CORPORATE DEBT MARKET IN ROMANIA

advertisement

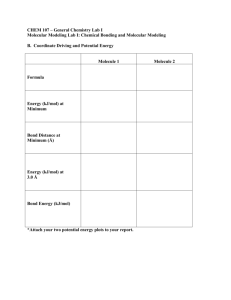

WHERE IS HEADING THE ROMANIAN CORPORATE BOND MARKET ? A NATIONAL AND INTERNATIONAL APPROACH Corduneanu Carmen West University of Timisoara, Faculty of Economics and Business Administration Timişoara/Romania carmen.corduneanu@yahoo.com Milos Laura Raisa Eftimie Murgu University Resita, Faculty of Economics and Administrative Sciences Resita/Romania miloslaura@yahoo.com, iovulaura@yahoo.com Abstract Bond issuing is a pretty used method of raising operating capital for most companies from developed countries that detain mature capital markets. It is also true that in these countries, during the time, there were taken a series of institutional and policy measures that have played an important role in the development of their domestic bond markets. This has lead to a positive dynamics, proven by the statistics. For example, the United States corporate bond market has been for a long time an important source of finance for the private sector, while for Japan or for the European developed countries, the corporate debt market has only lately matured. In our opinion, this was due to the understanding by the authorities of the necessity of having deep and liquid bond markets in the economy. Romania’s underdeveloped capital market has made this method of long-term financing to be less appreciated among potential issuers. The authors make a short review of what has been done in this area and what measures should be further taken for fostering the corporate bond market. More recently, there has been taken into discussion the potential positive incentive that can be brought for this market by the current financial crisis, having in consideration that during this difficult period, investors are more likely to put their money into fixed income instruments. The authors are going to analyze and give some arguments in favor or despite this believe, as far as concerns the Romanian case. Moreover, the objective of the paper is to discuss some issues regarding the development of the Romanian corporate bond market considering its dynamics between 2004-2008, evaluating some key indicators (volume, value of issuing, offered yield), likewise estimating the future for this market. Not at least, there are explained and compared the differences between the Romanian and some mature corporate bond markets. Keywords Bonds, capital market, financial crisis, corporate debt market 1. INTRODUCTION Bond issuing is a pretty used method of raising operating capital for most companies from developed countries that detain mature capital markets. It is also true that in these countries, during the time, there were taken a series of institutional and policy measures that have played an important role in the development of their domestic bond markets. The governments of such countries saw the role of provider of long-term funds of the bond market and understood that a well-functioning bond market would help lower funding costs. The taken measures have lead to a positive dynamics of this market, proven by the international statistics. By comparison, in Romania, bond issuing is not one of the main means of financing for the companies. Following the realized study, we noticed a lack of diversification of the bond market, although it is allowed by the legislation. In our opinion, this is due to the level of development of the stock market and to the fact that nowadays the current demand for financial instruments is not directed towards fixed-income instruments, with lower risk and lower return. Though, this thing can change in the near future. The current process of globalization of the markets oblige the companies to design more effective financing strategies in order to finance their investment projects in a competitive manner. This may have a positive role in developing also the bond markets from emerging economies. As the international experience shows, bond financing turns out to be an alternative to the traditional bank financing for the companies. It is also true that an increase of this type of financing leads to a deepening of the domestic capital market, especially in what concerns the emerging ones. In the context of the current international financial crisis, there are various opinions in favour for the development of the bond markets, giving the current situation. It is thought that the bond market could be fostered by an increase in the demand of bond issuings of the companies, once with the rose of the interest rates for bank loans. Secondly, in period of financial crisis, of high volatility on the markets, investors are likely to change the structure of their portofolios, acquiring more fixed-income instruments. The current turmoil in mature credit markets has highlighted that policymakers and market participants should aim to foster a strong institutional structure for local currency bond markets. Given the current state of development of the domestic corporate bond market, we are reluctant in seeing the financial crisis as having a major impact on fostering the domestic bond market. Though, we think it may have a positive impact on the long-run. 2. THE CURRENT STATE OF THE ROMANIAN CORPORATE BOND MARKET As far as concerns the Romanian corporate debt market, it is not surprising that this is insufficiently developed, given the lack of issuance in the primary market and of the liquidity in the secondary market, on the BSE. Through the main reasons for the lack of a functional and developed capital market we can mention the instability of the legislative framework, the reduced profitabilility in the economy, high interest rates and the increased inflation (until 2005, when the monetary policy had the inflation targeting as one of its main priorities). At the end of the year 2007, at the Bucharest Stock Exchange were traded 23 bonds, through them only 6 corporate bonds (in comparison with 7 at the end of 2006 and 6 at the end of 2005). Nowadays, the situation is even more accute, with only 2 corporate bonds trading on the domestic capital market. Moreover, if we analyse the total trade value of bonds, regardless the type, in 2007, it has reached 794,3 million RON (233,5 million Euro), declining with 19,4 % in comparison with the previous year. As far as concerns the structure of the stock exchange transactions, only 8,52 % is owed to the bond sector, the equity transactions accounting for 91,47 % of the total amount. 