EXCLUSION/EXEMPTION/LIMITATION CLAUSES

advertisement

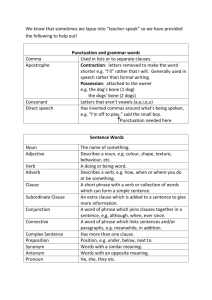

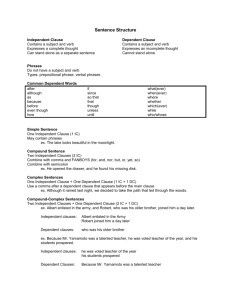

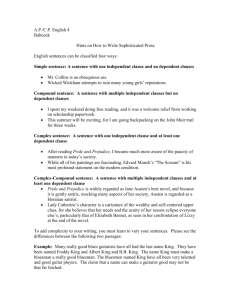

CONTRACT LECTURE 10 TRANSCRIPT C STRICKLAND EXCLUSION/EXEMPTION/LIMITATION CLAUSES Total time = 54.44 mins Track/slide 1 First of all, when looking at exclusion clauses, it is necessary to make some general remarks about their nature. An exclusion clause is the same as an exemption clause . Such a clause is an Express Term of the contract. The side putting it into the contract seeks to exclude himself from liability should the things specified in the exclusion clause transpire. A limitation clause is where one party seeks to limit his liability to a stated amount of money. The rules we discuss for exclusion clauses apply similarly to limitation clauses. In line with the doctrine of ‘laissez faire’ in the 19th century, originally it seemed OK to allow parties to exclude their liability for things that might go wrong under the contract. This was a time when most substantial contracts were between businessmen, who were regarded as being on an equal footing. What exclusion clauses did was to allocate the ‘risk’ under a contract and presumably this would be reflected in the final ‘price’ of the contract. A contract might be less expensive for the side that bore more risks under the contract. However, this approach was not seen as acceptable with new developments, basically when: i. ii. more CONSUMERS started making contracts and when widespread use of Standard Form Contracts (SFC) became the norm. Track/slide 2 A SFC is just a written set of standardised contractual terms. These grew in popularity and use due to the fact that it was unrealistic in many consumer contracts for the business to ‘waste’ time drawing up contracts from scratch with each consumer. It is arguable that if this had to be done, the final ‘price’ of the item bought would be higher to reflect the time spent on drawing up the contract. It is usual for SFCs to contain one or more exclusion clauses. The problem is that a consumer has had NO SAY in what goes into the SFC because of the unequal bargaining power. The consumer can merely accept the contract or not and this does not really reflect any sort of bargaining power. Thus, both the COMMON LAW (the judges in court) and PARLIAMENT (Acts of Parliament) have taken a REGULATORY ROLE with regards to the use of exclusion clauses by businesses – especially when it is a business dealing with a consumer and sometimes between businesses, though for the latter less often. Track/slide 3 Exclusion clauses could be seen as just an ‘ordinary term’ of the final contract and be interpreted as such by the judges in court. Thus, it could be seen as a term that merely allocated risk under the contract with a price to reflect this. However, judges do not do this. Rather, they see exclusion clauses as a ‘Defence’ that has been built into the contract to protect the person using it from claims of: i. Breach of contract, or ii. Negligence. In the light of this, judges have taken a ‘restrictive’ approach when interpreting exclusion clauses, in the first instance to protect a weaker party from exploitation by a stronger party. Track/slide 4 We can now consider the operation of exclusion clauses and what the person seeking to rely on one has to prove in court. The party wishing to rely on an exclusion clause has to prove 3 things: i. that the exclusion clause (the term) was actually incorporated into the contract in the first place; and ii. that the exclusion clause actually covers the liability (loss/damage) in question in the case; and iii. that the exclusion clause is not made ineffective by virtue of either the Unfair Contracts Terms Act 1977 or the Unfair Terms in Consumer Contracts Regulations 1999 We shall look at these 3 in turn. Track/slide 5 First, then, we shall consider whether the exclusion clause was incorporated into the contract. We have already covered this work in a previous lecture when looking at how a term becomes incorporated as an express term of the contract. Here one has to consider such things as: Firstly, was the document a contractual document? See for instance the cases of Barry v Chapelton Urban District Council 1940 and Grogan v Robin Meredith Plant Hire 1996 in which the ticket and time sheet respectively were not regarded as contractual documents. Secondly, did the consumer ‘sign’ the contract? If they did then it would seem that the exclusion clause has been incorporated into the contract and it will be difficult to plead non est factum – see L’Estrange v Graucob and Saunders v Anglia Building Society 1971. Thirdly, for unsigned documents, the timing of the notice given to the consumer on tickets and other notices. See for