Strategic Plan for Health Benefits

STRATEGIC PLAN - BENEFITS

STRATEGIC

PLAN

HEALTH BENEFITS

Prepared By: Total Rewards Steering Committee

Page 1 4/14/2020

STRATEGIC PLAN - BENEFITS

Table of Contents

TRSC Members:

Executive Summary: ....................................................................

Background/Environment: .............................................................

Key Stakeholders:

....................................................................................................... 6

Current Design:

Plan Actions to Date:

.................................................................................................. 7

Strategic Plan Scope:

................................................................................................. 7

Strategic Plan Approach:

.......................................................................................... 8

Strategic Plan Principles:

.......................................................................................... 9

Vision:

Value Based Approach:

............................................................................................ 10

Key drivers and solution alternatives:

............................................................... 11

Actions to be Considered:

....................................................................................... 13

Addendum 1 (Financial Trend Chart Illustrations):

...................................... 15

Addendum 2 (Multi-year Strategic Direction Chart Illustration):

Page 2 4/14/2020

STRATEGIC PLAN - BENEFITS

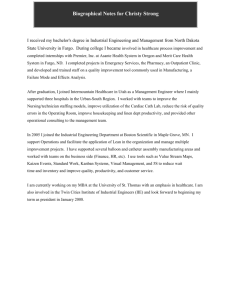

Total Rewards Steering Committee Members:

Dr. Phaedra Corso, Dept. Head, Health, Policy & Management, University of Georgia pcorso@uga.edu

Dr. William Custer, Associate Professor, Health Administration, Georgia State wcuster@gsu.edu

Dr. Ivan Florentino, M.D., M.B.A., F.A.A.P Associate Professor and Section Chief,

Pediatric Anesthesia at Georgia Health Sciences University iflorentino@georgiahealth.edu

Mr. Tom Gausvik, Associate VP for Human Resources, University of Georgia tgausvik@uga.edu

Mr. Ronnie Henry, VP for Business & Finance, Darton College ronnie.henry@darton.edu

Ms. Lydia Lanier, HR Sr. Managing Director, University of Georgia llanier@uga.edu

Dr. Linda Noble, Associate Vice Chancellor for Faculty Affairs, System Office linda.noble@usg.edu

Ms. Cheryl Johnson Ransaw, Director of Employee Development and Wellness,

Georgia State cjransaw@gsu.edu

Ms. Usha Ramachandran, Vice Chancellor for Fiscal Affairs, System Office usha.ramachandran@usg.edu

Ms. Sharon Ray, Director of Benefits, Georgia Institute of Technology sharon.ray@ohr.gatech.edu

Ms. Dorothy Roberts, System Benefits Administrator, System Office dorothy.roberts@usg.edu

Mr. Tom Scheer, Associate Vice Chancellor for Life and Health Benefits, System

Office tom.scheer@usg.edu

Mr. Russ Toal, Clinical Associate Professor, College of Public Health, Georgia

Southern University rtoal@georgiasouthern.edu

Executive Sponsors:

Wayne Guthrie, SPHR, Vice Chancellor for Human Resources, System Office wayne.guthrie@usg.edu

Robert E. Watts, Chief Operating Officer/Exec VC, System Office rob.watts@usg.edu

Page 3 4/14/2020

STRATEGIC PLAN - BENEFITS

Executive Summary:

The Total Rewards Steering Committee (TRSC) has completed its initial work in developing a multi-year strategic plan for the consideration of the Board of Regents.

It should be noted that this plan, as presented, is a template or roadmap to achieve our vision of allowing the University System of Georgia (the System) to promote optimal health for its members through a system of care and reimbursement that is competitive, coordinated, efficient, effective, accessible, and affordable. It will be centered on being patient-centered and focused on wellness.

The foundation of this vision is to continue to recruit and retain faculty and staff.

