fy2012 white goods grant program overview

advertisement

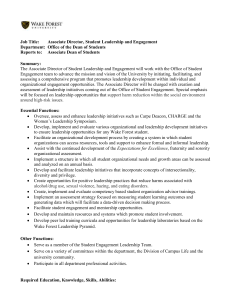

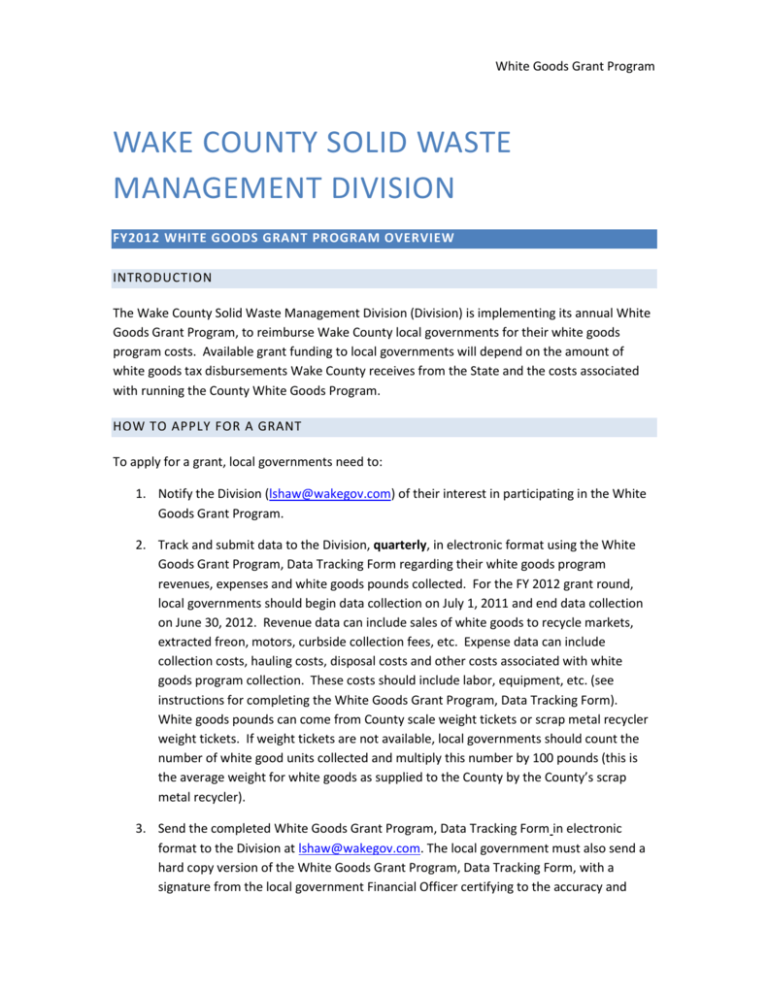

White Goods Grant Program WAKE COUNTY SOLID WASTE MANAGEMENT DIVISION FY2012 WHITE GOODS GRANT PROGRAM OVERVIEW INTRODUCTION The Wake County Solid Waste Management Division (Division) is implementing its annual White Goods Grant Program, to reimburse Wake County local governments for their white goods program costs. Available grant funding to local governments will depend on the amount of white goods tax disbursements Wake County receives from the State and the costs associated with running the County White Goods Program. HOW TO APPLY FOR A GRANT To apply for a grant, local governments need to: 1. Notify the Division (lshaw@wakegov.com) of their interest in participating in the White Goods Grant Program. 2. Track and submit data to the Division, quarterly, in electronic format using the White Goods Grant Program, Data Tracking Form regarding their white goods program revenues, expenses and white goods pounds collected. For the FY 2012 grant round, local governments should begin data collection on July 1, 2011 and end data collection on June 30, 2012. Revenue data can include sales of white goods to recycle markets, extracted freon, motors, curbside collection fees, etc. Expense data can include collection costs, hauling costs, disposal costs and other costs associated with white goods program collection. These costs should include labor, equipment, etc. (see instructions for completing the White Goods Grant Program, Data Tracking Form). White goods pounds can come from County scale weight tickets or scrap metal recycler weight tickets. If weight tickets are not available, local governments should count the number of white good units collected and multiply this number by 100 pounds (this is the average weight for white goods as supplied to the County by the County’s scrap metal recycler). 3. Send the completed White Goods Grant Program, Data Tracking Form in electronic format to the Division at lshaw@wakegov.com. The local government must also send a hard copy version of the White Goods Grant Program, Data Tracking Form, with a signature from the local government Financial Officer certifying to the accuracy and White Goods Grant Program truthfulness of the information contained on the Form. Detailed instructions for completing the White Goods Grant Program, Data Tracking Form will be posted on the County website and provided to local governments. Upon notification of interest to participate in the White Goods Grant Program, the Division will send local governments a packet of information that will include: The State definition of white goods White Goods Grant Program, Data Tracking Form Instructions to complete the White Goods Grant Program, Data Tracking Form FY 2012 Grant Time Table Grant Application Evaluation Spreadsheet Explanation of calculations used for the Grant Application Evaluation Spreadsheet This information will also be available on the Wake County web site at www.wakegov.com. Instructions for completing the White Goods Grant Program, Data Tracking Form are also indicated in the cell heading on the left side of the Form (place the mouse over the cell to reveal the instructions). APPLICATION DEADLINE Local governments MUST electronically submit their completed White Goods Grant Program, Data Tracking Form to lshaw@wakegov.com and also send a hard copy of the final White Goods Grant Program, Data Tracking Form, certified as accurate by the local government Finance Officer to the Division at lshaw@wakegov.com by September 7, 2012. Failure to submit applications by the deadline will result in forfeiture of grant consideration. AWARD DECISION Once the Division receives the final certified White Goods Grant Program, Data Tracking Forms from participating local governments, the Division will conduct an analysis of each local government’s request using the Grant Application Evaluation Spreadsheet. Details of how calculations are made in the Grant Application Evaluation Spreadsheet will be included in the information packet. Following the review, the Division will contact grant award recipients by email and regular mail. AWARD CRITERIA Local governments will be evaluated on three criteria. These are: White Goods Grant Program Quarterly electronic submission of the White Goods Grant Program, Data Tracking Form to the Division. Completion of final White Goods Grant Program, Data Tracking Form, with Finance Officer signature. A local governments’ program efficiency in its handling of white goods. This criteria