Stock Market Development and Economic Growth in Developing

advertisement

Stock Market Development and Economic Growth in Developing countries:

Evidence from Panel VAR framework

Boopen Seetanah, V Sannassee, M Lamport

aUniversity

of Mauritius,Reduit, Mauritius

* Corresponding author. Tel.:+230 4541041;

E-mail address:b.seetanah@uom.ac.mu (Boopen Seetanah)

Introduction

‘World stock markets are booming and stock markets in developing countries

account for a disproportionately large share of this boom. Investors are

venturing into the world’s newest markets and some are seeing handsome

returns. But are developing countries themselves reaping any benefits from

their stock markets?’ (Levine 1996)

Economists have traditionally concentrated on the role of financial

development to the economic growth of countries Overall there exists an

overwhelming consensus that well-functioning financial intermediaries have

played a significant role in economic growth (King and Levine, 1993 (a, b);

Levine and Zervos, 1998; Levine et al, 2000 (a, b); Wachtel, 2003, Seetanah

2008 among others). More recently, the emphasis has been increasingly

shifted to stock market indicators and the effect of stock markets on economic

development1 and the latter has been the subject of recent theoretical interest

(see Demirguc-Kunt and Levine, 1996, Levine and Zervos,1993, 1995, 1998

among others). Although some analysts view stock markets in developing

countries as “casinos” that have little positive impact on economic growth,

recent evidence suggests that stock markets may give a big boost to economic

development. In fact, the focus on stock markets as an engine of economic

growth is a new opening in financial literature. Going further, its benefits had

been largely ignored in the past, but now there is consensus concerning the

positive effects brought about by stock markets (see Pagano 1993, Levine and

Zervos, 1998).

In principle a well-developed stock market should theoretically increase saving

(by enhancing the set of financial instruments available to savers to diversify

their portfolios) and efficiently allocate capital to productive investments,

which leads to an increase in the rate of economic growth. In doing so they

provide an important source of investment capital at relatively low cost

(Dailami and Aktin, 1990; Greenwood and Smith, 1992). A more developed

equity market also provides liquidity that lowers the cost of the foreign capital

that is essential for development. As such the presence of stock markets would

mitigate the principal agent problem and reduce assymetryinformation, thus

promoting efficient resource allocation and growth (Adjasi and Biekpe 2006).

Perotti and van Oijen (1999) stress on the fact that diverse equity ownership

creates a constituency for political stability, which, in turn, promotes growth.

However it has also been argued that stock markets may be counter

productive, for instance more liquid stock markets may put companies at risk

of counter-productive takeovers or even with the high level of integration and

with the development of technological progress, if left uncontrolled, a stock

1

Stock market development involves the deepening of the stock market by increasing market

capitalisation, as compared to banking sector development where monetisation increases

financial intermediary development.

2

market can lead to economic collapse. Moreover, the effect of uncertainty on

savings rate and economic growth as markets become more liquid is

ambiguous. (Bencivenga and Smith 1991).

Empirical evidence shows the existence of a strong positive correlation

between stock market development and economic growth (Atje and

Jovanovich, 1993, Demirgüç-Kunt and Levine, 1996a, b, Korajczyk, 1996, Levine

and Zervos, 1996, 1998). However there exists some authors who could not

established any significant link between stock market development and growth

as well, for instance Bencivenga and Smith (1991), Naceur and Ghazouani

(2007) and Adjasi and Biekpe (2006) for developing countries cases.

In fact, previous empirical research has suggested a connection between stock

market development and economic growth, but is far from definitive. Although

the relationship postulated is a causal one, most empirical studies have

addressed causality, dynamics and endogeneity obliquely, if at all. Moreover

the existing literature tend to focus overwhelmingly on developed countries

sample and moreover have failed (Levine and Zervos (1993), Atje and

Jovanovic (1993), Levine and Zervos (1998)) to decouple the relative

contribution of banking and stock market development on economic growth in

a single framework.

Our work is believed to depart from and contribute to the existing literature in

various ways. In the first instance it focuses on a panel set of developing

countries

and

moreover

simultaneously

examines

banking

sector

development, stock market development, and economic growth in a unified

framework. It deals with issues of unmeasured cross country heterogeneity,

causality, dynamics and endogeneity, elements relatively ignored in the

literature of growth modelling, by innovatively employing rigorous panel VAR

procedures to examine the complex linkages between stock market

3

development, bank development and economic growth. Such a framework will

enable us not only to detect any bi causal relationships but also the presence

of indirect effects banking and stock market development on growth. The

complementarity and subsitutabilty element of bank and stock market

development will eventually be assessed. The data set comprises of 27

developing countries studies over a period of 15 years (1991-2007).

