Part 2: Formal VS Informal Compensation

advertisement

Total Compensation in Moral Hazard Settings

Pattarin Adithipyangkul*

Sauder School of Business

University of British Columbia

pattarin@interchange.ubc.ca

Current Draft: December, 2004

Preliminary and comments welcome.

Please do not quote without the author’s permission.

* The author is greatly indebted to Jerry Feltham, Dan Simunic, and Gilles Chemla for their kind

support and valuable comments. Comments from participants in the workshop at the University of

British Columbia are also very much appreciated. The author is responsible for any errors.

Abstract

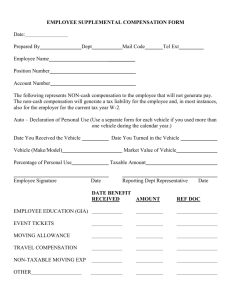

Prior literature has focused on the use of formal cash compensation to solve agency

problems. In practice, employees are also paid in terms of fringe benefits, perks, etc. Some

receive informal compensation, which includes any cash or other resources employees obtain

or appropriate for personal use without proper approval from authorized personnel. This

paper considers two aspects of compensation decisions: the composition of pay and the

method of payment. In part one, I examine the use of non-cash compensation to reduce the

total compensation cost in moral hazard settings. The main findings are that (i) for given

reservation utility and disutility of effort, the optimal compensation portfolio includes a noncash item with greater value to the agent (in the sense that the slope of the utility function

with respect to the dollars spent on that non-cash item is higher, while the degree of

concavity is lower) or a non-cash item with higher productivity; and (ii) when the agent’s

utility function is strictly concave in cash and non-cash compensation, the number of noncash items included in the compensation portfolio increases, as the agent’s reservation utility

and cost of effort rise.

In part two, I examine the use of informal compensation to benefit from greater flexibility.

Informal compensation is often paid to a small number of employees and is not covered by a

collective bargaining agreement. It sometimes involves “illegal” or “immoral” activities so

that the payees generally prefer the payment to be secretive. As a result, it is less rigid and

easier to change than formal compensation. I formulate a two-period model where the

principal optimally adjusts the compensation schemes from period to period, according to

the change in the value of non-cash compensation to the agent, and to the change in its cost

to the principal. The agent may find herself better off with the preceding period’s scheme, so

that she wants to resist the change in compensation. I show that when the agent can resist the

changes in compensation schemes, the principal can avoid the problem by paying part of the

compensation informally. Subsequently, I examine the use of illegal or immoral informal

compensation to deter employee litigation. I consider a setting in which the performance

measure is not verifiable by the courts so that opportunistic discrimination litigation is a

problem. By paying illegal or immoral informal compensation, the principal subjects the

agent to prosecution or reputation loss, which can deter the agent from suing the principal.

To make the agent accept the informal pay, the informal pay must be such that if not sued,

the principal will not prosecute the agent.

1

I. Introduction

The compensation decision is multi-dimensional. In addition to the amount of pay based on a

realized performance measure, the principal can choose the composition of the pay – cash or

non-cash; the way to pay it – formal or informal; and the timing of the pay – immediate or

deferred (e.g. retirement benefit, etc.). This paper addresses the optimal composition of the

pay and the method of payment in moral hazard settings. In the term ‘cash compensation’, I

also include cash-equivalents like stocks. Non-cash compensation includes fringe benefits,

an office, secretarial service, etc. By ‘formal compensation’, I mean such pay as is specified

in the employment contract, the company’s compensation policies, the company’s charters,

or any other pay that is formally approved by authorized personnel. By ‘informal

compensation’, I mean any cash or other resources employees receive or appropriate for

personal use without proper approval from higher authorities. For example, health benefits

specified in compensation packages are formal compensation. The money an employer pays

to an ill employee to assist her with the health care expenses on case by case basis is

informal compensation.

The motivation for this paper stems from the lack of agency literature on non-cash and on

informal compensation. Previous theoretical or empirical accounting literature focuses

almost exclusively on formal cash compensation when non-cash and informal compensation

can be significant parts of total compensation, both in terms of the amounts and in terms of

their effects on employees’ behaviour. For example, in the military, non-cash compensation

constitutes about 57% of total military compensation (Murray, 2004)1. Hashimoto (2000)

finds that the proportion of (formal) non-cash compensation (of the total (formal)

compensation) across industries has increased by 46.1% from 1966 to 1994. From casual

observation, we observe the use of productive non-cash compensation like an office, a

secretary (who may often be asked to help with her boss’s personal matters), a training

program, a company car, a laptop computer, an insurance policy, meals, etc. We also observe

the use of non-productive non-cash compensation like a paid leave, subsidy for children’s

education, etc.

1

Examples of the non-cash compensation paid include “subsidized goods and services that can be used

immediately--such as medical care, groceries, housing, and child care … other deferred benefits that service

members receive after they leave active duty--including health care for retirees and veterans' benefits.”

(Murray, 2004: 1)

2

I know of only one empirical accounting work addressing non-cash compensation. Lee,

Matolcsy, and Wells (2004) study the compensation-performance relation for State

Dominated Enterprises (SDE) and Non-State Dominated Enterprises (NSDE) in China. They

find no difference in accounting performance measures, which are tied to monetary

compensation, between SDE and NSDE, and no difference in the monetary pay-performance

relation. They also find that the level of monetary compensation is lower for SDE. They

anticipate that the amount of non-cash fixed compensation paid is higher for SDE, while the

amounts of cash bonuses are similar between SDE and NSDE. This possibly explains why

they do not find a difference in measured performance, despite the lower cash pay for SDE.

Other empirical work on non-cash compensation can be found in the macro-economics field

(Rosen, 2000).

As to theoretical work on non-cash compensation, I only know of Marino and Zábojník

(2003), who study the use of employee discounts and non-cash compensation in adverse

selection models. They first formulate a model in which a monopolist-employer determines

the optimal price to charge his employee and other customers. There are two types of

customers; one type has a greater preference for the firm’s product. The monopolistemployer wants to hire an employee from a pool of customers. Assume that the pool is large

so that the employer can choose which type to hire. Marino and Zábojník (2003) find that it

is optimal to charge the employee at marginal cost to induce the employee to purchase as

much as possible, and then extract the surplus the employee receives by decreasing the

amount of cash salary. Since a customer with high preference has a larger surplus the

employer can extract, it is optimal to hire her. The principal then designs a contract to induce

only the high-preference type to participate. There is price discrimination: the price charged

to outside customers is higher than the price charged to employees. Subsequently, the

authors also consider the use of perks in a setting where there are, again, two types of

workers, high-preference and low-preference, and the principal wants to hire both types. In

addition to their preferences, the two types also have different reservation utilities. Marino

and Zábojník show that the principal can wage-discriminate to minimize the amount of rent

paid the employee. Generally, the high-type is over-supplied, while the low-type is undersupplied, compared with the efficient levels.

Concerning informal pay, the empirical or field evidence in accounting barely exists. Some

evidence from the field exists in organizational behaviour (Greenberg and Scott, 1996).

3

Researchers describe controlled theft systems, where a certain employee is occasionally

allowed to “steal” a certain amount of a certain item as part of her compensation. As further

evidence, in Appendix 1, I include my findings on the use of informal compensation in a

pharmaceutical business in Thailand.

In this paper, I study moral hazard settings, rather than adverse selection settings. Part one

examines the use of non-cash compensation, while part two considers the use of informal

compensation. In part one, I show that the characteristics of the optimal contract are

determined by the agent’s utility function, her reservation utility, her cost of effort, and the

characteristics of the non-cash item considered. Section 2 describes a single-period moral

hazard model. Section 3.1.1 considers the use of non-cash compensation when it is not

productive and not available from the market. Section 3.1.2 assumes instead that the noncash compensation is productive. Section 3.2 examines the optimal contract when the noncash compensation is available from the market. The main results are: (i) for given

reservation utility and cost of effort, a non-cash item included in the optimal compensation

portfolio is a non-cash item with greater value to the agent (in the sense that the slope of the

utility function with respect to a dollar spent on that non-cash item is higher, while the

degree of concavity is lower) or a non-cash item with higher productivity; and (ii) when the

agent’s utility function is strictly concave in cash and non-cash items, the number of noncash items included in the compensation package increases, as the agent’s reservation utility

or cost of effort increase. Based on the assumption that the non-cash items which satisfy

basic needs have higher value to the agent, the theory explains why we often observe

employees being paid more in terms of non-cash items like food, lodging, health care, etc.,

which are both productive and necessary for survival. For an executive with high reservation

utility, other non-cash items (possibly luxurious items) are added into the compensation

portfolio.

