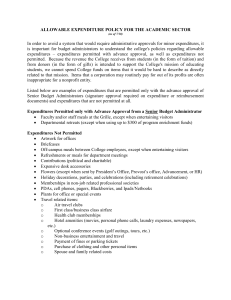

Expenditure Function Codes (GA)

advertisement

University of Virginia

Financial Analysis

Expenditure Function Code Directory

Revision Date: 8/7/2012

1

Instruction

Instruction, General Academic

Instruction, General Academic – SWVA Ctr

Instruction, General Academic – Medicine

Instruction, General Academic – Medicine

(Graduate Medical Education)

Instruction, General Academic – Family Medicine

Instruction, Vocational /Technical

Community Education

Instruction Preparatory/Remedial

Instruction Preparatory/Remedial- Medicine

Instructional Information Technology

2000

2005

2020

2025

2030

2100

2300

2400

2410

2450

Research

Research, Institutes and Centers

Research, Projects & Individual

Research, Commonwealth Research Initiative

Research, Projects & Individual – SWVA Ctr

Research Information Technology

2600

2700

2710

2705

2790

Public Service

Community Service

Community Service – Funds for Excellence

Community Services – SWVA Ctr

Conferences, Workshops, etc.

Public Broadcasting Services

Public Service Information Technology

2800

2801

2805

2810

2820

2850

Academic Support

Libraries

Museums and Galleries

Educational Media Services

Academic Support Information Technology

Academic Support Information Technology

– SWVA Ctr

Ancillary Support

Academic Administration

Course and Curriculum Development

Academic Personnel Development

3000

3100

3200

3300

3305

3400

3500

3600

3700

2

Student Services

Social and Cultural Development

Counseling and Career Guidance

Financial Aid Administration

Student Admissions

Student Services Administration

Student Records

Student Services Information Technology

4000

4200

4300

4400

4500

4600

4650

Institutional Support

Executive Management

Fiscal Operations

General Administration

General Administration – SWVA Ctr

Logistical Services

Public Relations/Development

Administrative Information Technology

5000

5100

5200

5205

5300

5400

5600

Operation and Maintenance of Plant

Physical Plant Administration

Physical Plant Administration – SWVA Ctr

Operation and Maintenance Information Technology

Building Maintenance

Rental Property

Custodial Services

Utilities

Landscape and Grounds Maintenance

Major Repairs and Renovations

6000

6005

6050

6100

6110

6200

6300

6400

6450

Scholarships and Fellowships

Scholarships

Scholarships – SLEAP Program

Fellowships

6500

6510

6700

3

Auxiliary Enterprises

Student Dining Services (Aux)

Student Housing (Aux)

Student Health (Aux)

Stores and Shops (Aux)

Student Activities – Std Unions/Rec Facilities (Aux)

Student Activities – Rec & Intramural Programs (Aux)

Student Activities – Other (Aux)

Auxiliary Enterprises – Faculty/Staff

Parking and Transportation (Aux)

Intercollegiate Athletics (Aux)

Auxiliary Enterprises – Other

7010

7020

7030

7040

7050

7051

7052

7100

7110

7200

7300

Other Self-Supporting Enterprises

Other Self-Supporting Enterprises

7350

Auxiliary State Reporting – Central Use Only

Auxiliary State Reporting – Central Use Only

7399

Hospitals

Hospitals

8000

Independent Operations

Independent Operations/Institutional

8500

Other Expenditure Function Codes

Agency Projects

Revenue Only Projects

Revenue Only Projects – Auxiliary

9970

9990

9950

Balance Sheet Only Projects – Central Use Only

Clearing and Suspense Projects

Balance Sheet Projects

Balance Sheet Projects-Auxiliary

Loan Funds

Investments

Other

Agency

9800

9810

9850

9820

9830

9840

9970

4

Renewal and Replacement

E&G

Student Housing

Parking and Transportation

Telecommunications

Student Health

Student Activities – Rec & Intramurals

Student Activities – Other

Intercollegiate Athletics

Other Auxiliary R&R

7981

7991

7992

7993

7994

7995

7996

7998

7999

Unexpended Plant

Unexpended Plant (capital projects)