The rest of the paper is as follows: Section II reviews existing literature on the

link between financial development and economic growth; Section III describes

the methodology applied in this research as well as sources of data; section IV

deals with the empirical analysis and section V concludes the study.

II Literature review

Financial Development and Economic Growth

The theoretical underpinnings of the relationship between financial depth and

growth can be traced back to the work of Schumpeter (1912) and, more

recently to McKinnon (1973) and King and Levine (1993). These authors

claimed that financial development may lead to growth in that a welldeveloped financial system performs several critical functions to enhance the

efficiency of intermediation namely by reducing information, transaction, and

monitoring costs. Creane, Goyal, Mushfiq, and Sab (2003) argued that a

modern and efficient financial system mobilizes savings, promotes investment

by identifying and funding good business opportunities, monitors the

performance of managers, enables the trading, hedging, and diversification of

risk, and facilitates the exchange of goods and services. These functions

ultimately result in a more efficient allocation of resources, a more rapid

accumulation of human and physical capital, and in faster technological

progress, which in turn feed economic growth. Tsuru (2000) also explained the

finance-growth link by arguing that financial development can promote

economic growth via its positive impact on capital productivity or the

4

efficiency of financial systems in converting financial resources into real

investment. However, its effect on the saving rate is ambiguous and could

affect the growth rate negatively. ‘In net terms, the impact on welfare is likely

to be positive, since increased efficiency of investment in the long term can

offset any reduction in the propensity to save’ Tsuru (2000).

The relationship between financial development and economic growth was in

fact extensively analysed more than two decades ago by Goldsmith (1969),

McKinnon (1973), Shaw (1973) and others. They found strong and positive

correlations between the degree of financial market development and the rate

of economic growth. More comprehensive empirical research was undertaken

by King and Levine (1993) who confirmed a very strong relationship between

each of their four financial development indicators. Subsequent empirical work

by Jayaratne and Strahan (1996), Levine and Zervos (1998) and more recently

Roisseau and Sylla (2001) and Seetanah (2008) also confirmed the above. At

the micro-economic, Demirguc-Kunt and Maksimovic (1998) and Rajan and

Zingales (1998) reported that financial institutions have been crucial for firm

and industrial expansion. However it is worth mentioning that there have been

also some studies which could not confirm the beneficial economic effect of

financial development, for instance Jappelli and Pagano (1994) and Ram (1999)

among others. It should be pointed out that is only recently that scholars have

been incorporating the

issue of causality and endogeneity in the debate.

Among the very few studies is that of Levine et al (2000,a,b) who used dynamic

panel estimators to overcome the issue of dynamic in the system. Their results

were seen to reconcile with the fact that financial development is a good

predictor of economic growth. Similar results were obtained by Beck, Levine

and Loayza (1999), Xu (2000). Among the recent few studies focusing

exclusively on developing countries feature Christopoulos and Tsionas (2004),

Seetanah (2007, 2008) which confirmed earlier work of Luintel and Khan

(1999) and that of Demetriades and Hussein (1996). Odedokun (1996) however

found mixed results.

5

Stock Market Development and Economic Growth

Literature on the topic of economic growth has taken a new stance, given the

significance of the effect of stock markets on economic growth. Indeed, past

literature considered financial intermediaries as the only causative channel to

economic growth, and this new phase of developmental economics has

achieved much in helping us understand this unexplored channel of causation

since Bagehot (1873). In fact, stock markets and banks provide services that

could either be complements or substitutes for each other depending on the

industrialisation extent of the economy. Several possible avenues whereby

stock market development have been advanced and discussed among them

are the following.

Stock markets provide an alternative channel for savings mobilisation and

better resource allocation (N’Zué 2006). They enable savings mobilisation for

financing “immense works” (Bagehot 1906, Hicks (1969), Greenwood and

Smith 1996). More efficiently mobilised savings cause capital accumulation,

which firms tap to finance large projects via equity issues. This, undoubtedly,

spurs economic growth (Levine and Zervos 1998a, 1998b; Adjasi and Biekpe

2006). Focusing on liquidity, Bencivenga, et. al. (1996) and Levine (1991) argue

that stock market liquidity plays a key role in economic growth. Without a

liquid stock market, many profitable long-term investments would not be

undertaken because savers would be reluctant to tie up their investments for

long periods of time. In contrast, a liquid equity market allows savers to sell

their shares easily, thereby permitting firms to raise equity capital on favorable

terms. By facilitating longer-term, more profitable investments, a liquid market

improves the allocation of capital and enhances prospects for long-term

economic growth. A more developed equity market may also provide liquidity

that lowers the cost of the foreign capital that is essential for development.

