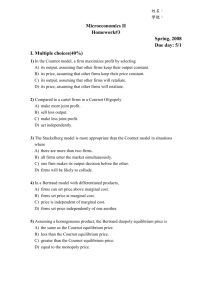

7.entry exog sunks

advertisement

Entry Games in Exogenous Sunk Costs Industries (Sutton, Chapter 2) Structure-Conduct-Performance Paradigm: Models one-way chain of causation Concentration to Performance, treating Conduct as a ‘Black Box’ New Industrial Economics: 1) Explicitly models Conduct 2) Allows for market structure to be Endogenous What determines market structure? Sutton (1991) – predictions that generalise across a broad range of industries “Benchmark”: which As MS Traditional Limit Theorem , The Equilibrium Concentration 0 1 Thus, MS C4 f in a negative way C4 MS Traditional Limit Theorem holds in Perfectly Competitive Framework, & thus assumes 1) no strategic interaction 2) only exogenous barriers to entry 2 Entry: Exogenous Sunk Costs Two stage game Stage 1 Long Run Entry Stage 2 Short Run P(N) The Entry Decision is a Backward Induction Procedure Modelling the P(N) function, Stage 2: The P(N) function links price cost margins to a given N P, for any given N, depends on how one models competition (or the ‘intensity of competition’) We modelled this in the earlier lectures for Homogenous Bertrand and Cournot (see lecture on static oligopoly), for Joint Maximising (see early part of lecture on dynamic oligopoly), and for Bertrand Horizontal Product Differentiation (see Salop 1979 circular road model in horizontal product differentiation model) 3 Modelling Entry, Stage 1: Enter with exogenous sunk cost Entry occurs as long as the expost entry profit > sunk costs of entry Last firm enters where expost entry profit = 4 Bertrand Homogenous Competition with Exogenous Sunk Costs Stage 2: Modelling Bertrand Homogenous Good Competition: Result P = MC for N 2 (see lecture on static oligopoly for more detail…. ) N = 1 Pm N > 1 P = MC m = Stage 1: First Firm enters, so long as m > 0 Second Firm? Expost entry = 0 (when N = 2), thus < Therefore, a second firm will not enter Equilibrium number of firms Homogenous Bertrand: N* = 1 under 5 Cournot Homogenous Competition with Exogenous Sunk Costs Stage 2 S or P Q S P Q Let N Q q Nqi i (identical firms ) or qi i 1 Q N i P qi cqi i P P qi c 0 qi qi P P c 0 N N P* c N 1 qi* Therefore , so c 0 Q N Thus, and S Q2 P Q S 1 S N 1 . . N P N c N2 i* ( P c ) qi c. i* N S N 1 c . . N 1 c N2 S N2 P falls with the number of firms in the industry, but at a decreasing rate Profits rise with the size of the market, and fall with the number of firms in the industry 6 Stage 1: i N* S N 2 (or i 0) S The equilibrium number of firms increases with the level of S/, but at a decreasing rate…. Concentration = 1/N The equilibrium concentration is inversely related to market size S relative to sunk costs . 7 Summary of Short Run relationship Price cost mark-ups and the number of firms in the market, i.e. the P(N) function, for homogenous goods P pmonop Joint Maximising Homogenous Cournot Homogenous Bertrand MC 1 2 N P, for any given N, depends on the ‘intensity of competition’ Bertrand is most intense, while Joint maximising least intense 8 Summary of Long Run relationship between market concentration (1/N) and market size S relative to exogenous sunk costs , for Homogenous Goods C 1 N Bertrand (t0 = 0) 1 Cournot Joint Maximising S For a given S/, the equilibrium level of concentration increases with the intensity of competition For a given intensity of competition, the equilibrium level of concentration falls with an increase in Market Size relative to sunk costs 9 Bertrand Competition for Horizontally Differentiated Products with Exogenous Sunk Costs (*see Salop 1979 circular road model – include as part of this lecture) Stage 2: (Assume N firms located symmetrically about a circle of circumference, distance between sellers is 1/N, zero cost): P t N Result is , where t is the (exogenous) per unit cost of distance travelled. Thus, as t 0 p MC while as N p MC i.e. P falls with the number of firms in the industry, but at a decreasing rate 10 Stage 1: i t s 2 N Thus, solving for equilibrium number of firms: N* t s The equilibrium number of firms increases with the level t, but at a decreasing rate…. The equilibrium number of firms increases with the level of S/, but at a decreasing rate…. Equilibrium concentration is inversely related to market size S relative to sunk costs 11 Summary of Short Run relationship Price cost mark-ups and the number of firms in the market, i.e. the P(N) function, for Horizontally Differentiated goods p t2 > t1 > t0 pmonop Differentiated Bertrand: t2 Differentiated Bertrand: t1 