A theory of fair compensation - The Hebrew University of Jerusalem

advertisement

1

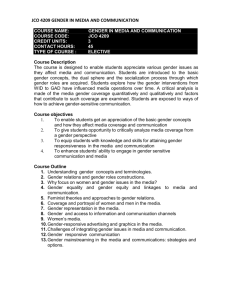

Abstract ............................................................................................................................... 3

1. Introduction ................................................................................................................... 3

2. The normative basis: a measure of riskiness................................................................. 5

2.1 Introduction to the operational measure of riskiness ................................................ 5

2.2 A special class of strategies ...................................................................................... 6

3. Approximating riskiness ............................................................................................... 8

3.1 A Taylor-based approximation of R ......................................................................... 8

3.2 From approximating riskiness to defining a decision rule ...................................... 11

3.3 A final refinement of the decision rule ................................................................... 14

4. Fair compensation theory............................................................................................ 15

4.1 Following the decision rule ..................................................................................... 16

4.2 Alternative interpretations of the decision rule ....................................................... 18

4.2.1 Gain and riskiness ............................................................................................ 18

4.2.2 The mechanism interpretation.......................................................................... 20

4.3 Compensation as an expected payoff ...................................................................... 21

4.3.1 The p-root transformation ................................................................................ 21

4.3.2 From riskiness measure to attractiveness measure .......................................... 23

5. Data analysis ............................................................................................................... 24

5.1 Analysis of the results ............................................................................................. 27

5.1.1 Loss probabilities up to 0.8 .............................................................................. 28

5.1.2 The 50-50 case ................................................................................................. 29

5.1.3 High loss probabilities (above 0.8) .................................................................. 30

6. Properties of the fair compensation rate ..................................................................... 32

6.1 Homogeneity ........................................................................................................... 32

6.2 Globality ................................................................................................................. 33

6.3 Stochastic dominance.............................................................................................. 33

6.4 Decomposing compensation into its components ................................................... 33

7. Discussion ................................................................................................................... 35

8. Conclusion .................................................................................................................. 37

Appendix A: Wealth considerations in prospect theory results ........................................ 39

Appendix B: Proofs........................................................................................................... 40

Appendix C: Expansion to “non-simple” gambles ........................................................... 42

References ......................................................................................................................... 46

2

Figure 1 ............................................................................................................................... 6

Figure 2 ............................................................................................................................. 11

Figure 3 ............................................................................................................................. 12

Figure 4 ............................................................................................................................. 15

Figure 5 ............................................................................................................................. 23

Figure 6 ............................................................................................................................. 28

Figure 7 ............................................................................................................................. 29

Figure 8 ............................................................................................................................. 32

Table 1: Compensation rate as a function of loss probability ........................................... 17

Table 2: A cross-theory comparison of indifference points.............................................. 27

Table 3: A test of loss aversion with mixed prospects...................................................... 40

3

Abstract

Prospect Theory, and more specifically Cumulative Prospect Theory, has challenged the

assumption that expected utility theory describes observed decision behavior in the real

world. Moreover, prospect theory has challenged the assumption, common in economics,

that the decision maker is rational. However, maximizing expected utility may not be the

one and only measure of rationality, and other normative theories of decision under risk

may be considered. Recently there has been progress in the development of the concept

of riskiness, which opens routes to a stricter definition of rational decision making.

In this paper we suggest that decision making under risk, as reported and analyzed in

(cumulative) prospect theory, can be explained as an approximation of a normative set of

rules based on the concept of riskiness measures. The approximation of fully rational

behavior can be thought of as a form of bounded rationality, where the sub optimality of

cognitive procedures finds expression in the substitution of complex formulas with their

simplified approximations. We then calculate an indifference threshold for the median

decision maker1 which is consistent with both riskiness considerations and evidence from

the lab, and which captures loss aversion and other descriptive attributes of common

decision making. This indifference threshold is interpreted as a fair compensation level

for accepting risky gambles, and its characteristics and implications are examined.

Finally, using the indifference threshold we build a new measure for the attractiveness of

gambles.

1. Introduction

Loss aversion, diminishing sensitivity, and overweighting of small probabilities have

been three essential characteristics widely regarded as explaining observed human

decision making ever since Tversky and Kahneman first articulated them in their seminal

work (Kahneman & Tversky, 1979; Tversky & Kahneman, 1991 and 1992). Prospect

Theory, and in particular Cumulative Prospect Theory, strives to describe these properties

by suggesting a two-stage formulation, whose first stage translates probabilities into

1

Throughout this paper, we use the term "median decision maker" to indicate a decision maker whose

attitude towards risk places him at the median of the population.

4

decision weights, and whose second stage translates payoffs into utilities using a value

function that is concave for gains and convex for losses. The nonlinear transformation of

probabilities contradicts the axioms of von Neumann and Morgenstern’s Expected Utility

Theory (von Neumann & Morgenstern, 1944), the most firmly established and widely

used decision theory in economics, and the dependency on a reference point contradicts

the common assumption in economics that utility is a function of total wealth. As a result

of this contradiction, there ensued a long and lasting debate on the extent to which

expected utility theory can explain observed behavior, and although the normative

character of expected utility theory is usually agreed upon, its positive (or descriptive)

character remains in doubt. A route seldom taken toward resolving the contradiction is to

look for an alternative normative theory of decision making under risk that would explain

real-world behavior better than expected utility theory and thus reaffirm the rationality of

the decision maker. We suggest that such an alternative theory can be found in the

growing body of literature on riskiness and measures of riskiness.

In chapter 2 we present the alternative normative theory to be discussed here—the

operational measure of riskiness suggested by Foster and Hart (2007)—and discuss a

class of strategies of a potentially descriptive nature that follow from this riskiness

measure. Chapter 3 raises some bounded rationality considerations that lead to a new

approximate measure of riskiness, and based on this new measure a decision rule is

suggested. Chapter 4 discusses the attributes of the decision rule, such as how it is used

and what interpretations can be given to it, which form the theoretical basis for our Fair

Compensation Theory. Chapter 5 checks the validity of the predictions of this fair

compensation theory against the results of cumulative prospect theory. Chapter 6

investigates the mathematical characteristics of the approximate measure of riskiness

used in this theory. In section 7 we discuss possible extensions of the fair compensation

theory. Section 8 concludes.

5

2. The normative basis: a measure of riskiness

2.1 Introduction to the operational measure of riskiness

Decision theory analyzes human decision making under risk, while sometimes presenting

such decisions as gambles. The statistical moments of a gamble’s outcomes (e.g., the

mean and the variance) can imply its level of risk, but there is no agreed-on measure of

riskiness, despite various attempts to define one. For a survey of measures of riskiness,

see Foster & Hart, 2007, Section 6.4; Aumann & Serrano, 2007, Section 7; Machina &

Rothschild, 2007.

There is an ongoing literature on measures of riskiness for gambles. Two fruitful

measures were recently suggested by Foster and Hart (2007) and Aumann and Serrano

(2007). Although these two measures originate from totally distinct hypotheses, and are

quite different in their agendas, both reach very similar results for a large class of

gambles,2 since their mathematical formulas are similar. Foster and Hart’s model is of

particular interest, since a decision rule that guarantees no bankruptcy can be based upon

their operational measure of riskiness. Their model suggests that in order to avoid

bankruptcy, one should compare one's “reserve wealth” (“wealth” for short, i.e., the

whole wealth or the fraction thereof dedicated to gambles) to the riskiness of the gamble

(measured in monetary terms), and reject the gamble if wealth is lower than riskiness

(henceforth the F&H rejection rule). On the other hand, accepting a gamble when wealth

is greater than riskiness is not mandatory.

