighed, measured, or is perceptible to the senses. Provincial Sales Tax (PST) is a tax imposed by the provincial Government at the retail price level. As a holder of a vendor permit, Ryerson University is required to charge PST on taxable sales and remit these taxes to the province of Ontario Tax Rates 8% for most goods and taxable services 5% for transient (Hotels, motels, etc.) accommodation 10% for admission to places of amusement and sales of alcohol 12% for alcohol sold by the LCBO Types of Sales for PST Purposes Taxable Sales Generally, all goods (Tangible Personal Property) are taxable if they have a value of more than $0.21. Some services are also taxable: Labour to repair goods (tangible personal property) Admission charges over $4.00 (not amateur sports events and other events where the performers are not paid) Craft and trade show admissions (unless it has restricted access to certain groups like university exhibits where there is an invitation list) Exhibits or shows on campus Labour to dismantle a booth, store a booth, transport a booth outside or inside of Ontario Rental of equipment such as a forklift, airfare for installers going outside of Ontario Labour to install plumbing or electrical (charges must be separated on invoice) Parking - unless provided as part of accommodation rent in excess of 30 days. Transient Accommodation Exclusion to the definition of transient accommodation includes: Lodging supplied to students, patients, residents, or employees of educational institutions Lodging where the daily charge is less than $10.00, or the weekly charge is $70.00 or less. 4 Unconditionally Exempt Sales Goods, such as food products and those listed below, are unconditionally exempt under the Act. Purchases of these types of goods do not require an exemption certificate. Food products for human consumption – not confections or prepared foods Coal (includes barbecue coals and briquettes ) Coke (fuel) Wood Natural Gas Electricity Conditionally Exempt Sales Goods for resale and those listed below, are conditionally exempt under the Act. If a purchaser wishes to purchase these types of goods without the payment of PST they must prepare an exemption certificate indicating the reason why. This document must be submitted to the vendor with their purchase order. The vendor is then required to maintain the exemption certificate on file for possible future review by the Minister of Revenue of Ontario. Goods for “resale’ under vendor permit (G number) Books and publications purchased by universities Local telephone service if the charge does not exceed $0.25 Tangible personal property to be shipped by the vendor outside Ontario Newsletter and bulletins Works of art purchased by an art gallery 50% of the revenue provided by public donations Computer programs designed and developed to meet specific requirements In order for the goods to be exempt from PST, the acquisition must be made by the university and not privately such as by a staff or faculty member. Guidelines for the Purchase of Equipment for Research Purposes Exempt of the PST/ORST The following is the wording of the Ontario Ministry of Revenue of the Retail Sales Tax Act, Subsection 7 (1) 18 as it relates to exempt purchases by Ontario universities: “Equipment purchased by the governing body of a university that is designed for use, and is used exclusively in research or investigation, and repair parts thereof, but the exemption conferred by this paragraph does not apply to any equipment, or repair parts thereto, or labour to install such parts or equipment, where the equipment is used in the instruction to students, or to any type of class of equipment that is prescribed by the Minister to be excluded from this paragraph, or repair parts for such equipment, or the labour to install such equipment or repair parts.” The following is a general guideline relative to the wording of the act: 5 “…equipment (that is) designed for use and is used exclusively in research or investigation…” the term “designed’ is used in regulation 7(1)18 in reference to equipment for research and investigation, and is to be interpreted as “meant for use, or sold for that purpose”. EQUIPMENT IS INTERPRETED TO INCLUDE UTENSILS, INSTRUMENTS, APPARTUS AND EQUIPMENT ANCILLARY THERETO. ALSO INCLUDED IN THIS CATEGORY ARE: Glassware and