Capital Project-Revenue Only

9700

9701

Debt – Central Use Only

Debt Operating – 0812-80930

Debt Operating – 0812-80940

Debt Operating – 0814-10440

Debt Operating – 0814-10790

Debt Operating – 0814-11004

Debt Operating – 0814-80930

Debt Operating – 0814-80940

Debt Operating – 0814-80980

Debt Operating – 0814-80990

Debt Operating – 0814-80995

Debt Operating – 0814-80910

Debt Operating – 0814-80997

Debt Operating – Other

9760

9761

9769

9770

9771

9772

9773

9774

9775

9776

9777

9778

9779

5

Expenditure Function Codes and Definitions

In their financial statements, public institutions are required to classify

expenditures by function. The following functional classifications are derived

from the Financial Accounting and Reporting Manual for Higher Education.

Instruction

Research

Public Service

Academic Support

Student Services

Institutional Support

Operation and Maintenance of Plant

Scholarships and Fellowships

Auxiliary Enterprises

Hospitals

Independent Operations

The expenditure function is a code used to categorize a project’s primary reason

for existence. Expenditure functions include “core missions” of the University

(Instruction, Research, and Public Service), as well as “support” functions. The

bulleted sections below are designed to help guide ACADEMIC departments in

determining the appropriate expenditure function code for their expenditure

projects.

The expenditure projects created by ACADEMIC departments will usually

fall into the core missions of Instruction, Research, and Public Service. To

a lesser degree, academic departments might have expenditure projects

that provide Academic Support or Student Services. Finally, academic

departments might have projects that provide Scholarships/Fellowships

support to students.

Academic Support includes academic administration at both the dean and

department level. It also includes libraries.

Student Services includes school/department based admissions and

records, as well as programs that provide social, cultural, counseling and

career guidance to students.

Academic units would rarely, if ever, have expenditure projects that fall

into the Institutional Support, Operation & Maintenance of Plant, or

Auxiliary Enterprise expenditure function categories. Central

administrative support offices would usually establish projects with these

functions.

Each Oracle project in Funds Management must be assigned one (and only

one) expenditure function code.

6

The following definitions should be used:

INSTRUCTION

The instruction category includes expenditures for all activities that are part of an

institution’s instruction program. Expenditures for credit and noncredit courses;

academic vocational and technical instruction; remedial and tutorial instruction;

and regular, special, and extension session should be included. Expenditures for

departmental research and public services that are not separately budgeted

should be included in this classification. This category excludes expenditures for

academic instruction when the primary assignment is administration – for

example, academic deans. However, expenditures for department chairpersons

and administrators for whom instruction is an important role are included.

The instruction category includes the following subcategories:

2000 Instruction, General Academic

2005 Instruction, General Academic – SWVA Ctr

2020 Instruction, General Academic – Medicine

2025 Instruction, General Academic – Medicine (Graduate Med Educ)

2030 Instruction, General Academic – Family Medicine

These subcategories include expenditures for formally organized and/or

separately budgeted instructional activities that are carried out during the

academic year, associated with academic offerings described by certain IPEDS

instructional program categories, offered for credit as part of a formal postsecondary education degree or certification program. Open university, short

courses, and home study activities falling within this classification and offered for

credit are included. However, these subcategories do not include instructional

offerings that are part of programs leading toward degrees or certificates at levels

below the higher education level, such as adult basic education.

2100 Instruction, Vocational/Technical

This subcategory includes expenditures for formally organized and/or separately

budgeted instructional activities that are carried out during the academic year,

usually associated with IPEDS instructional program categories identified as

vocational and technical, and offered for credit as part of a formal post-secondary

education degree or certificate program. Open university, short courses, and

home study falling within this classification and offered for credit are included.

However, this subcategory does not include instructional offerings that are part of

programs leading toward degrees or certificates at levels below the higher

education level, such as adult basic education.

2300 Community Education

This subcategory includes expenditures for formally organized and/or separately

budgeted instructional activities that do not generally result in credit toward any

formal post-secondary degree or certificate. It includes noncredit instructional

offerings carried out by the institution’s extension division as well as noncredit

offerings that are part of the adult education or continuing education program.

