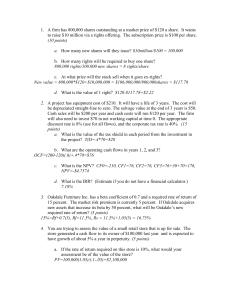

Chapter 4 – Linking corporate and financial strategies

advertisement

Chapter 4 – Linking corporate and financial strategies FOLLOWING THE WRONG FINANCIAL STRATEGY: MARCONI The GEC group was a UK-based defence and electronics company, which produced strong operating performance from a series of growing and mature businesses. The operating results meant that the business was strongly cash positive. Indeed, during the 1980s and early 1990s GEC was criticised by the markets for the excessive cash holdings the company maintained; well in excess of £2 billion. This cash mountain was not required to fund the company’s growth, and the City’s view was that it should be returned to shareholders. In 1996 the management of the company changed, as did its strategy. Over the next few years a number of the company’s businesses were sold, including its defence interests. Acquisitions were made to reposition the company in the fastgrowing telecoms sector, and GEC re-named ‘Marconi’ in 1999 to reflect this. The serial acquisitions were paid for out of the company’s cash pile, and in addition debt was taken on to meet their financing needs. By 2001 the company had net debt of about £3 billion. Although initially investors approved the change in strategy from a cash-rich low risk defence company to a highly geared telecoms business, changes in market conditions in the telecoms sector led to the collapse of the company’s markets, its share price and its credit rating. At the time of writing, Marconi’s financial position is still uncertain. With hindsight, it is apparent that whilst it was wrong for the mature defence businesses to be financed using equity (as will be discussed in Chapter 6), it was also wrong for the high growth telecoms business – with its considerable business risk – to be funded mainly with debt. The Marconi story appears to be a case of total mis-match of business and financial strategies. However, whereas GEC’s over-reliance on equity ‘merely’ irritated its shareholders, Marconi’s over-gearing destroyed the value of their investment. Chapter 4 – Linking corporate and financial strategy GETTING THE FINANCIAL STRATEGY WRONG: BIOGLAN PHARMA companies can add far more value in pursuing an appropriate business strategy than they can in tailoring their financial strategy. However, an inappropriate financial strategy can destroy value. An example of such an event occurred whilst we were in the process of writing this book. Bioglan Pharma is a UK-based speciality pharmaceutical company. Floated in December 1998, the company saw turnover grow from £23m in 1998 to £101m in 2001. It is led by its chairman and chief executive, Terry Sadler, owner of some 35% of the shares. At the end of July 2001 the company announced that it was negotiating the acquisition of a skincare business, which would greatly complement its business strategy. The cost of the acquisition would be £540m, to be paid in instalments over three years. At the time of the announcement Bioglan shares were trading at over 400p. Towards the end of August 2001 there were several further developments. On August 23rd it was announced that the company’s finance director, who had joined the company only six weeks earlier, was to resign. Bioglan cited ‘personality clashes’ with Mr Sadler as the reason. The shares fell by over 70p on this unexpected news. However, more was to come. On August 29th ABN Amro, the company’s broker, resigned, and the company’s share price fell to just over 200p. Press comment suggested that the reason for both of the resignations was a disagreement over the company’s proposed strategy for financing the acquisition. Bioglan already had a high ratio of debt to equity (apparently exceeding the already high 61% reported in the January 2001 financial statements). Both the finance director and the broker believed that equity should be used to finance the acquisition, but Mr Sadler was reported to be insisting on debt finance. As outsiders to the transaction, we can only speculate on the detail behind the press stories. However, this does neatly illustrate our thesis that growth companies should be financed with equity; apparently the outgoing executive and advisor were of this opinion, as, it is reported, were many of the institutional investors. (It is possible that Mr Sadler’s 35% holding in the company, which would have been diluted in the event of a large equity issue, was one of his reasons for preferring a debt-funded deal.) At the time of writing, Goldman Sachs had been appointed to replace ABN Amro, and they were considering the possibility of issuing a convertible bond to finance the deal. Convertibles, a hybrid of debt and equity, are discussed in Chapter 9: they may provide a suitable bridge to meet the stakeholders’ differing needs. It is interesting to note that had Bioglan announced an equity-financed acquisition in July, it would have been able to raise the new capital at round about the then share price of 400p. The clash over financial strategy means that any future equity issue (or convertibles issue) will be based on the current price, which is of course much lower. A confused financial strategy has had a direct impact on shareholder value. Sources: Financial Times (various dates); Hydra financial database; Bioglan Pharma financial statements to 