example, Thornton v Shoe Lane Parking 1971 and Thompson v London, Midland and Scottish Railway 1930 And finally, one has to remember that the full contents of an exclusion clause may not actually be incorporated into the contract if the person signing a document was misled by a misrepresentation as to the contents of the document being signed. See for example, Curtis v Chemical Cleaning and Dyeing Co Ltd 1951. Track/slide 6 If the exclusion clause is incorporated into the contract, the judge then has to consider whether it does actually cover the loss or damage in question. Whether or not it does is down to how the judge interprets the exclusion clause using ‘rules of construction’. Generally, the courts interpret them by giving the words used their ‘natural and ordinary meaning’. However, under the rules of construction, it can be seen how the judges often strained the interpretation to be given to words or phrases in an effort to protect the weaker party against the stronger party. This was before the passing of the Unfair Contract Terms Act in 1977 and the introduction of the Unfair Terms in Consumer Contracts Regulations 1999. Since the introduction of the 1977 Act and 1999 Regulations there has been less need for judges to struggle with words and phrases to protect the weaker party because the 1977 Act and 1999 Regulations give the weaker party, especially the consumer, a lot of protection against exclusion clauses. Under the 1977 Act the courts can now strike down an exclusion clause if it is not ‘reasonable’ and this give judges a sweeping power that was not available to them prior to 1977. Thus, even if the judge determines that an exclusion clause does cover the loss in question, it is likely that a consumer will nevertheless be protected from the effects of the exclusion clause under the 1977 Act because the judge can say that it is not reasonable. However, should the judge decide to get involved with the rules of construction, an outline of their operation follows. Track/slide 7 If the words in the ex clause are ‘ambiguous’ so capable of more than one interpretation, then the courts will tend to use the ‘contra proferentum’ rule to interpret the clause to the disadvantage of the person wanting to rely on it. Indeed, in order to protect one side of a contract, the courts have in the past ‘found’ ambiguity in the words in exclusion clauses just as a sneaky way to exert some control on exclusion clauses. Thus, in Houghton v Trafalgar Inso Co Ltd 1954 the Court of Appeal found ambiguity in the word ‘load’ to the advantage of the consumer. A car was covered by an insurance policy with an exclusion clause in it that stated that no cover was provided when the car was carrying ‘any LOAD in excess of that for which it was constructed’. An accident occurred when the car was carrying 6 people and the car was designed for 5 people. The Court of Appeal held that the word ‘load’ was ambiguous and using the contra proferentum rule construed it against the insurers as meaning excess ‘weight’ rather than excess people. Thus, words in exclusion clauses, to be effective, must be ‘clear’. Track/slide 8 The courts have also not allowed an exclusion clause to be effective if it stands in conflict with another term of the contract because of the ‘repugnancy’ rule. Thus, in Mendelssohn v Normand 1970 the printed exclusion clause excluding liability for loss or damage to cars in the car park could not be relied on because when the car park attendant promised to lock the person’s car, this created an implied term in the contract that the contents of the car would be safe. This is a bit like in Olley v Marlborough Court Limited 1949 where there was an implied term in the hotel contract to safeguard the possessions of clients in the hotel rooms. Since UCTA 1977, it is probably the case that these repugnancy cases would be interpreted as being ‘unreasonable’ and so unenforceable and hence there is less need for judges to struggle with artificial methods of construction. Thus, the position so far explained is that at common law and it can be seen that judges had no general power to strike down exclusion clauses because they were unreasonable - all they could do was see if it was incorporated into the contract and if it was they might be able to deny its effect by using one of the above rules of construction. This is why quite often they ‘stretched’ the rules of construction to protect consumers. However, such judicial gymnastics is no longer necessary because it is much easier these days for the judge to make use of the statutory controls on ex clause which greatly favour the consumer. Track/slide 9 It is necessary to make a comment on ‘fundamental breach’. Sometimes a party will claim that an exclusion clause protects them even if the breach