This subcategory also includes expenditures for activities associated with

7

programs leading toward a degree or certificate at a level below the higher

education level, such as adult basic education.

2400 Instruction Preparatory/Remedial

2410 Instruction Preparatory/Remedial – Medicine

These subcategories include expenditures for formally organized and/or

separately budgeted instructional activities that give students the basic

knowledge and skills required by the institution before they can undertake formal

academic course work leading to a post-secondary degree or certification. Such

activities, supplemental to the normal academic program, generally are termed

preparatory, remedial, developmental, or special educational services. These

instructional offerings may be taken prior to or along with the course work leading

to the degree or certificate. They are generally noncredit offerings, although in

some cases credit may be provided specifically for required preparatory or

remedial skills or knowledge should be included in this category. For example, if

students may satisfy preparatory requirements by taking offerings provided

primarily for other than remedial or preparatory purposes, those offerings should

be classified elsewhere.

2450 Instructional Information Technology

This subcategory includes expenditures for formally organized and/or separately

budgeted instructional information technology. If an institution does not

separately budget and expense information technology resources, the costs

associated with the three primary programs will be applied to academic support

and the remainder to institutional support.

RESEARCH

The research category includes all expenditures for activities specifically

organized to produce research, whether commissioned by an agency external to

the institution or separately budgeted by an organizational unit within the

institution. (An example might be internal research awards, awarded by the

VPR’s Office…aka URPC {University Research Policy Council}). Subject to

these conditions, the category includes expenditures for individual and/or project

research as well as that of institutes and research centers. This category does

not include all sponsored programs nor is it necessarily limited to sponsored

research, since internally supported research programs, if separately budgeted,

might be included in this category under the circumstances described.

Expenditures for departmental research that are separately budgeted for

research are included in this category. However, the research category does not

include expenditures for departmental research that are not separately budgeted.

Such expenditures are included in the instructional category.

The research category includes the following subcategories:

2600 Research, Institutes and Centers

This subcategory includes expenditures for research activities that are part of a

formal research organization created to manage a number of research efforts.

8

This expenditure function code should only be used for projects owned by

the following state-approved Centers and Institutes:

Virginia Foundation for the Humanities and Public Policy

Center for Public Service

Institute of Government

State Climatologist

Virginia Center for Diabetes Professional Education

Center for Liberal Arts

Institute of Nuclear and Particle Physics

Institute for Afro American and African Studies

White Burkett Miller Center of Public Affairs

The Papers of George Washington

The Papers of James Madison

Gang Prevention Project

Center for Governmental Studies

Fisheries Resource Grant Fund

State Arboretum

O'Brien Center of Excellence in Urology

Center for the Advancement of Generalist Medicine

2700 Research, Projects & Individual

2705 Research, Projects & Individual – SWVA Ctr

These subcategories include expenditures for research activities and are

managed within academic departments. Such activities may have been

undertaken as the result of a research contract or grant or through a specific

allocation of the institution’s general resources.

2710 Research, Commonwealth Research Initiative

This subcategory includes expenditures for research activities that are part of the

Commonwealth Research Initiative authorized by a specific state appropriation.

2790 Research Information Technology

This subcategory includes expenditures for formally organized and/or separately

budgeted research information technology. If an institution does not separately

budget and expense information technology resources, the costs associated with

the three primary programs will be applied to academic support and the

remainder to institutional support.

PUBLIC SERVICE

The public service category includes expenditures for activities established

primarily to provide non-instructional services beneficial to individuals and groups

external to the institution. These activities include community service programs

(excluding instructional activities) and cooperative extension services. Included

in this category are conferences, institutes, general advisory services, reference

bureaus, radio and television, consulting, and similar non-instructional services to

particular sectors of the community.

The public service category includes the following subcategories:

9

2800 Community Service

2801 Community Service – Funds for Excellence

2805 Community Services – SW VA Ctr

2810 Conferences, Workshops, etc.

These subcategories include expenditures for activities organized and carried out

to provide general community services, excluding instructional activities.

