Chip Design Sector - Ifise final report

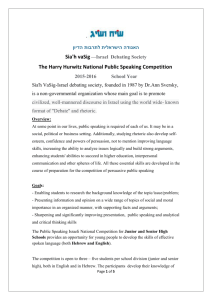

advertisement