2015-04BWG - National Association of Insurance Commissioners

advertisement

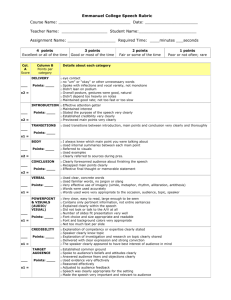

NAIC BLANKS (E) WORKING GROUP Blanks Agenda Item Submission Form DATE: 02/20/2015 FOR NAIC USE ONLY Agenda Item # 2015-04BWG Year 2015 Changes to Existing Reporting [X ] New Reporting Requirement [ ] CONTACT PERSON: Aaron Brandenburg TELEPHONE: 816-783-8271 EMAIL ADDRESS: abrandenburg@naic.org REVIEWED FOR ACCOUNTING PRACTICES AND PROCEDURES IMPACT ON BEHALF OF: Title Insurance Financial Reporting (C) Working Group No Impact [ X ] Modifies Required Disclosure [ DISPOSITION NAME: Gordon Hay TITLE: Sr. Casualty Actuarial Examiner AFFILIATION: Nebraska Department of Insurance ADDRESS: [ ] [ ] [ X ] [ ] [ ] [ ] [ ] ] Rejected For Public Comment Referred To Another NAIC Group Received For Public Comment Adopted Date Rejected Date Deferred Date Other (Specify) BLANK(S) TO WHICH PROPOSAL APPLIES [X ] [X ] ANNUAL STATEMENT INSTRUCTIONS [ ] [X ] QUARTERLY STATEMENT CROSSCHECKS [ [ [ [ [ Property/Casualty Fraternal ] Life and Accident & Health ] Separate Accounts ] Other Specify Anticipated Effective Date: ] ] [X ] [ ] [X ] BLANK Health Title Annual 2015 IDENTIFICATION OF ITEM(S) TO CHANGE Add one year and two year loss development in the Title Insurance Five Year Historical Data Exhibit. REASON, JUSTIFICATION FOR AND/OR BENEFIT OF CHANGE** 1. 2. 3. 4. 5. The Property and Casualty Five Year Historical Data Exhibit contains data related to one year and two year development within it. Adding the data to the Title Blank will increase consistency between the P&C and Title Blanks. Title insurance policy year loss emergence is typically slower than accident year emergence in virtually any P&C reserving segment. Known Claims Reserve development on the report year basis from Schedule P Part 3 will provide a leading indicator for Schedule P Reserve development on the policy year basis from Schedule P Part 2. These statistics are easily calculated from required information. Historical development studies have shown wide variations over time and between companies in the adequacy of Title insurers’ Schedule P and Known Claims Reserves. All executives who sign the Title Annual Statement and all Title insurance Appointed Actuaries should be aware of the development patterns from their Companies’ historically booked Schedule P and Known Claims Reserves. NAIC STAFF COMMENTS Comment on Effective Reporting Date: Other Comments: ______________________________________________________________________________________________________________ ** This section must be completed on all forms. Revised 6/13/2009 © 2015 National Association of Insurance Commissioners 53 ANNUAL STATEMENT INSTRUCTIONS – TITLE FIVE-YEAR HISTORICAL DATA This exhibit is a display of key statistics extracted from the annual statements of the current year and each of the four preceding years. It displays recent trends in the movement of sales, in force, surplus, and other financial data. For the most part, each section of five-year historical data references data from a specific page in the annual statement, with certain “key” lines having been extracted from that page. Page and line references for the current year are shown on the Exhibit. If a page or line reference is different for a prior year or years, it is shown below. Percentages are shown to one decimal place (e.g., 17.6). All figures taken from or developed from annual statements of corresponding years. The derivation of each line on Five-Year Historical Data is indicated in the annual statement blank except that Lines 42 and 43 should be based upon the book/adjusted carrying value of the asset, which is consistent with the other affiliated investments. Reporting entities that were part of a merger should refer to SSAP No. 3, Accounting Changes and Corrections of Errors, for guidance on restatement of prior-year numbers and footnote disclosure requirements for this exhibit. Complete the footnote only if reporting entity was a party to a merger in the current reporting period. Source of Direct Title Premiums Written All years .................................. Operations and Investment Exhibit, Part 1A Line 1 – Direct Operations All years .................................. Part 1A, Line 1, Column 1 Detail Eliminated To Conserve Space Other Percentages All years .................................. (Line item divided by Part 1B, Line 1.4 x 100.0) Line 64 – Losses and Loss Expenses Incurred to Net Premiums Written All years .................................. Page 4, Line 4 Line 65 – Operating Expenses Incurred to Net Premiums Written All years .................................. Page 4, Line 5 One Year Schedule P Part 2 Development (000 omitted) Line 66 – Development in Estimated Losses and ALAE on Policies Effective Before Current Year All years .................................. Schedule P, Part 2 Summary, Line 22, Column 11 Line 67 – Percent of Such Development to Policyholders’ Surplus of Prior Year-End All years .................................. Five Year Historical, Line 66 divided by Page 4, Line 16, Column 1 x 100.0 © 2015 National Association of Insurance Commissioners 54 One Year Schedule P Part 3 Development (000 omitted) Line 68 – Development in Estimated Losses and ALAE for Claims Reported Before Current Year All years .................................. Schedule P, Part 3 Summary, Line 12, Column 11 Line 69 – Percent of Such Development to Policyholders’ Surplus of Prior Year-End All years .................................. Five Year Historical, Line 68 divided by Page 4, Line 16, Column 1 x 100.0 Two Year Schedule P Part 2 Development (000 omitted) Line 70 – Development in Estimated Losses and ALAE on Policies Effective Before Prior Year-End All years .................................. Schedule P, Part 2 Summary Line 22, Column 12 Line 71 – Percent of Such Development to Reported Policyholders’ Surplus of Second Prior Year-End All years .................................. Five Year Historical, Line 70 divided by Page 4, Line 16, Column 2 x 100.0 Two-Year Schedule P Part 3 Development (000 omitted) Line 72 – Development in Estimated Losses and ALAE for Claims Reported Before Prior Year-End All years .................................. Schedule P, Part 3 Summary, Line 12, Column 12 Line 73 – Percent of Such Development to Reported Policyholders’ Surplus of Second Prior Year-End All years .................................. Five Year Historical, Line 72 divided by Page 4, Line 16, Column 2 x 100.0 © 2015 National Association of Insurance Commissioners 55 ANNUAL STATEMENT BLANK – TITLE FIVE–YEAR HISTORICAL DATA Show amounts in whole dollars only, no cents; show percentages to one decimal place, i.e. 17.6. 