Community service activities make available to the public various resources and

special capabilities that exist within the institution. Examples include

conferences and institutes, general advisory services and reference bureaus,

consultation, testing services (for example, soil testing, carbon dating, structural

testing), and similar activities. The activities included in these subcategories are

generally sponsored and managed outside the context of both the agricultural

and urban extension programs and of the institution’s public broadcasting station.

2820 Public Broadcasting Services

This subcategory includes expenditures for operations and maintenance of

broadcasting services operated outside the context of the institution’s instruction,

research, and academic support programs. Excluded from this subcategory are

broadcasting services conducted primarily in support of instruction (classified in

the subcategory ancillary support), broadcasting services operated primarily as a

student service activity (classified in the subcategory social and cultural

development), and broadcasting services that are independent operations

(classified in the subcategory independent operation/institutional).

2850 Public Service Information Technology

This subcategory includes expenditures for formally organized and/or separately

budgeted public service information technology. If an institution does not

separately budget and expense information technology resources, the costs

associated with the three primary programs will be applied to academic support

and the remainder to institutional support.

ACADEMIC SUPPORT

The academic support category includes expenditures incurred to provide

support services or the institution’s primary missions: instruction, research, and

public service. It includes the retention, preservation, and display of educational

materials, for example, libraries, museums, galleries; the provision of services

that directly assist the academic functions of the institution, such as

demonstration schools associated with a department, school, or college of

education; media such as audio-visual services and technology such as

computing support; academic administration (including academic deans but not

department chairpersons) and personnel development providing administration

support and management direction to the three primary missions (instruction,

research, public service); and separately budgeted support for course and

curriculum development. For institutions that currently charge some of the

expenses –for example, computing support – directly to the various operating

units of the institution, this category does not reflect such expenses.

This category includes the following subcategories:

10

3000 Libraries

This subcategory includes expenditures for organized activities that directly

support the operation of a catalogued or otherwise classified collection.

3100 Museums and Galleries

This subcategory includes expenditures for organized activities that provide for

the collection, preservation, and exhibition of historical materials, art objects,

scientific displays, etc. Libraries are excluded.

3200 Educational Media Services

This subcategory includes expenditures for organized activities providing

audiovisual and other services that aid in the transmission of information in

support of the institution’s instruction, research, and public service programs.

3300 Academic Support Information Technology

3305 Academic Support Information Technology – SWVA Ctr

These subcategories include expenditures for formally organized and/or

separately budgeted academic support information technology. If an institution

does not separately budget and expense information technology resources, the

costs associated with the three primary programs will be applied to this category

and the remainder to institutional support.

3400 Ancillary Support

This subcategory includes expenditures for organized activities that provide

support services to the three primary programs of instruction, research, and

public service, but are not appropriately classified in the previous subcategories.

Ancillary support activities usually provide a mechanism through which students

can gain practical experience. An example of ancillary support is a

demonstration school associated with a school of education. The expenditures

of teaching hospitals are excluded.

3500 Academic Administration

This subcategory includes expenditures for activities specifically designed and

carried out to provide administrative and management support to the academic

programs. This subcategory is intended to separately identify only expenditures

for activities formally organized and/or separately budgeted for academic

administration. It includes the expenditures of academic deans (including deans

of research, deans of graduate schools, and college deans), but it does not

include the expenditures of department chairpersons (which are included in the

appropriate primary function categories). The subcategory also includes

expenditures for formally organized and/or separately budgeted academic

advising. Expenditures associated with the office of the chief academic officer of

the institution are not included in this subcategory, but should be classified as

institutional support.

3600 Course and Curriculum Development

This subcategory includes expenditures for activities established either to

significantly improve or to add to the institution’s instructional offerings, but only

11

to the extent that such activities are formally organized and/or separately

budgeted.

3700 Academic Personnel Development

This subcategory includes expenditures for activities that provide the faculty with

opportunities for personal and professional growth and development to the extent

that such activities are formally organized and/or separately budgeted. This

subcategory also includes formally organized and/or separately budgeted

activities that evaluate and reward professional performance of the faculty.