MC Homogenous Bertrand: t0= 0 1 2 N P, for any given N, depends on the ‘intensity of competition’ Product Differentiation Relaxes the intensity of price competition 12 Summary of Long Run relationship between market concentration (1/N) and market size S relative to exogenous sunk costs , for Horizontally Differentiated Goods C 1 N Homogenous Bertrand (t0 = 0) 1 t2 > t1 > t0 Differentiated Bertrand (t1) Differentiated Bertrand (t2) S Greater product differentiation induces more entry (so less concentration) for any given s/ For a given S/, the equilibrium level of concentration increases with the intensity of competition For a given intensity of competition, the equilibrium level of concentration falls with an increase in Market Size relative to sunk costs 13 Exogenous Sunk Costs Traditional Limit Theorem: (–) MS C New Game Theoretic Modelling: (–) (+) MS C , I Note that only a Lower Bound to the equilibrium level of concentration is predicted by the theory. Concentration may be above the predicted lower bound – depending on the specifics of the industry e.g first mover advantage…… 14 Note that while in the short-run, an industry may fall below the lower bound to concentration, this is not possible in the long run. For any given market size relative to sunk costs, if concentration is below the predicted lower bound this implies that there are too many firms in the industry. Prices are not high enough to sustain a normal rate of return on sunk costs incurred. This results in the forced exit of firms, or mergers/acquisitions – thereby reducing N and increasing concentration levels back up to (or above) the predicted lower bound 15 The Salt and Sugar Case Studies (Sutton, Chapter 6) Objective: examine the long run evolution of market structure for the salt and sugar industries using theoretical framework above. Both Salt and Sugar industries were initially highly fragmented. Today they are highly concentrated. Theoretical Predictions: market will become more concentrated where there is (i) a decrease in market size relative to sunk costs or (ii) an increase in the intensity of competition 16 Theory to Empirics (figure 6.1): Exogenous influences that shift the functional relationship include: Change in Technology S/ Decline in Demand Equilibrium Structure Geographical Segmentation; lower transport costs Toughness of Price Competition Competition Policy Regime 17 Cases: Salt: highly concentrated in all countries (tough competition policy indicates tough price competition) Sugar: concentration reflects competition policy US: strict policy Europe: relaxed Japan: relaxed pre-1914 nature of Salt and Sugar: homogenous good, tough price competition Theory predicts a concentrated structure Intense price competition resulted in attempts to collude Price coordination in fragmented and homogenous good industry is hard to maintain Concentrated structure emerged as a result of firm exit/mergers/acquisitions 18 US SALT – key dates Early 1800s – increase p competition and lower t costs Attempts to collude to artificially maintain higher p - kept breaking down…. 1817 West Virginia 1876 Michigan Salt Association 1890 Sherman Act 1899 National Salt Company 1914 – tight countrywide coordination 1922 – FTC investigation 1914-1950s: stability – consolidations /mergers / acquisitions resulting in high level concentration at national and regional levels 19 UK SALT – key dates 1880s: increase in decrease in demand (i) lower exports as production abroad expands (ii) chemical industry replace salt with brine as key input sparked off intense price competition predict : high concentration 1882 – coordination attemp = ‘pooling’ 1888 – salt union 1905 – defects postwar years – 1950s - consolidations /mergers / acquisitions resulting in high level concentration stability – top 2 firms have >95% of market 20 US SUGAR Strict Competition Policy Advances in Technology reduce Increase in demand 1830’s-1870’s Regional versus National concentration levels Some regional monopolies – but lower concentration at national level CONTINENTAL EUROPE – FRANCE, GERMANY AND ITALY Regulated Quota System in EC (based on production levels pre-1968) Market structure is ‘frozen’ at 1968 levels JAPAN Pre-war – relaxed competition policy – increase demand – cartel Interwar years – tough price competition cartel collapse Post-war – governmental policies 21 A Test of the Theory? Product Homogeneity……. What factors determine Intensity of Competition? Can firms manipulate these? Barriers to Entry – can firms manipulate these? 22