of contract or negligence relates to a ‘fundamental breach’ of contract, that is, one that goes to the very root of the contract. Although historically, the courts have not allowed exclusion clauses like this to be effective, invoking a ‘rule of law’ approach, these days, since the case of Photo Production Limited v Securicor Transport Limited 1980, the courts approach exclusion clauses that cover a fundamental breach of contract just like any other breaches of contract – on a matter of construction. If they decide that the exclusion clause does in fact cover the loss in question, even if the loss amounts to a fundamental breach of contract, then the exclusion clause can apply to it. The courts are less worried about this nowadays because such an exclusion clause still has to be tested against UCTA 1977 and may fail if deemed ‘unreasonable’. There are also the 1999 Regulations to test it against. Track/slide 10 If the exclusion clause is said to be incorporated into the contract and if it is said to cover the loss in question, the judge than has to determine whether UCTA 1977 or the 1999 Regulations affect its operation. Can they negate its operation? A point to note here is that if the court decides that an exclusion clause is reasonable, then it will stand because in England there is no ‘general’ doctrine of ‘unfairness’ or ‘unconscionability’ in contract law to protect the weaker side. We shall look at these in turn, starting with UCTA 1977 Track/slide 11 First we can note a few key points; Firstly, UCTA governs contracts made in the ‘business setting’ Secondly, it is based on the ideas of REASONABLENESS and FAIRNESS Thirdly, it does not apply to ALL terms, generally only to Exclusion Clauses – thus a clever contract draftsperson will try to ‘hide’ terms excluding their liability in terms which on the face of it do not look like exclusion clauses to escape the Act . However, as we shall see, the courts will be careful when looking at clauses to see if they really are exclusion clauses and so are caught by the Act One question is, how does UCTA stand viz a viz the common law rules of construction used to avoid the effect of exclusion clauses mentioned above? What we can see is that the common law rules are still important and will apply to those contracts that do not fall within the scope of the 2 pieces of legislation. Track/slide 12 We will only be looking at sections 1 to 3, and 11 of UCTA. The act deals with what it calls ‘NEGLIGENCE’ liability and liability arising in ‘CONTRACT’. Section 1 – of the Act, tells us what it means when the Act talks of ‘negligence’ and the scope of the Act. It states: s 1 (1) For the purposes of this part of the Act, ‘negligence’ means the breach(a) of any obligation, arising from the EXPRESS or IMPLIED TERMS of a contract, to take reasonable care or exercise reasonable skill in the performance of of the contract; (b) of any common law duty to take reasonable care or exercise reasonable skill (c) of the common duty of care imposed by the Occupier’s Liability Act 1957 s 1 (3) In the case of both contract and tort, sections 2 to 7 apply ONLY to BUSINESS LIABILITY You can see from this that besides covering the ordinary law of negligence (when someone might try to escape their duty of care by for instance putting up a ‘notice’ to that effect) the Act also covers negligence liability which may arise in a ‘contractual’ situation, most notably when one party SUPPLIES A SERVICE for the other. As such we can see that the terms that may be IMPLIED into a contract for the SUPPLY OF SERVICES under the Supply of Goods and Services Act 1982 are subject to this Act – notably section 13 which states: ‘In a contract for the supply of a service where the supplier is acting in the course of a business, there is an implied term that the supplier will carry out the service with reasonable care and skill’ Note that in section 12 of the 1982 Act, it is stated that a contract for the supply of a service is such a contract even if ‘goods’ are also transferred under the contract – section 12 (3)(a). Track/slide 13 Section 2 - concerns Negligence Liability This section informs us that a person cannot by reference to a contract term or a notice exclude or restrict his liability for DEATH OR PERSONAL INJURY resulting from negligence. However, a person may exclude or restrict his liability for ANY OTHER TYPE OF LOSS OR DAMAGE so long as the contract term or notice satisfies the requirement of REASONABLENESS. Track/slide 14 Section 3 – concerns Contract liability This section gives protection to both CONSUMERS and ANYONE TRADING ON THE BASIS OF A STANDARD FORM CONTRACT (who may also be a consumer though it could be a businessperson). The section concerns ‘breach’ of contract and the standard of ‘performance’ of