Included in this subcategory are sabbaticals, faculty awards, and organized

faculty development programs.

STUDENT SERVICES

The student services category includes expenditures incurred for offices of

admissions and the registrar and activities with the primary purpose of

contributing to students’ emotional and physical well-being and intellectual,

cultural, and social development outside the context of the formal instruction

program. It includes expenditures for student activities, cultural events, student

newspapers, intramural athletics, student organizations, intercollegiate athletics

(if the program is not operated as an essentially self-supporting activity),

counseling and career guidance (excluding informal academic counseling by the

faculty), student aid administration, and student health service (if not operated as

an essentially self-supporting activity). In recent years, some institutions have

created an office of enrollment management; expenditures for such an office are

best categorized in student services.

The student services category includes the following subcategories:

4000 Social and Cultural Development

This subcategory includes expenditures for organized activities that provide for

students’ social and cultural development outside the formal academic program.

This subcategory includes cultural events, student newspapers, intramural

athletics, student organizations, etc. Expenditures of ran intercollegiate athletics

program are included in this subcategory if the program is not operated as an

essentially self-supporting operation (in which case all the related expenses

would be reported as auxiliary enterprises).

4200 Counseling and Career Guidance

This subcategory includes expenditures for formally organized placement, career

guidance, and personal counseling services for students. This subcategory

includes vocational testing and counseling services and activities of the

placement office. Excluded from this subcategory are formal academic

counseling activities (academic support) and informal academic counseling

services (instruction) provided by the faculty in relation to course assignments.

4300 Financial Aid Administration

This subcategory includes expenditures for activities that provide financial aid

services and assistance to students. This subcategory does not include outright

12

grants to students, which should be classified as either revenue reductions,

agency transactions, or expenses, as discussed elsewhere in this manual.

4400 Student Admissions

This subcategory includes expenditures for activities related to the identification

of prospective students, the promotion of attendance at the institution, and the

processing of applications for admission.

4500 Student Services Administration

This subcategory includes expenditures for organized administrative activities

that provide assistance and support (excluding academic support) to the needs

and interests of students. This subcategory includes only administrative activities

that support more than one subcategory of student activities and /or that provide

central administrative services related to the various student service activities. In

particular, this subcategory includes services provided for particular types of

students (for example, minority students, veterans, and handicapped students).

Excluded from this subcategory are activities of the institution’s chief

administrative officer for student affairs, whose activities are institution wide and

therefore should be classified as institutional support.

4600 Student Records

This subcategory includes expenses for activities to maintain, handle and update

records for currently enrolled students as well as for students previously enrolled.

4650 Student Services Information Technology

This subcategory includes expenditures for formally organized and/or separately

budgeted student services information technology. If an institution does not

separately budget and expense information technology resources, the costs

associated with the three primary programs will be applied to academic support

and the remainder to institutional support.

INSTITUTIONAL SUPPORT

The institutional support category includes expenditures for central executivelevel activities concerned with management and long-range planning for the

entire institution, such as the governing board, planning and programming, and

legal services; fiscal operations, including the investment office; administrative

data processing; space management; employee personnel and records; logistical

activities that provide procurement, storerooms, safety, security, printing, and

transportation services to the institution; support services to faculty and staff that

are not operated as auxiliary enterprises; and activities concerned with

community and alumni relations, including development and fund raising. To the

extent that fringe benefits are not assigned to other functional categories, those

benefits would be charged to institutional support.

Appropriate allocations of institutional support should be made to auxiliary

enterprises, hospitals, and any other activities not reported under the educational

and general heading of expenses.

13

The institutional support category includes the following subcategories:

5000 Executive Management

This subcategory includes expenditures for all central, executive-level activities

concerned with management and long-range planning for the entire institution (as

distinct from planning and management for any one program within the

institution). All officers with institution wide responsibilities are included, such as

the president, chief academic officer, chief business officer, chief student affairs

officer, and chief development officer. This subcategory includes such

operations as executive direction (for example, governing board), planning and

programming, and legal operations.

5100 Fiscal Operations

This subcategory includes expenditures for operations related to fiscal control

and investments. It includes the accounting office, bursar’s office, and internal

and external audits. It also includes unallocated interest expense.