This plan was developed in a very uncertain and changing environment. The

Committee has developed a set of strategic principles as a guide to develop the above vision as well as to serve as a base to evaluate options, resolve conflicting paths of action, and to assist in prioritizing and phasing changes.

While these principles should remain uncompromised, the specific actions and timetables presented in this plan can be altered or implemented as the environment dictates. State finances and unexpected healthcare reform regulations are two large factors influencing the need for this plan to be flexible.

Looking forward, the overarching goal for the USG is to continue to provide health benefits in the most cost-efficient manner while providing value to our employees.

Maintaining a competitive benefit package enhances our ability to attract and retain employees. This plan provides a series of action steps to achieve this goal. These steps, when taken in totality, will start to “bend the cost curve” while focusing on expanded employee engagement in all of their health-related matters.

The charts in Addendum 1 illustrate the tremendous cost to the BOR and employees if we continue along the current path. The University System of Georgia is paying $300 million dollars annually on health care in calendar 2011. If nothing is done, in ten years time, this amount will increase to over $706 million dollars annually with a total employee/employer expenditure of greater than $1.2 billion dollars. Simple cost shifting and/or fixing employer costs will not reduce overall expenditures. This is an indication that the System must fundamentally alter our approach to offering health benefits.

This plan outlines a strategy to contain the overall costs for both the employee and the

System. Short term, this plan recognizes the unacceptable financial impact of the

“status-quo or baseline” and thus outlines structural changes intended to provide the ground work for future financial stability, as well as to begin engaging employees in managing their own health.

Retiree coverage and its related costs are also a major financial concern. Initial strategies to consider are presented in this plan that also set the stage to better utilize the expanding Federal and market coverage available to retirees, as well as to begin to alter the current expectations of current and future retirees. In the short-term the plan focuses on contribution strategies but eventually will encompass a defined contribution plan where the System will incur only a fixed cost in the form of a Health

Reimbursement Account for future hires.

Page 4 4/14/2020

STRATEGIC PLAN - BENEFITS

For all employees and retirees, specific action items are outlined and listed in this plan report, and a summary chart is attached in Addendum 2. In the short term (1/1/12 where feasible), utilizing the principles on page 9, three major areas are to be addressed:

Plan design – Efforts will center on simplifying design and directionally pricing select options for efficiency and fiscal responsibility.

Vendor management – Utilizing the available networks and holding vendors accountable to position our plans to a desirable state.

Retirees – the issue of retiree coverage and costs will be a multi-year strategy beginning with short-term cost and directional changes.

The future benefit plans offered by the USG will continue to provide our employees with choice, but will also require active involvement on their part to proactively manage their healthcare. The System must create a positive environment to drive this change by providing leadership, education and communication. Long term

(generally 1/1/13 or later), the plan deals with continued plan design and vendor management, but the emphasis will shift to establishing a culture of wellness and engagement with our employees through comprehensive and integrated health management and consumerism programs. The System must begin to expand the communication and resources available to the enrolled members in order to raise awareness of their role in creating cost-effective and positive heath outcomes.

In summary, this plan attempts to outline a series of actions to respond to the needs of the System and to its enrolled members. The strategic plan is built on principles and pragmatic approaches that we believe well meet the needs of our collective constituents and organization. The major external environmental factors of Federal

Health Care Reform and fiscal position of the State will dictate the speed and order of the implementation of these actions. This plan is designed to continue to monitor, evaluate and proactively respond.

Page 5 4/14/2020

STRATEGIC PLAN - BENEFITS

Background/Environment:

Tactical versus Strategic Prioritization – As a direct result of a request by the

Chancellor and the Board of Regents, the Total Rewards Steering Committee (TRSC) was tasked with developing a Strategic Plan for the System’s benefit plans. In past years, planning was done on a year-to-year basis.

Current Environment – The Committee has identified the following non-financial areas that will have the greatest impact on the benefits area in the near and long term:

Healthcare Reform – With the recent passage of the various Federal Heath

Care Laws, the way organizations will handle their benefit plan will vastly change. Uncertainty and the lack of definite regulations and guidelines in the healthcare arena further complicate the planning process.