Section 4 in Part 2 discusses a multi-period setting, where the principal optimally adjusts the

compensation schemes from period to period according to the changes in the agent’s utility

function with respect to non-cash compensation, and to the changes in its cost to the

principal. When the agent can resist the change in compensation plan from period to period,

the principal is weakly worse off. I introduce informal compensation, which is less rigid and

easier to change than formal compensation for several reasons. Informal compensation is

often paid to a small number of employees and is not covered by a collective bargaining

4

agreement. Informal payment methods like allowed “theft” systems involve “illegal” or

“immoral” activities so that the payees prefer the payment to be secretive. I show that the

principal can solve the resistance problem by paying part of the compensation informally.

The formal compensation is then designed such that the agent has no incentive to resist the

changes in formal compensation. Consequently, the principal has greater flexibility in

changing the compensation schemes from period to period, with an option to pay informally.

Section 5 discusses the use of informal compensation to gain some power over the agent,

possibly to induce more cooperation or to deter undesirable actions. In particular, I consider

the setting in which the principal wants some power to deter costly employee litigation,

specifically the situation in which a performance measure is not verifiable to the courts. In

such a setting, when the agent is not paid a bonus because the realized performance measure

is not good, the agent can opportunistically sue the principal, claiming discrimination in

performance evaluation – the most “popular” employee lawsuits in the US courts. The

principal cannot defend himself very effectively, since he has no evidence to show the courts

that the agent is actually not paid a bonus due to inadequate performance. To deter the agent

from suing him, the principal can pay informal compensation which is illegal or immoral.

Examples include the controlled theft systems described above. With this illegal or immoral

informal pay, it is possible for the principal to punish the agent for opportunistic litigation by

prosecuting the agent for “misappropriation” or by revealing the agent’s “misappropriation”

to the public. The amount of informal pay is determined by the expected gain to the agent

from the lawsuit and the expected gain to the principal from the prosecution. The control

issues associated with informal compensation are discussed at the end of the section.

In explaining fraud, the most important theory in organizational behavior (which is adopted

for accounting – see, for example, Wells (1997)) seems to be the so-called triangle model of

fraud. According to this theory, fraud occurrence is determined by three factors: an

employee’s motives; her attitudes; and the opportunity to perpetrate fraud. The motives

include greed (which is assumed to be the only motive in the economics literature); personal

financial difficulties; and other psychological factors such as job dissatisfaction, the feeling

of being treated unfairly and the desire to retaliate, etc. Once the employee has a motive to

commit fraud, whether she really does so is determined by her attitude toward fraud (i.e., her

levels of honesty, risk aversion, possible guilt over fraud, etc.), and by whether the

opportunities to perpetrate fraud exist (i.e., whether the internal control is effective or not).

5

This theory explains from the employee’s perspective whether fraud will occur. It delineates

how the employee’s attitudes and the situational factors (e.g. whether the internal audit is

effective, whether the employee gets compensated fairly, etc.) affect her decision to

perpetrate fraud. From an employer’s perspective, the economic literature usually explains

the choice of control as a cost-benefit analysis. With costless control, an employer wants to

implement the perfect control to deter all fraud incidents. When control is costly, he

optimally chooses less than perfect control because perfect control is too costly, compared

with the benefit. Consequently, in equilibrium, we observe fraud.

Here, I argue that some of the fraud incidents we observe may be virtual fraud, which is

allowed as a way to pay employees informally, rather than the unwanted fraud which occurs

because the perfect control is too costly. Even when perfect control is costless, an employer

may not implement the perfect control to deter all fraud because he wants to pay the agent

informally to gain some power over the agent.

In summary, this paper contributes to the accounting literature by extending our knowledge

on use of non-cash and informal compensation. My research also suggests that the control

decision is not just a simple cost-benefit analysis. The principal may strategically impose

weak control somewhere to facilitate informal compensation, but stronger control elsewhere

to prevent unwanted appropriation of valuable organizational resources. Also, in addition to

prevention and detection of errors or fraud, we need to determine the degree to which the

control system can produce convincing evidence for successfully prosecuting the “thieving”

employees (or to support the claim that the employees have embezzled, when the employer

chooses to condemn the employees rather than prosecute them), if this becomes necessary.

Part 1: Cash vs Non-cash Compensation

Prior macroeconomic literature discusses various benefits of non-cash compensation: an

economy of scale from providing the non-cash compensation to a large number of

employees; its productivity; and tax benefits (Rosen, 2000; Long and Scott, 1982). In this

paper, I examine the effects of the productivity of non-cash compensation, the existence of

economies of scale, and the agent’s utility function on the optimal use of non-cash as

compensation. Below, I first examine a simple setting in which there is only one non-cash

item to be used. Subsequently, to analyze the choice of non-cash items to include in a

6

compensation portfolio, two non-cash items are considered. (The results are similar when

there are more than two non-cash items the principal can use.)

II. Model Description

I consider a moral hazard setting where the principal (P, later referred to as he) has a linear

utility function with respect to cash. The agent (A, subsequently referred to as she) is strictly

work-averse. At the beginning of the period, the principal offers a contract to the agent. The

contract specifies the amounts of cash and non-cash compensation as functions of a

performance measure. If the agent accepts the offer, she chooses an action a, which

stochastically determines the benefit of her effort to the principal. An additive disutility of

effort is denoted by v(a); v' > 0 and v" > 0. The agent’s action is not observable to the

principal. If not properly motivated, the agent will not supply the costly effort. Assume that

the agent has limited liability or has inadequate wealth, so that it is not possible for the

principal to sell the firm to the agent to solve the moral hazard problem, even when the agent

is risk-neutral.

Production Technology

The benefit of the agent’s effort to the principal (or the outcome) measured in monetary

terms is denoted by x. Since the focus of the model is on the compensation rather than on the

optimal action to induce, I consider a binary model where a {0, 1} and x {xL, xH}, xH =

xL + x > xL, and assume that the principal wants to induce a = 1. If the agent chooses a = 0,

then the outcome is xL, i.e. pr(xL| a = 0) = 1. If the agent chooses a = 1, then the outcome

realized is xH with probability p, i.e. pr(xL|a = 1) = 1 - p and pr(xH| a = 1) = p. Assume that

p (0, 1), i.e., that the outcome is an imperfect signal informing the principal of the agent’s

action. Let x = xL + px.

If the non-cash compensation is productive, assume that the productive benefit of the noncash pay is weakly concave, i.e. x {g(n)xL, g(n)xH}, g > 0, and g 0, where n is the noncash compensation provided during the production process.

The Agent’s Preferences

The agent’s utility function is denoted by ua(c, n, a) = u(c, n) – v(a), where c R+ is cash

compensation, n R+ represents the quantity of the non-cash compensation, and a {0, 1} is

7

the action taken. Let v = v(a=1) – v(a=0). I assume that n is a continuous variable. Let U

denote the agent’s reservation utility. The agent’s expected utility is denoted by Ua(a) ≡

E[u(c, n)|a] – v(a). Assume that the principal knows the agent’s preferences with respect to

cash and non-cash.

Note that it is difficult to capture the characteristics of all types of non-cash compensation

mathematically. This is especially true for non-cash compensation like an office, a company

car, or a paid vacation. In this case, it seems more appropriate to think about n as quality

rather than quantity. The higher the amount of cash spent, the higher the quality of the noncash compensation received.2

Compensation

At the beginning of the period, the principal offers a contract specifying fixed cash and noncash wages, and cash and non-cash bonuses. Let fc denote the fixed cash wage; fn denote the

quantity of fixed non-cash wage; c denote the cash bonus; and n denote the quantity of the

non-cash bonus paid if x = xH. The principal’s expected utility is denoted by UP(a, f, ). Note

that the non-cash bonus is paid after the production is finished and the outcome is known.