Bencivenga et. al. (1996), and Neusser and Kugler (1998)). Liquidity has also

6

been argued to increase investor incentive to acquire information on firms and

improve corporate governance (Kyle, 1984; Holmstrom and Tirole, 1993),

thereby facilitating growth. Levine further argued that a liquid stock market

complements a strong banking system, suggesting that banks and stock

markets provide different bundles of financial services to the economy.

However Demirguc-Kunt and Levine (1996) point out that increased liquidity

can deter growth through at least three channels2.

Indeed, for the case of the African subcontinent, liquidity has been a significant

factor in hamper stock market development (Adjasi and Biekpe 2006) and

consequently retards economic growth. Naceur and Ghazouani (2007) also

posits that the beneficial effect of liquidity is only found after a threshold level.

Sarkar (2006) also discussed that stock market development may have no

effect on fixed capital formation due to the high transaction and information

costs in least developed countries.

A second link of stock market development on the economy is based on the

premise that the presence of stock markets would mitigate the principal agent

problem, thus promoting efficient resource allocation and growth (Adjasi and

Biekpe 2006). Firstly, given that the stock price at any time is mirror of firm

performance, weakening corporate governance would be reflected as a fall in

share price. Management would have a disincentive to work in their personal

interests if their compensation is tied to stock performance (Jensen and

Murphy 1990). Thus the emphasis is on the role of equity markets in providing

proper incentives for managers to make investment decisions. Dow and

2

Demirguc-Kunt and Levine (1996) point out that increased liquidity can deter growth through

at least three channels. First, by increasing returns to investments, greater stock market

liquidity may reduce saving rates through income and substitution effects. If savings rates fall

enough and if there is an externality attached to capital accumulation, greater stock market

liquidity may slow economic growth. Second, by reducing the uncertainty associated with

investment, greater stock market liquidity may reduce saving rates because of the ambiguous

effects of uncertainty on savings. Third, stock market liquidity encourages investor myopia,

adversely affecting corporate governance and thereby reduces economic growth.

7

Gorton (1997) argued that such investment decisions affect firm value over a

longer time period than the managers’ employment horizons through equitybased compensation schemes. Binswanger (1999) and Yartey 2007, Bhide

(1999) however argued that the above might not be true in a situation of

investor myopia.

The role of equity markets in providing portfolio diversification, enabling

individual firms to engage in specialized production is bound to result in

efficiency gains ( Acemoglu and Zilibotti, 1997, Capasso 2008). Indeed, in the

presence of stock markets which provide for various vehicles for transferring

risk through which investors can confidently invest. What follows from this is

that investors now have the opportunity of switching from low-risk to high risk

investments. Obstfeld (1994) shows that international risk-sharing through

internationally integrated stock markets improves resource allocation and can

accelerate growth.

Indeed, stock markets have more information than do financial intermediaries

and usually translate in more efficient allocation and better growth (Caporale

et al 2004, Adjasi and Biekpe 2006, Atje and Jovanovic 1993). King and Levine

(1993b) also stressed on the ability of equity markets to generate information

about the innovative activity of entrepreneurs or the aggregate state of

technology. Perotti and van Oijen (1999) also argued that that diverse equity

ownership creates a constituency for political stability, which, in turn,

promotes growth.

Empirical review

Pioneering work from Spears (1991), Pardy (1992) Atje and Jovanovic (1993),

show that stock market development is strongly correlated with growth rates

of real GDP per capita. More importantly, they found that stock market

liquidity predict the future growth rate of economy. Levine and Zervos (1998),

Filer et al. (1999), Rousseau and Wachtel (2000) and Tuncer and Alovsat

8

(2001) examined stock market-growth nexus and exhibited positive casual

correlation between stock market development and economic activity.

Nevertheless, most of earlier studies suffered from various statistical

weaknesses namely with respect to endogeneity and causality issues together

with unmeasured cross country heterogeneity. Subsequent research, with

larger panel sets and longer time series and attempted to attend to the earlier

criticisms. Beck, and Levine (2003) for instance investigated the impact of stock

markets and banks on economic growth using a panel data set dynamic panels

(GMM), that stock markets and banks positively influence economic growth.

Chen et al (2004) , Paudel (2005) and Love and Zicchino

(2006) also

acknowledged that stock markets, due to their liquidity, enable firms to attain

much needed capital quickly, hence facilitating capital allocation, investment

and growth. Alam and Hasan (2003) for the case of the US also found a

significant positive impact of stock market development on economic growth.

Bahadur and Neupane (2006) concluded that stock markets fluctuations

predicted the future growth of an economy and causality is found only in real

variables.