5200 General Administration

5205 General Administration – SWVA Ctr

5300 Logistical Services

These subcategories include expenditures for activities related to general

administrative operations and services (with the exception of fiscal operations

and administrative data processing). Included in these subcategories are

personnel administration, space management, purchase and maintenance of

supplies and materials, campus wide communication and transportation services,

general stores, printing shops, and safety services.

5400 Public Relations/Development

This subcategory includes expenditures for activities to maintain relations with

the community, alumni, or other constituents and to conduct activities related to

institution wide development and fund raising.

5600 Administrative Information Technology

This subcategory includes expenditures for formally organized and/or separately

budgeted administrative information technology. If an institution does not

separately budget and expense information technology resources, the costs

associated with the three primary programs will be applied to academic support

and the remainder to institutional support.

OPERATION AND MAINTENANCE OF PLANT

The operation and maintenance of plant category includes all expenditures of

current operating funds for the operation and maintenance of the physical plant,

in all cases net of the amount charged to auxiliary enterprises, hospitals, and

independent operations. It includes all expenditures for operations established to

provide services and maintenance related to grounds and facilities. Also

included are utilities, fire protection, property insurance, and similar items. It

does not include expenditures made from the institutional plant funds accounts.

As the college guide prohibits recording depreciation in the current funds, this

category does not include depreciation.

14

This category includes the following subcategories:

6000 Physical Plant Administration

6005 Physical Plant Administration – SWVA Ctr

These subcategories include expenditures for administrative activities that

directly support physical plant operations. Activities related to the development

of plans for plant expansion or modification, as well as plans for new

construction, should be included in this subcategory.

6050 Operation and Maintenance Information Technology

This subcategory includes expenditures for formally organized and/or

separately budgeted operation and maintenance information technology. If an

institution does not separately budget and expense information technology

resources, the costs associated with the three primary programs will be applied

to academic support and the remainder to institutional support.

6100 Building Maintenance

6110 Rental Property

These subcategories include expenditures for activities related to routine repair

and maintenance of buildings and other structures, including normally recurring

repairs and preventive maintenance.

6200 Custodial Services

This subcategory includes expenditures related to custodial services in buildings.

6300 Utilities

This subcategory includes expenditures related to heating, cooling, light and

power, gas, water, and any other utilities necessary for operation of the physical

plant.

6400 Landscape and Grounds Maintenance

This subcategory includes expenditures related to the operation and

maintenance of landscape and grounds.

6450 Major Repairs and Renovations

This subcategory includes expenditures related to major repairs, maintenance,

and renovations. Minor repairs should be classified as building maintenance.

The distinction between major repairs and minor repairs should be defined by the

institution.

SCHOLARSHIPS AND FELLOWSHIPS

The scholarships and fellowships category includes expenditures for

scholarships and fellowships – from restricted or unrestricted current funds – in

the form of grants to students, resulting from selection by the institution or from

an entitlement program. The category also includes trainee stipends, prizes, and

awards. Trainee stipends awarded to individuals who are not enrolled in formal

course work should be charged to instruction, research, or public service.

15

Recipients of grants are not required to perform service to the institution as

consideration for the grant, nor are they expected to repay the amount of the

grant to the funding source. When services are required in exchange for

financial assistance, as in the College Work Study program, charges should be

classified as expenditures of the department or organizational unit to which the

service is rendered. Aid to students in the form of tuition or fee remissions also

should be included in this category. However, remission of tuition and fees

granted because of faculty or staff status, or family relationship of students to

faculty or staff, should be recorded as staff benefit expenditures in the

appropriate functional expenditure category.

This category includes the following subcategories:

6500 Scholarships

This subcategory includes grants-in-aid, trainee stipends, tuition and fee waivers,

and prizes to undergraduate students. It does not include funds for which

services to the institution must be rendered, such as payments for teaching.

