Homework Quiz 4

advertisement

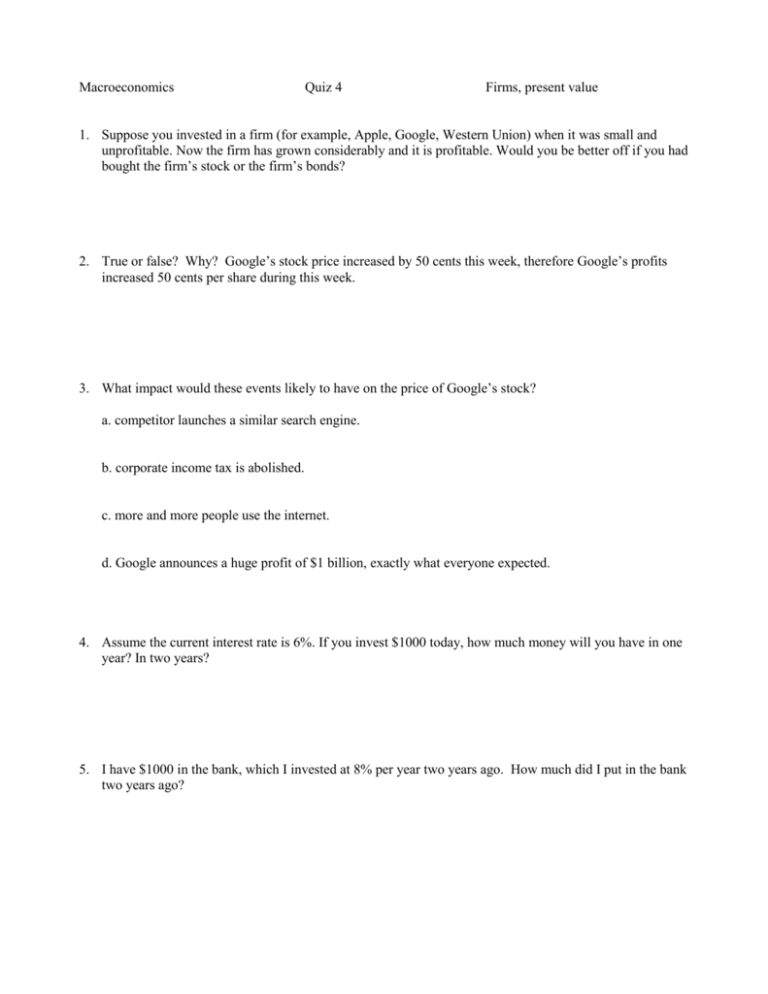

Macroeconomics Quiz 4 Firms, present value 1. Suppose you invested in a firm (for example, Apple, Google, Western Union) when it was small and unprofitable. Now the firm has grown considerably and it is profitable. Would you be better off if you had bought the firm’s stock or the firm’s bonds? 2. True or false? Why? Google’s stock price increased by 50 cents this week, therefore Google’s profits increased 50 cents per share during this week. 3. What impact would these events likely to have on the price of Google’s stock? a. competitor launches a similar search engine. b. corporate income tax is abolished. c. more and more people use the internet. d. Google announces a huge profit of $1 billion, exactly what everyone expected. 4. Assume the current interest rate is 6%. If you invest $1000 today, how much money will you have in one year? In two years? 5. I have $1000 in the bank, which I invested at 8% per year two years ago. How much did I put in the bank two years ago? 6. You have won $3 million in a lottery which promises to pay you $1 million every year for the next 3 years. Write down the formula you would use to calculate what this grand prize is really worth today, if the discount rate is 10%. Can you calculate it? 7. This year you bought $871.65 worth of shares of stock. Next year you will sell these shares for $880.10. Compute a. your capital gain b. the rate of return on your investment 8. Homer starts up his own business selling sugar. He makes $20,000 in revenue and spends $5,000 on the sugar, $2,000 on the bags, $1,000 on labor, and $1,000 to keep the bees away. He also had to quit his job at the power plant where he made $40,000 a year. a. What is Homer’s accounting profit? b. What is Homer’s economic profit? 9. Suppose eLake, an online auction site, is paying a dividend of $2 per share. You expect this dividend to grow 3% per year, and interest rate is 9%. What should be the price of a share of stock in eLake?