royal 86

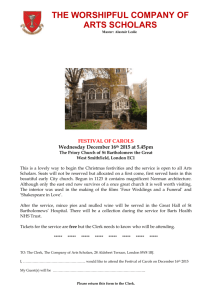

advertisement