Therefore, the non-cash bonus is not productive.

The cost of the non-cash compensation to the principal is denoted by KP(n), KP(0) = 0, KP >

0. Below, I first assume that the non-cash is not available from the market. Subsequently, I

assume that the non-cash is also available from the market, and let Ka(n), Ka(0) = 0, Ka > 0

denote the agent’s cost of acquiring the non-cash from the market. Whether the non-cash is

available from the market or not, assume that the agent cannot sell the non-cash she receives

as compensation (or does not find it optimal to do so because of high transaction costs).

III. The Optimal Compensation When the Performance Measure Is Verifiable

Assuming that the outcome x is contractible, in Section 3.1.1, I first consider a simple setting

in which the non-cash is not productive and is not available from the market. Next, in section

2

In this case, n represents the level of non-cash compensation above some base level that the principal needs

to provide. If the principal has an option not to pay in terms of that non-cash item, we need to consider a corner

solution.

8

3.1.2, I consider a setting in which the non-cash is productive but still not available from the

market. In Sections 3.1.1.1 and 3.1.2.1., I consider the setting with only one non-cash item

available to compensate the agent. To study the selection of non-cash items to include in the

compensation portfolio, I consider the setting with two non-cash items in Sections 3.1.1.2

and 3.1.2.2. The results are similar when the principal has more than two non-cash items to

choose from. Then in Section 3.2, I examine the setting in which there is only one non-cash

item under consideration and the non-cash is available from the market. (The results when

there are many non-cash items – which are not shown in this paper – are similar to the

results when only one non-cash item is available for use.)

3.1 The Non-cash Is Not Available from the Market

When the agent cannot purchase the non-cash from the market, the principal’s optimization

problem is as follows:

Max

f ,

U P ( f , , a 1) g ( f n ) x (1 p )[ f c K P ( f n )] p[ f c c K P ( f n n )]

subject to

( PC a )

U a (a 1) (1 p ) u ( f c , f n ) p u ( f c c , f n n ) v(a 1)

( IC a )

U a (a 1)

U

U a ( a 0) u ( f c , f n ) v ( a 0 )

The participation constraint (PCa) is to guarantee that the compensation contract pays the

agent at least her reservation utility, and the incentive compatibility constraint (ICa) is to

ensure that the agent is weakly better off choosing a = 1.

To simplify the analysis, I rewrite the utility function u(c, n) and the productivity function

g(n) as functions of the dollars spent on non-cash compensation n$, rather than of the

quantity of non-cash compensation n, i.e.,

u (c, n $ )

u(c, K P 1 (n $ )) , and

gˆ (n $ )

g ( K P 1 (n $ )) ,

where KP -1 is the inverse of the cost function KP.

Let fn$ = KP(fn)and n$ = KP(n) denote the dollar amount of non-cash fixed wage and bonus

respectively. To be able to use the first-order approach, I assume that u (c, n $ ) and gˆ (n $ ) are

9

continuous and weakly concave in c and n$. The rewritten optimization problem is as

follows:

Max

f ,

$

$

$

U P ( f , , a 1) gˆ ( f n ) x [ f c f n p c p n ]

subject to

( PC a ) U a (a 1) (1 p) u ( f c , f n ) p u ( f c c , f n n ) v(a 1) U

$

U a (a 1)

( IC a )

$

$

U a (a 0) u ( f c , f n ) v(a 0).

$

With this simplified problem, the principal basically decides how to spend each additional

dollar to compensate the agent for her cost of effort – simply pay $1 or use that $1 to acquire

the non-cash to pay the agent, with (PCa) and (ICa) specifying the amounts of fixed wage and

bonus he needs to pay.

The Lagrangian function is as shown below.

L

$

$

$

gˆ ( f n ) x [ f c f n p c p n ]

{ (1 p) [u ( f c , f n )] p [u ( f c c , f n n )] v(a 1) U}

$

$

$

{ p [u ( f c c , f n n ) u ( f c , f n$ )] [v(a 1) v(a 0)]}

$

$

Differentiate the Lagrangian function with respect to each choice variable. Let

ĝ ( ) represent the first derivative of gˆ (n $ ) with respect to n$, and ui( ), i = c, n denote the

first derivative of u (c, n $ ) with respect to c or n$ respectively. When the non-cash

compensation is not productive, the optimal interior solution is such that

1

u c ( f c , f

*

and

$*

n

)

uc ( f c c , f n$* n$* )

*

u n ( f c , f )

*

*

$*

n

p

,

1 p

un ( f c c , f n$* n$* )

*

*

( ) 1 .

When the non-cash compensation is productive, the optimal interior solution is such that

u c ( f c , f

*

and

$*

n

)

u n ( f c , f )

uc ( f c c , f n$* n$* )

*

*

*

$*

n

gˆ ( f n$* ) x

(1 p) p

1

=

un ( f c c , f n$* n$* )

*

*

p

,

1 p

( ) 1 .

To obtain further results, in this section and Section 4, I simplify the analysis by assuming

that the agent’s utility u(c, n) is additively separable in c and n, i.e. u(c, n) = uc(c) + un(n),

10

uc > 0, uc 0, un > 0, and un 0. The main characteristic of this additively separable form

is that c and n are additively independent (Keeney and Raiffa, 1993: Theorem 5.1), i.e. that

the agent is indifferent between the following two lotteries3:

Lottery A:

½

½

Lottery B:

(ch, nh)

(cl, nl)

½

(ch, nl)

½

(cl, nh)

Then, I rewrite the utility function with respect to non-cash compensation un(n) and the

productivity function g(n) as functions of the dollars spent on the non-cash compensation n$,

i.e., uˆ n (n $ ) u n ( K P 1 (n $ )) , and gˆ (n $ ) g ( K P 1 (n $ )) .4

Let wc denote the inverse of uc, i.e., wc ≡ uc-1. With both (PCa) and (ICa) binding, we can

rewrite the two constraints as shown below: 5

fc

fc + c

$

= wc(U + v(a=0) – uˆ n ( f n ))

(3.1.1)

= wc(U + v(a=0) + v/p – uˆ n ( f n$ n$ ))

(3.1.2)

Substitute the above into the objective function and differentiate the objective function with

respect to fn$ and n$. The first-order derivatives are the following:

3

If the cash and non-cash compensation are complements, the agent’s utility can be represented by u(c, n)

= uc(c) + un(n), + uc(c) un(n), > 0, uc > 0, uc 0, un > 0,and un 0. When c and n are complements, the

agent strictly prefers Lottery A to Lottery B.

4

For instance, let un(n) = 2n1/2,

g(n) = bpn, where bp is marginal product of n, and KP(n) = Pn, where P

is the cost per unit of n to the principal. Then, uˆ (n $ ) 2 1 n $

n

P

5

1/ 2

and gˆ (n $ ) b p n $ .

P

We can rewrite (ICa) as p [u c ( f c c ) u c ( f c ) uˆ n ( f n $ n $ ) uˆ n ( f n$ ) v . Substitute the

rewritten (ICa) into (PCa) and we have the rewritten (PCa), u c ( f c ) uˆ n ( f n $ ) U v(a 0) , which leads to

(3.1.1). Finally, substitute the rewritten (PCa) back into the rewritten (ICa), and we have the following equation,

which leads to (3.1.2): u c ( f c c ) uˆ n ( f n $ n $ ) U v(a 0) v / p .

11

U p (a 1)

fn

$

$

$

gˆ ( f n ) x (1 p) [ wc (U v(a 0) uˆ n ( f n )) uˆ n ( f n$ ) ]

v

$

$

p [ wc (U v(a 0)

uˆ n ( f n n )) uˆ n ( f n$ n$ )] 1

p

U p (a 1)

v

p [ wc (U v(a 0)

uˆ n ( f n$ n$ )) uˆ n ( f n$ n$ ) 1]

$

p

n

(3.1.3)

(3.1.4)

Below, I first analyze the case when the non-cash compensation is not productive. The

benefit of the non-cash comes from two sources: first, the difference between its value to the

agent and to the principal; and second, from the use of non-cash bonuses to minimize the

risk premium when the agent’s marginal utility with respect to cash is diminishing. Next, I

assume an additional benefit of the non-cash: its productivity.