31st January 2001. Chapter 7 – Start-ups A RISKY START-UP: WEBVAN Webvan, the online grocery business, was started in California in 1999, backed by venture capital funds. The company’s vision was to revolutionise the grocery business; it intended to take a significant proportion of the US groceries market by offering customers home delivery within an agreed time slot, at prices at or slightly below the price they would pay were they to visit their local supermarkets. As with many internet-based businesses at the time, a key element of the strategy was to obtain first-mover advantage; capturing the potential market before competitors could encroach on it. Webvan’s business plan depended on the use of technology. It used its first $120 million tranche of venture capital to build a state-of-the-art warehouse, and then almost immediately announced plans to roll out the concept across 26 sites around the US. Sophisticated purpose-built software systems were developed, to manage the expected volume of orders and to run the highly automated warehouses. Deliveries were made using fleets of customised vans. To match this investment in the operating side of the business, offices were fitted out to the highest specifications, to attract the top quality people that the company needed. The huge fixed cost base that the company installed was never matched by the revenues generated. Customers did not take to the Webvan concept. In two years the company burned its way through some $1.2 billion, before filing for Chapter 11 in July 2001. Webvan incurred unnecessary business risks by investing heavily in infrastructure before its business concept was proven. Contrast this with the online grocery strategy adopted by Tesco, the UK retailer. Tesco.com was formed to capitalise on the company’s strong brand, and to produce another way of servicing customers. The company did not invest in purpose-built warehouses: it used inventory from the shelves of its existing stores, picked from the aisles by its employees. Shopping would be delivered from the stores within a local area, or customers could opt to collect their prepacked shopping from the store. The Tesco.com strategy proved successful and the company is now rolling it out throughout the UK, and has commenced operations in a joint venture in the US. By minimising the fixed costs of the start up, Tesco reduced its business risk until the concept was proven. Chapter 8 – Growth companies A GROWTH COMPANY?: MATALAN PLC Matalan is a successful UK retailer of discount clothes and household goods. Founded by John Hargreaves (the current chairman) in the mid 1980s, the company floated on the London Stock Exchange in 1998 and by 2001 had seen its share price rise from 235p to around 500p. This growth in the share price reflected the company’s rapid growth. Growth was both organic and by acquisition. By 2001 the company had some 130 large out-of-town stores around the UK. It had also undertaken vertical integration, acquiring the Falmers jeans brand and also the brand and manufacturing business of Lee Cooper, another jeans company. In spring 2001 Angus Monro, the chief executive who had steered the Company to its success, suddenly left Matalan. Monro had dominated the development and activities of the company over the past few years, and was well regarded in the City. In Mr Monro’s leaving statement he stated that there had been no dispute between himself and the board, nor indeed between himself and the Hargreaves family who still owned over 50% of the company. His leaving statement went on, “It seemed to me that the difficult job of repositioning the business [i.e. managing the rapid growth] had been done, and I regarded the next few years as more of the same, though not without its challenges. It’s a fantastic growth story and an incredibly strong management team”. However, Press comment suggested that there was a split over the Company’s growth strategy, and that although Monro was preparing for a period of slower growth, other senior management figures were taking the view that the Company should be seeking ways to maintain its growth in the medium term and ‘develop more aggressively its strategic options’. Indeed, indications were that they were targeting an increase to over 200 stores by 2005, and were anticipating extending the floor-space in existing properties. From the press reports, it seems likely that Mr Monro took the view that the company had completed its aggressive growth stage and was entering maturity. However, the majority shareholders still desired a high rate of growth. With such a divergence of strategic views, Mr Monro’s departure was perhaps inevitable. Future results will show whether the company does in fact continue profitable growth at the desired rate. Chapter 13 – Dividends and buybacks SHARE BUYBACK: MICROSOFT Microsoft, a company which is both profitable and cash generative, does not pay dividends to its shareholders. Nor does it have a formal stock repurchase plan. However, since its flotation in 1986 it has frequently bought back shares from its shareholders. These buybacks are at irregular intervals and for differing amounts (a predictable buyback programme would attract attention from the Internal Revenue Service, and may lead the transactions to be treated as dividends for tax purposes). However, a Microsoft shareholder