More recent studies have employed vector models but has been restricted to

country case studies mainly and among them features Enisa and Olufisayo

(2009), N’Zué (2006) for the case of Ghana , Shahbaz, Ahmed and Ali (2008) for

Pakistan and Agrawalla and Tuteja (2007) for the Indian case.

There exists however few studies which could not establish any significant link

in the stock market-economic growth nexus (refer to theoretical and empirical

works of Bencivenga and Smith 1991; Demirguc-Kunt and Levine, 1996; Adjasi

and Biekpe 2006; Ghazouani, 2007 and Sarkar 2006 among others). It is

noteworthy that Rousseau and Xiao (2007) for the case of China although

found that banking sector development was central to the Chinese success,

however could not establish any significant relationship for the case of stock

market development.

9

In summary, previous empirical research has suggested a connection between

stock market development and economic growth, but is far from definitive.

Although the relationship postulated is a causal one, most empirical studies,

until lately have addressed causality obliquely, and this even more pronounced

in the case of panel data analysis. Moreover very few of them have adopted a

unified economic mode where both banking and stock development are

simultaneously considered in a framework that allows for dynamics, feedbacks

and endogeneity issues. To resolve them this paper uses VAR procedures in

panel analysis to examine the linkage between stock market development,

bank development and economic growth.

III Methodology and Data Analysis

The model that has been used in this study is based on the principles of some

earlier studies (e.g. King and Levine, 1993; Levine and Zervos, 1998; Levine et

al., 2000, Wachtel, 1998, 2001, Christopoulos and Tsionas, 2004 and Seetanah,

2008). The model takes the following functional form3:

Y f ( IVTGDP, XMGDP, SER, INDEX , PRIGDP )

(1)

The dependent variable output, Y was proxied by the real per capita gross

domestic product (GDP)4. IVTGDP is the country’s investment divided by its

Gross Domestic Product (investment ratio), XMGDP is total of export and an

import divided by the GDP of the country and is a measure of openness, EMP is

the employment level and SER is the secondary enrolment ratio and proxies for

3

Refer to Seetanah(2008) for a comprehensive justification of the explanatory variables.

This measure has been widely used in the literature for instance King and Levine, 1993,

Odedokun ,1996; Levine and Zervos, 1998; Ram, 1999 , Seetanah, 2007)

4

10

the quality of human capital. To measure banking development, we follow

(Levine et al., 2000) and used PRIGDP, that is the value of credits by financial

intermediaries to the private sector divided by GDP and. PRIGDP has been

used extensively as an indicator because it improves on other measures of

financial development. Higher levels of PRIGDP are interpreted as higher levels

of

financing

services

and

therefore

greater

financial

intermediary

development. This measure of financial development is also more than a

simple measure of banking sector size. PRIGDP isolates credit issued to the

private sector, as opposed to credit issued to governments, government

agencies, and public enterprises. Furthermore, it excludes credits issued by the

central bank.

Particularly in the context of our study, we consider individual indicators of

stock market liquidity. The rationale behind adopting disaggregated indicators

is to capture the different effects between stock market development and

economic growth more feasibly rather than adopting a single indicator that

would be focussed on a single aspect ((Levine and Zervos, 1998).

Our indicators of stock market development have been used in previous

studies (for example, Pagano 1993 and Demirgiic-Kunt and Levine 1996,

Rousseau and Wachtel, 2000, Beck and Levine, 2003). The ratio of stock

market capitalization to GDP (INDEX1) is a measure of both the stock market's

ability to allocate capital to investment projects and its ability to provide

significant opportunities for risk diversification for investors. The ratio of total

value of shares traded to GDP (INDEX2) and the ratio of total value of shares

traded to market capitalization (INDEX3) are indicators of market liquidity. The

former measures the ability to trade economically significant positions on the

stock market, and the latter is an indicator of liquidity of assets traded on the

market, not adjusted for the size of the market relative to the economy. We

also combine the three indicators in an equally weighted index of market

development, INDEX. For the sake of discussion in this study we will focus on

11

the result using the composite proxy INDEX and only report the results of the

other three indices.

The specification used in this study is of a log linear one. Recall model from

above and taking logs on the right hand side of the equation results in the

following:

yit 0 1ivtgdpit 2 xmgdpit 3 serit 4 index 5 prigdp it it

(2)

where i denotes the different countries in the sample and t denotes the time

dimension. The small letters denotes the natural logarithm of the variables.

The main sources of our independent variables are from the World Bank’s

‘World Development Indicators’ CD RPM and the IMF’s ‘International Financial

Statistics’ (IFS) CD ROM except for the case of SER, where the World

Development Reports and individuals country’s Central Statistical Office’s has

been consulted.