The following notations and definitions are based on Foster and Hart (2007). A

gamble g is a real-valued random variable having some negative values (losses are

possible) and positive expectation, i.e., Pg 0 0 and Eg 0 . The probability of loss

is strictly positive because otherwise the gamble would be degenerated: any gamble

whose outcomes are all positive must be accepted by a rational decision maker, and is

assumed to be accepted in practice by practically everyone.3 The expected payoff of the

gamble is restricted to positive values because every gamble with a negative expectation

2

The class of gambles with payoffs that are relatively small compared to the riskiness measure.

Rationality cannot be a requirement in a positive theory of decision making (as opposed to a normative

one), but this extremely weak sense of rationality—a preference for a positive amount of money over

none—is a reasonable characteristic for the ordinary decision maker.

3

6

is assumed to be rejected by the common decision maker, as most people are risk-averse.

We can assign a measure of riskiness RFH g to each gamble g, such that the greater the

risk involved in the gamble, the greater the value of RFH g . RFH g is homogeneous of

degree I, i.e., RFH g RFH g for every 0 . For each gamble g and wealth W, a

strategy s either accepts g at W, or rejects g at W. Hence we can write the F&H rejection

rule as follows: A strategy s guarantees no bankruptcy if and only if for every gamble g

and wealth W>0, whenever W< RFH g s rejects g at W. The value of RFH g (hereafter

g

simply R) is obtained by solving the equation E ln 1 0 (R has no explicit

R

expression).

2.2 A special class of strategies

Definition: A “simple” gamble g is a two-outcome gamble yielding a strictly negative

payoff -L with positive probability p, and a positive payoff G otherwise:

Figure 1

For the sake of simplicity we will restrict our discussion in this paper to “simple”

gambles (i.e., two-outcome gambles). This restriction should not weaken our analysis, as

prospect theory and cumulative prospect theory are completely based on evaluations of

two-outcome gambles (see Kahneman & Tversky, 1979, 1992). We refer to “non-simple”

gambles in Appendix C.

Next, we define vs g : inf W 0 : s accepts gat W . Thus vs g indicates the

minimal wealth needed in order to accept g when using s. Let us now look at a class of

strategies S* defined over the set of all “simple” gambles, that satisfy the F&H rejection

7

rule in the following manner: each s* S * corresponds to a unique probabilitydependent threshold Th(p), such that:

,

v s g

R ,

if G L Th( p)

if G L Th( p)

We let ε be some positive number arbitrarily small. In words, a strategy s* accepts a

gamble g if and only if the gain-to-loss ratio is above some threshold Th(p) and the

wealth is greater than the riskiness measure R. This decision rule can be written in a

simpler form:

Accept a gamble g if and only if:

(1) G/L>Th(p)

AND

(2) W>R.

Th(p) is a non-decreasing function of the loss probability p; this implies that the greater

the probability of losing (p), the higher is the threshold for acceptance (the gain-to-loss

ratio (G/L) needed to transfer a gamble from the upper group of gambles (whose

v s g ) to the lower group (whose vs g R )). Clearly, s* guarantees no

bankruptcy as R vs g for every gamble g. A strategy s* separates the space of

gambles into two clusters: one contains gambles that are rejected at all wealth levels, and

the other contains gambles that are accepted whenever R W . This clustering of

gambles suggests that the class S* can be described as a family of “compensation”

strategies, where each strategy s* is characterized by a compensation level, indicated by

the threshold Th(p), such that a gamble that offers a gain-to-loss ratio (G/L) below this

level is always rejected (reward not compensating for the risk taken), while a gamble that

offers a gain-to-loss ratio above this level is accepted as long as no bankruptcy is

guaranteed (i.e., as long as R W ). It is immediately evident that “compensation”

strategies incorporate two plausible attributes. First, they capture a naïve but powerful

“rule of thumb” according to which probabilities translate into risk and gain-to-loss ratio

translates into compensation, while Th(p) functions as a “price tag” of the required

compensation for each level of risk. Second, risk aversion becomes more dominant as the

stakes grow, as reflected by the fact that it is possible to skew up any gamble with

“compensating” G/L (multiply both G and L by λ>1) until its riskiness R surpasses the

8

wealth W, and as a result the gamble is rejected. The first property is a characteristic of a

CARA utility function,4 while the second is supported both theoretically and empirically

by numerous studies, such as Holt & Laury (2002), Smith and Walker (1993), PalaciosHuerta and Serrano (2006), and Fullenkamp et al. (2003, p. 219). The focus on the class

of strategies S* is motivated by their high descriptive ability, which will become much

more apparent in Chapter 5, where the predictions of an s*-based decision rule are

compared to the results of cumulative prospect theory.

3. Approximating riskiness

3.1 A Taylor-based approximation of R

In this section we take the first step from normative to positive decision theory. The

motivation for seeking riskiness-based decision making in real life stems partly from

evolutionary considerations: people whose behavior violates the F&H rejection rule are

prone to bankruptcy and therefore perhaps at an evolutionary disadvantage as bankruptcy

may lead to no living offspring. The adoption of decision rules (such as the F&H

rejection rule) through an evolutionary process is guided partly by their direct fitnessenhancing character and partly by their lack of complexity. The decision maker may not

be aware of using these rules, but he is nevertheless guided by them if his mind is capable

of being “programmed” to follow them. Such rules may be regarded as instances of rule

rationality, a term coined by Robert Aumann to describe unconscious “rules of thumb”

that work in general and evolve like genes: if they work well, they are fruitful and

multiply; if they work poorly, they become rare and eventually extinct (Aumann, 1997).

We just saw that “compensation level”-based strategies may guarantee no bankruptcy,

thus enhance fitness, but in order to be regarded rule rational they must not be too

complex. Let us examine the feasibility of an evolutionary process leading to adoption of

a compensation level-based strategy s* for decision making. Finding an arbitrary

monotonic threshold function Th(p) with which to compare the gain-to-loss ratio is an

easy mental task (e.g., one can demand, as one’s compensation level, a ratio G/L equal to

4

In the sense that a person with CARA utility evaluates the gamble regardless of his own wealth: he either

accepts it at all wealth levels or rejects it at all wealth levels. We describe this behavior as putting a “price

tag” on the risk involved in a gamble, and judging the payoffs relative to this “price tag,” while ignoring

wealth considerations.

9

the reciprocal of the gain probability, so that G:L equals 2:1 if the chance to win is 1/2,

G:L equals 4:1 if the chance to win is 1/4, and so on). However, how can one compare

his wealth W to RFH g , when the evaluation of the latter involves an implicit

function whose treatment is beyond the ability of an ordinary person, even if this

treatment does not involve solving equations but rather following an “evolutionarily

programmed” rule? It may prove a task too complicated for the human mind.

Nevertheless, it is reasonable to assume that people who used decision rules that were

based on a more accurate estimation of R had an evolutionary advantage over their

peers.5 Thus, there may have been an evolutionary pressure to approximate R, the implicit

expression of riskiness given by Foster and Hart. In a way, approximating R may be

regarded as a form of bounded rationality, that is to say, a method used by a brain with

limited calculation abilities to reach what Herbert Simon coined “satisficing” results

(Herbert Simon, 1972, 1982). In order to find a simple explicit expression that

approximates the F&H. measure of riskiness RFH g and can be used as its substitute, we

turn now to examine the mathematical aspects of the implicit formulation of R.

g

For the F&H measure of riskiness R we have E ln 1 0 . A Taylor series

R

development

of

the

2

expression

3

in

parentheses

is

4

g g 1g 1g 1g

ln 1 . Approximating this infinite series using

R R 2 R 3 R 4 R

g g 2

0 , from which a new approximated measure of

the first two terms yields E

2

R 2R

riskiness can be derived, namely R(g ) :

E g2

. R(g) is a good approximation as long as

2 Eg

g

is small enough (uniformly). From a bounded rationality perspective, R(g) has an

R

explicit expression that may substitute the implicit F&H measure of riskiness, while

giving the requested “satisficing” results. In addition, since R(g) is a ratio of the

dispersion and the mean, it reflects the intuition-driven convention that riskiness should

5

Accurate estimation of R is required in order to avoid bankruptcy.

