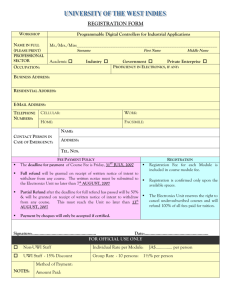

Legacy to Banner Transaction Mapping

advertisement

Legacy to Banner Transaction Mapping Introduction: This document takes transactions from the UWF cashiering and payroll systems and maps them into T-accounts in a format suitable for a Banner Journal entry using the JE16 rule class code. This mapping will be used to enter legacy accounting transactions that presently enter SAMAS in batch through the following process: SAMAS Transactions SAMAS/FOAP Crosswalk GURFEED JE16 FURFEED FRGACTG BANNER Journal Entries FGRTRNR FGRTRNI BANNER ledgers Teller Batches: A teller batch represents a day’s work for a given teller. It records the tellers receipts from the time the cash drawer is opened until the time the batch is closed and a bank deposit is made. A regular teller batch collects receipts at the window, over the phone, or over the web. A teller may also disburse Financial Aid net checks in their batches. Tellers may accept payment by cash, check, credit card, and debit card. They also accept non-cash receipts to record receipt of monies which have already been deposited in the bank. The tellers also write net check receipts which debit a Financial Aid expense account to pay a student’s debts and/or cut a check to the student. Special teller batches are opened to process refunds, receipt corrections, and mail outs, Batch Closing: A typical teller batch #3276H will be used to illustrate how the transactions will be mapped into Banner. Below is the daily cash report for the batch. The teller made a $10,740.47 bank deposit consisting of total checks received plus cash received in excess of the teller’s change fund amount. The credit card agency will transmit credit card receipts of $1,790.06 to the bank as part of the batch settlement. Two receipts were written to the Central Ticket Office totaling $1,021.20 to record money they had deposited in the bank. The debit (Nautilus) card account will transfer the $50.00 in debit card receipts directly to the receiving departments. Bank $10,740.47 $1,790.06 $240.00 $781.20 Debit Card $50.00 Revenue $13,601.73 The present plan to post the bank side in total as above as that is the way the deposit will appear on the bank statement. The revenue side of transactions will be posted in detail with the exception of student fee payments which will be posted in total into a pass through account called Fee Suspense for later distribution to the various fee accounts by the fee audit Some typical receipts are used to illustrate detail in detail how the revenue will be posted . Typical receipts: In the first receipt below, the customer paid housing and parking tickets with a $1,530.00 check: This maps to the following T-Accounts: Bank $1,530.00 Housing $25.00 $1,425.00 Parking Tickets $20.00 $20.00 $20.00 $20.00 The next receipt is a little more complicated. The customer charges $762.05 which is used to put $20.00 on his debit card with the balance going to fees. This is illustrated in the T-account below: Bank $762.05 Nautilus General $20.00 Fee Suspense $50.00 $692.05 Payment with Nautilus Card: In the next receipt, the customer pays housing and a parking ticket with her Nautilus card: In this instance, the debit is to the debit card account instead of the bank. Debit Card $50.00 Parking Tickets Housing $25.00 $25.00 Net Checks: The last receipt we’ll look at is a net check. The student is disbursed an $1,806.00 subsidized direct loan. An $1,806.00 receipt is written to a pass through account called Check Exchange. The net check receipt would be recorded in two steps. First the amount to awarded and received: Direct Loan Expense $1806.00 Check Exchange $1,806.00 Second, a check is cut to the student: Bank $1,806.00 Check Exchange $1,806.00 Refunds: The refund teller processes as a “cashless” transaction. There are separate tellers for miscellaneous refunds and student fee refunds. In addition, a separate teller is set up for credit card refunds of student fees. In cases of credit