will be measured on a net cost per weight basis taken from the White Goods Grant Program, Data Tracking Form. Final grant awards will be determined by the available funding for all local governments relative to their reimbursement requests. Details for how these evaluations are made is contained in the Explanation of Calculations Used for Grant Application Evaluation Spreadsheet. CONTRACT AND INVOICE Upon award of the grants to local governments, the Division will prepare and send local governments three original contracts for their signature. The purpose of the contract is to ensure that grant reimbursement funds have been properly accounted for. Local governments must return the signed contracts and submit an invoice to the Division for the grant amount in order to receive funding. GRANT REIMBURSEMENT CHECK Once the Division receives the signed contracts and an invoice from local governments, checks will be issued. CONTACT INFORMATION Information regarding the White Goods Grant Program will be posted on the County website. Forms can also be downloaded from the County website and must be sent to the Division electronically to the e-mail address below. Questions regarding the program should be directed to lshaw@wakegov.com White Goods Grant Program DEFINITION OF WHITE GOODS Local governments must use the State definition of white goods for the reason that the Wake County White Goods Grant Program is funded via the white goods tax distributions from the State. This definition is taken from the North Carolina Department of Revenue, Sales and Use Tax Technical Bulletin, Section 29 – White Goods Disposal Tax, D. Definition and 29-2 Examples of Items Classified as White Goods and Appliances Not Classified as White Goods Items A and B. DEFINITION OF WHITE GOODS: The term “white goods” includes refrigerators, ranges, water heaters, freezers, unit air conditioners, washing machines, dishwashers, clothes dryers and other similar domestic and commercial large appliances. ITEMS CLASSIFIED AS WHITE GOODS The following items are representative examples of additional appliances which are classified as white goods: Vending machines (refrigerated, heated, no refrigerated and nonheated types – does not include gumball and similar small dispensers). Large floor-model oil, gas and wood fired heaters and fireplace inserts (not small portable space heaters). Trash compactors. Large floor-model humidifiers (not small vaporizers). Water treatment equipment (not small faucet-mounted or under sink filtering devices). Dish sanitizers. Commercial fry cookers. Drinking water coolers. Freestanding ice makers. Built-in stove surface units. Built-in ovens. Floor-model popcorn machines. Hot food bar used to keep food hot. Refrigerated soft ice cream dispensers. Commercial refrigeration equipment manufactured and sold as a self-contained unit. Steam tables used to keep food hot. White Goods Grant Program ITEMS NOT CLASSIFIED AS WHITE GOODS The following items are representative examples of items which are not classified as white goods. Microwave ovens Radios. Small portable tabletop appliances. Record players. Toaster ovens. Video cassette recorders. Bread baking machines. Food processors. Office equipment, (i.e., copiers, telefax machines, etc.). Food mixers. Central heating systems. Food blenders. Chillers. Garbage disposals. Small portable electric, oil and gas space heaters. Gas grills. Central air conditioners. Charcoal grills. Electric fans. Vacuum cleaners. Propane gas tanks. Range hoods. Water pumps and tanks. Computer terminals. Televisions. Commercial refrigeration component systems White Goods Grant Program EXPLANATION OF CALCULATIONS USED FOR GRANT APPLICATION EVALUATION SPREADSHEET FUNDS AVAILABLE: Total white goods grant funds available to local governments are determined, in part, by several factors; 1) the amount of money Wake County receives from the State in the form of quarterly white goods tax disbursements, 2) the operational and capital expenses required for the Wake County White Goods Program, and 3) any reserve funds required by Wake County. Wake County will determine the amount of grant funds available for each grant round. This amount will be indicated in the top left portion of the Grant Application Evaluation Spreadsheet. MAXIMUM COST/TON: This is the maximum cost per ton for white goods collection program management as determined by the Division. This cost per ton is subject to change. MUNICIPALITY: The local government requesting grant funds. TOTAL TONS: This figure is derived from Total White Goods Pounds Collected as shown on the White Goods Grant Program, Data