10

rise with increased dispersion and fall with increased expectation (this may recall the

logic behind the Sharpe Ratio). Therefore, if there was an evolutionary pressure to base

decision rules on RFH g , it is possible that R(g) was used instead, thanks to its relative

simplicity. Another interesting feature of R(g) is that it is also the Taylor-based

approximation to the measure of riskiness of Aumann and Serrano (henceforth the A&S

g

measure of riskiness): the A&S measure of riskiness solves the equation E 1 e R 0 ,

while 1 exp x x

g

1 2 1 3 1 4

x x

x . Substituting x with and again taking

2

6

24

R

only the first two terms of the Taylor series we get R(g), just as was shown with the F&H

measure of riskiness. Thus, even if the A&S measure has certain advantages over the

F&H measure as a normative guideline, R(g) nevertheless approximates it just as well.

Holding L and p constant, RFH g declines monotonically to zero as the gain G

grows to infinity. For small values of G the ratio

g

is also small, and therefore R(g)

R

behaves very similar to RFH g . However, as G keeps growing,

g

grows too, and R(g)

R

gradually draws away from RFH g . Unlike RFH g , its approximation R(g) does have a

minimum point as a function of G (while L and p are fixed). Define the gain at this

minimum point G'. Then obviously R(g) at the gain G' is min R(g). Since beyond G'

R(g) gradually rises, while RFH g keeps decreasing, we get that for values of G above

G' min R(g) is a better approximation to RFH g than R(g) itself. This fact is

demonstrated in Figure 2, and will be used now for a refinement of the decision rule.

11

Foster-Hart riskiness measure vs. its approximation - R(g)

1400

1200

Riskiness

1000

800

600

G’

400

200

0

100

150

200

250

300

350

400

The Gain - G

Foster-Hart riskiness measure

R(g) - approximated measure of riskiness

G - the gain of the gamble

Min R(g)

Figure 2

The graph illustrates the relations between

RFH g , R(g), min R(g), and G, for L=100 and

p=0.5. The X-axis is G. The blue line indicates RFH g , which decreases monotonically with G.

The orange line is R(g), which reaches its minimum at the point G', where G (green line) crosses

it. The purple line shows min R(g). It can be noticed that beyond the crossing point G', min R(g)

approximates RFH g better than R(g).

3.2 From approximating riskiness to defining a decision rule

The fact that min R(g) approximates RFH g for G>G' better than R(g) does indicates

that R(g) can be replaced with an improved approximation to RFH g for all G. Define

R* as follows:

Rg

R*

min Rg

, if G G '

, if G G '

Therefore, R* is preferred to R(g) in order to approximate RFH g for all values of G.

This is demonstrated graphically in Figure 3.

12

Foster-Hart riskiness measure vs. its approximation - R(g)

1400

1200

Riskiness

1000

800

600

400

200

0

100

150

200

250

300

350

400

The Gain - G

Foster-Hart riskiness measure

R* - approximated measure of riskiness

G - the gain of the gamble

Figure 3

The graph illustrates the relations between RFH g , R*, and G, for L=100 and p=0.5. The orange

line is R*, which is composed of R(g) up to the point where it reaches its minimum, and a

horizontal continuation from this point on (indicating the minimal value of R(g)).

In addition to reducing computational complexity, the substitution of the F&H riskiness

measure with its approximation R* achieves two other goals. First, R* smoothens the

behavior of the riskiness measure for small loss probabilities. In the original F&H

riskiness measure, the loss L is the lower bound on RFH g . Thus, for example, the

gamble A, which yields -100 with 1% probability and 10,000 with 99% probability, has

the same riskiness as gamble B, which yields -100 with 5% probability and 100 with 95%

probability; the RFH g for both is 100 (which is the absolute value of the loss L), though

the former is definitely more attractive than the latter, regardless of one’s attitude to risk.

Allowing the riskiness measure to be lower than L captures the fact that people may be

willing to accept such low-risk gambles as gamble A even when their own capital is

lower than the possible loss (i.e., when W<L). This relaxation of the lower bound

restriction is achieved by substituting RFH g with R*. Second, and more important for

13

this paper, the substitution of RFH g with R* enables us to set a non-arbitrary

compensation level Th(p) to the strategy s*, based on R* itself. As mentioned, the

compensation level for a strategy s* is a non-decreasing function of the loss probability

Th(p), which represents the threshold to which the gain-to-loss ratio of the gamble is

compared. In order to show how R* can dictate a specific Th(p) we need to examine the

properties of G', which is the point where R(g) reaches its minimum.

R(g) can be written explicitly for a “simple” gamble in the following way:

E g2

1 1 p G 2 pL

R(g )

. By deriving this particular expression of R(g) with

2 E g 2 1 p G pL

2

respect to G, we find that the gain that minimizes R(g) is G', such that G ' L

p

1

p

.

Since at this point the gain G' equals the riskiness R(g) (see Appendix B for a proof), we

get * G' L

p

1 p

Rg G G ' min Rg . Now define Th( p)

p

1 p

(this is a non-

decreasing monotonic function of p). Hence, G' can be written as L Th( p) , and a

compensation-level strategy s* with Th( p)

p

1 p

accepts a gamble if and only if the

gain G is greater than G' (equivalent to G/L>Th(p)) and the wealth W is greater than the

riskiness.

The requirement that the gain be greater than G' follows from the significance of G'

in the definition of R*: if by using R*, RFH g can be assessed only approximately, risk

aversion might take the form of minimizing R* by accepting gambles only in the

horizontal part of R*, where riskiness is constant and at a minimum (this can also be

described as minimizing a second-order approximation of the accurate riskiness RFH g ).

Since the value of G for which R(g) reaches its minimum (and the horizontal part of R*

begins) is G', minimizing R* is equivalent to demanding the gain G to be greater than G'.

In conclusion, the compensation level can be based upon min R*, such that by setting

Th( p )

p

1

p

as a lower threshold on G/L, only gambles whose gain-to-loss ratio

minimizes R* are considered.

14

3.3 A final refinement of the decision rule

In Section 2.2, we defined the class of strategies S*, such that each s* S * has a unique

probability-dependent threshold Th(p), for which it accepts a gamble g if and only if two

conditions are satisfied:

W RFH g

G L Th( p)

To adjust such a strategy to the bounded capability of the human mind, “evolution” had

to approximate RFH g . As we showed, a natural candidate for that approximation is R*.

We were also led to concentrating on one specific s* that followed from using R* instead

of RFH g . When we update the general characteristic conditions of S* strategies to that

of the specific R*-based strategy s*, we see that acceptance of g is dependent on

satisfying two conditions:

W R *

p

G

L

1 p

where R* is defined as

Rg

R*

min Rg

, if G G '

, if G G '

Bearing in mind that G>G' and G L

p

1 p

are equivalent conditions, we notice that

condition (II) restricts R* to the region where it equals min R(g). This allows for a slight

manipulation in the writing of the decision rule, such that

W min Rg

p

G

L

1

p

And finally, recalling from (*) that G' L

p

1 p

min Rg , we can write the decision

rule in its final form:

Define Th( p)

p

1 p

. The compensation-based decision rule is:

15

g

Accept

if

and

only

if

W Th p L

AND

G Th p L ,

that

is,

Th p L min W , G.