Using the Im, Pesaran, and Shin (1995) panel unit root tests, the test was

applied on the dependent and independent variables. Im, Pesaran, and Shin

(1995) developed a panel unit root test for the joint null hypothesis that every

time series in the panel is non-stationary. This approach is based on the

average of individual series ADF test and has a standard normal distribution

once adjusted in a particular manner. Results of this test applied on our time

series in levels reject a unit root in favor of stationarity (the results were also

confirmed by the Fisher-ADF and Fisher-PP panel unit root tests, refer to

appendix) at the 5 percent significance level for each variable. It was judged

safe to continue with the panel data estimates of the above econometric

specifications.

12

Analysis and discussion

Endogeniety issues and the Panel Vector Autoregressive Model

There might still be the possibility of the loss of dynamic information even in

panel data framework as the dependent variable may have something to do in

explaining itself as well (Levine et al, 2000). It is likely that there exists dynamic

feedbacks and indirect effects among the variables in a growth function,

particularly with respect to our financial development variables. Including

these feedbacks are essential to the modeling of our hypotheses since as

Pereira and De Fructos (1999) argued ‘if feedback exists, an elasticity of zero

with respect to some determinants in a static framework would have been

neither necessary nor sufficient for public capital to have no effect on output.’

Indeed both banking and stock market development can directly affect output

directly but they may also have indirect positive impacts5 on a country’s output

as they may affect private capital and other inputs in the growth functions.

Furthermore one should realise that the output level of a country may also

translate into the more development in the financial system, that this resulting

in reverse causation (see Seetanah 2008 among others).

Given the possibility of endogeneity and causality issues we use vector

autoregressions (VAR) on panel data to enable us to consider the complex

relationship that might exist between banking and stock market development

economic growth6. This framework also allows us to test the substitutability

and complementarity issue between banking and stock market development

rigourously. Moreover, Panel VAR also allows for a firm-specific unobserved

5

It has also been argued though that higher availability of the public input could also reduce

the demand for private inputs and crowding out effects (Lighthart, 2000).

6

Powell, Ratha, and Mohapatra (2002) and Love and Zicchino, (2006) used similar approach in

their respective study. The former studied the interrelationships between inflows and outflows

of capital and other macro variables and the later that of financial development and dynamic

investment behaviour.

13

heterogeneity in the levels of the variables. Panel-data vector autoregression

combines the traditional VAR approach, which treats all the variables in the

system as endogenous, with the panel-data approach, which allows for

unobserved individual heterogeneity. We specify a first order VAR model as

follows:

it 0 1 it 1 i t

(3)

where zt is a six-variable vector (gdp, ivtgdp, xmgdp, ser,index, prigdp) and the

variables are as defined previously. We use i to index countries and t to index

time, are the parameters and is the error term. For the econometric

analysis, the system of equations as above is expressed as a log-linear

regression for ease of interpretation. The lowercase variables are the natural

log of the respective uppercase variables

In applying the VAR procedure to panel data, we need to impose the

restriction that the underlying structure is the same for each cross-sectional

unit. Since this constraint is likely to be violated in practice, one way to

overcome the restriction on parameters is to allow for “individual

heterogeneity” in the levels of the variables by introducing fixed effects,

denoted by i in the model (Love and Zicchino, 2006). Since the fixed effects

are correlated with the regressors due to lags of the dependent variables, the

mean-differencing procedure commonly used to eliminate fixed effects would

create biased coefficients. To avoid this problem we use forward meandifferencing, also referred to as the ‘Helmert procedure’ (see Arellano and

Bover, 1995). This procedure removes only the forward mean, i.e. the mean of

all the future observations available for each firm-year. This transformation

14

preserves the orthogonality between transformed variables and lagged

regressors, so we can use lagged regressors as instruments and estimate the

coefficients by system GMM7.

Estimation and Analysis

We estimate the coefficients of the system given in (3) after the fixed effects

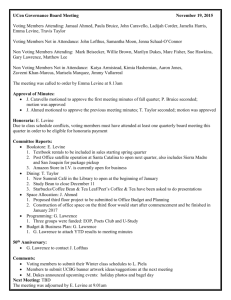

have been removed and Table 1 report the results of the model.

Table 1:Results from the VAR model (1991-2007)

Response to

Respons

Constant gdp t-1

e of

ivtgdpt- xmgdpt- sert-1

index- prigdpt-1

1

1

1

Gdp

ivtgdp

xmgdp

ser

-0.43

0.25

0.44

0.38

0.21

0.13

(1.64)

(2.34)*

(2.15)*

(2.19)*

(1.99)* (1.87) (1.98)*

0.36

0.26

0.64

0.15

0.17

(1.87)*

(2.15*)

(2.21)*

(2.14*)

(1.81)* (2.22) (1.82)

0.88

0.21

0.17

0.57

0.09

0.11

(1.75)*

(2.21)*

(2.13)*

(1.97)*

(1.58)

(1.51) (1.02)

0.11

0.26

0.07

0.08

0.54

0.03

(1.44)

(2.24)*

(1.33)

(1.65)*

(1.98)* (0.45) (1.52)

0.12

0.17

0.19

0.05

0.08

7

In our case the model is “just identified”, i.e. the number of regressors equals the number of

instruments, therefore system GMM is numerically equivalent to equation-by-equation 2SLS.