Healthcare Delivery Systems – Providers of healthcare services, primarily hospitals and physicians, are evaluating different methods of providing and charging for services. The current system is primarily a “fee-for-service” model. Future services may be changed to a bundled arrangement. If implemented, this methodology will transform the entire health care reimbursement model.

Data – The Committee has determined that expanded data and data analysis capabilities are necessary to plan, evaluate and maximize the utilization and management of our benefit plans.

Total Health Management – Long term the System must invest resources in education, communication, and programs to promote employee health to

“bend the trend” of upward spiraling medical costs. This will involve intensive change management over many years.

OPEB/Retirees – With our growing number of retirees and the related GASB

45 liabilities, the System must begin to address this issue.

Key Stakeholders:

Stakeholder Name

Board of Regents

Institutions

Total Rewards Steering Committee

Fiscal Affairs

System HR

Employees and Retirees

Mercer, Inc.

Stake in the Project

Ultimately responsible

Must be able to attract and retain workforce and remain competitive

Plan, evaluate, and recommend

Responsible for financials of the System

Responsible for ongoing plan designs and administration

Users of the plans

Actuary and consultant

Page 6 4/14/2020

STRATEGIC PLAN - BENEFITS

Current design: o Offerings o Traditional PPO with two networks o High-deductible PPO with two networks o 2 HMO offerings o Limited wellness and lifestyle options o Health Savings Account with employer seed o Self funded for all plans except Kaiser HMO o Bundled premiums for actives and retirees o Benefit eligibility set at 20 hours o Non-grandfathered status for Healthcare Reform (HCR) mandates

Plan Design Actions taken through Calendar 2011: o Eliminated high-cost indemnity plan o Goal is to move towards lower-cost managed networks o Implemented an alternative network as a voluntary option for PPO and HDHP plans o Goal is to move towards lower-cost managed networks o Self Funded HMO & HDHP o Goal is to reduce administrative costs and promote efficiency o Implemented a high-deductible PPO with an employer seed to the employee’s

Health Savings Account. o Goal is to continue to promote consumerism o Implemented tobacco use surcharge of $50 monthly o Goal is to promote wellness and reduce claim costs o Made minor changes to prescription plan o Goal is to promote wellness and administrative efficiency o Installed various “wellness” provisions o Goal is to promote wellness o All future retirees and spouses not enrolling in Medicare Part ”B” when eligible are now required to pay the full cost of insurance o Goal is to provide incentive for controlling OPEB liability

Scope of the Strategic Plan:

Scope defines what is within the boundaries of the strategic plan and what is outside those boundaries. The purpose of defining scope is to describe and gain agreement on the logical boundaries of this plan. While the committee has the name of “Total

Rewards,” our current charge deals specifically with the area of healthcare benefits.

As a committee, we are not responsible for other areas of total rewards, such as salary compensation. We are keenly aware there is a synergistic relationship between compensation and benefits that creates an employment package that assists in the recruitment and retention of employees. While we have to limit the scope of this plan to the benefit area, we have to be cognizant of this important interrelationship.

The Total Rewards Steering Committee strived to present a complete and accurate roadmap to chart the course of benefits for the next few years. The Committee had to develop general principles to guide our actions and areas to be explored. These principles shaped our methodology used to evaluate our decisions and recommendations. As stated earlier, the uncertainty about healthcare reform, the lack of actionable data, and the difficult situation surrounding the finances of the State of

Georgia are all factors that have to be constantly evaluated and acted upon.

Page 7 4/14/2020

STRATEGIC PLAN - BENEFITS

Strategic Plan Approach:

The Committee met every 2 -3 weeks over the past nine months and has concluded that although the System needs a vision for the benefits area. This vision will be implemented over a period of a few years. Therefore, this strategic plan is being developed as “working document” with the flexibility to implement tactical responses in the short term to move the benefits towards the ultimate goal as well as to meet shortterm environmental factors.