Moreover, this decision rule is homogeneous; i.e,. if g is accepted at wealth W, then λg is

accepted at λW for every λ>0.6

F.H. riskiness measure, its approximation (R*), and the gain condition in the decision rule

1400

The condition on the gain

in the decision rule:

G>G’ ≡

G>R(g) ≡ G>min R(g)

≡ G>R* ≡ G>L∙Th(p)

≡ {R*|R*=min R(g)}

1200

Riskiness

1000

800

600

G’

400

200

0

200

150

100

250

350

300

400

The Gain - G

Foster-Hart riskiness measure

Approximated measure of riskiness

G

Figure 4

The graph illustrates the area of acceptance according to the condition on the gain in the decision

rule, while presenting its varied formulations. The illustration is done for L=100 and p=0.5.

4. Fair compensation theory

Fair compensation theory (compensation theory for short) is the name we suggest for the

decision theory described in this paper, according to which people follow the two-part

6

If g is accepted at wealth W, then it follows that:

1) W > R(g) => W >

λW > E

g 2Eg => λW > R(λg)

2

2) G > R(g) => G >

E g 2 2Eg => λW > λ E g 2 2Eg => λW > 2 E g 2 2Eg =>

E g 2 2Eg => λG > λ E g 2 2Eg => λG > 2 E g 2 2Eg => λG

> E g 2 E g => λG > R(λg)

and therefore λg is accepted at wealth λW.

2

16

decision rule stated above, while doing their best in terms of bounded rationality to avoid

bankruptcy and guarantee growth of wealth.

The critical gain G' is the fair compensation for making a decision at the risk of

losing L with probability p, such that the decision maker is indifferent between accepting

and rejecting the gamble (L,G';p,1-p). Our reason for using the term “fair compensation”

has to do with the way we often interpret risky (as well as non-risky) offers. Once we

have a notion of the gain needed to induce us to accept a certain risk (even if the notion is

merely an “evolutionarily programmed” hunch), one may interpret offers of lower gains

as unfair or as uncompensating for the risk involved (unfairness is a common motive in

the literature for rejecting otherwise attractive offers, e.g., in ultimatum games; see Fehr

& Schmidt (1999), Fehr & Gachter (2000), Rabin (1993), Kahneman, Knetsch & Thaler

(1986)).

In the following sections we describe the logic behind the theory, and in particular how

the decision rule can be followed by boundedly rational agents, how this rule can be

interpreted, and how it relates to the demand for a positive expected payoff.

4.1 Following the decision rule

The whole procedure of approximating the original riskiness measure suggested by

Foster and Hart was driven by the motivation to find how riskiness can be assessed by

everyone, and to make sure that the s*-based decision rule can be followed (before

claiming that empirically it is followed). Was this goal achieved? Let us start with the

condition G Th p L , where Th( p)

p

1 p

. Note that the condition on G is linear

with respect to the loss L. This means that we expect the decision maker to be able to

assess the gamble’s compensation rate G/L (clearly an easy task) and the required

compensation level Th(p), as a function of p. Assessing Th(p) does not require solving

root equations, but merely acquiring a sense of the size of Th(p) as a function of p. For

example, the compensation level Th(p) for a 50-50 gamble over L and some G is 2.41,

and so “feeling” that a fair compensation rate in a coin flipping is a bit below 2.5 is

enough to guarantee that the decision maker follows the rule quite closely: every gamble

17

offering a smaller compensation rate G/L will be rejected, and every gamble offering a

higher compensation rate may be accepted.

The descriptive capabilities of the decision rule are analyzed in Chapter 5, but we

will note here that this number 2.41 is inside the range of the loss aversion coefficient

estimations of Tversky and Kahneman: between 2 and 2.5 (Tversky & Kahneman, 1991),

and is backed up empirically by the ratio that characterizes the asymmetric effects of

price increases and decreases (Putler, 1988; Kalawani, Yim, Rinne, and Sugita, 1990). In

a similar manner, by having merely the sense of the magnitude of compensation rate

needed for only a few loss probabilities, one can follow the decision rule quite closely.

Like the value function in prospect theory, Th(p) is a function that emphasizes losses

more than gains. This “loss aversion” attribute of the fair compensation rate is illustrated

in Table 1 for a few loss probabilities:

p(Loss) G'/L

0.5

2.4

0.9

18.5

0.75

6.5

0.25

1

0.1

0.46

Table 1: Compensation rate as a function of loss probability

With such a table or a slightly more detailed one encoded in our brain, we are guaranteed

a small margin of error when following the condition G Th p L .

The second condition, W Th p L , is very similar in structure, and so can be

followed in a very similar way, namely, by replacing G by W, and demanding a “wealthto-loss” ratio W/L greater than the compensation level Th(p) (which is evaluated in any

case). Though less intuitive, this “wealth” condition is as easy to follow as the “gain”

condition.

18

4.2 Alternative interpretations of the decision rule

In Chapter 5 we will use Cumulative Prospect Theory (Tversky & Kahneman, 1992) as a

reference for observed decision making under risk to show that decision making can be

described quite accurately with the decision rule suggested above (accept a gamble if and

only if Th p L min W , G). As mentioned, this decision rule is based on a strategy s*

that satisfies the necessary condition for no bankruptcy (W>R for every accepted

gamble), except that R* is used instead of the original RFH g to reflect bounded

rationality. Therefore, if the accuracy of RFH g is not too crucial for this condition, then

the principal goal of this paper—finding a normative rule that fits observed behavior and

thus can serve as an alternative explanation to the heuristics-based explanation of

Prospect Theory—is already achieved. Nevertheless, though one element in the decision

rule is directly connected to Foster and Hart’s normative assertions (which require W>R),

the other element (which requires G Th p L ) may appear out of place. Therefore, we

devote the next section to suggesting some interpretations of this part of the rule, in the

hopes that at least one of them will shed light on the true reason for its evolution.

4.2.1 Gain and riskiness

To better understand the “gain” condition G Th p L , we need to return to two earlier

and equivalent definitions of this condition: (I) R* = min R(g) and (II) G>R* (Figure 4).

The fact that condition (I) requires that only gambles with a riskiness R* that is constant

and at a minimum be accepted suggests a very simplistic and straightforward form of risk

aversion. We shall refer to it as the minimum riskiness condition. On the other hand,

condition (II) is based on the fact that G' is the only point where G=R* (Figure 3), and for

greater values of G the gain remains above the riskiness, i.e., G>R*. Viewed this way,

condition (II) implies that the gain is compared to the riskiness, and that acceptance

follows from the fact that the gain is greater than the riskiness measure. We can think of

condition (II) as a simplistic compensation-based rule, where a gamble’s riskiness R*

should be compensated by a gain greater than R*. We shall refer to it as the gain greater

than riskiness condition.