3.1.1 The Non-cash Compensation Is Non-Productive

3.1.1.1 One Type of Non-cash Compensation under Consideration

In this section, assume that there is only one type of non-cash compensation item for the

principal to use and it is not productive, i.e. gn(n) = 1, g(n) =0 n.

From the first-order derivatives, when both uc and û n are linear, we have a corner solution, in

which the principal pays either in cash or in non-cash terms. Let uc(c) = c and uˆ n (n $ ) =

ban$. With linear utilities, the solution depends on the slopes of uc and û n . When $1 spent

purchasing the non-cash for compensation has the value ba > 1 to the agent, the principal is

better off spending $1 to acquire the non-cash to pay the agent than simply paying her

$1.The solution is as follows:

(i)

when ba > 1,

fc* = c* = 0, fn$* = (U + v(a=0))/ba, and n$* = v/pba;

(ii)

when ba 1,

fc* = U + v(a=0), c* = v/p, and fn$* = n$* = 0.

Next I consider interior solutions, when the two utility functions uc and û n are weakly

concave. From the first-order conditions (note that gˆ (n $ ) 1 n $ R ) and the fact that

wc (u c (c)) 1 / u c (c) , the optimal interior solution must be such that

uˆ n ( f n$* ) = uc(fc*)

and

uˆ n ( f n$* n$* ) = uc(fc*+c*)

(3.1.5),

(3.1.6).

12

For example, when the agent’s utility with respect to cash uc is linear while her utility with

respect to non-cash û n is concave, the optimal interior solution is as follows:

fn$*

such that uˆ n ( f n$* ) = uc(fc*) = 1 ,

fc*

=

U + v(a=0) - uˆ n ( f n$* ) , and

n$*

=

0,

c*

=

v/p.

The fixed non-cash compensation fn$* is chosen such that the marginal utility from the

dollars spent on non-cash compensation is equal to the marginal utility from cash

compensation. Paying a non-cash bonus is not optimal, since for n$ > fn$*, the incremental

benefit from $1 paid to acquire the non-cash compensation is less than the incremental

benefit from paying $1 to the agent, due to the concavity of û n . Similarly, the principal

cannot improve her payoff by choosing fn$ < fnS* and n$ > 0, due to the concavity of û n .

If the principal is limited to cash compensation, his payoff is x - U – v(a=1). When he can

pay non-cash compensation as well, his payoff increases to x - U – v(a=1)+ ( uˆ n ( f n$* ) - fn$*),

i.e., he can reduce the total compensation by the amount of the agent’s surplus from noncash compensation. When the agent’s preference is concave in cash, the principal can also

benefits from the reduction in risk premium, as discussed below.

The interior solution when the agent’s utility with respect to cash uc is concave but her utility

with respect to non-cash û n is linear, i.e., uˆ n (n $ ) = ban$, is as follows:

fn$*

such that uc(fc*) = uˆ n ( f n$* ) = ba ,

fc*

=

U + v(a=0) - uˆ n ( f n$* ) , and

n$*

=

v/pba,

c*

=

0.

If the principal is limited to paying cash as compensation, he has to pay risk premium when

uc is concave. When the non-cash compensation is introduced and û n is linear, the principal

is better off, since he does not have to pay risk premium any more. (Even when û n is

concave, the principal can reduce the risk premium by paying some non-cash bonus when

the slope of û n is adequately high.)

13

When either one of the two utility functions is linear, we have a corner solution, where the

slope of the two utility functions differs greatly. For example, when uc is linear and û n is

concave, the principal only pays in cash when uc(m) > uˆ n (m) for all m R+.

When both the agent’s utility with respect to cash uc and her utility with respect to non-cash

û n are concave, the optimal solution is determined by the slopes and the concavity of uc and

û n . To simplify the analysis, I assume that either uc(m) > uˆ n (m) for all m R+ or vice versa

- the two utility functions do not cross. When the slopes of uc and û n differ vastly, the

principal pays either cash or non-cash compensation. From (3.1.1) and (3.1.2), if the

principal has to pay only in cash, the cash pay must be such that uc(fc) = U + v(a=0) and

uc(fc+c) = U + v(a=0) + Δv. Consider Figure 1a. The slope of uc at fc + c for uc(fc + c) =

U + v(a=0) + v/p is still greater than the slope of û n at the origin. In other words, the

marginal benefit from spending money as cash compensation is higher than the marginal

benefit from purchasing the non-cash to pay as compensation. Therefore, the principal only

pays in cash. The opposite is true when the slope of û n is much higher than the slope of uc.

Figure 1a

uc

U + v(a=0) +v/p

U+v(a=0)

û n

fc

(fc + c)

When the slopes of uc and û n differ rather greatly, the principal pays either a cash or a noncash fixed wage, and pays both cash and non-cash bonuses. Consider Figure 1b. The slope of

uc at fc for uc(fc) = U + v(a=0) is greater than the slope of û n at the origin, but the slope of uc

at fc + c for uc(fc + c) = U + v(a=0) + v/p is less than the slope of û n at the origin.

Therefore, the principal pays a fixed wage only in cash but pays both cash and non-cash

14

bonuses. The fixed cash wage, the cash and non-cash bonuses are such that (3.1.6) is true.

Again, the opposite is true when the slope of û n is much larger than the slope of uc.

Figure 1b

uc

U + v(a=0) +v/p

U+v(a=0)

û n

n$ fc (fc+c)

When the slopes of uc and û n do not differ greatly, we have a truly interior solution in which

the principal pays fixed wages and bonuses both in cash and non-cash terms. The interior

solution is characterized by conditions (3.1.5) and (3.1.6). See Figure 1c. The amounts of

cash and non-cash compensation are determined by both the slopes and the degrees of

concavity of the two utility functions, with the marginal utilities from cash fixed wage and

from non-cash fixed wage being equal, and the marginal utility from (fc*+c*) equal to the

marginal utility from (fn$* + n$*).

Figure 1c

uc

U + v(a=0) +v/p

U+v(a=0)

û n

fn$ fc (fc+c)

(fn$+n$)

The results from the analysis above are summarized in Proposition 1.

15

Proposition 1: Assume that the agent’s utility with respect to cash and non-cash is

additively separable.6 When the non-cash compensation is non-productive and is not

available from the market, the principal pays a non-cash fixed wage when the slope of û n is

sufficiently high, and he pays a non-cash bonus when the slope of û n is sufficiently high and

the degree of concavity of û n is sufficiently low.

Exponential Utility Example

Let uc(c) = – exp[-rcc], un(n) = – exp[-rnn], where rc and rn are the degrees of risk aversion

with respect to cash and non-cash compensation respectively. Let ri = 1/i, i = c, n represent

the degree of risk tolerance with respect to cash and non-cash compensation. The cost of

non-cash compensation to the principal is represented by KP(n) = Pn, P > 0. We can

rewrite un(n) as uˆ n (n $ ) exp[ rˆn n $ ], where rˆn rn / P ; ˆn 1 / rˆn . In addition, assume that

(- U - v(a=0)) (0, 1] and (- U - v(a=0) - v/p) (0, 1]. The interior solution is as follows:

*

c

U v(a 0) ,

c ln

c ˆn

$*

n

U v(a 0) ,

ˆn ln

c ˆn

c*

c

c ln

c ˆn

c

v

U v(a 0)

ln

U v(a 0) ,

p

c ˆn

n$*

ˆn

ˆn ln

ˆ

n

c

ˆn

v

U v(a 0)

ln

U v(a 0) .

p

c ˆn

fc

fn

From the above, c* is decreasing, while fc* is increasing in rc, the degree of concavity of uc.