15

index

prigdp

0.43

0.12

0.11

0.19

0.19

(1.34)

(1.88)*

(1.72)*

(1.87)*

(2.11)* (1.96) (1.77)

0.32

0.16

0.12

0.05

0.15

(2.23)** (1.96)*

(1.44)

(1.95)* (1.22) (2.22)***

405

405

405

405

405

405

25

25

25

25

25

25

(1.54)

No.

of

0.57

0.13

0.15

0.56

obs

No

of

countries

The VAR model is estimated by GMM and fixed effects are removed prior to

estimation. Reported numbers show the coefficients of regressing the row

variables on lags of the column variables. Heteroskedasticity adjusted tstatistics are in parentheses. *** indicates significance at 1% level, ** at 5%

and *** at 10% respectively. The small letters denotes variables in natural

logarithmic and t values are in parentheses

Table 1 is a composite table where each column can be viewed and analysed as

an independent function. For instance, of interest to us primaririly is column 1

which is in fact our output equation. It is observed that the coefficient of index

is positive and significant (+0.13) and this suggest that stock market

development has had a positive and significant effect on economic growth for

our sample of developing countries over the year of studies. In fact, the

coefficient of 0.17, a measure of output elasticity, denotes that a one percent

increase in stock market development contributed to 0.17 percent increase in

16

the GDP of our selected economies and this is the direct effect. These positive

elasticities results takes into account the often ignored issues of panel

stationarity, dynamics, and endogeinty. The results are consistent to those of

Levine and Zervos (1998) and Rousseau and Wachtel (2000) but do not validate

those of Adjasi and Biekpe (2006). It is noteworthy that the three indices of

stock market development namely index1, index2 and index3 all also yielded

positive and significant coefficients of 0.15, 0.09 and 0.11 respectively.

Interestingly the banking development proxy also exhibits positive and

significant effects on growth and suggest that banks and stock markets play

somewhat different roles in economic progress (similar to Levine and Zervos

1998) and that put together financial development is confirmed to be an

ingredient of growth. Interestingly the higher coefficient of PRIGDP tends to

show that in, developing countries at least, the banking sector’s contribution

to economic performance is relatively higher than stock market development.

This can be explained by the fact that developing countries’ stock markets have

not yet reached those maturity levels (from both investors and firms

perspectives) as the case of developed or newly industrialised countries.

Moreover financial intermediaries remain till now the major source of

investment credits in most of the economies under study. It should be stressed

that our results oppose those found by Atje and Jovanovic (1993) and

Caporale, Howells and Soliman (2004).

The rest of the growth explanatory variables turned out to be also significant

and have the expected signs. It should be however noted that the magnitude

of the stock market development (and even the banking development)

coefficient remains relatively smaller than for instance private investment and

17

openness which remains the major growth drivers in developing according to

this study.

The VAR framework, as discussed before, enables us to gauge more

interesting insights on endogeneity issues and indirect effects as well. While it

has been shown that stock market development induces growth (stock market

led growth), referring to the ‘index’ equation, it is observed that a reverse

causation exists as well as output appears to be also a determinant of stock

market development thus supporting a bi-causal and reinforcing relationship.

In other words, output level which proxies economic well being and level of

development, may play an important role in the development of stock markets

as well. These results are consistent with those obtained from Rousseau and

Wachtel (2000) and Seetanah (2008). The ‘index’ equation can also be viewed

as a stock market development equation with, in addition to income level,

education attainment investment level and banking development being other

determinants. The latter is particularly interesting as it reveals some sort of

complementarity between these the apparently competing source of bank

based and market based finance. This is yet another rejoiner to Levine and

Zervos (1998) argument that banks and stock markets play different roles in

economic progress. One could also argue that banking development levels acts

as some signalling effect on the financial system stability, lead to optimistic

outlook and thus encouraging financial investment and stock development8. In

general, thus, stock market development is bound to have better growth

effects in the presence of the above three variables.