The Committee immediately identified the need to invest in a healthcare data solution.

The proper identification of areas to address is a key to the success of any plan. This includes but is not limited to: identifying high cost disease states, provider cost/effectiveness, demographic/geographic differences, and efficient plan administration.

In developing this strategic plan the TRSC utilized the following Mercer model to identify areas of opportunity and likely positive outcomes:

We also adopted Mercer’s Five Step Strategy process to organize our work.

Page 8 4/14/2020

STRATEGIC PLAN - BENEFITS

Principles:

The Committee also developed a set of strategic principles as a guide to develop our vision. These principles also served as a base to evaluate options, resolve conflicting paths of action, and to assist in prioritizing and phasing changes.

Strategic Principles:

Healthcare benefits should be designed and communicated as part of an overall

benefits and reward package.

Healthcare benefits should be competitive and provide good value to the Board of Regents, its institutions and their employees.

Management of healthcare costs through greater focus on health improvement and appropriate use of healthcare services for employees and their families.

Healthcare program structure should include initiatives to support employee health needs.

Healthcare program structure should be administratively efficient and hold

providers and vendors accountable for healthy and cost efficient outcomes.

Healthcare program design and implementation will be data driven.

Healthcare program should demonstrate good stewardship of state resources.

Vision:

To continue to have faculty and staff who perform at their best and for retirees who have completed their service, the University System of Georgia seeks optimal health for its members through a system of care and reimbursement that is: o Patient-centered, o Focused on wellness, o Coordinated, efficient, effective, accessible, and affordable.

The system of care: o Emphasizes the relationship between patients, providers, and their community, o Will focus on optimal healthcare outcomes; and o An integrated approach to health by treating each individual in a holistic manner.

To achieve this vision, the University System of Georgia will: o Continue to leverage the full, multi-disciplinary resources of the System, o Monitor the healthcare environment on a macro and micro level, o Be flexible and adaptive in order to take advantage of new and emerging market trends and regulations; and o Keep the strategic plan updated and communicated to stakeholders

Page 9 4/14/2020

STRATEGIC PLAN - BENEFITS

Value-based approach:

In order to achieve our desired vision we believe we must adopt a value-based approach to designing the System’s healthcare insurance programs. For the System, it creates a healthier workforce with less absenteeism and lower claims costs. For our employees and retirees, it encourages better health.

Simply stated, this is a strategic approach to employee benefits. A value-based approach is the planning, design, implementation, administration, and evaluation of health management practices grounded in evidence-based guidelines across all healthcare issues. This approach is one key component of our strategy and will provide tools and education to guide our employees and retirees in making informed medical decisions. Access to information on the relative value of all medical therapies will also be available. Appropriate plan design will help minimize the economic barriers that hinder access to proper care.

The ultimate design of our plan will also hold providers/payers of healthcare accountable for both cost and quality of care including patient outcomes and health status. This approach will be a vast improvement over the market’s current focus on negotiating price discounts, which may reduce costs in the short term but do little to account for the quality/quantity of care.

The Center for Health Value Innovation has just completed a survey of 176 diverse employers and has concluded that a value-based approach is used by all of the national healthcare companies and a number of local and regional managed care companies.

The survey data indicates that this continued growth is due largely in the belief of employers that they can expect to see a return on their investment from value- based approach in the areas of:

reductions in medical and pharmaceutical cost trends,

reductions in lost productivity costs, improvement in health status of the covered populations coupled with

reductions in disability and worker compensation claims

Value-based programs are increasingly being discussed, piloted and adopted. It is believed that value-based programs are one preferred way for organizations to lower cost and improve quality of care.

To move in this direction, we need to obtain and properly evaluate our particular group’s data to help identify a number of targeted initiatives that are practical and that will show meaningful financial ROI to "bend the cost curve" for the Board of Regents.

