Press release

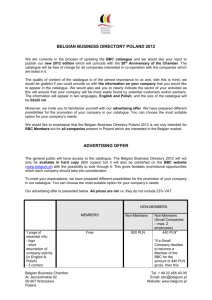

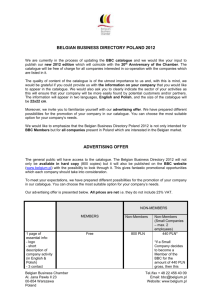

advertisement

Warsaw, August 14th 2014 Press release Strong financial performance in difficult market conditions Grupa Azoty delivers strong performance in the first half of 2014. The Company generated operating profit (EBIT) of PLN 285m (H1 2013: PLN 788m) and net profit of nearly PLN 235m (H1 2013: PLN 771m), with revenue slightly above PLN 5bn (H1 2013: PLN 5.2bn). The period's weaker year-on-year performance was attributable to the accounting for the Puławy acquisition, recognised as a non-recurring event in 2013. However, the Company's actual results are above the market expectations. “Net of non-recurring events, the adjusted EBIT and EBITDA margins decreased slightly from 7% and 12% to 6% and 11%, respectively, on the back of adverse pricing environment, especially in the Fertilizers segment,” said Andrzej Skolmowski, Vice-President of the Grupa Azoty Management Board, when asked to comment on the Company's performance. “Declining prices forced us to increase sales volumes and move into new markets. We successfully reduced costs thanks to lower prices of raw materials and synergies generated across the Group,” Mr Skolmowski added. “Despite the price pressures in the Fertilizers segment, we managed to deliver financial results above the market expectations. Our strategy yields tangible positive results, as do our consolidation efforts and the capital expenditure programme we are currently implementing. Consequently, the Company outperformed its peers despite the challenging market environment,” said Paweł Jarczewski, President of the Management Board of Grupa Azoty S.A. In H1 2014, Grupa Azoty took advantage of the opportunities offered by the deregulation of the Polish natural gas market. Lower commodity prices on the global markets and the large supply of gas on the domestic market drove down the prices of natural gas and hard coal on the power exchange by 7%−9% and 12%−13%, respectively, allowing the Company to deliver a solid EBITDA margin of 13% in the Fertilizers segment. Consolidated results of Grupa Azoty S.A. H1 2013 H1 2014 Change Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 5,247 5,073 ↘ 2,569 2,226 2,348 2,703 2,370 788 285 ↘ 369 -9 -77 182 103 EBITDA 1,085 564 ↘ 555 111 57 325 239 EBITDA* 639 564 ↘ 283 111 -13 325 239 Net profit 771 235 ↘ 360 0.2 -57 149 86 Revenue EBIT * Adjusted for gain on bargain purchase of Grupa Azoty PUŁAWY Grupa Azoty's consolidated revenue by segment In the Chemicals Segment (which includes the former OXO segment and concentrates on the manufacture of melamine, technical-grade urea, sulfur and pigments), revenue increased by over 3% year-on-year, while the EBITDA margin remained broadly flat at 7%, chiefly on the back of the Siarkopol acquisition and lower prices of raw materials (natural gas for urea and melamine manufacture, and ilmenite, used to manufacture titanium white). The Plastics Segment saw prices of highly-processed products (Tarnamid and Alphalon) stabilise, which, accompanied by a slight year-on-year decline in prices of such raw materials as benzene and phenol, translated into higher profitability (EBITDA margin up to -1%, from -3%). This was primarily a result of the difficult situation on the caprolactam market, with strong price competition seen in Europe and elevated supply in the Middle East. Grupa Azoty Puławy Group's consolidated results In Q4 2014, Grupa Azoty Puławy earned net profit of PLN 74m (down from PLN 105m last year), on revenue of nearly PLN 0.88bn (down from PLN 0.93bn last year). Q1-4 12/13 12M Q1-4 13/14 12M Change Q4 12/13 Q2 2013 Q1 13/14 Q3 2013 Q2 13/14 Q4 2013 Q3 13/14 Q1 2014 Q4 13/14 Q2 2014 3,886 3,626 ↘ 930 840 923 983 880 EBIT 429 230 ↘ 110 19 21 111 80 EBITDA 554 379 ↘ 142 55 57 149 118 Net profit 390 209 ↘ 105 18 19 98 74 Revenue Grupa Azoty Police Group's consolidated results In H1 2014, Grupa Azoty Police earned net profit of PLN 42m, on revenue of nearly PLN 1.25bn. Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q2/Q1 change H1 2014 Revenue 728 510 500 632 617 ↘ 1,249 EBIT 32 5 -21 20 32 ↗ 52 EBITDA 53 24 4 51 52 ↗ 102 Net profit 23 7 -13 15 26 ↗ 42 Grupa Azoty Zakłady Azotowe Kędzierzyn's consolidated results In H1 2014, Grupa Azoty ZAK earned net profit of PLN 69m (down from PLN 84m last year), on revenue of PLN 1.04bn (down from PLN 1.07bn last year). 2012 2013 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 1,043 y/y change ↘ 1,074 530 474 528 572 471 EBIT 96 79 ↘ 44 2 0 47 33 EBITDA 133 124 ↘ 63 21 20 69 54 Net profit 84 69 ↘ 39 5 -4 39 31 Revenue *** The Grupa Azoty Group, whose parent is Grupa Azoty S.A. of Tarnów, is one of the leading players on the European fertilizer and chemical markets, formed through successive acquisitions of Polish chemical companies. The Group now comprises a number of entities, including: Grupa Azoty S.A. (the Parent), Grupa Azoty Zakłady Azotowe Puławy S.A, Grupa Azoty Zakłady Chemiczne Police S.A., and Grupa Azoty Zakłady Azotowe Kędzierzyn S.A. Grupa Azoty S.A. is currently the second largest EUbased manufacturer of nitrogen and compound fertilizers, and its other products, including melamine, caprolactam, polyamide, oxo alcohols and titanium white, enjoy a strong standing in the chemical sector, with a wide range of applications in various industries. For 2013, the Grupa Azoty Group reported revenue of PLN 9.8bn (2012: PLN 7.1bn), net profit of PLN 714m (2012: PLN 315m) and operating profit (EBIT) of PLN 703m (2012: PLN 372m). Grupa Azoty S.A. has been listed on the Warsaw Stock Exchange since 2008, and since 2013 it has been a constituent of the new WIG30 index. Since 2009, the Company has also been included in the RESPECT Index, the first CSR-focused index in Central and Eastern Europe, and since 2013 – in the MSCI Emerging Markets index. For more information, please contact: Grzegorz Kulik Grupa Azoty Group Press Officer mobile: +48 785 780 005 email: rzecznik@grupaazoty.com