3.20% 5.32% Equity 0.01% Rights Romanian bonds 91.47% Foreign bonds Fig. 1. Structure of the stock trading in 2007 Source: realized by authors with dates provided by BSE It is obvious that the bond trading is by far less interesting for the investors than the equity trading. This certainly leads to a reduced liquidity for the bond market. The first initiative for issuing corporate bonds belonged to International Leasing, in may 2000, with a total issue value of 2,2 billion RON and with a maturity of 18 months. Since then, there have been developed on the market no more than 15 public offers for corporate bonds, this number dropping in the last period but being characterised by an increase in the maturity and in the issued value. The average rate of interest reached in 2007 the value of 8,10 %, surpassing the bonification for the bank deposits at that time. 20% 18% 16% 14% 12% 10% 8% 6% 4% 2% 0% 18.72% 7 6 9.24% 6.89% Average rate of interest for corporate bonds (left scale) 5 8.10% 4 Number of corporate bonds (right scale) 3 2 2004 2005 2006 2007 Fig. 2. Corporate bonds yield and the number of corporate bonds realized in the period 2004-2007 Source: realized by authors with dates provided by BSE Nevertheless, in contrast with the government bond market and the municipal bond market, that has made significant strides in both primary and secondary market, the Romanian corporate bond market remains largely underdeveloped and illiquid. Moreover there is no diversification of this market, missing the mortgage bonds, that contribute in a significant way to the development of the bond markets in countries that detain mature capital markets. The limited range of debt instruments and investment opportunities are perceived to be a major constraint in the development of the corporate bond market. In the absence of a product range and investment opportunities, which provide an exit route, investors are compelled to hold the investment to maturity or incur heavy costs to raise the desired liquidity. 3. DYNAMICS OF THE INTERNATIONAL CORPORATE DEBT MARKET At the international level, bond issuing is becoming more and more frequent as alternative source of financing the companies´ activity. We can easily notice that the amounts outstanding on the global corporate debt market increased over the latter period, whenever we take into consideration the developed European Union countries, USA or Japan (Fig.3). After a long-lasting period of relative constant volume of issuings, the European corporate debt market began in 1998 an expansion trend, which still continues. As in the case of the American market, the corporate bond market is dominated by the financial corporations that are high value bond issuers. This is due to the intense activity of the banks on the capital market, as well as to the importance of financial liberalization and deregulation of the banking sector. Moreover, the lack of currency risk in the Euro Zone has led to an increased attractiveness for the corporate debt market. The constant growth of the corporate bond market, measured as percent of GDP proves once more the importance of this sector for financing the companies and its positive dynamics over the time, regardless the geographical area. It is also true that the development of this market occured as well due to the financial globalization process, consequently to the intensification of financial transactions between countries, to the financial liberalization that fostered the global competition for finance. Not at least, the decreasing rates of inflation have fostered the investment climate and encouraged the financial transactions. 3500 3000 2500 2000 1500 1000 500 0 1998 1999 2000 Euro area 2001 2002 2003 USA 2004 2005 2006 2007 Japan Fig. 3. Dynamics of bond markets in the financial triad Eurozone-Japan-EA (bill.Euro) Source: realized by authors with dates provided by ECMI If we take into consideration only the European Union countries we can notice the important advance made by this market in the analysed period of time (1989-2007). This was due mainly to the dissapearance of the currency risk for the Euro zone countries that has encouraged the bond issuers to finance their activities through such financial instruments. Fig.4. Dynamics of European corporate bond market (billion $) Note: there are only illustrated the bond issuings realized by nonfinancial companies Source: DCM Analytics, Datastream 4. CONCLUSIONS The Romanian bond market cannot stay immune to what happens on the global capital markets. As far as concerns the mature economies, bond markets are very developed. A growing number of emerging market economies have made also considerable efforts in order to develop the domestic capital market. Where the Romanian bond market is heading will depend on the institutional effort meant to foster the domestic bond market. However, giving the current financial crisis and the fact that the institutional investors are becoming more and more present on the Romanian capital market, we strongly believe that in the near future, in the context of financial globalization, the domestic bond market will develop. References [1] Ayyagari, M., Demirguc-Kunt A., Maksimovic V. - How important are financing constraints? The role of finance in the business environment, World Bank Working Paper 3820, 2005 [2] Batten, J., Szilagyi, P. – Disintermediation and bond market development in Japan, Deakin University Working Paper nr. 2002-02 [3] Burger, J., Warnock, F., Warnock V. – Global financial stability and local currency bond markets , available on: http://faculty.darden.virginia.edu/warnockf/BWW_2009.pdf Corduneanu, C. – Pieţe de capital. Teorie şi practică, Ed.Mirton, Timişoara, 2006 [4] Demirguc-Kunt, A. – Finance and economic development: policy choices for developing countries, Policy Research Working Paper Series 3955, The World Bank, 2006 [5] Krittayanavaj, B. – Global financial crisis 2008: a view from Thailand, GH Bank Housing Journal, vol.2, nr.4-5, pg. 36-43, 2008 [6] Wehinger, G. – Lessons from the financial market turmoil: challenges ahead for the financial industry and policy makers, Financial market trends , ISSN 1995/2864, OECD, 2008 [7] Wignall, A., Atkinson, P. Lee, S. – The current financial crisis: causes and policy issues, Financial market trends , ISSN 1995/2864, OECD, 2008 [8] http://www.bvb.ro - Bucharest Stock Exchange [9] http://www.eurocapitalmarkets.org - European capital market institute [10] http:// www.datastream.net - Datastream