Page 10 4/14/2020

STRATEGIC PLAN - BENEFITS

Key decision drivers and Solution Alternatives:

Decision Drivers - With the scope of the strategic plan identified, guiding principles established, a vision identified, and a value-based approach adopted, the TRSC has to build the “roadmap” to achieve its goals. These action items/plans are affected both positively and negatively in both the short and long term by key drivers, but in any case all plans need be flexible to adapt to an uncertain environment driven by these key factors: o Financial realities of the USG year-to-year o Growing retiree liability under GASB/OPEB o Uncertainty in the future direction of healthcare reform o Changes in the delivery and pricing of healthcare by providers and insurers

As the strategic framework is developed and refined, the scarcity of relevant and actionable data affects the speed of advancing some components in the process. We have identified the need for more data in order to identify areas to address. The decision was made to pursue a medical “data warehouse” solution and related consulting. This additional data, when available, will supplement/enhance the decisionmaking process but not preclude the Committee from developing key strategic action items. It, however, will be necessary to obtain detailed data before we can fully recommend a comprehensive “wellness” program.

Current Financial Drivers o Continuing increases in premiums corresponding with national healthcare trends: A premium increase of 10% in calendar year 2011 will cost the

University System an additional $29M. This is not expected to be funded by the state. o Incurred but not Reported Claims (IBNR): The system needs to have cash on hand of at least the IBNR amount of $14.7M. Current figures indicate that additional cash of $ 8.6M is now required to cover IBNR.

o OPEB Liability: For FY 2009, the University System reported a net OPEB liability of ($395.5M), which will increase to ($699.9M) for FY 2010.

Page 11 4/14/2020

STRATEGIC PLAN - BENEFITS

Solution Alternatives - In working toward a comprehensive strategic plan, the

Committee strongly recommends the pursuit and consideration of a variety of solutions that align with the overall vision as described earlier. The Short and Long

Term Actions to be considered, which are part of these areas of opportunities, are detailed later in this document and reflect the following general categories of solutions:

Program Design/Offerings – identify and encourage development and migration to options supporting the longer term strategy:

Assess the number and types of plan options to offer

Identify the cost-effectiveness of each option

Contribution strategy by plan and group – determine how to share costs between the different options

Consider contribution strategies that are “cost-neutral” to the BOR, i.e. where participants “buy-up” for benefits beyond the “core” plan option

HMO fit with core PPO foundational strategy

Strategy by group (active, pre/post 65, eligibility, etc.)

Additional techniques to encourage migration to strategically designed options include:

- Improving desired options’ benefits relative to other options

- Subsidize contributions of desired option

- Communicating rationale for direction to desired options

- Eliminating less desired options to stimulate pace of change

- Offering new aggressive options only to new hires

- Offering transitional designs

- Providing incentives or popular design features on strategic offerings

Health Management / Consumerism solution alternatives to consider:

HDHP / consumerism commitment

Wellness and care/disease management programs

Value Based Design approaches

Supporting incentives and communication and change management

Vendor Management

Vendor selection – Request For Proposal resource intensive; directional Request

For Information /access/discount data available

Alternative networks - key cost opportunity

Carving out specialty providers i.e. Rx, wellness etc.

Self funding Kaiser/HMOs

Page 12 4/14/2020

STRATEGIC PLAN - BENEFITS

Short term (1/1/12 if feasible) Actions under evaluation:

Program Design / Offerings:

ITEM

Align contributions by relative value of plans

Create contribution and benefit incentives to promote new alternative network by offering benefit level reimbursements at 90/10. Modify current

PPO benefit level reimbursements to 80/20

Rx plan design changes

Change benefit eligibility to 30 hours

Merge 4 dependent tiers to 3 dependent tiers

Eliminate “Consumer Choice Option” plan offering

Benefits start on hire or 1 st of the month after enrollment

Require employees to contribute to HSA to receive seed.

