New Market Tax Credit Intake Form

advertisement

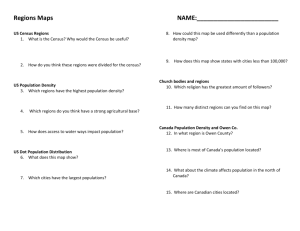

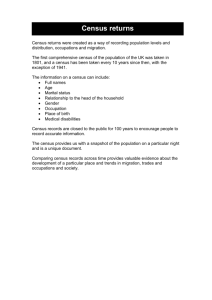

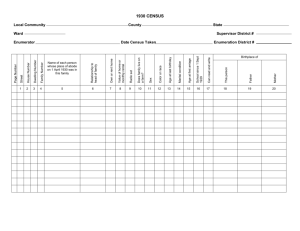

Texas Community Development Capital New Markets Tax Credit Funding Application Texas Community Development Capital (“Texas CDC”) will provide significant financial support to exceptional qualified applicants. This form will be used to determine if an applicant: Meets NMTC program requirements Meets the terms of Texas CDC’s Allocation Agreement Needs advantageous NMTC financing to generate community impact Would be unable to finance the proposed business without the benefit of a NMTC allocation Requires the benefit of a NMTC allocation within the range considered appropriate by Texas CDC Proposals which satisfy the basic criteria will then be evaluated more thoroughly by Texas CDC staff. Additional due diligence information may be required to confirm assertions made in the proposal application. Additional information including, but not limited to, a developed budget and development team resumes may be requested, as well as conversations with the sponsor and/or developer. Submit a list and copies (when appropriate) of sources utilized to complete this application with accurate and detailed information. Please provide as much information as possible. Greater detail will result in a better application. You may attach supplemental files; however, the inclusion of other documents should be in addition to completing the following form, rather than in the place of filling out all sections. If specific questions or sections in the application do not seem applicable to your business or you would like clarification, please contact Suzanna Caballero at 512 433 1173 or scaballero@txcdc.com Completed forms should be sent to: Suzanna Caballero Texas Community Development Capital P.O. Box 6370 for Courier Delivery: 1701 East 7th Street. Austin, TX 78762 Austin, TX 78702 (512) 477-5732 -1- I. Project Description A. Project name: B. Provide a narrative that describes the project in detail: II. Project Location & Community Profile A. Street Address: B. City, State & Zip Code: C. 11-digit Census Tract Code1: D. Community Type2 Major Urban Area (total urban/suburban population greater than 1 million) Minor Urban (total urban/suburban population less than 1 million) Rural Area (non-metropolitan) E. Population in Census Tract1 (11 digits): F. Community Distress Criteria: (If you answer “yes” to the questions below, you must submit supporting documentation with your application.) i. Percent living below poverty line in Census Tract1: ii. 2006 estimated Census Tract median family income1: iii. Unemployment rate in Census Tract3: iv. Is the project located in a FEMA-designated “major disaster declaration” since 7/15/05, AND is the county eligible for both individual and public assistance?4 v. Is your business located in a Federally-designated Empowerment Zone, Enterprise Community, or Renewal Community?5 vi. Is your business located in a SBA-designated HUB Zone, and is it a HUB Zone certified business and will this investment support businesses that obtain HUB Zone certification from SBA?6 1 This information can be found at http://www.ffiec.gov/Geocode/default.aspx. Information can be found by town or city name under Table 1a at http://www.census.gov/population/www/cen2000/phc-t29.html. Rural should be equivalent to Micropolitan. Urban should be equivalent to Metropolitan. 3 This information can be found at 2 http://factfinder.census.gov/servlet/QTGeoSearchByListServlet?ds_name=DEC_2000_SF4_U&_lang=en&_ts=173711 807959 and by then selecting “Census Tract” as the Geographic Type. Complete the State, County, and Census Tract boxes, then “Add” this location to your geographic selection, and continue to the next window. “Add” table “DP-3 Profile of Selected Economic Characteristics: 2000” to your table selection and continue to the next window. Select “Show Result.” 4 This information can be found at http://www.fema.gov/news/disasters.fema or by contacting your FEMA/EPR Regional Office. 5 This information can be found at http://egis.hud.gov/egis/cpd/rcezec/welcome.htm. -2- vii. Is your business located in a Federally-designated Brownfields Redevelopment Area (as defined under 42 U.S.C. 9601(39))?7 viii. Is your business encompassed by a HOPE VI Redevelopment Plan?7 ix. Is your business located in a Federally-designated Native American area, or redevelopment areas by the appropriate Tribal or other authority?8 x. Is your business located in a colonias area as designated by the US Department of Housing and Urban Development?10 xi. Is your business located in a Federally-designated medically underserved area, and will this investment support health related services?11 xii. Is your business located in a High Migration Rural County (defined as any county which, during the 20 year period ending with the year in which the most recent census was conducted, has a net out-migration of inhabitants from the county of at least 10% of the population of the county at the beginning of such period)?12 xiii. Is your business located in a State or local Tax Increment Financing (TIF) district, Enterprise Zone, or any other State or local program for particularly economically distressed areas? If yes, which?7 xiv. Is your business located in a non-Metropolitan county?13 6 Information on whether the census tract is a HUB Zone can be found at https://eweb1.sba.gov/hubzone/internet/general/findout.cfm. The businesses must confirm directly that they have SBA certification. 7 This information can be found by contacting your local Office of Community and Economic Development (contact information available through your state, county, and city government websites). 