6510 Scholarships – SLEAP Program

This subcategory is to distinguish SLEAP scholarships from other scholarships

(described above). In July 2000, the State Council of Higher Education for

Virginia (SCHEV), using funds from the federal Special Leveraging Educational

Partnership (SLEAP), created the Higher Education Teacher Assistance Program

(HETAP). This scholarship program was established by SCHEV to help address

the teacher shortage in Virginia by assisting undergraduate students enrolled in a

K-12 teacher preparation program. Preference is given to students enrolled in a

teacher shortage content area identified by the Virginia Department of Education.

6700 Fellowships

This subcategory includes grants-in-aid and trainee stipends to graduate

students. It does not include funds for which services to the institution must be

rendered, such as payments for teaching.

AUXILIARY AND ENTERPRISES

An auxiliary enterprise exists to furnish goods or services to students, faculty, or

staff, and charges a fee directly to, although not necessarily equal to, the cost of

the goods or services. The distinguishing characteristic of an auxiliary enterprise

is that it is managed as an essentially self-supporting activity. Examples are

residence halls, food services, intercollegiate athletics (only if essentially selfsupporting), college stores, faculty clubs, faculty and staff parking, and faculty

housing. Student health services, when operated as an auxiliary enterprise, also

are included. The general public may be served incidentally by auxiliary

enterprises. Hospitals, although they may serve students, faculty, or staff, are

classified separately because of their financial significance.

The auxiliary enterprise category includes all expenditures relating to the

operation of auxiliary enterprises, including expenses for operation and

maintenance of plant and institutional support. Also included are other direct and

16

indirect costs, whether charged directly as expenses or allocated as a

proportionate share of costs of other departments or units.

This category includes the following subcategories:

7010 Student Dining Services (Aux)

7020 Student Housing (Aux)

7030 Student Health (Aux)

7040 Stores and Shops (Aux)

7050 Student Activities – Std Unions/Rec Facilities (Aux)

7051 Student Activities – Rec & Intramural Programs (Aux)

7052 Student Activities – Other (Aux)

These subcategories include expenditures for auxiliary enterprise activities

primarily intended to furnish services to students. A student health service, when

operated as an auxiliary enterprise, is included. However, intercollegiate

athletics are excluded from this category.

7100 Auxiliary Enterprises – Faculty/Staff

7110 Parking and Transportation (Aux)

These subcategories include expenditures for auxiliary enterprise activities

primarily intended to provide a service to the faculty and/or staff. Such activities

include the faculty club, faculty/staff parking, and faculty housing.

7200 Intercollegiate Athletics (Aux)

This subcategory includes expenditures for an intercollegiate sports program

when the program is operated in accordance with the definition of an auxiliary

enterprise, which means that it is essentially self-supporting.

7300 Auxiliary Enterprises – Other

This subcategory includes expenditures for auxiliary enterprise activities primarily

intended to furnish goods and services that are related to the higher education

mission. Customers of these goods and services will primarily not be students,

faculty, or staff. Entities of this type are formed to meet the geographic and public

service needs of a region and generally relate to an institution’s mission of

teaching, research, or public service. Examples of such an entity would be a drug

testing center or a university press department.

OTHER SELF-SUPPORTING ENTERPRISES

7350 Other Self-Supporting Enterprises

This subcategory includes activities that were primarily established to provide

goods and services to other internal units on a fee for service basis. The

following characteristics assist in identifying these units:

1. They are self-supporting units that operate on a break-even basis for those

goods and services offered to other units.

2. They could provide, to a lesser extent, the same goods and services to

faculty, staff, students, and related entities.

17

3. The goods and services are provided at an institutional level. This excludes

enterprises that only serve units within the same department. Examples are

that a telecommunications department services the entire institution and

would be considered other self-supporting while the chemistry stores

department only services other chemistry units and is therefore reported in

net within Educational and General (331-339).

4. This classification does not preclude the current reporting practices for

entities included in other functional categories.

5. The subcategory of Other Self-Supporting Enterprises should be net of

expenses since the predominance of transactions are internal.

AUXILIARY STATE REPORTING – CENTRAL USE ONLY

7399 Auxiliary State Reporting – Central Use Only

This subcategory is used by Central Administration for State reporting purposes.

