Taxation, what`s in it for me? transcript

advertisement

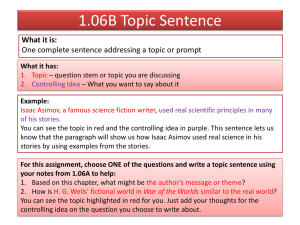

Ghana: Taxation, what’s in it for me? Duration: 00:06:20 Reporter: Isaac Tetteh Studio cue Ghana's government is keen to raise more income from tax. To achieve this, its president, former tax professor John Atta Mills wants to widen the country's tax base. Over the past 30 years successive governments have pushed through tax reforms - some violently opposed by the public. As a result, governments have been forced to be more transparent about spending. Isaac Tetteh reports from Accra. He began by asking citizens in Accra whether they think their tax money is being spent wisely. Vox pop one Yes and no. Yes some social interventions, for instance health facilities and educational institutions. No, the gap between north and south is too wide a gap. Vox pop two Formerly our roads and some of our school buildings here in Ghana were not constructed well but now I think it is okay, they are using it very wisely. As Ghanaians it’s our money, government should come out and let us know what is going on. I think there is nothing wrong with that. Vox pop three Our taxes are not being used wisely. Government doesn’t tell us how much, which areas made gains, there are a few of them but there are not enough Reporter Isaac Tetteh: A few opinions on the streets of Accra about the state of government spending and tax today. Over the last couple of decades, taxation has proved a controversial issue for the public - and they have often made their feelings known. I'm standing in Holy Gardens, Kwame Nkrumah Circle, Accra. This is where protests in 1995 led to the deaths of three people and forced the government to drop plans for a 17.5 per cent VAT. Right behind me is the podium that the leaders mount to address the protest right before they leave Abdullah Ali Nakyea, a tax consultant and a lecturer remembers only too well Abdullah Ali Nakyea: It wasn’t the fact that the tax itself was a bad tax but the timing....one it was new as far as the country was concerned and then secondly the education was not well informed as far as the people were concerned. So we had this problem and it had to be withdrawn. It was introduced successfully in 1998 with more sensitisation, public education and this time the rate was reduced. And it went down well with the business community and the public as a whole. Reporter Isaac Tetteh: One consequence of the protests was that government began to make it clear why taxes were being raised Ali Nakyea: Then along the line there was the need to be able to find money to support the educational system. The educational system was running down – facilities in the educational institutions. So the government of the day proposed that the Value Added Tax should be increased from 10 per cent to 12.5 per cent, so the 2.5 per cent is transferred for the administration of assistance to the educational institutions. And education being key to everybody, it caught on well Sfx: mobile phone ring tones Reporter Isaac Tetteh: A tax on mobile phone talk time is the latest tax-rise which was pushed through with the promise of creating jobs for unemployed young people. Rose Abibo who directs traffic at the Hansonic Junction in Accra has the tax to thank for her job Rose Abibo: I am happy, I have a job, it pays some of my bills and it pays my child’s school fees. I am aware taxes were placed on mobile phone calls to help fund our services and some of us have jobs because of those taxes. And the trouble now is if we start fighting for salary increments, that may lead governments to increase the rates, that is the taxes on the mobile phones. That will be an interesting debate again. Reporter Isaac Tetteh: Getting tax rises accepted is just one challenge for the government – getting people to pay their taxes is another – as Paul Obing– a former tax official knows Paul Obing: In my view taxes being collected by governments are being used wisely. We see a lot of improvements and development going on– roads, hospitals and schools. The only problem is people not prepared to pay the correct taxes; lots of people do not disclose their proper income What do you think they can do, the IRS or the other tax agencies to improve the collection? It’s all education, it’s education. Tax men have to go to town and meet individuals one-to-one and ask them their problems. It will help you to get the correct assessment. So they should intensify education and I think the tax net will be... Wide enough so we have more people paying taxes? Yes Reporter Isaac Tetteh: With the government eager to widen the tax base and stop depending heavily on a few key sectors of the economy, what advice would Ali Nakyea offer? Ali Nakyea: Govt has a duty to communicate and inform and sensitise the populace as to what their money is being put to use. I remember during the times of the former commissioner we had these billboards which would be pointing at you as you are driving, “Have you paid your income tax”? Then the next billboard you would find “This is what your tax money is used for”. I believe that tax should be administered in such a way that people voluntarily pay their taxes. Because I remember research work done to look at the way Ghanaians are willing to pay collections in church. A person would throw their last cedi in the church bowl and walk home. Why? Because such a person knows and appreciates what the church does for him. If the people are able to appreciate what they get in return then we can generate that voluntariness in people to run to the taxman and disclose that “look I’ve earned so much, this is your share as tax.” Reporter Isaac Tetteh: What’s more, he says tax payers stand to gain more by paying tax than by avoiding it. Ali Nakyea: Taxation is the first civic duty of a citizen because if you pay your taxes then you have a voice to challenge the government that I’ve paid my taxes so provide me with this and that. But if you don’t pay your taxes or you underpay, I think your conscience will tell you that you have no business challenging government because you are keeping the money.