19

Recall that Foster and Hart state that it is possible but not necessary to accept a gamble

when W>R, whereas it is detrimental to accept a gamble when W<R, since it guarantees

bankruptcy in the long run. As a result, for each level of wealth W, gambles may be

partitioned into affordable (i.e., acceptable) and unaffordable risks (i.e., leading to

bankruptcy if accepted). We will now try to demonstrate how an intelligent use of the

riskiness measure may lessen the danger of bankruptcy and even lead to enhanced

growth. To do so, we will suggest an evolutionarily based intuition to the proposed

decision rule. Evolutionary considerations are often used to explain heuristics of

judgment and decision making. This kind of reasoning is based on the assertion that

human behavior was shaped, in the long process of evolution, for the most part while

human beings lived in nomadic hunting and gathering tribes, under conditions that

merely enabled subsistence. Thus, a behavior that makes no apparent sense today can

sometimes be understood by the advantage in fitness it may have conferred to hunting

and gathering societies. In these societies, consumption reduces to its narrow conception

of consumption of calories, and the payoff currency that sets preferences is calories rather

than money. The “reserve wealth” from the Foster–Hart model may then be interpreted as

the calories at your disposal (in your stomach or stored in your cave), and the gamble

may be the decision whether to exert energy on a risky venture, e.g., going on a hunting

expedition (or wandering to a new location, etc.). One interesting observation can already

be made: while in the Foster–Hart model having a large initial wealth translates to the

possible acceptance of gambles with very small positive expectations (since both W and

R are large), from an evolutionary point of view it nonetheless makes more sense to avoid

hunting expeditions with only small positive expectation if you already have many

calories at your disposal. So the fact that you can afford to take the risk does not mean

that you should go ahead and take it. But what affordable risks are worth taking? Here

we wish to demonstrate the logic of the “minimum riskiness” and “gain greater than

riskiness” conditions as guidelines for decision making. Under the “minimum riskiness”

condition, one goes on a hunting expedition only if the possible gain is at least the gain

that minimizes the riskiness. Minimizing the riskiness is therefore a heuristic that

dispenses with the affordable but unnecessary ventures, including opportunities to

marginally improve an already satisfying nutrition. Under the “gain greater than

20

riskiness” condition, one goes hunting only if the possible gain is greater than the

riskiness. Remember that the rejection rule (reject if R>W) implies that one should reject

gambles one cannot afford, where the measure for affordability is the riskiness R. Hence,

the rejection rule implies that riskiness serves as a measure of the amount of calories that

the hunter stands to lose in a hunting expedition (so that R>W means that the amount of

calories that the hunter stands to lose on an expedition is greater than the amount at his

disposal). Therefore, “gain greater than riskiness” can be understood to mean that the

hunter should go on the hunting expedition only if the hunt holds the promise of gaining

more calories than those he will lose by going out (and the same is true of wandering to a

new location). More generally, the no-bankruptcy condition W>R instructs us to keep the

level of riskiness below the initial wealth, and the “gain greater than riskiness” condition

instructs us to keep the level of riskiness below the possible gain. Taken together, these

conditions tell us to avoid taking actions whose riskiness is either greater than what we

already have or greater than what we can expect to achieve by taking them.

4.2.2 The mechanism interpretation

Unlike the previous two interpretations, the mechanism interpretation to be presented

here seeks to explain the plausibility of the condition not through its direct consequences,

but rather as an indirect mechanism for avoiding bankruptcy, without any need to

compare wealth to riskiness. For this interpretation, the condition may be written simply

as G>G', where the significance of the point G' lies in the fact that it separates R* into

two parts as follows:

Rg

R*

min Rg

, if G G '

, if G G '

While assessing R(g )

E g2

1 1 p G 2 pL

2 E g 2 1 p G pL

2

is too complicated a task for a

boundedly rational agent, we showed in Section 4.1 that assessing min Rg L

p

1 p

(see (*) in Section 3.2) is not. Therefore, assessing riskiness using R* is almost

impossible when G≤G', while quite feasible when G>G'. Since a good assessment of R*

is crucial to avoid bankruptcy (by following the “wealth” condition W>R*), a

21

psychological mechanism that rejects “uncompensating” gambles (i.e., gambles with

G≤G') can guarantee that only gambles whose riskiness measure is estimable will be

considered, which enables the decision maker to follow the “wealth” condition required

for avoiding bankruptcy.

A psychological mechanism can take the form of emotions or expectations, while a

physical mechanism takes the form of a chemically based stimulation. Two principal

physical mechanisms are hunger and sexual attraction: hunger is a mechanism for

guaranteeing a supply of energy to our body through food consumption; sexual attraction

is a mechanism for the genes’ reproduction through intercourse. Insult or the demand for

fairness (as in the Ultimatum Game) are psychological mechanisms for safeguarding

against a reputation that one is a “sucker” (Aumann, 1997). In a similar way, we suggest

that seeking compensation for risk is a mechanism for preventing bankruptcy: demanding

a compensation rate G/L greater than the threshold Th(p) leads to considering only

gambles with G>G', whose riskiness R* is estimable; thus wealth can be compared to

riskiness and bankruptcy can be easily avoided. This mechanism of “seeking

compensation” is well known to investors: every investment bears a risk, but only

investments where the risk of failure is believed to be well compensated for by the

expected revenues are eventually taken.

4.3 Compensation as an expected payoff

4.3.1 The p-root transformation

Let us now consider only the “gain” condition of the decision rule, namely,

G L

p

1

p

. G', the value of G that makes the decision maker indifferent to the

gamble g, solves the equation 1 p G p L 0 . But this is exactly the point of zero

expected payoff of a transformed gamble, such that p p and 1 p 1 p . When

we define this transformation as a “p-root transformation,” it follows that the decision

maker’s behavior can be interpreted as demanding a positive expected payoff in the proot transformed gamble.

22

Two main attributes of judgment in prospect theory are the emphasis on losses and

the non-linear weighting of probabilities. In prospect theory these two are modeled

separately: the emphasis on losses is modeled with the parameter λ in the value function;

the non-linear weighting of probabilities, i.e., the overweighting of low probabilities and

the underweighting of high probabilities, is modeled with an inverse S-shaped weighting

function. Analyzed together, these two effects accumulate in a gamble with low

probability of loss, since both magnify the effect of this possible loss, one through

overweighting its size (compared to the gain), and the other through overweighting its

low probability of being realized. On the other hand, these two effects tend to cancel each

other out in a gamble with a high probability of loss, since the size of the loss is

overweighted while the probability of its realization is underweighted. However, since

the loss-emphasizing parameter λ is greater than 2, its effect suppresses the diminishing

effect of the high probability, i.e., a possible loss is always overemphasized, no matter

how high its probability.

The p-root transformation incorporates both effects solely through its transformation

of the probabilities. The superiority of the effect of the loss-emphasizing parameter λ

over the effect of the magnitude of the probability is reflected by the fact that the p-root

transformation always increases the loss probability and always decreases the gain

probability. The second-order effect—overweighting of low probabilities and

underweighting of high probabilities—is reflected in the intensity of its emphasis on

losses. As demonstrated in Figure 5, the p-root transformation always overweights the

probability of loss, but it does so appreciably for low probabilities and only slightly for

high ones. Similarly, it always underweights the probabilities of gain, but it does

so appreciably for high probabilities (since both the gain and the high probability are

underweighted) and only slightly for low ones.

23

p -root transformation of probabilities

Transformed probability

1

0.8

0.6

0.4

0.2

0

0

0.2

0.4

0.6

0.8

1

Original probability

Loss probability

Gain probability

Non-transformed probability

Figure 5

This is a graphic illustration of the p-root transformation. Loss probabilities are always magnified, but the

extent of magnification is diminished as the probability increaes. Gain probabilities are always reduced,

but the extent of reduction is increased as the probability increases. This is a superposition of two effects

known in Prospect Theory: loss aversion and non-linear weighting of probabilities.

As a result, the p-root transformation may substitute prospect theory’s compound

structure of a weighting function multiplied by a value function, while embodying the

same implications for decision making under risk.

4.3.2 From riskiness measure to attractiveness measure

We now suggest a characterization of an attractiveness scale of gambles based on the

expectations of their p-root transformations. Define the attractiveness of a gamble g to be

the expected payoff of the p-root transformation of g. By definition, we get zero

attractiveness for gambles toward which the median decision maker is indifferent.