Similarly, n$* is decreasing, while fn$* is increasing in r̂n , the degree of concavity of

6

If the cash and non-cash compensation are complements, as discussed in footnote 3, the optimal contract is

still such that the marginal utility from cash and the marginal utility from the dollars spent on non-cash are

equal (but the functional forms of the marginal utilities now differ.) The significant change is in the optimal

contract, when the agent’s utility with respect to cash is linear but the utility with respect to the dollars spent on

non-cash is concave. When the utilities are additively separable, the principal does not pay a non-cash bonus.

When the utilities are not additively separable, e.g. when the cash and non-cash are complements, the principal

also pays a non-cash bonus, to increase the utility the agent receives from the cash bonus.

16

uˆ n (n $ ) , i.e. n$* is increasing in P but decreasing in rn, while fn$* is decreasing in P but

increasing in rn.

3.1.1.2 Two Types of Non-cash Compensation under Consideration

As before, I assume additively separable utility function, i.e., u(c, n1, n2) = uc(c) + un1(n1) +

un2(n2) , uc > 0, uc 0, uni > 0, and uni 0, for i = 1, 2. Assume also that the three utility

functions do not cross, and their slopes can be ordered, i.e., uc(m) > uˆ ni (m) > uˆ nj (m) for all m

R+, i, j = 1, 2, i j, or any other orders. I repeat the analysis above and find that the

optimal interior solution is characterized by

uˆ n1 ( f n$1* ) = uˆ n 2 ( f n$2* ) = uc(fc*)

and

uˆ n 1 ( f n$1* n$1* ) = uˆ n 2 ( f n$2* n$2* ) = uc(fc*+c*)

(3.1.7),

(3.1.8).

Similar to the results in Section 3.1.1.1, when the slopes of uc , uˆ n1 , and uˆ n 2 differ greatly, we

have a corner solution where the principal does not pay the fixed wage or bonus in all

possible forms. The principal optimally pays an additional $1 in the form that creates the

highest incremental utility for the agent. For a given value of (U, v(a=0), v), as the slope of

û ni increases, the incremental benefit from paying $1 as a non-cash item i increases. The

non-cash item to be selected first is the one that exhibits the greatest slope. Given an

adequately high slope, the principal pays a bonus in terms of the non-cash item i when û ni is

not very concave.

Proposition 2: Assume that the utility with respect to cash is strictly concave. When there

are many non-cash items to choose from, the principal optimally includes in the

compensation portfolio the non-cash item for which the utility function exhibits a higher

slope and a lower degree of concavity.

Now we hold constant the slopes and degrees of concavity of uc, uˆ n1 , and uˆ n 2 . If U + v(a=0)

and v are large, the amount of cash compensation needed to induce the agent to accept the

contract and to choose a = 1 is large, especially when uc is concave so that the marginal

utility from cash compensation is decreasing. As a result, if the slope of the non-cash utility

17

function is sufficiently high, the principal is better off paying a non-cash fixed wage and

bonus to complement cash compensation. To illustrate, consider Figure 1a. If U + v(a=0) or

U + v(a=0) + v/p increases to, say, the highest dotted horizontal line, the principal is better

off paying a fixed wage and bonus both in terms of cash and non-cash, rather than only in

cash as he does when the reservation utility and disutility from work are low.

Proposition 3: Assume that the utility with respect to cash and the utility with respect to

each non-cash item are strictly concave. As the reservation utility or the disutility of effort

increases, the number of non-cash items included in the optimal compensation portfolio

increases.

In practice, it seems most reasonable to assume that the agent’s marginal utility from cash

and that from the dollars spent on non-cash compensation are diminishing. Also, the slope of

the utility with respect to cash should be high, since we definitely need some cash to buy

goods or services necessary for survival today and in the future, for both ourselves and our

families. The slopes of utility functions for goods or services that satisfy basic needs (like

food, lodging, health care) should be high as well. I anticipate that these necessary non-cash

items will be provided to employees at all organizational levels, especially in a setting where

production occurs in a remote area without a well-developed market for food,

accommodation, and supplies (e.g., a military base). When the reservation utility or the cost

of effort is large, I anticipate the inclusion of more non-necessary goods or services in the

compensation portfolio. For instance, we observe that executives (who have higher

reservation utility) are paid more in terms of some luxurious non-cash items, e.g. a better

office, an expensive car, etc. Some of the items paid are not only paid because an employee

has diminishing marginal utility with respect to cash, but also because those items are

productive, as discussed in Section 3.1.2 below.

3.1.2 The Non-cash Is Productive and Is Not Available from the Market

3.1.2.1 One Type of Non-cash Compensation under Consideration

In this section, the agent cannot purchase the non-cash from the market and the non-cash is

productive. The first-order derivatives are as shown by (3.1.3) and (3.1.4). In addition to the

slopes and the degrees of concavity of uc and û n , the solution is determined by the slope and

the degree of concavity of the productivity function ĝ .

18

From the first-order derivatives, we have a corner solution when uc, û n , and ĝ are linear. Let

uc(c) = c, uˆ n (n $ ) = ban$, where ba is marginal utility to the agent from the dollars spent on

the non-cash compensation, and gˆ (n $ ) = bPn$, where bP is marginal product of the dollars

spent on the non-cash compensation. The solution is as follows:

fc* = c* = 0 , fn$* = (U + v(a=0))/ba, and n$* = v/pba;

(i)

when ba > 1,

(ii)

when ba 1 but ba + bP > 1,

fn$* = (U + v(a=0))/ba, n$* = fc* = 0, and c* = v/p;

when ba + bP 1,

(iii)

fc* = U + v(a=0), c* = v/p, and

fn$* = n$* = 0.

When the principal spends $1 to acquire the non-cash compensation, the value to the agent is

ba. If ba > 1, then the principal optimally pays only in non-cash terms. If ba 1, but the

marginal utility to the agent plus the marginal product is greater than 1, i.e., ba + bP > 1, the

principal pays all the fixed wage in non-cash terms but pays all the bonus in cash. This is

because the bonus is paid after the production ends, and hence is not productive. If the

incremental utility plus the incremental production outcome of $1 spent to buy non-cash

compensation is less than $1, the principal does not pay non-cash compensation at all.

Next I consider interior solutions, when the two utility functions uc and û n are weakly

concave. From the first-order conditions and the fact that wc (u c (c)) 1 / u c (c) , the interior

optimal solution must be such that

and

$*

uc(fc*) gˆ ( f n ) x /(1 p) uˆ n ( f n$* ) uc(fc*)

(3.1.9),

uˆ n ( f n$* n$* ) = uc(fc*+c*)

(3.1.10).

For instance, when the agent’s utility with respect to cash uc is linear while her utility with

respect to non-cash û n is concave, and ĝ is weakly concave, the optimal interior solution is

as shown below.

$*

fn$* such that gˆ ( f n ) x /(1 p) uˆ n ( f n$* ) uc(fc*) = 1,

fc*

=

U + v(a=0) - uˆ n ( f n$* ) , and

n$*

=

0,

c*

=

v/p.

Compared with the case where the non-cash is not productive, the optimal fixed non-cash

wage fn$* is now higher, since the marginal benefit of the fixed non-cash compensation

19

increases by the amount of the marginal product of the non-cash. The non-cash bonus

remains zero.

Similarly, when the agent’s utility with respect to cash uc is concave but her utility with

respect to non-cash û n is linear, and ĝ is weakly concave, the interior solution is such that

the fixed non-cash wage is higher than when non-cash is not productive, while the non-cash

bonus remains the same.

When both the agent’s utility with respect to cash uc and her utility with respect to non-cash

û n are concave (and ĝ is weakly concave), the optimal interior solution is characterized by

conditions (3.1.9) and (3.1.10). When the slopes of uc and û n differ greatly, the principal

may not pay in all forms possible, as discussed in Section 3.1.1.1 above.

Compared with the setting where the non-cash is not productive, the fixed non-cash wage

increases, while the non-cash bonus decreases. (See the proof in Appendix 3.) Intuitively,

this is because the amount of non-cash fixed wage - which is essentially chosen so that the

marginal benefit to the principal (the marginal product plus the marginal benefit to the agent)

equals the marginal cost - is already so large that it is “more expensive” to pay a large

additional non-cash bonus (in the sense that an additional dollar spent on the non-cash to be

paid as a bonus will not create very large incremental utility to the agent).