Tracking Form, divided by 2,000. TOTAL NET COST: This figure is taken from the Total Reimbursement Funds Requested from the Data Tracking Form. NET COST PER TON: This cost is determined by taking the Total Reimbursement Funds Requested (from the Data Tracking Form) and dividing it by Total Tons (as calculated above) to arrive at a net cost per ton. White Goods Grant Program REIMBURSABLE BEFORE % ADJUSTMENT: Comparison is made of local governments net cost per ton against the County’s established maximum cost per ton for a white goods collection program. If the local governments’ net cost per ton is less than the established Wake County maximum cost per ton, the local governments’ net cost per ton is multiplied by the local governments’ total tons. However, if the local governments net cost per ton is more than the established maximum cost per ton, the maximum cost per ton is multiplied by the local governments’ total tons. % ADJUSTMENT This takes the Total Reimbursable Cost for all local governments and compares the sum against the Funds Available. Funds Available is divided by the sum of all local government reimbursable cost to arrive at a percentage of reimbursable cost available. For example: If total funds available was $7,500 and the sum of all local government reimbursable costs was $10,400, the percent of total reimbursable costs available for each local government is 72.12% of their reimbursable costs. REIMBURSEABLE AFTER % ADJUSTMENT: A comparison is made of the Total Reimbursable Cost for all local governments against the total funds available. The Total Reimbursable Cost for each local government is then multiplied by the % Adjustment to arrive at a total available reimbursement amount. The reimbursable amount will not exceed the total funds available. White Goods Grant Program INSTRUCTIONS FOR COMPLETING DATA TRACKING FORM Please see the headings on the left side of the White Goods Grant Program, Data Tracking Form. Instructions, guidance and examples are given to assist you in completing this form. Please enter the data under each corresponding month. The information will automatically be summarized for you. If you need further assistance, please send your inquiry to lshaw@wakegov.com FISCAL YEAR: Please indicate the fiscal year applicable to the reimbursement funds requested using the dropdown menu provided (place mouse over cell and select year). LOCAL GOVERNMENT: Please indicate your local government using the drop-down-menu provided (place mouse over cell and select your local government). TOTAL REIMBURSEMENT FUNDS REQUESTED: Total white goods funds requested for reimbursement is automatically summed in the Data Tracking Form, Balance Total. Program expenses are subtracted from program revenues to arrive at a net reimbursement request. WHITE GOODS POUNDS COLLECTED: White goods are defined as inoperative and discarded refrigerators, ranges, water heaters, freezers, and other similar domestic and commercial large appliances (see the White Goods Definition Sheet for further white goods descriptions). Local governments should enter the white goods pounds collected, by month, on the White Goods Pounds Collected line. Total white goods pounds collected are automatically summarized by quarter and total and will appear in the top portion of the Data Tracking Form. White good pound information can come from scale tickets or weight estimates. To estimate weight, count the number of units collected and multiply this number by 100 (this is the estimated average weight of appliances as provided by a local scrap metal processor). WHITE GOODS COLLECTION SERVICE IS PROVIDED BY: Indicate who is providing white goods collection services. Place the mouse over the attached cell and select either local government, if providing own service, or the name of a local waste White Goods Grant Program hauler as shown in the drop-down menu (if your hauler is not listed in the menu, please send the hauler’s name to the e-mail address provided above). REVENUES: Any revenues received from the sale of white goods, motors, freon, etc. should be reported. If a fee is charged to households that request white goods collection, this fee also needs to be reported as revenue. EXPENSES (COLLECTION): Collection costs will generally include labor and equipment. These costs are related to curbside or drop-off site collection of white goods. Labor costs should be allocated based on the weight of white goods collected and does include benefits paid as part of labor. Example: If 8% of the total weight of materials that moves through a collection program is white goods and the