Moreover, a gamble with G>G' always has a positive index of attractiveness, and a

gamble with G<G' has a negative index of attractiveness. Therefore, the “gain” condition

of the decision rule may be substituted by a demand for a positive index of attractiveness.

Incorporating attractiveness into the model of decision making, we can now talk about

24

each gamble’s level of attractiveness and compare all kinds of gambles, rather than

settling for a rule that can only distinguish between participation and avoidance. In so

doing, we render attractiveness an objective measure that substitutes the subjective

measure of utility. The empirical question of whether a more attractive gamble indeed has

a higher chance of being accepted by the median decision maker is left for future

investigation, as is the theoretical appeal of its properties (clearly it violates the expected

utility hypothesis, and therefore new axiomatization needs to be done to support it as an

index). Therefore, the index of attractiveness will not be used for analyzing the

predictions of compensation theory.

5. Data analysis

Tversky and Kahneman present cumulative prospect theory as “a new version of prospect

theory that… allows different weighting functions for gains and for losses.” They further

state that “the key elements of this theory are 1) a value function that is concave for

gains, convex for losses, and steeper for losses than for gains, and 2) a nonlinear

transformation of the probability scale, which overweights small probabilities and

underweights moderate and high probabilities” (Tversky & Kahneman, 1992). The value

function and weighting functions are the following:

Their theory is backed up by experimental data gathered in the lab. From the

experimental results they compute the numerical values for the parameters of the

functions: α = β = 0.88, λ = 2.25, γ = 0.61, and δ = 0.69 (Tversky & Kahneman, 1992).

The fact that the parameters α and β of the value function are found to be equal is

significant to this paper. In fair compensation theory, the equation G/L=Th(p), which

25

describes the indifference point of the “gain” condition in the decision rule, is

characterized by a property of “scale independence”; i.e., for given probabilities to gain

or to lose, only the ratio G/L matters, so that multiplying both G and L by the same

constant has no effect. In cumulative prospect theory, the indifference point can be

vG w (1 p) v L w p 0 . Substituting the

derived from the equation

expressions for the value function and weighting functions in this equation, and replacing

β with α (since they are equal), we get the following equation for the indifference point:

G

p

p 1 p

L 1 p

p 1 p

1

.

1

1

We shall refer to it as the “indifference point” representation of prospect theory. As can

be easily seen, the indifference point in prospect theory bears the same “scale

independence” property as the indifference point of the decision rule in fair compensation

theory. This makes them easy to compare, since the comparison is independent of the

scale of gains and losses: for each couple of win-lose probabilities (characterized solely

by the value of p), the G/L ratio that makes the decision maker indifferent to the gamble

according to one theory can be compared to the G/L ratio that makes him indifferent

according to the other.

The “wealth” condition of the decision rule, i.e., W/L>Th(p), cannot be compared to

the results of prospect theory since the wealth of the subjects in the experiments is

unknown. Nevertheless, as analyzed in Appendix A, it can be assumed that the wealth

condition was not violated by the vast majority of the subjects (because the condition was

satisfied for all gambles for most subjects), and so the wealth condition is redundant for

the comparative analysis presented here. A broader discussion of wealth considerations in

analyzing prospect theory results appears in the Conclusion.

We are using the “indifference point” representation with the explicit numerical

values of the parameters to get prospect theory’s estimations on decision making, and

comparing them to the “gain” condition of the decision rule in fair compensation theory.

Both theories are further compared to estimates based on the F&H and the A&S measure

of riskiness. These two measures are both monotonic w.r.t. first-order stochastic

dominance (Section 6.3) and therefore have no point of minimum riskiness for a given

26

possible loss (which is a desirable property for a measure of riskiness). However, each of

them has a unique point where riskiness equals gain (for a “simple” gamble), and this

equity point is used for the comparison. The purpose of entering estimates based on these

riskiness measures, despite the fact that none of them attempts to suggest a wealthindependent indifference point as a function of the ratio G/L, is to create a scale that

enables us to notice just how close the predictions of fair compensation theory are to

those of prospect theory.

The usual graphic representation of prospect theory is separated into a value function that

is concave for gains and convex for losses, and two inverse S-shaped weighting

functions. However, for the sake of comparison with other alternatives, we represent the

function as assigning a gain value to a vector (p,L) (a possible loss and its probability),

which indicates the gain needed to make the median decision maker indifferent to the

gamble (G,1-p;L,p). This is a graphic illustration of the “indifference point” defined

above. Furthermore, asking for the gain that makes one indifferent to a suggested gamble

is a method used by Tversky & Kahneman to derive the parameters of the functions of

prospect theory.7 In a similar manner, each of the other theories and measures provides an

estimation of the gain G that makes the median decision maker indifferent to the same

vector (p,L).8

Table 2 summarizes the results for a loss of $100 with probabilities at the range

[0.01, 0.99].

Prob. of Loss (p)

0.01

0.05

0.1

0.25

0.5

0.75

0.9

0.95

0.99

Prob. of Gain (1-p)

0.99

0.95

0.9

0.75

0.5

0.25

0.1

0.05

0.01

The gain (G) required for indifference:

Prospect Theory

7.13

27.02 49.43 118.6 274.1 601.2 1270 2093 6329

Fair Compensation 11.11 28.80 46.25 100.0 241.4 646.4 1849 3849 19850

Theory

F&H measure of 100.0 100.0 100.2 114.3 200.0 484.7 1349 2791 14333

riskiness

“[T]he subjects made choices regarding the acceptability of a set of mixed prospects (e.g., 50% chance to

lose $100 and 50% chance to win x) in which x was systematically varied” (Tversky & Kahneman, 1992).

8

As mentioned, the “estimate” of the F&H and the A&S index of riskiness is the point where R=G.

7

27

A.S. measure of 24.08 38.98 52.62 94.0

204.2 523.1 1473 3056 15715

riskiness

Table 2: A cross-theory comparison of indifference points

5.1 Analysis of the results

Since the ratio G/L is not dependent on the size of L for any of the theories and measures

presented, one can simply divide all values by 100 (the size of loss in the numerical

example) to obtain the compensation rate suggested by each of them. Figure 6 shows for

each of the theories and riskiness measures defined above the compensation rate (i.e., the

G/L ratio) required to make a decision maker indifferent to a gamble g as a function of

the loss probability. In addition, the compensation rate needed for a risk-neutral agent is

drawn as a reference (a risk-neutral agent will accept any gamble with a positive expected

payoff and reject any gamble with a negative expected payoff). Hence, he is indifferent to

g whenever 1 p G p L 0 , i.e., when G L p 1 p .9 It can be observed from

the graphs that a risk-neutral agent is the least sensitive of all to the risk of losing (as we

would have expected), while compensation theory describes the most risk-averse decision

maker, with very similar results to prospect theory for most of the range (see detailed

analysis below).

9

Similarly, in fair compensation theory one is indifferent to a gamble whenever the expected payoff of its

p-root transformation is zero (as illustrated in Section 4.3).