Proposition 4: Assume that the slope of û n is sufficiently high. Compared with the setting

where the non-cash compensation is not productive, the principal pays a higher fixed noncash wage when the non-cash compensation is productive. The principal also pays a lower

non-cash bonus if the agent’s utility with respect to cash uc and the utility with respect to the

dollars spent on the non-cash û n are both strictly concave.

Are Agency Costs a Form of Compensation?

When the non-cash is productive, the principal essentially chooses the level of non-cash such

that the marginal productivity (MP) plus the marginal benefit from paying non-cash

compensation (MB) equals the marginal cost (MC), as opposed to the level where MP = MC,

which seems to be an efficient level. This explains why we observe a luxurious executive

office rather than a budget one, a corporate jet rather than business-class airfares, etc. This

20

apparent abuse of shareholders’ money may be part of the compensation. It is paid because

the employee’s marginal utility with respect to cash is diminishing and because the cost of

the non-cash compensation to the employer is lower than the benefit to the employee (i.e.,

uˆ n (n $ ) > n$ at least for some small n$).

3.1.2.2 Two Types of Non-cash Compensation under Consideration

Assume that the production outcome is represented by x {[g1(n1)+ g2(n2)] xL, [g1(n1)+

g2(n2)] xH}, with gi > 0, gi 0, where ni, i = 1, 2 is the non-cash compensation provided

during production. The optimal interior solution is such that

uc(fc*) =

=

and

uc(fc*+c*)

$*

uc(fc*) gˆ1 ( f n1 ) x /(1 p) uˆ n1 ( f n$1* )

$*

uc(fc*) gˆ 2 ( f n 2 ) x /(1 p) uˆn 2 ( f n$2* )

=

uˆ n 1 ( f n$1* n$1* ) =

uˆ n 2 ( f n$2* n$2* )

(3.1.11),

(3.1.12).

Consider the analysis used to derive Proposition 2. With a similar analysis, I find that, given

that uˆ n1 uˆ n 2 , the principal will choose to pay a fixed wage in terms of the non-cash item for

which the productivity function exhibits a higher slope and a lower degree of concavity first.

3.2 The Non-cash Compensation is Available from the Market

The objective of this section is to determine when the agent’s access to the non-cash market

alters the characteristics of the optimal contract, compared with situations where the agent

has no access to the non-cash market. For simplicity, assume that the agent’s cost of

purchasing n from the market is Ka(n) = (1 + ) KP(n), > -1. When the economy-of-scale

parameter is greater than zero, the cost to the principal is lower than that to the agent and

vice versa.

3.2.1 The Model When the Agent Has Access to the Non-cash Market

Let q = (qf, q) denote the amount of the non-cash the agent purchases from the market; qf

[q] is the non-cash bought when the outcome realized is xL [xH] and the compensation paid

is (fc , fn) [(fc + c, fn + n)]. Note that when n is not productive, g(n) = 1 for all n.

The principal’s optimization problem is as follows:

21

U P ( f , , a 1) g ( f n ) x (1 p)[ f c K P ( f n )] p[ f c c K P ( f n n )]

Max

f , ,q

subject to

( PC a ) U a (a 1, q) (1 p) u ( f c K a (q f ), f n q f )

p u ( f c c K a (q ), f n n q ) v(a 1) U

( IC a 1 ) U a (a 1, q)

U a (a 1, qˆ*) where qˆ* arg max U a (a 1, qˆ )

( IC 2 ) U (a 1, q)

U (a 0, qˆ * *) u ( f c K (qˆ * *), f n qˆ * *) v(a 0)

qˆ

a

a

a

a

where qˆ * * arg max U a (a 0, qˆ ).

qˆ

Note that qˆ * * qˆ f * . (ICa1) and (ICa2) can be rewritten as follows:

( IC a 1 ) q (q f , q ) arg max U a (a 1, qˆ )

qˆ

( IC a 2 ) u ( f c c K a (q ), f n n q ) u ( f c K a (q f ), f n q f )

v

p

When the cost of the non-cash to the agent is lower than the cost to the principal, or the cost

functions KP and Ka are convex, the principal will want to use an agent as both worker and

supplier. In addition to paying the agent for her productive effort, the principal also needs to

pay her some commission for arranging the deal with the low-cost manufacturer. The

amount of commission paid should be determined by the bargaining power between the two

parties, the characteristics of the non-cash market, etc. Here I only characterize the

compensation contract for work effort. If the principal also wants the agent to be his

supplier, he offers another buyer-supplier contract, which is not discussed in this paper. In

other words, below, I rule out the employee-supplier solutions where the principal basically

asks the agent to purchase some of the non-cash compensation to be used in production or to

be used as compensation (because the agent can purchase the items at a lower price or

because the cost functions are convex), without paying her the commission.

As in the previous sections, I simplify the analysis by assuming that that the agent’s utility

u(c, n) is additively separable in c and n, i.e. u(c, n) = uc(c) + un(n).

3.2.2 The Optimal Contract When the Agent Has Access to the Non-cash Market

The main objective in this section is to compare the optimal contract when the agent has

access to the non-cash market and when she does not. Intuitively, we must first answer the

following questions:

22

(i)

Given the optimal contract derived assuming the agent does not have access to the

non-cash market, does the agent have an incentive to purchase additional non-cash

from the market? (If not, then the optimal contract derived assuming no access is

still optimal when there is access to the market.)

(ii)

If so, the purchase will lead to a different consumption bundle from the one when

the agent has no access to the non-cash market. Do the slopes and concavities of

the cash and non-cash utility functions associated with the new consumption

bundle differ from the ones at the consumption bundle derived in the last section?

(If not, then the optimal contract derived assuming no access is still optimal with

access to the non-cash market.)

(iii) If so, how does the principal react?

First, consider a simple linear setting where the agent’s utilities with respect to cash and noncash are linear, i.e., uc(c) = c and uˆ n (n $ ) = ban$. The optimal solution, assuming no access to

the market, is such that the principal pays non-cash compensation if the marginal benefit

(marginal value to the agent plus marginal product to the principal) is greater then the

marginal cost to the principal. Given such a contract, the agent will purchase more of the

non-cash if the marginal utility of the dollars spent on the non-cash is greater than her

marginal cost. However, the purchase does not change the slope of û n at the consumption

point, i.e. uˆ n ( f n$* ) uˆ n ( f n$* q $ ) , q$ R+ due to the linearity. Therefore, the optimal

contract remains similar to the one derived when the agent has no access to the non-cash

market.

Second, consider the setting where the agent’s utility with respect to cash uc is concave, and

her utility with respect to the non-cash û n is linear. Again, uˆ n ( f n$* ) uˆ n ( f n$* q $ ) , q$

R+. Therefore, the optimal contracts are similar whether the agent has access to the non-cash

market or not. Whether the agent will purchase additional non-cash from the market depends

on the degree of productivity and the cost saving parameter. For simplicity, assume that the

productivity function is linear, i.e., gˆ n (n $ ) = bPn$, bP (0, 1). If the cost to the agent is

23

higher than the cost to the principal, or > 0, the agent will not purchase more non-cash

from the market. For < 0, the agent will purchase more of the non-cash when || > bP.7

Proposition 5: Whether the agent’s utility with respect to cash uc is linear or concave, when

her utility with respect to the dollars spent on non-cash û n is linear, the optimal contract

when the agent has access to the non-cash market is similar to that when she does not.

Third, consider the setting where the agent’s utility with respect to cash is linear, i.e., uc(c) =

c, and her utility with respect to the non-cash û n is concave.8 Assume that the cost function

KP is linear or mildly convex. The agent will not purchase additional non-cash if the cost to

the agent is higher than the cost to the principal or > 0. Intuitively, this is because the

principal optimally selects the non-cash fixed wage such that u(fn*) = KP(fn*) < Ka(fn*) =

(1+ )KP(fn*) for > 0. For < 0, when the non-cash is adequately productive, the non-cash

fixed wage chosen will be large such that u(fn*) < Ka(fn*). (See the proof in Appendix 3.)