plasticware Manufactured skeletons and like products Computers and related peripheral equipment, including terminals, printers, modems, etc. Audio and video tapes and diskettes Disposable items capable for reuse, e.g. glassware, Petri dishes, culture dishes and bottles, pipettes, weigh boats, etc. In general, laboratory items of a scientific nature, sold by scientific supply houses Note: Off-the-shelf software, whether sold under license or not, is subject to tax. Software specifically designed for and used in research by a university, would qualify for exemption. Custom and specialty software is subject to tax exemption under certain situations. Customization costs must equal or exceed the initial costs of acquisition. Repair parts for equipment designed and used exclusively in research, is interpreted to include articles and materials for use in the fabrication of research equipment. Items that do not qualify for exemption ANYTHING that is not used 100% in research. This means no mixed applications such as research and teaching Generally, any disposable or consumable supplies. Goods purchased without an end use certificate. (i.e. without a purchase order stating the end use is for exclusive use in research or investigation as per the ORST act.) Purchasing card acquisitions are all taxable unless you provide a purchase exemption certificate. Chemicals Gases Laboratory or office equipment Office equipment Computer supplies such as paper or toner General use equipment and supplies including photographic, audio visual Equipment or supplies used in any teaching or administrative activities Self-Assessment It is the responsibility of the collector of the tax to pay the government. However, when no PST is collected from the university it is the university’s responsibility to pay the tax. To do this you must “self-assess”. If an invoice indicates that no PST was charged where there should have been, you would either request a corrected invoice indicating PST or self-assess. Self-assess upon 6 making payment by applying the proper tax code. Some companies outside Canada are registered for GST and also collect Ontario PST. Their invoices should clearly indicate which taxes they collect. Exemption certificate for Scientific Equipment A blanket certificate is valid for four years or until cancelled, whichever occurs first. If a purchase order is issued, a “reference’ to the blanket certificate issued for the items, must be typed, written or stamped on the purchase order. If the purchaser is a vendor who in the future will be making additional purchases of the items listed below, the word “Blanket” should be inserted in front of the words “Purchase Exemption Certificate” at the top of this form and he will not be required to complete certificates for subsequent purchases of the same items. Internet Services and Sales Not subject to PST: Membership or subscription fees to access the internet Internet E-mail services Live chat or conferencing sessions directly on the internet Technical assistance or support over the phone, electronically, or even in person but not hands-on Web hosting services Real-time streaming video and/or audio Internet access fees do not attract the PST if they are charged and billed separately. Subject to PST: Telecommunications services provided to access the internet attracts the PST Rental of computer equipment and license fees are PST applicable When your invoice contains one fee or combined services fees then the entire invoice amount is PST applicable Web Page Design Services Web based design is not a PST applicable service unless there is an executable computer program within the site When there is an applet in the design, it is not considered an executable program because it needs a browser to interpret it, therefore it is not PST applicable When a web page has an executable computer program then the entire web page design is taxable. The charges cannot be split to avoid the PST. 7 Purchases via the Internet Taxable goods or services purchased or sold on the net are taxable if bought in Ontario, regardless of location. If you purchase the “right to use “a computer program downloaded from the internet, the fee is taxable. Some examples of programs are games, spread-sheet programs, word processing, data base and upgrades. Information acquired from the internet such as from an on-line encyclopedia or a reference library is not subject to the PST. Access to information is not taxable. 