28

Comparative Graph of Compensation Rates

35.0

30.0

Compensation rate

25.0

20.0

15.0

10.0

5.0

0.0

0.05

0.15

0.25

0.35

0.45

0.55

0.65

0.75

0.85

0.95

p (Loss)

Compensation Theory

Risk-Neutrality

Prospect Theory

Foster-Hart

Aumann-Serrano

Figure 6

5.1.1 Loss probabilities up to 0.8

For loss probabilities up to ~0.8, the compensation rates predicted by Compensation

Theory (C-T) are similar to those predicted by Prospect Theory (P-T), outperforming

even the F&H and A&S riskiness measures to which it approximates (Figure 7). This is

true even for very small probabilities, such as p=0.05 (2.7 in P-T, 2.9 in C-T) and p=0.01

(0.07 in P-T, 0.11 in C-T). Therefore, at least in this range of loss probabilities, the

simple “fair compensation rate,” G L

p 1 p , manages to capture all three

attributes of decision making in prospect theory: loss aversion, diminishing sensitivity,

and the non-linear weighting of probabilities (since all three are embedded in prospect

theory’s predictions). The fact that a decision rule based on R*, which is only an

approximation to the riskiness measures of Foster and Hart and of Aumann and Serrano,

predicts observed behavior better than the equivalent decision rules that are based on

them directly (at least according to the prospect theory standard), can be ascribed to its

greater conformity to the real-life behavior of boundedly rational agents.

29

Comparative Graph of Compensation Rates

9.0

8.0

Compensation rate

7.0

6.0

5.0

4.0

3.0

2.0

1.0

0.0

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

p (Loss)

Compensation Theory

Risk-Neutrality

Prospect Theory

Foster-Hart

Aumann-Serrano

Figure 7

5.1.2 The 50-50 case

Of particular interest is the point where winning and losing are equally likely. The

behavior at this point can be used to infer “pure” loss aversion, i.e., the exact size of the

gain needed to cancel out an equally likely loss. The equal likelihood case has been

investigated more than other cases, and it enabled Tversky & Kahneman to conclude that

the loss aversion coefficient is 2–2.510: “Such estimates [of the coefficient of loss

aversion] can be obtained by observing the ratio G/L that makes an even chance to gain G

or lose L just acceptable. We have observed a ratio of just over 2:1 in several

experiments. In one gambling experiment with real payoffs, for example, a 50–50 bet to

win $25 or lose $10 was barely acceptable, yielding a ratio of 2.5:l. Similar values were

obtained from hypothetical choices regarding the acceptability of larger gambles, over a

range of several hundred dollars” (Tversky & Kahneman, 1991). In their next, 1992

article Tversky and Kahneman present cumulative prospect theory, and supply

10

Tversky & Kahneman indicate that loss aversion coefficient could vary across dimensions, e.g. when

moving from money to safety issues. Here I am only concerned with monetary payoffs, and leave these

extensions to other disciplines outside the scope of this paper.

30

experimental results that enable them to estimate the loss aversion coefficient directly

from subjects’ indifference to participation in an equal likelihood gamble. Faced with a

50% chance to lose a predetermined amount (-$25, -$50, -$100, or -$150), the median

subject demanded a 50% chance to win $61, $101, $202, or $280, respectively, in order

to be indifferent to taking the gamble. These results suggest a loss aversion coefficient of

1.87-2.44, which matches the 1:2 - 1:2.5 ratio Tversky & Kahneman indicated in their

previous paper.

Compensation theory suggests a loss aversion coefficient of 2.41, which not only

falls within the range of the results just mentioned, but is also a better fit for these

experimental results than the value of 2.7411 obtained from multiplying the value function

and weighting functions as suggested by cumulative prospect theory. It is worth noting

that the extent of loss aversion is believed to be testable in real-life markets: “The

response to changes is expected to be more intense when the changes are unfavorable

(losses) than when they are for the better” (Tversky and Kahneman, 1991). An empirical

study aimed to assess loss aversion in real markets is Putler (1988), which found that the

estimated elasticity of price increases was 2.4412 times stronger than the estimated

elasticity of price decreases. This value is very close to the value of 2.41 estimated by

compensation theory.

5.1.3 High loss probabilities (above 0.8)

As the probability of loss grows and approaches 1, the prediction of prospect theory

draws away from that of compensation theory, until it even crosses that of a risk-neutral

agent, when prospect theory predicts that the median decision maker will accept a gamble

with a negative expected payoff if the probability of winning is very small and the

potential gain is very large relative to the potential loss (Figure 8). In prospect theory this

phenomenon is attributed to the underweighting of high probabilities and the

overweighting of small probabilities, and is known as risk-seeking in the domain of small

Tversky & Kahneman estimate the loss aversion parameter λ of the value function as 2.25, but after

translating probabilities to weights the loss aversion coefficient obtained is 2.74, larger than the 2-2.5

coefficient widely quoted.

12

Putler tested his model by estimating separately demand elasticities for increases and for decreases in the

retail price of shell eggs, relative to a reference price estimated from a series of earlier prices. The

estimated elasticities were -1.10 for price increases and -0.45 for price decreases, implying a 2.44 ratio of

elasticities.

11

31

probabilities of winning large gains. Yet it would be more precise to say that the behavior

observed in the laboratory is a preference for a very risky but high-yield gamble (a small

probability of winning a large amount or nothing) over its expected monetary payoff.

This cannot be easily extrapolated to a preference for a gamble with negative expected

payoff over avoidance. In fact, these attributes describe most real-life casino-style

gambles, and the median decision maker avoids them more regularly than he participates

in them. It is unlikely that a subject in a laboratory experiment will ever be asked to take

a 99% chance of losing his own $100 for a 1% chance of winning a lot more, but it is

reasonable to expect that were he asked to do so, the median subject would be willing to

accept only a gamble with positive expectation, for a gain at least as large as required by

the risk-neutral agent (and according to compensation theory the gain would have to be

about twice as large as that required by a risk-neutral agent). Therefore, if one accepts the

claim that risk-seeking in the sense of taking gambles with negative expectation is not

characteristic of the median decision maker, then one should favor the predictions of

compensation theory over those of prospect theory for risky decisions with high loss

probabilities.13

13

This is not to say that there are no people who would risk $100 for a 1% chance of winning $6,300 (as

predicted by prospect theory), while ignoring the negative expectation of such a gamble. However,

compensation theory predicts that the median person will be willing to engage in such a risky prospect only

for prizes of $20,000 and up.

32

Comparative Graph of Compensation Rates

100.0

Compensation rate

80.0

60.0

40.0

20.0

0.0

0.8

0.82

0.84

0.86

0.88

0.9

0.92

0.94

0.96

p (Loss)

Compensation Theory

Risk-Neutrality

Prospect Theory

Foster-Hart

Aumann-Serrano

Figure 8

6. Properties of the fair compensation rate

A fair compensation is a positive value function G'(p,L), which describes the gain G' that

makes the median decision maker indifferent to the gamble g = (G', -L ; 1-p,p) for given

values of p and L. Since the fair compensation G' is linear with respect to L, it can be

replaced by the fair compensation rate G'/L, which is a function of the loss probability p

alone, such that

p

G'

.

L 1 p

6.1 Homogeneity

The fair compensation needed to compensate for a risk of losing L with probability p (in a

“simple” gamble) is homogeneous of degree I with respect to the loss L, i.e.,

G ' ( p, tL) tG' ( p, L) . It can be shown that R* is also homogeneous of degree I (proved in

Appendix B). Homogeneity of degree I is a property shared by the riskiness measures of

Foster–Hart and Aumann–Serrano as well. Aumann and Serrano claim that homogeneity

of degree I embodies the cardinal nature of riskiness, since it captures the intuitive logic

33

that riskiness must grow at the same rate as the stakes (Aumann & Serrano, 2007). In a

similar way, homogeneity of degree I embodies the fundamental nature of compensation,

in the sense that doubling the possible loss requires doubling the gain needed to

compensate for it.

6.2 Globality

Some riskiness measures, such as Pratt (1964) and Arrow (1965), are criticized for their

inapplicability to gambles of large amounts; their “local” character arises from their being

based on derivatives of the utility function (Aumann & Serrano, 2007; Eisenhauer, 2006).

