Department of Mines - Cambridge University Press

advertisement

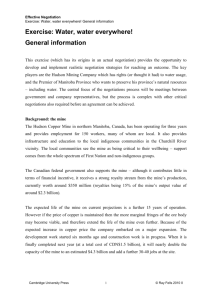

Effective Negotiation Exercise: Water, water everywhere! The company negotiators Exercise: Water, water everywhere! The company negotiators Overview The three government departments (environment, mining and the attorney general’s office) will have to spend some time formulating their position which – when approved by the Premier – will be the basis of their negotiation with you. You also have to prepare an initial position. The CEO has put together a team of senior executives – a corporate finance officer, a corporate development officer and a corporate legal officer. Each one of you has been put on the negotiating team because of your particular areas of expertise. You should assess the impact of the Premier’s plan and develop a response as a basis for discussion with the two others on your negotiating team. There has already been discussion within the management team to generate a number of possible options. You have taken these options back to your respective specialist areas within the company and have evaluated each one (giving each a nominal value in the range of plus 10 to minus 10). This will enable you to establish your negotiating priorities when you meet with the other company negotiators to develop an overall position to put to government. Before you meet with the government representatives you will have to get approval of your negotiating approach by the CEO. He will want to know what you expect to achieve by way of an outcome. Once you have CEO approval, you can then prepare for your meeting with the government representatives. If at any time in the negotiations new proposals are generated, these should be matched against the values of those already identified. Should it be necessary, your ‘CEO’ will attribute a value to a new proposal. As the negotiations progress, you may be required to report back to the management group and if you reach an agreement with the government representatives this will have to be presented to the CEO for final approval before you can commit to it. (The lecturer should act as the CEO and your immediate boss, if required) Good negotiating Cambridge University Press 1 © Ray Fells 2010 Effective Negotiation Exercise: Water, water everywhere! The company negotiators The company perspective The company has to consider two main aspects to this issue: 1) What is the impact upon the company’s standing in the community and its reputation as a good corporate citizen, and 2) what is the impact of the proposal on the company’s profit? The company currently has a good reputation and has the support of the local business community and the representatives of the local first nation group. It has invested heavily into building these good relations, not only through community projects and local purchasing, but also through local employment schemes. However, the area also has great tourist potential, and while in the past no one in their right mind would want to go to somewhere as cold as the Hudson Bay for a holiday, now areas such as this are beginning to feature as progressive recreational areas. It will only be a matter of time before this develops in the area – some of the far-sighted business and community leaders are beginning to realise this and are therefore likely to support the Premier’s water initiative. Furthermore, if the present government does win the next election (a distinct possibility) then it will not have been wise to oppose the Premier on what would look like a purely selfish commercial interest stance. The company cannot rely on the Federal government, despite its expressions of support. It is likely to take the issue and use the company for its own political ends in supporting the current opposition party in the forthcoming provincial elections. On the other hand, its corporate citizenship would be upheld by campaigning against arbitrary government (after all this is not some African dictatorship!), and the rule of law underpins commercial certainty – particularly in a capital-intensive industry like mining. The Provincial and Federal governments both rely on mining royalties. The commercial issues in relation to the expansion project are not straightforward. The options are: 1. To halt the expansion project and work the mine with its existing capacity 2. Complete the project then mothball it 3. Complete the expansion and operate at the higher capacity. Cambridge University Press 2 © Ray Fells 2010 Effective Negotiation Exercise: Water, water everywhere! The company negotiators If the political realities are such that new water regulations come into force it, then the objective is to minimise and/or delay the impact of any outcome on the company’s bottom line. The company’s revenue is determined by its output of copper, and the price of copper is set by the London Metals Exchange. The demand for copper is such that the company expects to be able to sell all the ore extracted from the expanded mine. The technology of mineral extraction is such that the output of the mine is directly proportionate to the level of water usage (eg. a 50% cut in water usage reduces annual output by 50%). Cambridge University Press 3 © Ray Fells 2010 Effective Negotiation Exercise: Water, water everywhere! The company negotiators Corporate finance officer You have been placed on the negotiation team to monitor the cost impact of any proposed solution. The Chief Financial Officer has a bit of a reputation around the company for his protection of the profit stream – he guards it so tightly you would think that any reduction in profit has to be paid for out of his own pocket! His view is that ‘the economics of this will win out in the end over any other competing interests’. The possible outcomes are listed