Investors Eagerly Anticipate

advertisement

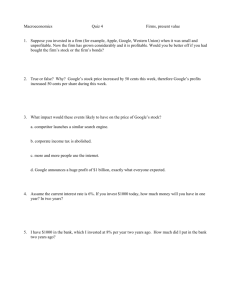

Investors Eagerly Anticipate Google's Public Offering Dutch Auction-Type Process May Give Smaller Bidders A More Level Playing Field By RUTH SIMON and ELIZABETH WEINSTEIN Staff Reporters of THE WALL STREET JOURNAL April 30, 2004; Page C1 One of Google's search options is entitled "I'm Feeling Lucky." The same sentiment will be needed for individual investors seeking to get a piece of Google Inc.'s hot IPO. In a sharp break with tradition, Google will offer shares through a process modeled after a Dutch auction. "We are in a new world," says Richard Peterson, chief market strategist for Thomson Financial. "This will be the true test of how the Dutch auction works." In traditional IPOs, underwriters help fix the number of shares a company will sell and set the offering price, with favored clients often reaping the benefits of a big first-day run-up in the stock price. The Google auction is designed to put investors on a more equal footing by letting them, rather than investment bankers, help set the price for shares via bidding. But there are big risks: The auction might encourage investors to bid up the offering price so high that the shares actually sink rather than soar once they begin trading. Moreover, many IPOs have been poor performers over the long run. Many details of the Google offering have yet to be determined, but here's what the company said about how the auction will work: To start the process, Google will set a price range for its shares. In order to bid, potential investors must open an account with one of the underwriters. Morgan Stanley and Credit Suisse Group's Credit Suisse First Boston were listed in the registration statement Google filed with the Securities and Exchange Commission yesterday, but other firms will also distribute shares. HOW TO BID FOR A PIECE . . . Qualify to participate in the IPO: Contact one of the underwriters to see if you meet eligibility requirements, open a brokerage account and get a bidder ID. Submit your bid: Provide the number of shares you want and pick a price. It can be within the range Google suggests or a higher one if you think demand will be stronger than expected or a lower one if you think demand will be weaker. Hope that you get a piece: Google will calculate the highest price that sell all shares, then choose a final price that may be lower if it wants to give the stock price room to grow immediately. If you bid at or above the offering price, you get Google shares: You probably won't get all you requested, because it's likely that successful bidders will request more than 100% of the available shares. Investors who meet the brokerage firms' eligibility and suitability requirements -- and accept a copy of Google's prospectus electronically -- will receive a bidder ID. Later, investors will be able to bid by phone, fax or over the Internet, providing the number of shares they would like to purchase and the price they are willing to pay. Many investors are likely to make bids within Google's price range. But they can bid above or below the range, speculating that demand for the shares will be stronger or weaker than Google expects. Google and its underwriters will compile the bids and then calculate the highest bid, or clearing price, that will allow the company to sell all the available shares. Google can choose to offer shares at that price or select a lower price that makes it more likely that the shares will increase in value when they begin trading. Google hopes the process will deter short-term speculation by setting a price that will meet demand. "Buyers hoping to capture profits after our ... stock begins trading may be disappointed," the company says in the filing. The company adds it "will reject bids that we believe are speculative or manipulative." Given the huge interest in Google, it is likely that demand will outstrip the supply of shares. In its filing, Google says it reserves the right to increase the size of the offering in response to strong demand. It also spells out options for dividing shares among bidders. One is to prorate distribution so that all bidders receive the same proportion of shares. Another, called maximum share allocation, would give investors with the smallest bids the entire amount they requested. Investors who place larger bids, on the other hand, might get a smaller proportion of their request. CNBC DOW JONES BUSINESS VIDEO WSJ Money & Investing Editor Dave Kansas and U.S. Bancorp Asset Management Money Manager Barry Randall talk about how Google going public could change the way Wall Street handles IPOs. Windows Media Player Required: HIGH bandwidth (DSL, Cable) LOW bandwidth (Dial-up) Notre Dame. Google didn't indicate when the auction process would begin or how long it would take. First-day gains for initial public offerings were particularly striking during the Internet bubble, when the average stock climbed 65% the day it went public, according to professors Jay Ritter of the University of Florida and Tim Loughran of the University of But over the long run, most IPOs have been mediocre investments. Companies that went public between 1970 and 2002 returned just 9.2% annually in the five years after their initial offering, 4.2 percentage points less than stocks of similar size, according to Professors Ritter and Loughran. "The poor performance tends to come in the second year," says Prof. Loughran, when the companies fail to meet investor expectations. (Prof. Ritter declined to comment because he has advised Google.) The Dutch auction system -- modeled after a technique for selling flowers in the Netherlands -- could result in a broader distribution of shares and smaller firstday gains. "It reverses the usual practice that has been roundly condemned ... where favored people get favored allocations," says John Markese, president of the American Association of Individual Investors. But there are risks. With an auction, there is a temptation to "just bid very high," says Tom Taulli, an IPO analyst with Current Offerings. "It could drive the stock price to levels that are unsustainable and inflated." Indeed, in its registration statement, Google cites the possibility that the offering price will be so high that demand for shares could be limited, causing the price to drop. Moreover, it says, winners of the auction may then conclude that they overpaid and sell to limit their losses, further driving down the price. That phenomenon is known as "winner's curse." Google says in the filing that its goal is to "achieve a relatively stable price in the days following the IPO." There are signs that demand for Google shares will be unusually strong, however. Interest in Google's registration statement was so high that it almost overloaded the SEC's Edgar Web site. The agency had to double its normal capacity to handle the deluge of people trying to access the site and view the filing, SEC officials said. It was the most traffic the SEC's site has ever had to handle, the officials said. Jim Kelley, director of development for athletics at the University of North Florida, is among the investors looking to get in on the ground floor. "I thought I might buy $30,000 worth," says Mr. Kelley, who normally makes about two or three stock trades a year. "I don't care what the offering price is on the first day. It will shoot up," he added, before reviewing the filing. "It's one of the rare things ... you know almost 100% it's a sure thing." Even some investors who have been burned by past IPOs are willing to give Google a look. Richard Couture, a retired furniture and appliance store owner in Freeport, Maine, keeps confirmation statements from the purchase and sale of Yahoo Inc. shares framed above his desk to remind him of the nearly $2,800 he lost buying the stock the day it came public. But Mr. Couture is taking a close look at the Google IPO. "It's definitely going to be hot," he says. The auction system is still relatively untested in the U.S. Fewer than a dozen companies have used this format to go public in recent years. WR Hambrecht & Co., a San Francisco investment bank, has helped nine companies go public this way. One WR Hambrecht offering, Andover.net, gained 331% on its first day of trading in December 1999. Most of the others have had small, if any, run-ups in their first day of trading. Outside the U.S., where auctions have been more common, the process tends to generate smaller first-day gains than traditional IPOs. In France, where companies have used both methods, "the first day returns were in the order of 12% as opposed to 20%" with traditional IPOs, says Kent Womack, an associate professor at the Tuck School of Business at Dartmouth. The lesson for investors: "don't rush into these things expecting you are going to get some 100% gift the first day," says Prof. Womack. Ironically, Google's decision to embark on an auction comes at a time when the use of this approach is fading. "Around the world, auctions have fallen out of favor," says Alexander Ljungqvist, a finance professor at New York University's Stern School of Business. Write to Ruth Simon at ruth.simon@wsj.com and Elizabeth Weinstein at elizabeth.weinstein@wsj.com