The Bertrand (price as a strategic variable) oligopoly model

advertisement

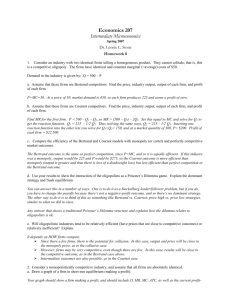

THE BERTRAND (PRICE AS STRATEGIC VARIABLE) OLIGOPOLY MODEL I. Homogeneous products. A. General assumptions: - Only a "few" firms are in the industry; entry barriers are high - Firms sell identical products (commodities) - Each firm considers price to be its strategic variable - Each firm sets its price myopically on the assumption that the other firm(s) will keep its price unchanged B. Specific example: - 2 identical firms produce widgets - MC1=MC2=$50 - Linear (market) demand: Q = 10,000 - 20P; P = 500 - 0.05Q C. Specific outcome: - Since each firm assumes that the other firm's price is fixed, each tries to set its price a little bit lower than the other's price (so as to capture the entire market) - Since both firms behave this way, there's only one stable (Nash) outcome: P1=P2=$50; at that point, neither firm wants to reduce its price any further; Q=q1+q2=9,000; 1=2=0; this is the competitive outcome (Note: If the two firms colluded and achieved the monopoly outcome, PM=$275; QM=4,500; M=$1,012,500) $ 500 D MR 275 50 0 MC 4.5K 9K 10K Q D. General outcome: - Firms that behave according to the Bertrand assumption will reach equilibrium at P=MC -- the competitive outcome - Note: If the two firms above each also have fixed costs (say, FC1=FC2=$40,000), the Bertrand assumption still leads them to set P1=P2=$50; they will not be able to set prices that cover their fixed costs; they will complain bitterly about "cut-throat competition" II. Differentiated products A. General assumptions - Only a few firms are in the industry; entry barriers are high - Each firm sells a somewhat similar but not identical product; each firm's sales are affected by its own price and by the prices of its somewhat similar rivals - Each firm considers price to be its strategic variable - Each firm behaves myopically with respect to the prices of its rivals B. Specific example: - 2 firms each producing a somewhat different style of widget (e.g., blue widgets vs. red widgets) - MC1=MC2=$50 - Firm 1: Demand: Q1 = 5000 - 20P1 + 10P2 - Firm 2: Demand: Q2 = 5000 - 20P2 + 10P1 1 = P1Q1 - C1 = P1(5000-20P1+10P2) - 50(5000-20P1+10P2) d1/dP1 = 5000-40P1+10P2+1000 = 0 P1 = 150+0.25P2; similarly, P2= 150+0.25P1 These are "reaction curves" Note: Identical reaction curves are reached if demand is expressed "inversely" (i.e., P1=250-0.05Q1+0.5P2) and the firm sets MR=MC (i.e., d1/dQ1=50) P1 275 Firm 2’s reaction curve Firm 1’s reaction curve 200 150 0 150 200 275 P2 C. Specific result: P1 = $200; P2 = $200; Q1 = 3000; Q2 = 3000; 1 = 2 = $450,000 Note: A purely "competitive" result (P=MC) would yield P1=$50; P2=$50 Note: If the two firms collude, P1 = $275; P2 = $275; Q1 = 2250; Q2 = 2250; 1 = 2 = $506,250 D. General result: - Product differentiation "softens" the price competition that follows a Bertrand format III. Differentiated products and one firm sets its prices first and the other firm follows The firm that sets its prices first should “look ahead” and anticipate that the second firm will set its prices in accordance with its reaction function. In the example above, firm 1 would substitute firm 2’s reaction function (P2 = 150+0.25P1) into its profitability condition (1 = …). Firm 1 then takes its first derivative and solves for its maximizing price; and then firm 2 sets its price in accordance with its reaction function. This will yield a result of P1 = $210.75; P2 = $202.68; Q1 = 2812; Q2 = 3054; 1 = $453,476; 2 = $466,285 Thus, though the first firm does better than if it doesn’t anticipate the second firm’s reactions, it is the second firm that does even better by being the second firm. (There is a relative second-mover advantage.)