staff member provides assistance in this collection, then 8% of his/her time is labor attributed to white goods management. The cost of operating and maintaining equipment used for the collection of white goods should be reported. This includes roll-offs, dump trucks, flatbed trucks, or other vehicles used to collect white goods. As with labor costs, the allocation of costs associated with split-duty equipment should be determined based on weight. These costs may include parts, maintenance, fuel, etc. If your municipality contracts for white goods collection, enter the portion of the contract costs that can be attributed to white goods collection. EXPENSES (HAULING): Municipalities may incur hauling costs at various stages. Most likely there will be costs associated with moving white goods from the curb, drop-off location or staging facility to the County Multi-Material Recycling Facility or a local scrap metal recycler. Labor costs should be determined based on the labor cost per haul for white goods and the number of hauls made in a given time period. Calculate hauling equipment operation and maintenance in the same manner it was calculated for collection. If hauling is contracted, enter the portion of the contract cost that can be attributed to hauling white goods. EXPENSES (DISPOSAL): If market conditions or other circumstances arise that require local governments to pay for white goods disposal, enter that amount. For example: If a market does not accept the electric motors from white goods and they must be disposed of, include these costs. Also, if a local scrap recycler requires payment to accept white goods, these costs should be reported. EXPENSES (OTHER): White Goods Grant Program Determine and describe any other daily operational costs associated with white goods management that were not previously included. Use the same principals provided under collection to determine the actual cost incurred. Such costs might include white goods equipment purchases, illegal white goods clean-up costs (1), etc. (1) Two criteria regulate the reportable costs for illegal disposal clean-up under the white goods management program. 1) If a visual inspection indicates that the illegal disposal site is at least 50% white goods, then 100% of the clean-up cost for that site may be reported; 2) if a visual inspection indicates less than 50% of the illegal disposal site is white goods, then the clean-up cost may be allocated to white goods management cost based on the percentage of white goods. For example: If the site is 25% white goods, 25% of the cost may be reported. BALANCE: In order to determine white goods funds requested for reimbursement, expenses are subtracted from revenues to arrive at a net funding request. This is done automatically in the Data Tracking Form and is summarized at the top left portion of the form. White Goods Grant Program TIME TABLE FY 2012 MONTH/YEAR ACTIVITY DESCRIPTION July 29, 2011 Local governments to notify Wake County of interest in participating in FY 2012 White Goods Grant Round. Note: Local governments interested in participating in the FY 2012 White Goods Grant Round must begin data collection from July 1, 2011. August 12, 2011 Wake County to supply local governments interested in the FY 2012 White Goods Grant Round with a packet of information. October 31, 2011 Local governments to submit 1st electronic quarterly update (White Goods Grant Program, Data Tracking Form) to Wake County. (1) January 31, 2012 Local governments to submit 2nd electronic quarterly update (White Goods Grant Program, Data Tracking Form) to Wake County. April 30, 2012 Local governments to submit 3rd electronic quarterly update (White Goods Grant Program, Data Tracking Form) to Wake County. June 30, 2012 Local governments to end data collection for FY 2012 White Goods Grant Round. July 31, 2012 Local governments to submit 4th electronic quarterly update (White Goods Grant Program, Data Tracking Form) to Wake County. August 15, 2012 Deadline for final submission of White Goods Grant Program Data Tracking Form (form must be signed by Finance Officer). August 30, 2012 Wake County to analyze grant applications, notify grant recipients of grant award and prepare contracts for local governments receiving grants. October 31, 2012 Local governments to sign and return White Goods Grant Contract to Wake County and submit an invoice to Wake County for the approved grant amount. November 30, 2012 Wake County to send checks to local governments for the FY 2012 grant round. White Goods Grant Program Electronic updates and correspondence should be sent to: lshaw@wakegov.com