8 3) Tax Table – GST and PST To determine if a sale should contain GST or PST one must first consult the attached tax table (Tax Table – GST and PST), which lists both taxable and exempt supplies of goods and services for both GST and PST purposes. If the sale is taxable, one must consider the overriding exemption provisions listed above to again determine if it is exempt or taxable. A Accomodation Short term (less than 30 days) and over $20.00/day or $140/week Long term (30 days or over) with continuous occupancy Administration fees Admission to places of amusement and recreation, professional performances, etc. Alcoholic beverages Appliance rental Application fee Aptitude testing service Art supplies Athletics Memberships Compulsory fee included in tuition Other (staff, alumni, etc.) Audio Tapes Production (i.e., recording, editing, etc.) Duplication Audio visual equipment rental GST STATUS PST STATUS Taxable Exempt Taxable @ 5% regardless of cost Exempt Exempt Exempt Exempt Taxable Taxable Exempt Exempt Taxable Exempt Taxable @ 10% Taxable Exempt Exempt Taxable Exempt Taxable Exempt Exempt Exempt Taxable Taxable Taxable Taxable Taxable Taxable Taxable Exempt Taxable/Exempt Taxable Exempt Taxable Exempt Taxable Taxable Exempt Taxable B Beverages Binding service (varying PST rules apply, Phone for clarification) Books (published for educational, technical, cultural or literacy purposes and contain no advertising) Books (blank exercise books, catalogues, directories rate books, etc.) Books (used or donated text books) Building Materials 9 C GST STATUS PST STATUS Carrel Rentals Catering Certified Copy of Academic Documents Child Care Services Classroom Supplies Clothing Coin-Op Photocopier Services $0.20 or less per transaction greater than $0.20 per transaction Coin-Op Laundry Service Commissions from Vending Machines, Ticket Sales, etc. Computers Mainframe Rental Personal, sale of Supplies (papers, diskettes manuals, etc.) Confectionery Conferences (refer to GST Bulletin #8 for complete details) Consulting Services Convocation Fees Counseling Services Course Descriptions (Individual) Course Manuals Courses: Credit (refer to GST Bulletin #8 for complete details) Cover Charges Taxable Taxable Taxable Exempt Taxable Taxable Exempt Taxable Exempt Exempt Taxable Taxable Exempt Exempt Exempt Exempt Taxable Exempt Exempt Exempt Taxable Taxable Taxable Taxable Taxable Taxable Taxable Taxable Taxable Exempt Exempt Exempt Taxable Taxable Taxable Exempt Exempt Exempt Exempt Exempt Exempt Taxable Exempt Exempt Exempt Exempt Exempt Exempt Taxable Exempt Exempt Exempt Exempt Exempt Exempt Exempt D Damage Fees (student) Day-Care Services Desktop Publishing Service Diagnostic Testing Services Diploma Replacement Donated Goods 10 D (cont’d) GST STATUS PST STATUS Drugs, Prescription Duplicate T2202A Exempt Taxable Exempt Exempt Taxable Exempt Exempt Taxable Exempt Exempt Exempt Taxable Exempt Exempt Fax Services Field Trip Fees (course-related) Film Processing Service Where client brings in goods for production Where university originates, produces and Exempt Exempt Exempt Exempt Exempt Taxable sells goods to customers Fines (parking, library, etc.) Food Basic Groceries (bulk food sales) Student Meal Plans (meeting minimum dollar value) Snacks and prepared foods Other (restaurant meals, etc.) Fund Raising Dinners/events (varying tax rules, Phone for clarification) Taxable Exempt Taxable Exempt Exempt Exempt Exempt Taxable Taxable Exempt Taxable Taxable if Over $4.00 E Equipment Rentals Includes audio visual, laboratory, musical instruments Furniture, etc.) Eggs (basic grocery) Examination Scripts Exported Goods and Services Consumed outside Canada Consumed outside Ontario F Taxable/Exempt Taxable/Exempt G Giftware Gift Certificates Graduate Referral Service Taxable Exempt Exempt 11 Taxable Exempt Exempt G (cont’d) Graphic Art Service (varying PST rules apply, Phone for clarification) GST STATUS PST STATUS Exempt Taxable/Exempt H Health and Beauty Aids Taxable Housing Rentals Long-Term (30 days or over) with continuous occupancy Exempt Short-Term (under 30 days) Taxable Taxable Exempt Taxable I Ice Cream Single Serving Bulk (basic grocery) Ice Rentals (Athletics) ID