7

Note that û n is linear if both un(n) and KP(n) are linear. Let un(n) = bn, and P denote the cost per unit to

$

the principal. Therefore, uˆ n (n $ ) b n b a n $ , b a b . With $1, the principal can purchase 1/P unit of

P

P

the non-cash, while the agent can buy 1/(1+ )P unit. Let w

ˆ n uˆ n 1 u n / b a . Assuming that (ICa2) and (PC)

are binding, we can rewrite the two constraints as follows:

fn$

=

wˆ n (U v(a 0) u c ( f c )) , and

n$

=

wˆ n (U v(a 0) v / p u c ( f c c )) f n$ .

Substitute the above into the objective function and differentiate with respect to fc and c. Using the result from

the last section that c* = 0, the fixed cash wage fc* is chosen such that uc(fc*)(1 – bP) = ba, i.e. uc(fc*) =

ba/(1-bP), and the non-cash bonus is v/pba. Let the marginal utilities with respect to cash and non-cash

approximately represent the incremental utility the agent receives from $1 cash and from $1 spent to acquire

non-cash compensation, respectively. If the agent spends $1 to buy additional non-cash, the incremental utility

is approximately b/(1+)P = ba/(1+). The incremental “cost” is approximately uc(fc*–1)> uc(fc*) = ba/(1-bP).

Therefore, if the cost to the agent is higher than the cost to the principal, or > 0, the incremental benefit is

less than the incremental cost, so that the agent will not purchase more non-cash from the market. For < 0,

the agent will purchase more of the non-cash when || > bP.

8

Note that a concave û n is generally possible when (i) un is linear and KP convex, and (ii) un is concave

and KP linear or convex.

24

Proposition 6: Assume that the agent’s utility with respect to cash uc is linear and her utility

with respect to the dollars spent on non-cash û n is concave. Also assume that the cost

function KP is linear or mildly convex. The optimal contract when the agent has access to the

non-cash market is similar to that when she does not if (i) the cost of the non-cash

compensation to the principal is lower than the cost to the agent or (ii) the cost to the

principal is not much higher than the cost to the agent, and the non-cash compensation is

adequately productive. Otherwise, the principal optimally pays a lower non-cash fixed wage

(and a higher cash fixed wage) than when the agent does not have access to the market, and

the agent will purchase some non-cash from the market.

The analysis when both the agent’s utility with respect to cash uc and her utility with respect

to the dollars spent on non-cash û n are concave is more complicated and not tractable.

However, I anticipate the results above to be valid. To be specific, I conjecture that the

optimal contract remains the same if the cost to the principal is lower than the cost to the

agent ( > 0), or when < 0 and the non-cash is very productive. Otherwise, the agent has

an incentive to purchase the non-cash from the market. The principal optimally pays less

non-cash compensation (and more cash compensation), compared with the situation when

the agent does not have access to the non-cash market.

Part 2: Formal vs Informal Compensation

In this part, I study another dimension of the compensation decision: formal vs informal.

While the previous accounting research on informal compensation does not seem to exist,

employee thefts and informal compensation have been topics of interest for researchers in

organizational behavior. Mars (1982), for instance, remarks that the total compensation from

work consists of the formal, legal rewards (e.g. wages, salaries, etc.); the informal, legal

rewards (e.g. tips, perks, etc.); and the hidden economy rewards (e.g. pilfering, overcharged

expenses, etc.) He reports a custom of compensating journalists informally for the quality of

the articles submitted. The journalist handing in a better article can submit a more inflated

expense list for reimbursement. Another vivid real-world case is reported by Zeitlin (1971:

22).

A close friend of mine, an accountant, told me of an experience he had recently when

he audited the books of a corporation. It became apparent that the office manager was

dipping into petty cash to the extent of about $2,000 a year. He reported this fact to the

25

president. The president responded, “How much are we paying him?” “Ten thousand a

year,” replied the accountant. “Then keep quiet about it,” said the president. “He’s

worth at least $15,000.”

Greenberg and Scott (1996) argue that employers pay informally rather than formally

because this is a more a flexible and timely way to reward an employee. In Appendix 1, I

report the compensation practices of a pharmaceutical manufacturer in Thailand. I find that,

consistent with the main idea in this paper, the executive pays informally both because that

method is more flexible and the informal pay helps him maintain some influence over his

employees.

For formal compensation, we generally focus on the amount of pay. For informal

compensation, in addition to the amount, an employer also needs to decide how the pay can

be transferred to an employee. The control system in an organization must be designed to

allow the informal pay. For example, Greenberg and Scott (1996) describe the controlled

theft system, where the employer allows the employee to take a certain amount of a certain

item from the workplace as part of compensation. By the word “allow”, I mean the firm

chooses not to implement an adequate control system to protect certain organizational

resources at risk. The control is weak enough to facilitate the permitted asset appropriation,

but strong enough to prevent unwanted misappropriation. Consider an example of the

inflated expense account discussed earlier. With a weak policy as to what and how much is

allowed for reimbursement, the editor has some leeway to compensate the journalist for

good work. However, the business can prevent the unwanted abuse of the expense account

by requiring management’s authorization for a large reimbursement. To change the amount

of informal pay, the employer adjusts the control system accordingly. While employees can

negotiate formal compensation, they generally cannot negotiate internal control practices. As

a result, informal compensation is less rigid and easier to change.

One of the explanations for why misappropriation is observed in workplaces, as suggested

by the “fraud” triangle theory, is that a control system effective in eliminating all

misappropriation would be too expensive. Here, I assume that any level of control is

available to the principal at no cost. I propose an explanation why the principal may choose

not to implement the costless perfect control system to eliminate all “misappropriation”.

What seems to be theft may actually be informal compensation. The control, as a result, is

weaker somewhere but stronger elsewhere.

26

In addition to control, another important issue is the “shade” of the informal pay. The

informal pay can be “white” – legal and moral (e.g. a boss paying for a birthday gift or a

party for a certain employee); “black” – illegal or immoral (e.g., “employee theft”); or

“grey” – perhaps illegal or immoral, depending on the context and the individual critics (e.g.

the “abuse” of an expense account). If the objective of the informal pay is to gain some

power over the agent, the business uses dark (grey or black) informal pay. By accepting the

pay, the employee is subject to being prosecuted for “misappropriation” or to being

condemned, if the employer discloses the “misappropriation” to the public.

Below, in Sections 4 and 5, I examine the settings where the employer pays informally due

to flexibility and power motives respectively. Section 4 focuses more on the amount of

informal compensation, while Section 5 concentrates on the “shade” of the informal

compensation and control issues.

IV. The Optimal Two-period Contract When the Performance Measure Is Verifiable

In this section, I consider the use of informal compensation due to its greater flexibility. In

the real world, the agent’s preference with respect to the non-cash compensation or even to

cash compensation may change over time. For example, the value of health insurance and

health care benefits to an employee who is diagnosed with a certain disease may increase

until the disease is cured. Cash may become more valuable to an employee who has financial

troubles. The tax law may change so that an employee may prefer one form of compensation

over the others. In addition, the cost of the non-cash compensation to the principal can

fluctuate from period to period (whether it is an opportunity cost of those resources or the

purchase price). As a result, the slope and the concavity of the utility function from the

dollars spent on the non-cash û nt change over time. The principal then optimally adjusts the

compensation scheme in each period accordingly.

In a friction-free world, the principal can change compensation schemes from period to

period according to changes in the functional form of û nt without resistance from

employees. In the real world, as time passes, the agent gathers skills and knowledge which

increase her productivity. This greater productivity then gives her some bargaining power

with respect to compensation. In practice, one way employees use their power is to resist

27

unsatisfactory changes in cash compensation or fringe benefits. In particular, it can be

difficult to decrease any component of the formal compensation (even when another

component is increased).