the contract and subjects any exclusion clauses to the test of REASONABLENESS. It states: s 3 (1) This section applies as between contracting parties where one of them deals as a consumer or on the other’s written standard terms of business. (2) As against that party, the other cannot by reference to any contract term(a) when himself in BREACH of contract, exclude or restrict any liability of his in respect of the breach; or (b) claim to be entitled(i) to render a contractual performance substantially different from that which was reasonably expected of him, or (ii) in respect of the whole of any part of his contractual obligation, to render no performance at all, EXCEPT in so far as the contract term satisfies the requirement of REASONABLENESS. Track/slide 15 Can the terms that are ‘implied’ under the Sale of Goods Act 1979 and under Supply of Goods and Services Act 1982 be excluded from a contract? The implied term as regards ‘title’ in either act cannot be excluded at all. The implied terms as regards description, quality and suitability and sample of goods sold under the SGA 1979 and provided under the SGSA 1982, CANNOT be excluded as regards CONSUMERS but may be excluded in business to business contracts when the exclusion clause will be put to the test of reasonableness under UCTA. These rules had to be put on a statutory footing because business people historically had been able to exclude the operation of these implied terms; the net result of which was that the implied terms were not worth the paper they were written on. You can see how UCTA has given lots of protection to consumers and arguably less to business people when trading with business people to reflect inequality or equality of bargaining power. It can be seen that the whole Act hinges on what is ‘reasonable’ and so we need to consider what is reasonable. This is answered in section 11 and Schedule 2 of UCTA. Track/slide 16 Section 11 explains what is meant by ‘reasonableness’ First, note that the reasonableness test does not apply to, for instance, s 2(1) of the Act which totally prohibits exclusion clauses regarding death or personal injury arising from negligence. Also, that the reasonable test does not apply to the implied terms noted earlier that cannot be excluded in ‘consumer’ contracts. Section 11 states: s 11 (1) that the court should decide whether the term in the contract was a fair and reasonable term in the light of - circumstances known to the parties - circumstances that ought reasonably to have been known to them - circumstances that were in their contemplation when the contract was made. s 11 (5) put the onus of proving reasonableness on the person wishing to say the clause was reasonable Just what is reasonable or not is left up to the judges to decide and it is clear that the judges are not prepared to let a decision on reasonableness in one case become a precedent for use in subsequent cases – they want each new case to be decided on its own particular facts and circumstances. In fact there aren’t many reported cases on reasonableness because most cases, especially those involving consumers, have been dealt with in the County Court whose decisions are not reported. There are a few reported cases in the appellate courts but these are mainly cases between business and business – purely commercial cases. What we can see is that the judges take a different stance in consumer cases and in commercial cases. In consumer cases they are more likely to say an exclusion clause was unreasonable and thus ‘interfere’ in the contract to ‘protect’ the consumer. But in purely commercial cases they like to support ‘laissez faire’ and interfere less in the contract – and so are more likely to say that an exclusion clause can stand. Track/slide 17 Some of the factors the judges consider are: was there equality or inequality of bargaining power? was the contract on a standard form contract? were alternative contracts available? did one party deal as a consumer? did the parties have a previous course of dealing? was one party covered by insurance so that the contract reflected an allocation of risk to the one insured? was the price lower due to the ex clause and acceptance of risk? and so forth. Some of these things are listed in Schedule 2 to the Act which have been applied generally to reasonableness although supposedly only to the sale of goods. Some of these points can be seen in the following cases but remember they do not necessarily form precedents. Track/slide 18 For commercial cases we can look at, firstly R W Green Ltd v Cade Brothers Farms 1978 In the contract between the two businesses for the sale of seed potatoes there was a ‘limitation’ clause limiting liability to the price paid for the potatoes - £634. It turned out that the potatoes were