LC Monitor - Trade Services Update

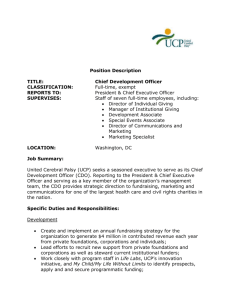

advertisement

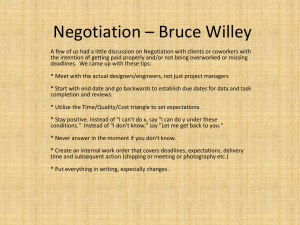

LC Monitor - Trade Services Update Volume 11, Issue 5, September – October 2009 What is Negotiation? A vexing thought, and often misunderstood, however, the concept of negotiation continues in UCP 600. If one had to choose one word to define it, it would be “ownership”. To understand this simple definition let’s look more closely at UCP 600 which changed the UCP 500 definition of Negotiation to: “Negotiation means the purchase by the nominated bank of drafts (drawn on a bank other than the nominated bank) and/or documents under a complying presentation, by advancing or agreeing to advance funds to the beneficiary on or before the banking day on which reimbursement is due to the nominated bank.” It is important to break down the key elements to this definition: 1. 2. 3. 4. 5. 6. You must “Purchase” the documents (in other words, to purchase is to become the owner). You must be a “nominated bank” (“NB”) to receive the protections afforded by UCP. Drafts should not be drawn on the “negotiating bank”. The documents must be “complying” to receive the protections afforded by UCP. You must either a. pay up-front or b. commit (in writing – while not in UCP it is wise) to pay at a fixed future date. You cannot use the issuing bank’s reimbursement prior to purchasing the document*. While a great majority of practitioners appear to understand points 2 and 4, the other aspects appear to be causing market confusion. Under point 1, dictionary.com defines the word purchase as: “to acquire by the payment of money or its equivalent; buy”. In simple terms, negotiation means that a nominated bank is expected to “buy” the documents, using their own funds and thus becoming the owner of the documents. As a qualified document owner, and provided that the LC and UCP mandates were followed, a NB is entitled to receive all UCP and subsequent legal protections. This is further emphasized by point 3. It is technically incorrect for a bank to “negotiate” a draft(s) drawn on themselves. Banks cannot “purchase” sight paper drawn on themselves which is why UCP Article 7 a. does not offer the issuer the option to negotiate documents. An issuer may only honour the documents. As a caution, if a NB makes a payment against drafts drawn on the NB and does so without any beneficiary’s agreement providing otherwise, this could be considered a “final payment” in some regimes and the NB may have no recourse to the beneficiary, though this would be a legal matter subject to applicable law. I should emphasize that I am not a lawyer and am speaking as a lay practitioner. In point 5, we learn that negotiation does not have to be “at sight”. It is possible to have a time negotiation. For example, a credit could provide a tenor of 180 days from bill of lading date, by negotiation. *Point 6 generates the most confusion. As stated previously, the expectation is that an NB will buy the documents using its own funds. However, the UCP definition does provide that funds can be paid to the beneficiary “on or before the banking day on which reimbursement is due”. It appears that the word “on” leads to the mistaken belief that banks can await reimbursement prior to “negotiating”. This is not the intention of UCP. Article 7 c. confirms this by stating, in part: “An issuing bank undertakes to reimburse a nominated bank that has honoured or negotiated a complying presentation”. UCP drafters recognized that there are time zone differences and different processing standards. This last part of the definition was included in order to allow NBs the ability to negotiate by deferring immediate payment and instead providing a written statement to a beneficiary confirming that they will pay on a fixed future date i.e. say the 5th day. Upon that 5th day (note: this is an arbitrary time period) the NB must pay whether or not it has received reimbursement and/or debited an issuer’s account on the date it had anticipated. As the UCP drafters have often mentioned, UCP Articles cannot be read in isolation. For UCP purposes, to be considered an NB, an NB must also have mailed documents onwards, in accordance with Article 7 c: “forwarded the documents to the issuing bank” and Article15 c.: “When a nominated bank determines that a presentation is complying and honours or negotiates, it must forward the documents to the confirming bank or issuing bank”. In UCP 600 Articles 7 c. and 8 c. we learn that an issuer’s and/or confirmer’s undertaking to “reimburse a nominated bank is independent of the issuing (or confirming) bank's undertaking to the beneficiary.” This statement, while apparently meant for legal professionals, reflects that an issuer/confirmer must understand that the NB that has negotiated has legal rights over and above any beneficiary’s rights. This is especially relevant in case of a fraudulent underlying transaction. UCP Article 12 c. clarifies that mere document examination and mailing of documents is not honour or negotiation. “(12 c. Receipt or examination and forwarding of documents by a nominated bank that is not a confirming bank does not make that nominated bank liable to honour or negotiate, nor does it constitute honour or negotiation.)”. Performing only these actions, without making a payment or committing to make a payment at a fixed future date, would make a nominated bank a “presenting bank”. A presenting bank has no right to reimbursement under an LC as referred to in Article 7 “c. An issuing bank undertakes to reimburse a nominated bank that has honoured or negotiated a complying presentation and forwarded the documents to the issuing bank.” Article 12 a, states that: “a. Unless a nominated bank is the confirming bank, an authorization to honour or negotiate does not impose any obligation on that nominated bank to honour or negotiate, except when expressly agreed to by that nominated bank and so communicated to the beneficiary”. This imposes that a duty for a confirming bank to negotiate “without recourse” while a NB that has not confirmed an LC has no duty whatsoever to honour or negotiate documents unless they agree to do so and it is customary to have a written negotiation agreement. Article 8, which refers to the duties and obligations of a confirming bank, states in part, in subsection e. that: “ii. negotiate, without recourse, if the credit is available by negotiation with the confirming bank.” This confirms that a confirming bank must negotiate “without recourse” to the beneficiary. In all other cases, where an NB has negotiated, but has no written recourse agreement with the beneficiary, then depending on applicable law the NB may or may not have recourse. For informational purposes, I am forwarding an excerpt from a UCP 500 opinion from which the UCP 600 drafters gained inspiration for the current definition of negotiation. “From Unpublished Opinion TA569 A letter of credit that is stated to be available with a nominated bank, by negotiation, should not include any reference to claiming reimbursement from a reimbursing bank or, indeed, any reference to the debiting of the issuing bank's account held with the nominated bank. This form of structure is a payment letter of credit. A negotiation letter of credit should specify that the nominated bank is to send the documents to the issuing bank and, upon the issuing bank's ascertaining that it complies with the terms and conditions of the credit, the issuing bank will reimburse in accordance with the instructions of the negotiating bank. Meanwhile, the laws in most countries define "negotiation" as giving money or similar value, leading to a conflict in definitions. (This becomes important in situations involving fraud, negotiable instruments, and holder-in-due-course.) The new definition conforms better with most legal definitions, while avoiding use of the term "giving value," which many bankers found especially confusing.” As always, feel free to send any comments to me at: Glennransier@loc.cc