Total Health Management & Consumerism:

ITEM

Utilize data warehouse

Introduce consumer behavior/change management program(s)

Expand web communications

Install web-based plan evaluator

Vendor Management:

ITEM

Self-fund or modify offering of Kaiser HMO

Rx plan vendor changes including Rx carve-out to one vendor

Retirees:

ITEM

Begin to change cost-share structure by increasing retiree share by 2% per year for 5 years

Install Employer Group Waiver Plan (EGWP) - Retiree Rx

TRSC Actions:

ITEM

Identify interactive HR Assessment Tool for possible integration with

Payroll

Review gap in current communication & change management practices

Investigate Total Rewards statement

Mercer to help investigate access & discounts

Develop multi-year measurement strategy

Investigate stand-alone or “defined contribution” retiree plans for future hires

* Any figures shown are preliminary or estimates under review

Rationale/Financial

Savings *

Fairly priced plan options and stable or lower employer cost

Effective network utilization/

$10MM

$750k - $1.5MM

Administrative Efficiencies

Administrative Efficiencies

Administrative Efficiencies

Administrative Efficiencies

Appropriate Plan design

Supports data driven strategy

Promoting wellness

Expanded Communication

Providing tools

$1.25

– 2.5 MM

$ 1MM

$500k and address OPEB

Address OPEB

Promoting wellness

Expanded Communication

Expanded Communication

Vendor Management

Data driven

Address OPEB

Page 13 4/14/2020

STRATEGIC PLAN - BENEFITS

Long term Actions (1/1/13 or later) to be considered:

Program Design / Offerings:

ITEM

Reduce number of plan options

Align, re-price or eliminate option(s)

Only offer Alt Network option/plan design

Add low-cost Health Care Reimbursement option

Total Health Management & Consumerism:

ITEM

Dashboard of key performance metrics via data warehouse

Adopt targeted behavior program(s) with incentives

Adopt evidence based design incentives

Promote employee and spouse health assessment and biometric screenings via use of HRA tool

Develop integrated set of care management programs encompassing wellness, risk reduction and chronic care management

Install HR Assessment Tool

Single sign-on vendor portal

Communicate PPACA exchanges

Targeted communication by population segment

Integrated change management and communication activities

Vendor Management:

ITEM

Possible medical RFI/RFP

Possible PBM RFI/RFP

Partnership with all vendors to work together in support of goals; full provider transparency on tools and future strategy

Consolidate voluntary insurance packages

Retirees:

ITEM

Continue to realign retiree premiums until get to a 60/40 split

Explore exchanges and “defined contribution” approach for all retirees

Explore no retiree coverage for Medicare eligible

Explore age/service premium structure

Page 14

Rationale/Principle

Stable or lower employer cost

$TBD

$TBD

$TBD

Data driven

Promoting wellness

Promoting wellness

Promoting wellness

Promoting wellness

Promoting wellness

Promoting wellness

Expanded Communication

Expanded Communication

Expanded Communication

$TBD

$TBD

Vendor Management

Administrative Efficiencies and Cost Savings

$TBD and address OPEB

$TBD and address OPEB

$TBD and address OPEB

$TBD and address OPEB

4/14/2020

STRATEGIC PLAN - BENEFITS

ADDENDUM 1

Scenario #1 - Cumulative cost in over 10 years represents 1.2 billion in total cost

Scenario #2 - Employer contributions increase by 400 million due to cost increase of 10% each year and employee's contributing the remaining cost

Scenario #3 - Employer contributions slow over 10 years due to employer strategy of increasing employee contributions and plan design cost

Scenario #4 - Depicts an overall reduction in gross cost due to employer strategy of move to more efficient network in 2011, introduction of incentives for wellness participation, and advance health management strategies which lead to behavior changes within the population, thus reducing plan consumption.

Page 15 4/14/2020

STRATEGIC PLAN - BENEFITS

Addendum 2

Page 16 4/14/2020