infected with a virus and so did not grow into a good crop when planted. The real loss was thus in the region of £6000. The court held that the limitation clause was reasonable because the 2 sides were of equal bargaining power, the limitation clause had been negotiated by the relevant trade bodies, had been in existence for years and the buyers could have paid more to get a contract without a limitation clause in it. And, in Monarch Airlines Ltd v London Luton Airport Ltd 1997 a clause in a contract excluding the airports liability for unintentional damage to aircraft was held to be reasonable because of the equality of bargaining power between the 2 sides, the fact that the clause was accepted in the industry and by allocating risk between the 2 sides it avoided the need for them both to be insured against such damage. These cases show how the courts do not like to interfere in commercial contract making. Track/slide 19 For consumer cases we can look at Smith v Eric S Bush 1990 House of Lords – This case went all the way to the House of Lords and so is important (although note what we have said about not setting precedents). It concerned two cases that went together on appeal because they concerned the same point of law. There was the case of : Mrs Smith v Eric S Bush and the case of Mr and Mrs Harris. Basically the cases involved both consumers purchasing houses of modest value – the Harris house cost £9000 and the Smith house cost £18,000. Both required a mortgage. The Harris mortgage was provided by the local council and the Smith mortgage was provided by Abbey National Building Society. Both the council and Abbey National as mortgagees required a survey to be carried out on the property before agreeing to a mortgage advance. The council used one of its employed surveyors and the Abbey National employed a surveyor from a local firm. In the application form filled in by Mrs Smith was a declaration and notice which read: ‘... I understand that neither the society nor the surveyor ... will ... give any assurance to me that the statements ... expressed or implied in the report ... will be accurate or valid and the surveyors report will be supplied without any acceptance of responsibility on their part to me’. In the application form filled in by Mr and Mrs Harris with the council it had the following declaration and notice: ‘... no responsibility whatsoever is implied or accepted by the council for the value or condition of the property by reason of such inspection and report.’ Track/slide 20 Both families and mortgagees relied on the surveyors reports which were favourable and the sales took place. In both cases serious problems later arose concerning the condition of the houses and they sued the valuers for damages in negligence. In the House of Lords all 5 Law Lords found in favour of the consumers. We shall note some comments from the judgments of Lord Templeman and Lord Griffiths. Lord Templeman Said that there were 3 questions to consider: i. ii. iii. whether the surveyor owed the purchaser in tort a duty to exercise reasonable care in carrying out the valuation whether a disclaimer of liability (that is, an exclusion clause) by the valuer is a notice which comes under the control of the UCTA 1977 if it does, whether it is ‘fair and reasonable’ to let the valuer rely on the exclusion clause On point one, His Lordship stated that at common law the law implies a term into contracts for the supply of services that the work will be done with reasonable care and skill (and in statute by SSGA) and that a similar duty arose without a contract in the law of tort. He said that the valuer owed a duty to exercise reasonable care and skill to ‘both’ the mortgagee and the consumer (mortgagor) knowing that both of them would rely on the valuation. The existence of this duty to both was agreed by all sides. On point two, His Lordship stated that the council had argued (since they employed and were vicariously liable for any negligence of the surveyor whilst in their employ) that their exclusion clause did not come under the control of UCTA. They argued this by saying that instead of trying to exclude their liability for negligence, rather, they had stated in the notice that a duty of care between themselves and the purchaser would not come into existence. As such the Act did not apply. Lord Templeman did not allow this line of argument because he said it was not possible to exclude the existence of the duty of care because of section 13(1) of the Act which prohibits this very thing from being done. If one could do this, then the whole point of the Act would be destroyed. Thus, he held that both exclusion clauses by the council and the other surveyor had to be subjected to the Act. Track/slide 21 On point three, His Lordship considered