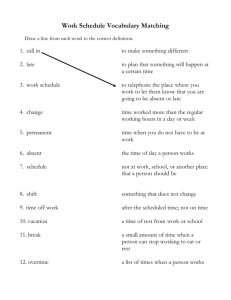

table of contents

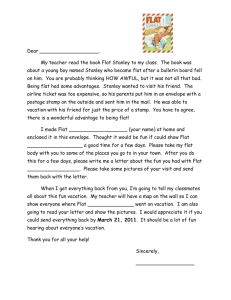

advertisement