8 This information can be found at http://www.census.gov/geo/www/maps/tbtrmaps.htm or by contacting your local Office of Community and Economic Development (contact information available through your state, county, and city government websites). 10 Colonias counties are: ARIZONA: Cochise, Yuma; CALIFORNIA: Imperial; NEW MEXICO: Chaves, Dona Ana, Eddy, Luna; TEXAS: Bee, Brewster, Brooks, Cameron, Dimmit, Duval, Edwards, El Paso, Frio, Hidalgo, Hudspeth, Jeff Davis, Jim Hogg, Jim Wells, Kinney, La Salle, Maverick, Pecos, Presidio, Reeves, San Patricio, Starr, Terrell, Uvalde, Val Verde, Webb, Willacy, Zapata, Zavala 11 This information can be found at http://muafind.hrsa.gov/. This information can be found at http://www.cdfifund.gov/docs/nmtc/2007/NMTCCensusTracts.pdf 13 Information can be found by town or city name under Table 1a at http://www.census.gov/population/www/cen2000/phc-t29.html. Non-metro should be equivalent to Micropolitan. 12 -3- xvi. As permitted by IRS and related CDFI Fund guidance materials, projects serving Targeted Populations to the extent that: (a) such projects are located in nonMetropolitan Areas; (b) such projects are at least 60% owned by members of eligible Targeted Populations; (c) at least 60% of the employees are members of eligible Targeted Populations; or (d) at least 60% of the customers are members of eligible Targeted Populations?14 III. QALICB Profile A. Do you believe your proposed business/project is a Qualified Active Low-Income Community Business (QALICB)? B. Owner/QALICB name: C. What type of business is the QALICB? (examples: Special Purpose Entity, operating business, etc.) D. What type of organization is the QALICB? (examples: corporation, LLC, partnership, etc. E. Please describe the members of your development team and their applicable experience: IV. QALICB Qualification [Documentation to support the following answers must be submitted prior to commitment of allocation.] A. Are any of the following businesses conducted by the QALICB or at the subject real estate: massage parlor; hot tub facility; suntan facility; country club; racetrack or other facility used for gambling; store whose principal purpose is the sale of alcoholic beverages for consumption off premises; development or holding of intangibles for sale; private or commercial golf course? B. Does income from residential rental real estate account for more than 80% of the QALICB’s revenues? C. Will at least 40% of the QALICB’s tangible property be within the low-income community? D. Will at least 50% of the QALICB’s revenue be derived from activity performed at the subject location? 14 Additional guidance on Targeted Populations can be found at http://www.cdfifund.gov/docs/2006/nmtc/Notice%202006-60.pdf. -4- V. Community Impact of your Project A. Provide a narrative that describes in detail the community impact that will result from this project; submit supporting documentation if applicable. Discuss impact in terms of all of the following: i. ii. iii. Estimated temporary and permanent job creation Expansion of goods and services available to the low-income community Expansion of educational and/or cultural amenities available to the low-income community. B. Provide a narrative describing in detail other development activity in this community. Address all the following: i. ii. iii. Is this project one of the only new developments in the area? Is the project part of a larger, comprehensive revitalization plan? How will this project influence development in the area? C. If your project has a residential housing component, will at least 20% of the housing units developed or rehabbed as a result of the NMTC investment be affordable to Low-Income Persons (80% AMI)? D. If applicable, provide a narrative describing other types of community impact, including: i. ii. iii. LEED certification, or other sustainable resource, “green” features Impact on minority populations Impact on neighborhood stabilization VI. Financial Profile [**In addition to completing the following financial information, please include a pro forma development budget (sources and uses) and operating budget of the project.] A. Total project cost: B. Requested NMTC financing: C. Why does this project need NMTCs? (examples: budget gap, inadequate state/local government support, land constraints, high rental rates, etc.) D. Have other sources of NMTC allocation been sought? If so, why couldn’t other CDEs fund the project? E. Would this project be feasible without Texas CDC allocation? If no, please explain. F. Describe all other sources of financing and the status of each transaction. Provide a narrative for any relevant timing or conditions related to each source: -5- In the following table list all other sources of financing as described in the above narrative: Type* Amount Source Status** *Examples: debt, grant, equity, other tax credits, etc. **To establish the how soon the project can begin, please use the following status categories: Dispersed: Funds have been given to the borrower and distributed for use. Committed: The borrower has received a legally binding commitment from the lender. Term Sheet: Financing is contingent on approval and verification of assumptions. The lender is not yet legally bound. Application Pending: Borrower has submitted a request for financing but not yet received a decision. Estimate: An informal, preliminary estimate of available funds. Other: Please explain G. What is the earliest date by which this transaction could likely close? H. What is the latest date by which this transaction must close? I. Describe any other factors that might affect the timing of the closing: VI. Contact Information A. Date submitted: B. Application completed by: C. Relation to project: D. Contact person for follow-up: E. Relation to project: F. Telephone number: G. Fax number: H. E-mail address: -6-