1 2015 2 2014 3 2013 4 2012 5 2011 ..................... ..................... ..................... ..................... ..................... ..................... ..................... ..................... ..................... ..................... ..................... ..................... Source of Direct Title Premiums Written (Part 1A) 1. 2. 3. 4. Direct operations (Part 1A, Line 1, Col. 1) ....................................................................................... Non-affiliated agency operations (Part 1A, Line 1, Col. 2) .............................................................. Affiliated agency operations (Part 1A, Line 1, Col. 3) ................................................ Total ............................................................................................................................................... Detail Eliminated To Conserve Space FIVE–YEAR HISTORICAL DATA (Continued) 1 2015 2 2014 3 2013 4 2012 5 2011 ....................... ....................... ....................... ....................... ....................... ....................... ....................... ....................... ........................ ........................ ........................ ........................ ....................... ....................... ....................... ....................... Capital and Surplus Accounts (Page 4) 47. 48. 49. 50. Net unrealized capital gains or (losses) (Line 18) ................................................ ........................ Change in nonadmitted assets (Line 21) .............................................................. ........................ Dividends to stockholders (Line 28) .................................................................... ........................ Change in surplus as regards policyholders for the year (Line 31) ....................... ........................ Detail Eliminated To Conserve Space Other Percentages (Line item divided by Part 1B, Line 1.4 x 100.0) 64. 65. Losses and loss expenses incurred to net premiums written ........................ (Page 4, Line 4) ................................................................................................... Operating expenses incurred to net premiums written (Page 4, Line 5) ....................... ....................... ........................ ....................... ....................... ....................... ........................ ....................... ....................... ....................... ........................ ....................... ....................... ....................... ........................ ....................... ....................... ....................... ........................ ....................... ....................... ....................... ........................ ....................... ....................... ....................... ........................ ....................... ....................... ....................... ........................ ....................... One Year Schedule P Part 2 Development (000 omitted) 66. 67. Development in estimated losses and ALAE on policies effective before current year (Schedule P, Part 2 Line 22, Col. 11) ................................ ........................ Percent of such development t o policyholders' surplus of prior year end (Line 66 above divided by Page 4, Line 16, Col. 1 x 100.0) .................. ........................ One Year Schedule P Part 3 Development (000 omitted) 68. 69. Development in estimated losses and ALAE for claims reported before current year (Schedule P, Part 3, Line 12, Col. 11) .............................................. ........................ Percent of such development to policyholders' surplus of prior year end (Line 68 above divided by Page 4, Line 16, Col. 1 x 100.0) ................................ ........................ Two Year Schedule P Part 2 Development (000 omitted) 70. 71. Development in estimated losses and ALAE on policies effective before prior year-end (Schedule P, Part 2, Line 22, Col. 12) ......................... ........................ Percent of development of losses and loss expenses incurred to reported policyholders' surplus of second prior year end (Line 70 above divided by Page 4, Line 16, Col. 2 x 100.0) .................................................................... ........................ 63. Two Year Schedule P Part 3 Development (000 omitted) 72. 73. Development in estimated losses and ALAE for claims reported before prior year-end ( Schedule P, Part 3, Line 12, Col. 12) ....................................... ........................ Percent of such development to policyholders' surplus of second prior year-end (Line 72 above divided by Page 4, Line 16, Col. 2 x 100.0) NOTE: If a party to a merger, have the two most recent years of this exhibit been restated due to a merger in compliance with the disclosure requirements of SSAP No. 3, Accounting Changes and Correction of Errors? If no, please explain ............................................................................................................................................................................ ............................................................................................................................................................................................................. W:\QA\BlanksProposals\2015-04BWG.doc © 2015 National Association of Insurance Commissioners 56 Yes [ ] No [ ]