HOSPITALS

8000 Hospitals

The hospital category includes all expenditures associated with the patient care

operations of a hospital, including nursing and other professional services,

general services, administrative services, fiscal services, and charges for

physical plant operations and institutional support. Also included are other direct

and indirect costs, whether charged directly as expenses or allocated as a

proportionate share of costs of other departments and units. Expenditures for

activities that take place within the hospital, but that are categorized more

appropriately as instruction or research, are excluded from this category and

accounted for in the appropriate categories.

INDEPENDENT OPERATIONS

The independent operations category includes expenditures that are independent

of or unrelated to, but that may enhance the primary missions of, an institution.

This category generally is limited to expenses associated with major federally

funded research laboratories. Excluded are expenses associated with property

owned and managed as investments of the institution's endowment funds.

Expenditures of independent operations are identified by the same criteria as

educational and general expenditures to distinguish them from transfers.

Mandatory transfers follow the same criteria of identification as educational and

general mandatory transfers to distinguish them from expenditures and nonmandatory transfers. Non-mandatory transfers follow the same criteria of

identification as educational and general non-mandatory transfers to distinguish

them from expenditures and mandatory transfers.

This subcategory includes the following category:

8500 Independent Operations/Institutional

This subcategory includes separately organized operations owned or controlled

by an institution but unrelated to, or independent of, the institution’s missions.

18

This subcategory generally includes commercial enterprises operated by the

institution but not established to provide services to students, faculty, or staff or

to provide support to one or more of the institution’s missions. Activities operated

as auxiliary enterprises (i.e., those established to provide a service to students,

faculty, or staff and charging a fee related to the cost of the service) are excluded

from this subcategory. Operations with commercial aspects that primarily

support instruction, research, and/or public service (for example, hospitals and

ancillary support activities) are excluded. Also excluded are activities operated

as a part of the institution’s endowment funds.

OTHER EXPENDITURE FUNCTION CODES

9970 Agency Projects

9990 Revenue Only Projects

9950 Revenue Only Projects-Auxiliary

These subcategories are used to denote:

Expenditure projects (9970) that belong to entities for which UVA serves as the

fiscal agent and revenue projects which have the deposit and recording of

revenue as their sole purpose. Thus, expenses should never be charged to

revenue only projects and awards should never fund revenue only projects.

BALANCE SHEET ONLY PROJECTS – CENTRAL USE ONLY

9800 Clearing and Suspense Projects

9810 Balance Sheet Projects

9850 Balance Sheet Projects-Auxiliary

9820 Loan Funds

9830 Investments

9840 Other

9970 Agency

These subcategories are used by Central Administration for reporting purposes.

RENEWAL AND REPLACEMENT

7981 E & G

7991 Student Housing

7992 Parking and Transportation

7993 Telecommunications

7994 Student Health

7995 Student Activities – Rec & Intramurals

7996 Student Activities - Other

7998 Intercollegiate Athletics

7999 Other Auxiliary R&R

These subcategories include expenditures for renewal and replacement of

institutional properties.

19

UNEXPENDED PLANT

9700 Unexpended Plant (capital projects)

This subcategory includes expenditures for construction or acquisition of

institutional properties.

9701 Capital Project-Revenue Only

This subcategory includes revenue projects which have the deposit and

recording of revenue as their sole purpose. Thus, expenses should never be

charged to revenue only projects and awards should never fund revenue only

projects.

DEBT – CENTRAL USE ONLY

9760 Debt Operating – 0812-80930

9761 Debt Operating – 0812-80940

9769 Debt Operating – 0814-10440

9770 Debt Operating – 0814-10790

9771 Debt Operating – 0814-11004

9772 Debt Operating – 0814-80930

9773 Debt Operating – 0814-80940

9774 Debt Operating – 0814-80980

9775 Debt Operating – 0814-80990

9776 Debt Operating – 0814-80995

9777 Debt Operating – 0814-80910

9778 Debt Operating – 0814-80970

9779 Debt Operating – Other

This subcategory is used by Central Administration for State and other reporting

purposes. It includes expenditures for debt service charges and the retirement of

indebtedness on institutional properties.

20