Cards (Original and Replacements) Inter-Library Loan Service Internet Services Taxable Exempt Taxable Taxable Exempt Exempt Taxable Exempt Exempt Exempt Exempt Exempt Exempt Taxable Taxable Exempt Exempt Taxable Exempt Taxable Taxable Exempt Taxable Exempt Exempt Exempt Taxable Exempt Exempt Exempt Taxable Taxable/Exempt Exempt Exempt Exempt Exempt Exempt Exempt Exempt Exempt L Lab Analysis Service Lab Coats Lab Manuals Laminating Service Land Sales (generally taxable although tax rules vary, phone for clarification) Laser Printing Service (varying PST rules apply, phone for clarification) Laundry Services Laundry, Coin-Op Lecturing (on behalf of the University, not privately) Letters of Permission Library Overdue Book Fines Literature Searches Loans (financial) Locker Rentals 12 M GST STATUS PST STATUS Manuals – Lab, Classroom, Computer Mailing Labels Meal plans – Student (meeting minimum dollar value) Meat (basic grocery) Medical devices Meeting Rooms Long-Term (30 days or over) with continuous occupancy Short-Term (under 30 days) Milk (basic grocery) Taxable Taxable Exempt Exempt Exempt Exempt Taxable Exempt Exempt Exempt Exempt Taxable Exempt Exempt Taxable Exempt Taxable Exempt Taxable Taxable Exempt Taxable Taxable Taxable Exempt Taxable Exempt Exempt Exempt Taxable Exempt Exempt Taxable Taxable Taxable Taxable Exempt Taxable Exempt Exempt Exempt Exempt Exempt Exempt Taxable Taxable N Non-Credit Course Fees (refer to GST Bulletin #8 For complete details) O Office Supplies Overhead Transparencies Where client brings in goods for production Where University originates, produces and sells goods to customers P Parking For Resident Students All Other Patents Pet Diagnostic Services Pet Food Prescription Non-Prescription Pharmaceuticals Prescription Labeled for veterinary or agriculture use Photocopies If total charge is $0.20 or less If total charge exceeds $0.20 Photographic Services (also see Film Processing Service) 13 P (cont’d) GST STATUS PST STATUS Plants, Trees and Shrubs Printing Services (varying PST rules apply, phone for clarification) Where client brings in goods for production Where University originates, produces and sells goods to customers Psychological Testing Services Taxable Taxable Exempt Taxable/Exempt Taxable Exempt Taxable/Exempt Exempt Exempt Taxable Exempt Exempt R Recreational Instruction Primarily for those 14 years of age All Others Rentals, Equipment Audio-Visual, laboratory, musical instruments, furniture, etc. Research Contracts (refer to GST Bulletin #3 for details) Residence Fees, Student Right to use Computer Terminals Royalties Taxable Taxable Taxable/Exempt Exempt Exempt Exempt Taxable Exempt Exempt Exempt S Seminars (refer to GST Bulletin #8 for complete details) Skate Sharpening Service Slide Production Where client brings in goods for production Where University originates, produces and sells goods to customers Custom designed, single copy Produced and sold in quantity Space Rentals, Room Rentals Long term (30 days or over with continuous occupancy) Short term (under 30 days) Sporting Goods Statement of Attendance Stationery Subscriptions for magazines, journals, & similar publications Survey Research Services 14 Taxable Exempt Exempt Taxable Exempt Taxable Taxable Exempt Taxable Taxable Exempt Taxable Exempt Taxable Taxable Taxable Taxable Taxable Exempt Exempt Exempt Taxable Exempt Taxable Exempt Exempt S (cont’d) GST STATUS PST STATUS Swimming Pool Rentals Taxable Exempt Exempt Exempt Taxable Exempt Exempt Taxable Taxable Taxable Exempt Exempt Exempt Exempt Exempt Taxable/Exempt Exempt Taxable Taxable Taxable Exempt Taxable Exempt Exempt Exempt Taxable Taxable Taxable Exempt Exempt Exempt Exempt Exempt Exempt Exempt Exempt T Telephones Line and Equipment Rental Direct cost recovery for personal by staff, faculty Tickets To amateur performances or competitions To professional performance or competitions Towel and Gym Apparel Rental Transcripts Typesetting Services (varying PST rules apply, phone for clarification) U Used Goods Sale of goods previously used in non-commercial Operation, academic dept’s Sale of goods previously used in a commercial operation such as hospitality services V Veterinary Services Veterinary Supplies Video Tapes Production Duplication W Website Design Wool Word Processing Service Writing Services 15