below, with an attributed value based purely on a financial perspective. You can anticipate that others on the negotiating team will value some of the outcomes differently. The CFO will be keeping a close eye on the progress of the negotiations. (You know that he has assured the CEO that he had nothing to worry about so far as the financial aspects are concerned.) Then, with other members of the negotiating team you will have to report to the CEO to secure his approval of any proposed solution. Your first task is to decide what position you will take to the pre-negotiation meeting with the two other executives (some options are provided below). Outline your position and key points on a separate sheet to give to the CFO for approval, prior to meeting your negotiating colleagues. Some options These options suggest how the water restrictions issue might be resolved. Financial value 1. The Premier’s plan is introduced before the next election -10 The proposed 50% reduction in water extraction would reduce the current operation and would impact directly on the bottom line. If implemented, the reduction in mine output as a result of the water restrictions would convert the existing plant’s profitability from $51.5 million per annum, to a loss of $7.5 million. The lower operating costs of the new mine barely offset this. Even a break-even solution is financially unacceptable. Cambridge University Press 4 © Ray Fells 2010 Effective Negotiation Exercise: Water, water everywhere! The company negotiators 2. The plan is introduced with a review The impact is dependent upon the option chosen. 2.1 The restrictions are enforced but may be reduced once the review is conducted -9 Initially this would have the same impact on the bottom line as option 1 above. But once the 50% reduction rate has been enforced any reduction is going to look politically weak, so you don’t really expect any longer term lessening of the financial impact. 2.2 Partial implementation of the plan (eg. 25% reduction pending the review) +1 A 25% reduction in water extraction reduces current output and therefore impacts upon the bottom line – the effect will be to reduce the existing plant’s profitability from $51.5 million per annum to around $22 million; but the expansion mine would be profitable. So while it is acceptable, it is a thoroughly unpalatable outcome. 2.3 No implementation until review completed, then a percentage to be set as determined by the review +5 This is the ideal ’defer’ solution as there would be a delay in implementation (which might also be watered down in its impact). As there is current or short-term financial impact, this option can be presented as a good solution financially. 3. The plan is introduced but companies are allowed to maintain full or partial extraction rates, on the condition that they provide offsets. This would mean the company could proceed with the expansion, provided both it was offset along with the existing mines water usage. 3.1 Desalination plant at Hudson Bay area +2 Capital cost of $650 million (capital costs on all these projects would be spread over twenty years) Annual operating cost of $17.5 million Cost impact per annum (650/20 +17.5) = $50 million A plant like this would offset the existing mine and expansion’s water usage. Cambridge University Press 5 © Ray Fells 2010 Effective Negotiation Exercise: Water, water everywhere! The company negotiators Fund water conservation elsewhere in the Province especially in the south where demand for water is greatest. Each proposal has its costs (and impact on profit) 3.2 Desalination plant in the south +2 To operate a plant to the south of the country would imply less tight control, more local management and labour costs, hence an extra $5 million per annum operating costs. 3.3 Groundwater extraction project +3 There are significant aquifers in Manitoba so there have been a number of proposals to extract more water from aquifers in the lakes area of the Province The capital cost of a 10 million litre project is $50 million. Annual operating cost $1 million Cost impact per annum per project (50/20 +1) = $3.5 million It looks like the sort of project that could easily have a cost blow-out when it comes to operating the project. 3.4 Canal/pipeline +4 There have been a number of proposals to transport water, for example from Lake Winnipeg to the more densely populated area at the south of the Province. Costs are expected to be around $250 million, with an annual operating cost of $5 million. Cost impact per annum (250/20 +5)= $17.5 million. 3.5 Establish a water research centre +9 A research centre with $50 million over five years would have a cost impact of $10 million per annum, but it hardly counts as an ‘offset’. 4. The restrictions plan is introduced for new mines, but existing mines are required to ‘offset’ their water usage. This means the extension can only operate at 50% (ie, would be profitable but only marginally). Overall profit would be reduced from notional $140 million to around $58 million, further reduced by whatever the cost of the offset is. This means that whatever the offset option the financials for the company are poor. Cambridge University Press 6 © Ray Fells 2010 Effective Negotiation Exercise: Water, water everywhere! The company negotiators The existing mine has to be offset by projects totalling around 50-60 million litres. 4.1 Desalination plant north -5 4.2 Desalination plant south -5 4.3 Groundwater projects (need six) -3 4.4 Canal/pipeline -1 4 5 Research centre -1 5. A new water resources commission is set up +9 This is a ‘defer’ solution so it’s better than implementation. It’s almost certain that existing projects would escape any impost, and any financial impact on new projects would be delayed or even avoided – particularly if the expansion was near completion. 