whether the exclusion clauses were fair and reasonable in accordance with section 11(3) of the Act? Counsel for the valuers argued that it ‘was’ fair and reasonable because: i. ii. iii. iv. the exclusion clause was clear and understandable and forcefully drawn to the attention of the purchaser – in red the purchasers solicitor should have reinforced the warning and urged them to take out their own survey if valuers cannot disclaim liability they will be faced with lots of claims and as a result their insurance cover will go up and this will have to be reflected in the price charged for valuations and that there was no contract between the valuer and purchaser Lord Templeman rejected all of these arguments as being inconsistent with the Act. His lordship then stated that the public are constantly being encouraged to purchase their homes by the government and it is often difficult to find homes to rent. Couple this with the fact that valuers know that 90% of purchasers totally rely on the mortgage valuation and do not commission their own as most can’t afford it especially when the house is of modest price. The valuer thus knows that if he fails to exercise reasonable care and skill the result may be disastrous for the purchaser. As a result, he felt it was not fair and reasonable for the building societies and valuers to put the risk of loss, due to incompetence or carelessness by the valuers, onto the purchasers. Track/slide 22 Lord Griffiths noted that it was now common practice by building societies to send the purchaser a copy of the valuers report and that it was also common practice that the reports contained a disclaimer in red lettering and in clear terms that neither they nor the valuer guaranteed the accuracy of the report. He thus stated that at common law the disclaimer was effective in excluding the valuer’s liability. Although it was an onerous term in the contract it had been specifically drawn to the attention of the other side (see Spurling v Bradshaw and Thornton v Shoe Lane Parking). But, he felt that the disclaimer was caught by the UCTA. He can to this conclusion by constructing section 1(1)(b), and section 11(3) together with section 13(1). Lord Griffiths said that these sections introduced a ‘but for’ test – would the duty of care exist ‘but for’ the notice? If yes then it could not be excluded. Otherwise the Act would be toothless. Having decided that the notice came under the Act he then said it was for the valuer to show that in all the circumstances it was fair and reasonable to let him rely on the exclusion clause. Track/slide 23 His lordship stated that in his view the following matters should always be taken into consideration: i. were the parties of equal bargaining power? In a one off deal between parties of equal bargaining power then the disclaimer might be reasonable but not so easily where the disclaimer is imposed upon a purchaser who has no effective power to object. ii. in the case of advice, would it have been reasonably practicable to obtain the advice from an alternative source taking into account factors such as cost and time? The valuers in this case claim the purchasers should have got a second valuation but at the bottom end of the property market such costs are often prohibitive to purchasers iii. how difficult is the task being undertaken for which liability is being excluded? When the task in very difficult or dangerous with a high risk of failure this might be a factor pointing towards the reasonableness of excluding liability as a condition of doing the work. A valuation, on the other hand, should present no difficulty if carried out with reasonable care and skill. As such it does not seem to place an unreasonable burden on the valuer to require him to accept responsibility for the elementary degree of skill and care involved – surely it is work at the lower end of the surveyors field of professional expertise. iv. what are the practical consequences of the decision on the question on reasonableness? This involves consideration of the sums of money potentially involved, the ability of the parties to bear the loss involved which raises the issue of insurance. Everyone knows that prudent professional men carry insurance and so bearing the loss by the valuer is unlikely to cause hardship whereas it could be a financial catastrophe for the purchaser. In addition to these factors that must always be considered he added another for this case v. although employed by the council or building society, the purchaser has in reality contributed to the valuer’s fee and so the present position is not far removed from that of a direct contract between the surveyor and the purchaser. And no one has argued that had the contract been between valuer and purchaser it would have been reasonable