Referring to the ‘investment equation’, positive indirect effects of stock

market development on private investment are noted. This confirms the view

that stock market development encourages private investment (including

foreign investment). An elasticity value of 0.12 denotes that a percentage

8

Referring to the banking development equation, there is not significant evidence that stock

market development encourages banking sector development directly

18

increase in index would lead to 0.12 increase in private investment. Given that

the direct effect of investment is to the order of 0.44 percent increase in the

GDP for a 1 percentage increase in private investment, put together this leads

to a 0.12 x 0.44 percentage increase in the output after two years. This is an

estimate of the indirect effect of stock market development on output via the

private capital channel. Similar findings can be found for banking sector

development.

Finally, the presence of bi-causality between private

investment, education and income level is found.

Orthogonalised

impulse-response

functions

analysis9

and

variance

decompositions10 overall produced equivalent results. Details are available

from the corresponding author upon request.

Conclusion and policy implications

This paper focused on a panel set of developing countries to simultaneously

examined banking sector development, stock market development, and

economic growth in a unified framework. It employed rigorous panel VAR

procedures to examine the complex linkages between stock market

development, bank development and economic growth for the case of 27

developing countries studies over a period of 15 years (1991-2007). Results

from the analysis showed that stock market development is an important

ingredient of growth, but with a relative lower magnitude as compared to the

other determinants of growth, particularly with banking development.

Interesting stock market development and banking development are seen to

9

The impulse-response functions describe the reaction of one variable to the innovations in

another variable in the system, while holding all other shocks equal to zero. Impulse response

are orthogonalised since the actual variance–covariance matrix of the errors is unlikely to be

diagonal.

10

This shows the percent of the variation in one variable that is explained by the shock to

another variable, accumulated over time. The variance decompositions show the magnitude of

the total effect

19

be complement to each other and moreover there are important indirect

effects through ‘investment channel’ to growth. It is noteworthy to emphasise

on the dynamic process of the stock market development and growth nexus.

Given the above findings, the policy implications for government are

numerous. They should attempt to develop the financial sector even more and

one of the first steps is to have less state involvement in the system. This

includes cutting back on public ownership of financial institutions and

minimising monetary financing of budget deficits. Government should ensure

clear and concise rules for investment, and to attract capital on equity markets

from the international monetary system.The deregulation and liberalization

process should continue in a cautious way and more competition within the

financial sector should be encouraged. This may mean a more opened

approach to multinational banks and other institutions which would also

benefit the industry in terms of financial innovation. As such stronger, more

transparent institutional and legal framework should be present to consolidate

the sector. Investment in human resources remains also a major factor to

accompany the sector’s development process.

Moreover, governments should promote stock market liquidity by for instance

propagating knowledge to the public of the benefits of investing in stock

markets (N’Zué 2006) and moreover, create state-run mutual funds so as to

ensure higher liquidity on stock markets11. These incentives would promote

both domestic and foreign investments to penetrate the domestic economies,

and thus help draw immense benefits from these sources of capital.

11

An example is the case of Argentina where the state runs its mutual fund to favour its stock

market.

20

REFERENCES

Akinlo A. E ,and Akinlo O. 2009, Stock market development and economic

growth: Evidence from seven sub-Sahara African countries, Journal of

Economics and Business Volume 61, Issue 2, March-April 2009, Pages 162-171

Arestis, Phillip, Panicos Demetriades, and Kul Luintel, 2001. Financial

Development and Economic Growth: The Role of Stock Markets," Journal of

Money, Credit and Banking, 2001, pp. 16-41.

Atje, Raymond and Boyan Jovanovic, 1993. Stock Markets and Development,

European Economic Review, 1993, pp. 632-640.

Beck T

and

Levine T. 2004. Stock markets, banks, and growth: Panel

evidenceJournal of Banking & Finance Volume 28, Issue 3, March 2004, Pages

423-442

Bencivenga, Valerie and Bruce Smith, 1991. Financial Intermediation and

Endogenous Growth," Review of Economic Studies, 1991, pp. 195{209.

Christopoulos, D.K. and Tsionas E. G., 2004. Financial development and

economic growth: Evidence from panel unit root and cointegration tests.

Journal of Development Economics, 73, 55-74.

Creane S., Goyal, A. Mushfiq M., and Sab R. 2003. Financial development and

growth in the Middle East and North Africa, IMF Working Paper, Washington,

DC.

Demetriades, Panicos and Khaled Hussein, 1996. Does Financial Development

Cause Economic Growth? Time-series Evidence From 16 Countries., Journal of

Development Economics, 1996, 51, 387-411.

21

Demirgüç-Kunt A. and Maksimovic V. 1998. Law, finance, and firm growth,

Journal of Finance, 53, 2107-2139.

Goldsmith, R., 1969. Financial structure and development, New Haven, Yale

University Press.