could have received a significant cash return from participating in the buybacks as and when they occurred. Chapter 13 – Dividends and buybacks SHARE BUYBACKS: UK BUILDING SOCIETIES Following their privatisation (de-mutualisation) many of the UK’s former building societies, now banks, were over-capitalised, having too high a capital adequacy ratio and far more funds than they could use in their business. This made the markets nervous: often, companies sitting on a cash pile choose to spend it unwisely; even if they don’t, shareholder value is not created when companies merely invest cash on the money markets. Three of the larger banks chose to give at least part of the surplus cash – almost £2 billion in total - back to the shareholders. Halifax did this by way of a £1.5 billion share buyback; Alliance and Leicester also chose the buyback option; and Woolwich used the alternative of a special dividend together with a buyback. Chapter 13 – Dividends and buybacks REDUCING DIVIDENDS TO SUIT CHANGE IN BUSINESS STRATEGY: ICI In November 2000 ICI, the UK chemicals company, announced that its dividend for 2001 would be cut by about 50%. The company’s share price rose by about 10% in the week following the announcement. This contrasted markedly with the last time ICI had announced a dividend cut, in 1981. At that time the investment community was traumatised, and the whole market – not just ICI – fell sharply. So, what changed? In 1981 ICI was seen as the ‘bellwether’ of British industry. A mature chemicals company, sentiment was such that if times were hard enough for ICI to have to conserve cash by cutting its dividend, industry must be in a perilous situation. In 1997 ICI began its transformation from a commodity bulk chemicals company to a speciality products and paints company. This was seen as a fast growing market, with considerable potential. The transformation was complete by 2000, and the announcement of the dividend cut was accompanied by a letter from the Chairman to each shareholder, setting out the very positive reasons for the reduction in dividend. The letter stated that the directors believed more value would be created for shareholders by reinvestment in this profitable area than by paying dividends; and that such reinvestment would drive future growth in dividends. As can be seen from the increase in the share price; the company’s signals were believed and the dividend cut was seen as a positive move for the future. Chapter 14 – Floating a company DIFFICULTIES OF PRICING AN IPO: ORANGE When France Telecom was considering floating Orange, its subsidiary, it was advised that the company was worth between €70bn and €80bn. However, a few weeks later changes in market conditions meant that advisors changed their views, and the pricing was set to raise between €55bn and €65bn. The price was cut by a further €10bn just before the IPO, to ensure that the float would be a success. However, although the share price fell on its debut, the company then out-performed its sector. Chapter 14 – Floating a company DIFFICULTIES OF PRICING AN IPO: KINGFISHER When Kingfisher floated its Woolworths subsidiary in August 2001, original expectations had been for a value of £550 million. Investors and advisors then reduced their expectations considerably, and the IPO went ahead at the substantially lower price of £350 million. The market capitalisation rose to £475 million on the first day of trading. Chapter 15 - Acquisitions BUYING A COMPANY FOR SHARES: AOL/TIME WARNER In January 2000 it was announced that internet company AOL was to acquire media giant Time Warner. The $163 billion deal, at the time the largest ever, was to be effected by the issue of new shares in AOL Time Warner, with each Time Warner shareholder receiving 1.5 new shares, and each AOL shareholder receiving one new share. This gave Time Warner shareholders 45% of the combined company. At the time of the deal, AOL’s market capitalisation was considerably more than Time Warner’s, and the deal terms effectively meant that AOL was offering a huge premium to the Time Warner shareholders. It was suggested at the time that this was at least partly because AOL shares were trading on a ‘dot.com’ valuation, which in early 2000 was at a significant premium to the market, whereas Time Warner shares reflected an ‘old economy’ company, at a lower P/E ratio. The premium paid to the Time Warner shareholders was perhaps to compensate them for the likelihood that AOL was relatively overpriced. In any event, within the week the value of the deal had fallen to from $163 billion to $145 billion, as AOL’s share price fell in reaction to the news of the deal. Chapter 15 – Acquisitions BID DEFENCE STRATEGIES: GUCCI, LVMH AND PPR In January 1999 LVMH, the luxury goods company, acquired 34% of the share capital of Gucci, another luxury goods company. LVMH stated that it would not make a full takeover bid, but demanded board representation (which would effectively have given it a great deal of control without the cost of making a bid). The Gucci directors took the view that this was not in their/the company’s interests. Accordingly, their first step (in February 1999) was to issue new shares to an employee share trust, effectively diluting LVMH’s stake. In March that year Gucci issued a further tranche of new shares to Pinault Printemps