for the valuer to have excluded liability for negligence. His lordship thus concluded that it would not be fair and reasonable to let the valuer exclude his liability. He added that this decision applied to a modest dwelling house and that the position might be different for a more expensive house or commercial property where it might be reasonable to expect the purchaser to obtain their own survey. Track/slide 24 Remember that this case concerned not a contract between the purchaser and other party, but a ‘notice’ in the valuation report – thus it concerned negligence in tort. However, attempts to exclude negligence liability in either contract or tort are both included in section 2 of the Act and so the themes discussed are relevant to contract as well. Certain contracts do not come under the Act as per Schedule 1 and one such contract is ‘any contract so far as it relates to the creation or transfer of an interest in land’. We can note the position with regards to composite exclusion clauses. This is where the exclusion clause covers more than one thing – eg. ‘liability is excluded for reason A, reason B and any other reason whatsoever that may arise’. When considering such clauses the courts only look at the ‘whole clause’ – they won’t split it up into bits. So, unless the whole clause is the subject of scrutiny for reasonableness, the reasonableness test cannot be applied to just one of the bits of the clause. This was decided in Stewert Gill Ltd v Horatio Myer and Co Ltd 1992. Track/slide 25 It has been noted that the key implied terms under the SGA 1979 and under the SGSA 1982 cannot be excluded in contracts with consumers, so it is important to establish just who is a ‘consumer’. A person is a consumer where they do not make the contract in the course of a business whereas the party they are dealing with does, and the goods concerned are of the type ordinarily supplied for private use. Just because a person is a business person does not mean that all their contracts are made in the course of a business. A case that helps understand ‘in the course of a business’ relates to the implied term as to quality of goods under section 14 of the SGA 1979 - R & B Customs Brokers Co Ltd v United Dominions Trust Ltd 1988 – the Court of Appeal held that a contract was made in the course of a business if it was: - ‘integral’ to the nature of the business or if only incidental, there was a degree of regularity in entering into such transactions In this case the husband and wife owned a company and they bought a car for both business and private use. When they discovered it was defective they sued the supplier who tried to rely on an exclusion clause in the contract excluding him from liability as regards the quality of the car. He could only exclude the implied term under s 14 SGA 1979 if the husband and wife had not dealt as ‘consumers’. The Court of Appeal said the car was bought by them as consumers because the car was not ‘integral’ to their freight business and they did not buy cars like this that often and so the implied term under s 14 could not be excluded. Track/slide 26 We can now very briefly consider the Unfair Terms in Consumer Contracts Regulations 1999 These regulations replaced the 1994 version of them that were brought in to implement EU Directive 93/13 which was an attempt to ‘harmonise’ law in EU countries to protect ‘consumers’ from the sellers and suppliers of goods and services. The Regulations are short. Key points to bear in mind are: - the Regulations only apply to CONSUMER contracts whereas UCTA can apply to commercial contracts. For instance, when 2 businesses use a Standard Form Contract. - the Regulations apply to ANY term in a contract not just exclusion clauses - the Law Commission is currently looking at how UCTA and the Regulations work together, as at present there is overlap and confusion – see Law Comm No 166 August 2002 - the Regulations apply to any terms that have not been individually negotiated, in other words, where Standard Form Contracts are used. However, it is possible for a contract still to be seen as a SFC even when the consumer negotiates a minor term - the 2 main tests for deciding if a term is unfair are: i. ii. is the term contrary to the requirement of ‘good faith’ and does it cause a ‘significant imbalance’ in the parties rights and obligations under the contract to the detriment of the consumer - unlike UCTA where the seller/supplier has to show that the exclusion clause was reasonable if he wants to rely on it, with the Regulations the burden of proof is on the consumer to show that the term was unfair - schedules to the Regulations give indications of what an unfair term may be - if a term is declared unfair, if possible the contract continues as if it were not included