By contrast, compensation theory is not based on derivatives, and is therefore applicable

to all two-outcomes gambles, regardless of the size of their payoffs. This makes the

theory globally applicable.

6.3 Stochastic dominance

One of the most important concepts of riskiness is stochastic dominance (see, e.g.,

Rothschild and Stiglitz, 1970; Hadar and Russell, 1969). Say that a gamble g first-order

(stochastically) dominates (FOD) g', if g g ' for sure, and g g ' with some positive

probability. A measure of riskiness R is called first-order monotonic if R(g)<R(g')

whenever g FOD g'. Some of the most prominent measures of riskiness violate

monotonicity with respect to FOD, e.g., standard deviation/mean (sharp ratio),

variance/mean, and “value at risk” (VaR, common in portfolio risk management). R*

violates FOD in the strict sense, though it can be said to satisfy “quasi-FOD,” i.e.,

R*(g)≤R*(g') whenever g FOD g'. In addition, the fair compensation G'(p,L) is strictly

monotonic with respect to p and L, thus making a strict compliance of R* with stochastic

dominance not obligatory.

6.4 Decomposing compensation into its components

Let us decompose the decision rule suggested by compensation theory into its two

original components:

W R *

p

G L 1 p

34

Consider now a hypothetical decision process that yields this decision rule in the

following way: When faced with a gamble, or more generally, with the need to decide

under risk, two distinct decision processes, one for each condition in the decision rule, are

running in parallel in two separate parts of the brain. One process evaluates the properties

of the gamble alone (regardless of current wealth considerations) and sends a positive

signal to the decision center of the brain if and only if G L

p

1

p

. The other process

evaluates the level of risk imposed on the gambler due to his current “liquidity

constraints” and sends a positive signal to the decision center of the brain if and only if

W>R*. Finally, the decision center of the brain rules in favor of the risky decision if both

signals are positive, and against it otherwise. Now examine the characteristics of these

two separate decision processes. The first one embodies the main characteristic of a

CARA decision maker: it is indifferent to wealth and cares only about the properties of

the gamble. The second process, were it using the original RFH g instead of its

approximation R*, would have imitated a logarithmic utility decision maker, a person

with a CRRA utility function of ux log x 14 (since R* is used instead of RFH g , it

may be regarded as “boundedly rational” CRRA decision making). Described in this way,

the decision rule is an intersection of the outputs of CARA-like and CRRA-like decision

processes.15

The description of two distinct decision processes captures another aspect of

“bounded rationality,” namely, the aspect of computational limitations, reflected in the

decomposition of a complex task into simple modules that can be analyzed more easily,

though not yet optimally.

14

15

Foster and Hart (2007) contains an extensive discussion of this characteristic.

RFH g and RAS g share the first two terms in their Taylor development (on which R* as an

RFH g and RAS g , Foster and Hart write: “ RAS g

looks for the critical risk aversion coefficient regardless of wealth, whereas RFH g looks for the critical

approximated measure is based). Comparing

wealth regardless of risk aversion” (Foster and Hart, 2007). By incorporating the characteristics of both

riskiness measures, the R*-based decision rule may be seen as a heuristic that considers both the critical

risk aversion coefficient regardless of wealth and the critical wealth regardless of risk aversion.

35

7. Discussion

It has become common in recent years to try and trace the evolutionary reasoning for a

range of typical human practices (see, e.g., Gintis, 2007; Jones, 2001; Robson, 2002).

According to this school of thought, practices that violate the normative theory of

judgment and decision making are analyzed in a prehistorical context, and are often

claimed to have conferred survival advantage to small nomadic groups. However, we find

it more appealing to forgo the vague past, which is open to too many hypotheses, and

instead to seek support for normative theories in the contemporary human behavior. To

this end, we interpret the decision behavior reported in prospect theory as stemming from

a “boundedly rational” usage of a normative measure of riskiness. While Foster and Hart

base their guideline for avoiding bankruptcy on an implicit measure of riskiness, a

boundedly rational human mind may use a simple threshold-based bankruptcy-proof

strategy, which approximates the implicit measure of riskiness to an estimable explicit

expression.

Three conceptual layers of explanations for human behavior can be distinguished:

the bottom layer is in fact more descriptive than explanatory, since it models observed

behavior patterns and suggests their formulation; the middle layer adds a principal

explanation to observed patterns, but lacks insight into the prevalence of this explanation;

the top layer supplies the reasoning for the existence, and in the case of behavior the

fitness-enhancing character, of the behavior described by the bottom layer and explained

by the middle layer. In the light of this multilayered conception, we suggest that prospect

theory be viewed as the bottom layer of modeling decision making behavior. The theory

describes observed patterns, such as loss aversion and overweighting of small

probabilities, and suggests their formulation in the form of a characteristic value function

and inverse S-shaped weighting functions. Compensation theory seeks to provide a

principal explanation to the patterns observed by prospect theory of people estimating the

riskiness measure of a suggested gamble, and accepting it if and only if the gain and their

wealth are both higher than the estimated riskiness. The top layer of this argument is

supplied by Foster and Hart (2007), where they prove that using their measure of

riskiness for decision making is the only way to avoid bankruptcy and guarantee

sustained growth.

36

The main emphasis in Foster and Hart (2007) is put on the necessity for rejecting

gambles whose riskiness measure RFH g exceeds W. We incorporated this condition

into the decision rule of compensation theory (with R* instead of RFH g ), but kept it

subordinate to the condition that guarantees a gain-to-loss ratio greater than the fair

compensation rate. In fact, we do not claim that this paper gives any supporting evidence,

whether direct, implicit, or approximate, that people actually compare their reserve

wealth to the riskiness of gambles. What we do claim is that the fair compensation-based

decision rule introduced in this paper (with its wealth-dependent property) is an

approximation to a strategy that guarantees “infinite wealth” in the long run, and is as

capable of explaining decision making as cumulative prospect theory is. Thus, our

decision rule provides (an approximation to) a normative one that suits allegedly

irrational decision making.

The inability to give a descriptive proof of the wealth part of the decision rule stems

from the fact that the gambles that were used by Cumulative Prospect Theory to evaluate

loss aversion had R* values of no more than a few hundred dollars, far less than the

wealth that students from industrialized societies assume they posses when relating to a

hypothetical gamble (see a detailed calculation in Appendix A). As a result, it is hard to

identify cases where subjects reject otherwise attractive gambles due to their wealth

limitations. However, unlike cumulative prospect theory, compensation theory assumes

that each decision maker has a certain level of riskiness—the level equal to his wealth—

above which he will refuse to participate in the gamble. The intuition is that people tend

to avoid risking their entire savings to the same extent that they are willing to risk small

amounts of money.16 For example, it is reasonable to assume that most people will reject

a real-life gamble of two equally likely alternatives where one alternative is to lose $5M,

no matter how much they stand to gain by the other alternative. Indeed, Foster and Hart

(2007) imply that people who ignored their wealth constraints were prone to bankruptcy

(a similar logic is suggested in footnote 23 in Foster and Hart, 2007).

Tversky and Kahneman empirically demonstrated the irrelevance of wealth

considerations in gambles whose riskiness measure is below the W=R* threshold by

showing that it is possible to calculate one loss aversion coefficient that holds for a wide

16

I.e., wealthier people are less risk-averse.

37

range of payoffs, thereby implying that the reference point for decision making is current

wealth rather than zero wealth.17 Others have corroborated this claim with the high extent

of risk aversion found in low-payoff gambles, which suggests that wealth considerations

are widely ignored in such decision situations. For example, Rabin (2000) demonstrates

the exaggerated risk aversion needed to justify wealth considerations in these situations.

8. Conclusion

Prospect theory is based on experiments that became famous for demonstrating