Imam Alam M,

Hasan T 2003. The causality between stock market

development and economic growth : evidence from the United States, Studies

in Economics and Finance, 21 (1), 93-104

Jappeli T. and M. Pagano., 1994. Saving, growth and liquidity constraints,

Quarterly Journal of Economics, 109(1), 83-109.

Jayaratne J. and Strahan P.,1996. The Finance-Growth Nexus: Evidence from

Bank Branch Deregulation. Quarterly Journal of Economics, 111(3), pp. 639-70.

Kennedy, P 2003, A guide to econometrics, 5th edition, Oxford, Blackwell

King, R. and Levine R., 1993b. Finance and Growth: Schumpeter Might Be

Right. Quarterly Journal of Economics, 108(3), pp. 717-37.

King, Robert E. and Levine, Ross 1993a. “Financial Intermediation and

Economic Development.” in Financial Intermediation in the Construction of

Europe. Editors: Colin Mayer and Xavier Vives. London: Centre for Economic

Policy and Research, pp. 156-89.

Kirwan, F. and D. Holden, 1986, Emigrants’ Remittances, Non-Traded Goods

andEconomic Source in the Source Country, Journal of Economic Studies, Vol.

13,No. 2, pp. 52-58.

Levine R. and Zervos A., 1998. Stock Markets, Banks, and Economic Growth.

American Economic Review, 88(3), pp. 537-58.

Levine R., Loayza N., and Beck T., 2000. Financial intermediation and growth:

Causality and causes. Journal of Monetary Economics, 46, 31-77.

22

Levine R., Loayza N., and Beck T., 2000b. Finance and the sources of growth.

Journal of Financial Economics, 58, 261-300.

Levine, Ross, and Sarah Zervos, 1998. Stock Markets, Banks, and Economic

Growth," American Economic Review, June 1998. pp. 688-726

Love I and Zicchino L. 2006, Financial development and dynamic investment

behavior: Evidence from panel VAR. The Quarterly Review of Economics and

Finance, 46, 190-210

Luintel B., and Khan M. 1999. A Quantitative Reassessment of the FinanceGrowth Nexus: Evidence from a Multivariate VAR. Journal of Development

Economics; V.60, pp. 381-405.

Mc Kinnon R., 1973. Money and capital in economic development, Washington

DC: Brookings Institution

Odedokun, M., 1996. Alternative Econometric Approaches for Analysing the

Role of the Financial Sector in Economic Growth: Time Series Evidence from

LDCs. Journal of Development Economics; V.50-#1, pp.119-146.

Odedokun M.O. 1998, Financial Intermediation and Economic Growth in

Developing Countries, Journal of Economic Studies, Vol. 25 No.3, pp.203-224

Pereira, A.M. and R.F. De Frutos 1999. Public capital accumulation and private

sector performance, Journal of Urban economics, Vol.46, pp300-322

Pereira, A. M. and O Roca-Sagales. 2003, Spillover effects of public capital

formation: evidence from the Spanish Regions, Journal of Urban economics,

Vol. 53 pp 238-256

Rajan R. and Zingales L., 2000. The Great Reversals: The Politics of Financial

Development in the 20th century, OECD Economics Department Working

Papers, No 265, OECD publishing

23

Ram R., 1999. Financial Development and Economic Growth: Additional

evidence, The Journal of Development Studies, 35, No. 4, 1999, 164-174.

Rousseau, Peter and Paul Wachtel, 2000. Financial Intermediation and

Economic Performance: Historical Evidence from Five Industrialized Countries,

Journal of Banking and Finance, 2000, pp. 1933-1957.

Rousseau P and Sheng X, 2007. Banks, stock markets, and China's ‘great leap

forward’ Emerging Markets Review Volume 8, Issue 3, September 2007, Pages

206-217

Schumpeter J., 1912. The Theory of Economic Development. Oxford University

Press, Oxford

Seetanah B. 2008. ‘Financial development and economic growth in an ARDL

approach. Applied Economics Letter, 4(43), pp 43-50

Shaw E., 1973. Financial deepening in economic development, New York,

Oxford University Press.

Tsuru K., 2000. Finance and Growth: Some theoretical considerations, and a

review of the empirical literature, Economics Department Working papers no

228.

Wachtel, Paul. 2003. How much do we really know about growth and finance?

Federal

Xu Z., 2000. Financial development, investment and growth. Economic Inquiry,

38, 331-344

Appendix: List of developing countries

Algeria, Angola, Brazil, Cameroon, China, Ghana, Egypt, Ethopia, India,

Indonesia, Israel, Kenya, Mauritius, Malaysia, Malawi, Morroco, Mexico,

Nigeria, Pakistan, South Africa, South Korea, Taiwan, Thailand, Tunisia, Uganda

24