Redoute (PPR), another luxury goods company, one which the Gucci board viewed more favourably. This gave PPR 42% of the share capital, further diluting LVMH. In April 1999 LVMH made a bid for the whole company at $91 per share, which the Gucci management rejected. There followed a series of legal actions through the courts. The situation was eventually resolved in September 2001, as follows: PPR would acquire about 20% of LVMH’s existing shareholding, thus giving PPR majority control of the company (although, by agreement, not a board majority). A special dividend of $7 per share was to be paid to all Gucci shareholders expect PPR. PPR committed to making an offer, at $101.50, for all of the outstanding shares by March 2004. It may be argued that by rejecting the original LVMH bid the Gucci management created value for their shareholders. However, based on the opportunity cost of rejecting the 1999 LVMH bid of $91, the IRR receivable by the Gucci minority shareholders to 2004 is less than 4% per year. Chapter 16 – Restructuring a business DEEP DISCOUNT RIGHTS ISSUE – BT The acquisition of 3G licences in the auctions by Europe’s governments meant that by the end of 2000 BT had amassed debt of almost £30 billion (compared to a market capitalisation of less than £40 billion). The company was by no means alone in this situation – a combination of 3G licences and expensive acquisitions had led most of Europe’s telecoms companies into a similar predicament. The high debt burden had led to the company’s credit rating being downgraded (which increased the cost of its debt), and to financial uncertainty. Accordingly, restructuring strategies needed to be implemented. These included a £5.9 billion deep discounted rights issue; plans to sell and lease back properties; the demerger of the business into two separately quoted public companies; and asset disposals. Further, dividend payments were suspended for the foreseeable future. The terms of the rights issue were as follows. For every 10 shares held, the shareholder was offered the chance to buy another three shares at a price of 300p per share. This price was some 47% lower than the price of 568.5p on the day before the rights issue was announced. The theoretical ex rights share price based on these parameters would have been about 507p. (10 shares at 568.5p plus three shares at 300p gives a value of £65.85, divided by 13 shares.) However, the news of the deep discounted issue (and of course the situation that had demanded it) caused the company’s share price to fall sharply in the first few days of trading after the announcement, dropping some 12% in less than a week. Chapter 16 – Restructuring a business REORGANISATION AND ISSUE OF NEW SECURITIES – LUCENT TECHNOLOGIES The collapse in the value of technology stocks and changes in global economic conditions badly affected telecoms equipment company Lucent Technologies. Facing a growing debt burden and the possibility of breaching its banking covenants and having its debt status downgraded to ‘junk’ the company undertook several restructuring strategies. In March 2001 Lucent floated its subsidiary Agere. However, although the IPO was successful, the fall in overall market values meant that it raised only $2.5 billion, only half of the company’s original expectations. Accordingly, further funds needed to be raised. The fundraising carried out in August 2001 was in the form of redeemable convertible preferred stock offered on very favourable terms. The securities carried a coupon of 8%, somewhat higher than the yield on the company’s debt, and would convert to equity at a premium of only 22%, giving investors an excellent chance of achieving a significant upside. The issue raised some $1.75 billion, more than originally expected due to the high demand for the generouslypriced offer. Chapter 16 – Restructuring a business CONFLICTING STAKEHOLDER INTERESTS: HYNIX SEMICONDUCTORS The South Korean semiconductor manufacturer Hynix experienced major financial difficulties in 2001 due to the economic slowdown and overcapacity in the semiconductor market. In August 2001 it failed to make the due payments on a Won400bn ($313m) bond. At the time it had Won7,100bn in interest-bearing liabilities. Hynix was in protracted negotiations with its various stakeholders in order to sort out its financial situation. However, the stakeholders had different interests. The interested stakeholders included a syndicate of 10 European banks; a syndicate of 19 Korean banks (some state-owned); Korea’s investment trust sector which had bought the company’s bonds; and Korean and overseas shareholders. The domestic bank creditors were led by Korea Exchange Bank, which was negotiating a Won3,000bn debt-for-equity swap together with rolling over some of the debt due for repayment in the short term. The Korean banks were keen to avoid having to make formal write offs of the loans in their financial accounts, as this would have damaged their capital adequacy ratios and credit standing considerably. Had this happened, the Korean government would probably have had to inject further capital into its banks, thus the government was also a key stakeholder in the Hynix reconstruction. However, the many European and American banks who were also Hynix creditors were not in this predicament and were reluctant to forgive the company its