card refunds, the teller processes the refund using either their credit card machine or the “pps access” web site if refunding a web payment. In the following receipt, a $10.00 refund from the parking decal account is processed to the customer’s credit card. This would be represented as follows: Bank $10.00 Parking Decals $10.00 The case of a miscellaneous refund that generates a check is a bit more complex. In the following instance, the customer is to receive a $498.25 refund check from Housing. The refund is processed through a pass through account called Student Refunds over night and a check is printed a couple of days later. The following accounting entry records the refund: Student Refunds $498.25 Housing $498.25 and this the printing of the check: Bank $498.25 Student Refunds $498.25 Fee Audit: The fee audit is a series of batch programs that distributes a student’s fee payments in (and out) of the various fee accounts (at the present time more than 50) in light of the student’s current registration and prior payments. The two fee audit programs that post entries into the accounting system are the daily spread and the adjustment run. The daily spread distributes fee receipts and refunds from the day’s teller batches. Consider the following credit card receipt for $102.25. This receipt collects a $100.00 in student fees and a $2.25 convenience charge. The student fees are originally posted to the fee suspense pass through account: Bank Fee suspense $102.25 Convenience Fee $100.00 $2.25 As part of nightly processing, the fee audit runs the daily spread program to distribute the student’s fee payment: SSNO NAME AMT PAID RES COURSE HRS COURSE HRS COURSE HRS MATRIC O/S BLDG F/A CAPI ACTIV ATHL HEALTH GREENE, JIN B R ACG3101 0008 3.0 MAC2233 0944 3.0 SPC2016 1456 3.0 S 3282CAD 285.57190.23. 00 6.969.51- 7.32- 24.7534.8012.00- LOISELLE, MICHAEL F EVT3367 0718 3.0 3282HAE 100.00 69.53 .00 2.54 3.48 2.68 The transactions generated are illustrated below: 9.05 12.72 .00 Fee Suspense $100.00 Matriculation $69.53 Financial Aid $3.48 Student Activities $9.05 Building $2.54 Capital Improvement $2.68 Athletics $12.72 Fee Refunds: Student fee refunds work in much the same way as miscellaneous refunds except that the student refund account is reimbursed by the fee spread accounts (matriculation, capital improvement, health fees, etc) when the audit is run. Consider the following refund: The student dropped a course and is to receive a $285.57 refund. This is described in the following sequence of transactions: The student refund account is debited to record the refund to the student’s card. Bank $287.57 Student Refunds $287.57 The Student Refunds account is reimbursed by the daily run of the fee audit: Student Refunds Matriculation $287.57 Building $190.23 $6.96 Financial Aid Capital Improvement $9.51 $7.32 Student Activites $24.75 Athletics Heath $12.00 $34.80 Fee Adjustments: A weekly fee adjustment run consists of a series of net zero transactions that move money from one fee account to another to adjust for changes in the students registration. Adjustments should map smoothly into the JE16 format. RUN DATE: 10-17-2003 PAGE: THE UNIVERSITY OF WEST FLORIDA 1 REPORT NO: CF300R02 CORRECTIONS AUTOMATED INPUT OF ADJUSTMENT RECEIPT DIST: CONTROLLER SPRING 2003 DOCNO LINE TYPE DEPARTMENT OBJECT DESCRIPTION 031017ADJ 31 200355511 001012 MATRIC 031017ADJ 31 200355511 001022 O/S 031017ADJ 31 200357025 001032 BLDG 031017ADJ 31 100459254 001042 F/A 031017ADJ 31 200357126 001052 CAPI 031017ADJ 31 200345251 001082 ACTIV 200301 200301 200301 200301 200301 200301 AMOUNT 184.76 221.137.34 1.257.71 22.57 In the example above, funds are taken from out of state tuition and financial aid and placed In Building, Capital Improvement, Matriculation, and Student Activities (all with revenue account codes). This maps to the following T-accounts: Matriculation $184.76 Building $7.34 Captial Improvement $7.71 Out of State Tuition $221.13 Financial Aid $1.25 Student Activities $22.57