6. The Premier’s plan is an election policy issue to be implemented after being re-elected -9 If the Premier is re-elected then the financial costs would only be delayed. Cambridge University Press 7 © Ray Fells 2010 Effective Negotiation Exercise: Water, water everywhere! The company negotiators HUDSON COPPER MINE - FINANCIAL SUMMARY Current mine operation Expected life (years) Construction cost Daily output (tonnes) Annual output (90%) Forward copper price (US$/t) Output value pa (US$/t) Operating costs/t Operating costs pa Construction Overheads (cost/exp life) Royalty payments (% of revenue) Profit pa Water usage (litres pa) $ Effects of water restrictions reduction 50% 1,200 394,200 6,000 $ 25% 197,100 295,650 2,365,200,000 1,182,600,000 1,773,900,000 1,892,160,000 66,666,667 354,780,000 51,593,333 946,080,000 66,666,667 177,390,000 -7,536,667 1,419,120,000 66,666,667 266,085,000 22,028,333 164,250 246,375 1,971,000,000 985,500,000 1,478,250,000 1,511,100,000 75,000,000 295,650,000 89,250,000 755,550,000 75,000,000 147,825,000 7,125,000 1,133,325,000 75,000,000 221,737,500 48,187,500 140,843,333 -411,667 58,718,333 70,215,833 4,800 15 120,000,000 Water lease Max amount of water extraction Annual cost of lease 25 years (20 years to run) 220m litres pa $35m pa Expansion Expected life (years) Construction cost 20 1,500,000,000 Daily output (tonnes) Annual output (90%) Forward copper price (US$/t) Output value pa (US$/t) Operating cost/t Operating costs pa Construction Overheads (cost/exp life) Royalty payments (% of revenue) Profit pa Water usage (litres pa) TOTAL PROFIT, mine + expansion Total profit, existing mine and 50% expansion Cambridge University Press $ 15 1,000,000,000 1,000 328,500 6,000 4,600 15 100,000,000 8 © Ray Fells 2010 Effective Negotiation Exercise: Water, water everywhere! The company negotiators Corporate development manager You are an engineer by background, so one reason you have been placed on the negotiation team is to call on your expertise for the practical implementation of any proposed solution. Your current role is in corporate services working with the corporate services director on profiling and building the reputation of the company. The director is fully aware of the political and social implications of the company’s activities, and is committed to advancing the corporate image of the company – particularly in the Hudson Bay area. The possible outcomes are listed below, with an attributed value based purely from the perspective of the proposal’s impact on the company’s reputation. You anticipate that others on the negotiating team will value some of the outcomes differently. You will have to report back to the director on the outcome of the negotiation. You know that he is battling hard at the corporate level to consolidate a corporate social responsibility profile within the company, and so he wants a strong result from you. With other members of the negotiating team you will have to report any proposed agreement the CEO for formal approval. Your first task is to decide what position you will take to the pre-negotiation meeting with the two other executives (some options are provided below). Outline your position and key points on a separate sheet to give to your director for approval, prior to meeting your negotiating colleagues. Some options These options suggest how the water restrictions issue might be resolved. Reputational value 1. The Premier’s plan is introduced before the next election +2 The proposed 50% reduction in water extraction would reduce the current operation and would impact directly on the bottom line. However, the company could put effort into being seen to embrace the Premier’s initiative and therefore enhance its environmental credentials. Essentially with this and the options under minus two, the company can salvage something positive out of an otherwise negative situation. Cambridge University Press 9 © Ray Fells 2010 Effective Negotiation Exercise: Water, water everywhere! The company negotiators 2. The plan is introduced with a review +2 The difficulty with a review is that the company will be seen as opposing the government on the issue. Nevertheless some reputational benefit might be extracted. 2.1 The restrictions are enforced but may be reduced once the review is conducted +2 2.2 Partial implementation of the plan (eg. 25% reduction, pending the review) +2 2.3 No implementation until review completed, then a percentage is set as determined by the review +1 This looks to be a better ’defer’ solution, but paradoxically if the review is dragged out and drifts off the public agenda, there is not much the company can do to look good. 3. The restrictions plan is introduced but companies are allowed to maintain full or partial extraction rates on the condition that they provide offsets through other water saving projects. This option gives the company the opportunity to be seen to be taking the initiative and implementing environmental/community projects. The offset projects might be: 3.1 Desalination plant at Hudson Bay area +7 Capital cost of $650 million Capacity 110 million litres per annum A costly exercise, but it would clearly stamp the company as being at the forefront of the water conservation issue. Fund water conservation elsewhere in the Province especially in the south, where the water is needed. 3.2 Desalination plant in the south +7 Similar construction costs but you believe that operating costs might be higher in the south. However, the same reputational benefits would flow. Cambridge University Press 10 © Ray Fells 2010 Effective Negotiation Exercise: Water, water everywhere! The company negotiators 3.3 Groundwater extraction project +7 There are significant aquifers in Manitoba so there have been a number of proposals to extract more water from aquifers in the lakes area of the Province. These are relatively small in terms of capital cost (around $50 million) and water flow (10 million litres per annum), but they do give a good ‘on the ground’ opportunity to the company to show it is doing something practical about the water resource issue. 