debts. This led to considerable dissent amongst the stakeholders. The terms of a potential debt-for-equity swap also caused dissent amongst the stakeholders. The company’s financial situation had led to a massive fall in its share price. Had the swap been carried out at this new share price, shareholder dilution would have been almost total, and they were negotiating to prevent this happening. Finally, the possibility of a government-supported bail out led to the US administration warning the South Korean government that this would be a breach of international commitments under world trade agreements, which could lead to an international trade dispute. Source: The Financial Times, various dates Chapter 16 – Restructuring a business DEMERGER: BRITISH TELECOMMUNICATION As discussed elsewhere in this book, BT undertook an extensive restructuring in order to reduce its debt burden and improve the market’s perceptions of it. Over the period between late 2000 and mid 2001 it announced various demerger proposals; the feasibility of some of these strategic options diminished as market conditions changed. At one time the restructuring proposal involved splitting the company into five separate listed companies. However, the final outcome was to split the business into two, with shareholders in the current BT receiving shares (in equal proportions) in the separate businesses to be named BT Group plc (which would hold the network and retail telecoms business) and mmO 2 plc (the wireless business). Of the original plans to float off five businesses, some had been combined, and others disposed of in trade sales in the intervening period. Chapter 16 – Restructuring a business DEMERGER: KINGFISHER Kingfisher, the UK retailer, undertook a demerger of its Woolworths general stores in summer 2001. The company had considered various alternatives, including an outright sale, to dispose of the Woolworths business, however, there were no serious buyers for the company and market conditions favoured the demerger instead. The Kingfisher reorganisation also included the sale to a trade buyer of another of its subsidiaries, Superdrug, and the sale of its High Street property portfolio. The effect of the disposals, together with the portion of the group’s debt taken over by Woolworths on the demerger, reduced Kingfisher’s debt burden by some £1.1 billion. The purpose of the restructuring was to strengthen the balance sheet to enable the group to focus attention on retailing areas in which it saw better prospects for profitable growth. Chapter 16 – Restructuring a business ASSET DISPOSALS IN A REORGANISATION: MARKS & SPENCER An example of a reorganisation occurred in summer 2001 in the UK retailer Marks & Spencer. Facing financial problems due to a trading downturn, Marks & Spencer reversed its long-held strategy of owning its prime High Street sites, and entered into a sale-and-leaseback arrangement. It arranged to sell a portfolio of some of its High Street stores to a financial institution for some £300m and to lease them back. The stores sold, although raising a significant amount, represented only about 10% of the value of the company’s UK property portfolio. The sale-and-leaseback formed only the first strand of the company’s financial reorganisation. It was announced that further stages would see the securitisation of the income from a portfolio of its stores, and the sale of its head office building to property developers. Chapter 18 – International corporate finance DIFFERENT ACCOUNTING RULES: BMW AND ROVER The German car company BMW acquired the UK manufacturer Rover in 1994. After years of heavy financial losses, the German company eventually sold Rover in May 2000. However, was Rover really as bad a company as the headlines reported? The UK company’s results as filed at Companies House under UK accounting regulations differ considerably from those prepared by BMW using German policies, which were the focus of public debate. 1995 1996 1997 Three year total loss UK result £m (51) (100) 19 (132) German result £m (163) (109) (91) (363) Differences in accounting policies include a more aggressive depreciation policy, higher provisions and different rules on stock valuation in Germany. Source: Accountancy Age, 18 February 1999. Chapter 18 – International corporate finance CULTURAL BARRIERS IN INTERNATIONAL ACQUISITIONS: VODAFONE AND MANNESMANN The hostile takeover of Mannesmann by Vodafone in 2000 was unusual, in that the regulatory environment means that successful hostile bids for German companies are very rare (although German companies are very adept at acquiring businesses in other countries). Accordingly, the very fact of the deal came as a culture shock to the employees of the long-established German company. During the initial period of ownership, Vodafone did the following: Sold off the prestigious Mannesmann fine art collection Sold off the century-old wood panels in the board room Stopped the practice of sending employees cards and wine on their birthdays Promoted its charitable donations in order to benefit from the publicity (Mannesmann had always given anonymously). These actions, which would have been seen as reasonable in shareholder valuebased Anglo American cultures, were totally alien to the German employees and caused deep resentment. Source: The Financial Times, 5th June 2001.