3.4 Canal/pipeline to the south +7 There have been a number of proposals to transport water, for example from Lake Winnipeg to the more densely populated area at the south of the Province. But there is a big debate raging about whether canals or pipelines ‘work’. The estimate is a cost of $250 million to build (though operating costs are low), but for only 50 million litres per annum. Even so, this would again provide the company with a positive opportunity. 3.5 Establish a water research centre +4 Someone suggested putting $50 million into a research centre. While it might do good work, unless it is very clearly identified with the company (which it won’t be – it will probably have to be linked to a university or somewhere else) then the beneficial reputational impact for the company will be diluted. 4. The restrictions plan is introduced for new mines, but existing mines are required to ‘offset’ their water usage. The distinction between new and existing mines probably impacts on the economics of the operation, but the opportunities for the company to build its environmental and sustainability credentials are the same. 4.1 Desalination plant north +7 4.2 Desalination plant south +7 4.3 Groundwater projects, +7 4.4 Canal/pipeline +7 4 5 Research centre +4 Cambridge University Press 11 © Ray Fells 2010 Effective Negotiation Exercise: Water, water everywhere! The company negotiators 5. A new water resources commission is set up +3 Could use the commission processes to promote the company image, but it might be found having to promote two competing priorities – economics versus community benefits. 6. The premier’s plan is an election policy issue to be implemented after being re-elected -1 This would place the company in an even more difficult position. The company would not be able to support the Premier’s position in the election campaign. If the Premier’s party won then the new proposals might be even harsher. Cambridge University Press 12 © Ray Fells 2010 Effective Negotiation Exercise: Water, water everywhere! The company negotiators Corporate legal officer You have been asked to be involved in this negotiation because of the legal dimensions of the issue. Your remit, as explained to you quite bluntly by the CEO (to whom you report directly), was to “fix this thing”. The possible outcomes are listed below, with an attributed value based purely on the legal perspective, particularly around the legal point of existing contracts being unilaterally altered. You can anticipate that others on the negotiating team will value some of the outcomes differently. You will have to report back to the CEO to get his endorsement of any proposed agreement. Your first task is to decide what position you will take to the pre-negotiation meeting with the two other executives. Outline your position and key points on a separate sheet to give to the CEO for approval, prior to meeting your negotiating colleagues. Some options These options suggest how the water restrictions issue might be resolved. Legal value 1. The Premier’s plan is introduced before the next election -10 This is the worst possible outcome – there is no legal precedent for unilaterally changing contractual terms through legislative provision. It will deter future business investment. 2. The plan is introduced with a review The impact is dependent upon the option chosen. 2.1 The restrictions are enforced but may be reduced once the review is conducted -8 2.2 Partial implementation of the plan (eg. 25% reduction, pending the review) -6 Both these options set an adverse precedent, but the ‘reviews’ will allow opportunity to rework the issue and, hopefully, reduce its future impact 2.3 No implementation until review completed, then a percentage set as determined by the review Cambridge University Press -4 13 © Ray Fells 2010 Effective Negotiation Exercise: Water, water everywhere! The company negotiators The ideal ’defer’ solution as the review can take forever, or be subject to appeal, legal challenge, etc. But the legislation would be on the statute book in some form. 3. The restrictions plan is introduced, but companies are allowed to maintain full or partial extraction rates on the condition that they provide offsets. -2 You understand that this would mean the company could proceed with the expansion as well as maintain existing production at the mine. The ‘offsets’ – presumably other water conservation projects – are really only a ‘tax’ on the company. If the legislation is shaped that way it is more palatable legally (if not financially!). You understand there are several options – desalination plans, pipelines, etc. Whatever the option, the legal aspects are just the same. 4. Plan introduced for new mines but existing mines are required to ‘offset’ +2 The requirement that existing mines ‘offset’ is still a problem legally but is far more manipulatable, given that the core of the legislation will apply only to new mines (a legitimate legal position). 5. A new water resources commission is set up +10 A ‘defer’ solution that has no legal impact on current contracts. 6. The Premier’s plan is an election policy issue to be implemented after being re-elected +10 A risky outcome. While it might be possible to work on having the policy set aside after the election (ie. banking on the continued demand for minerals, increased prosperity, etc), a strong vote for the government will increase the Premier’s resolve. Legally this is a non-contestable outcome. Cambridge University Press 14 © Ray Fells 2010