Theoretically, the principal can design a long-term compensation contract to avoid the

problem of the agent’s resisting changes in the compensation scheme, as discussed in

Appendix 2. However, sometimes the long-term resistance-proof contract involves paying

the agent less than her reservation utility in some periods and more than her reservation

utility in other periods. This will work only when both the principal and the agent can

commit to staying in a long-term relationship and the principal can commit to the contract

which pays more than the reservation utility in the latter period. If the agent anticipates that

the principal cannot commit to pay her more than the reservation utility in some period, she

will not accept the long-term resistance-proof contract. Also, in practice, an employer and an

employee may not be able to commit to a long-term relationship for various reasons. A

future economic recession may require the firm to lay off its employees or even to

discontinue a certain operation. In subsequent periods, production technology may change so

that the skills or knowledge the agent has acquired are no longer useful. If this is the case,

the principal is then better off firing the old agent (who will be paid more than the

reservation utility under the long-term resistance-proof contract) and hiring the new one (and

paying the new agent only at her reservation utility). On the other hand, the agent may not be

able to stay with the current employer because of a family emergency, the discovery of a

new career path, etc.

In this section, I consider a two-period setting where the principal and the agent cannot

commit to a long-term relationship. The principal can only offer a spot contract. I assume

that after working for one period, the agent gains some firm-specific skills and knowledge

that increase the expected level of productivity from x1 to x 2 , x 2 x1 . As a result, the

principal prefers to hire the same agent to work in the second period rather than the

inexperienced one, given that they are paid the same amount. In reality, in addition to the

firm-specific skills and knowledge, the agent may also gain general skills and knowledge

that can be used elsewhere, which consequently increases her reservation utility in the

second period. In the model below, for simplicity, I assume that the agent does not gain any

general skills and knowledge. (The results presented below are valid, given that the increase

28

in the reservation utility from the general skills and knowledge acquired is not very large

compared to the degree of change in unt.)

The main results are that when the difference in productivity between the experienced and

the inexperienced agent is large, and the agent’s utility with respect to cash or to the unit of

non-cash compensation shifts up so that the agent has an incentive to resist the change in

compensation plan, the principal can solve the resistance problem by paying informally. (In

fact, even when the agent does not have bargaining power in the subsequent periods, the

principal can still benefit from the use of informal compensation if the communication costs

to inform and justify the changes in formal pay are higher than those to inform and justify

the changes in informal pay.)

4.1 The Agent Cannot Resist the Change in Compensation Contracts

In this section, I make the following assumptions to simplify the analysis. First, the agent’s

utility with respect to cash is linear, but her utility with respect to the dollars spent on noncash is concave. Both the principal’s and the agent’s utilities are time-additive, and there is

no discounting. Borrowing and lending cash is thus not an issue here. Second, the non-cash

is not productive and is not available from the external market. The agent cannot save the

non-cash from one period to consume in another. Third, the unit cost of non-cash

compensation to the principal is constant and is denoted by tP, t = 1, 2. Fourth, the two

periods are independent in the sense that the period-one action does not affect the period-two

outcome, and there is no correlation between the two periods’ outcomes.

From the analysis in Section 3.1.1, the optimal spot contracts for the first and second periods

are as shown below. For, t = 1, 2,

fnt$*

such that uˆ nt ( f nt$* ) = uct(fct*) = 1 ,

fct*

=

U + v(a=0) - uˆ n ( f n$* ) , and

nt$*

=

0,

ct*

=

v/p.

The interior solution above is such that no risk premium is paid. Therefore, there is no room

for ex-post beneficial renegotiation to increase the total welfare of the two contracting

parties by removing the incentive risk after the action is taken. The principal receives the

first-best payoff in both periods. In Section 4.2 below, I relax the assumption that the agent

cannot resist the change in compensation contracts. Note that as opposed to renegotiation

29

which is beneficial ex post, resistance allows the agent to extract some wealth from the

principal. It does not increase the total welfare.

4.2 The Agent Can Resist the Change in Compensation Contracts

In this section, I examine the conditions under which the agent will resist the change in

compensation plans, if the optimal spot contracts derived in Section 4.1 are used. Then in

Section 4.3, I show how the principal can overcome resistance problems with informal

compensation.

Consider a game between the principal and the agent. At the beginning of the second period,

the principal offers a period-two spot contract specifying (fc2,

c2, fn2

$

) to the agent. The

agent then decides whether to accept the contract or to bargain. The wage bargaining is in

practice complicated, and may involve many rounds of offers and counter-offers, or even a

strike. Since we often observe employees using the preceding formal compensation practice

as a fall-back position in wage bargaining - the new compensation packages proposed should

be at least as good as the previous one - I consider a simplified strategy where the agent can

choose whether to accept the contract or to fight by pressing the principal to switch back to

the first-period contract. If the agent chooses to fight, the principal chooses whether to

accommodate by switching to the first-period contract as requested, or to fight back by firing

the old agent and hiring a new agent. The bargaining game between the principal and the

agent is as shown in Figure 2 below.

Accomodate

[ x 2 -fc1 - pc1 – 2P( fn1$/P1),

fc1 + pc1 + un2(fn1$/ 1P)]

Fight

Offer

P1

P2

Fight

[ x1 -fc2 - pc2 –fn2$- R,

U - J]

A1

Accept

[ x 2 -fc2 - pc2 – fn2$,

fc2 + pc2 + un2(fn2$/ 2P)]

Figure 2: The Wage Bargaining Game in Period 2

30

At node P2, if the principal accommodates by using the period-one spot contract, he receives

the expected outcome of x 2 , and pays the expected cash payment fc1 + pc1. Also, he

provides non-cash compensation of fn1$/P1 unit, which costs him $2P( fn1$/P1). If the

principal decides not to accommodate, he fires the experienced agent, and then hires a new

one, paying R as a recruitment cost. He receives the expected outcome of only x1 x 2

because the new agent is inexperienced. The expected amount of cash compensation paid is

fc2 + pc2. In addition, he pays non-cash compensation of fn2$/ 2P unit, which costs him $

fn2$.

Consider the optimal spot contracts derived in Section 4.1. If the principal hires another

agent, his payoff is x1 - U – v(a=1). If the principal accommodates, his payoff is x 2 - [fc1 +

pc1 + 2P( fn1$/P1)]. The principal chooses to accommodate when

2P

( x2 x1 ) R f 1 P

1

$*

n1

[uˆ n 2 ( f n$2* ) f n$2* ] [uˆ n1 ( f n$1* ) f n$1* ]

(4.1).

In other words, the principal accommodates when the difference in productivity between the

experienced and inexperienced agent and the recruitment cost are sufficiently large, and

when the cost of non-cash to the principal is decreasing, i.e., 1P > 2P.

At node A1, if the agent accepts the offer, her expected payoff is fc2 + pc2 + un2(fn2$/ 2P). If

the agent fights and the principal accommodates, her payoff is fc1 + pc1 + un2(fn1$/ 1P). If

the agent fights and the principal fires her, she finds a job which pays at her reservation

utility elsewhere. She also incurs the cost of job-finding J. The optimal contract derived in

Section 4.1 is such that the agent receives her reservation utility with (fc2*, c2*, fn2$*).

Therefore, if the agent anticipates that the principal will fight, she will not fight. If she

anticipates that the principal will accommodate, she will fight when her payoff from the

period-one spot contract is greater than that from the period-two spot contract offered, i.e.,

when

un2(fn1$*/ 1P) - un1(fn1$*/ 1P) >

0

(4.2).

Intuitively, the period-one contract pays the agent equal to her reservation utility in the first

period. In the second period, if her utility function un2 shifts up, the same quantity of noncash compensation fn1 = fn1$*/ 1P will result in higher utility. If the amount of cash payment

31

remains the same, she receives more than her reservation utility by the amount un2(fn1*) un1(fn1*). Therefore, she prefers the first-period spot contract in the second period.

At node A1, if un2(n) < un1(n) for all n R+, the agent does not prefer the first-period spot

contract to the second-period contract (whether she expects the principal to accommodate or

not). Therefore, the agent’s resistance is not a problem. At node P1, the principal can offer

the first-best spot contract for period two (derived in Section 4.1) and it will be accepted.

When un2(n) > un1(n) for all n R+, but x 2 x1 R is small so that condition (4.1) is not

true, the agent anticipates that the principal will fight. As a result, she will not fight even

though she prefers the period-one contract. Again, resistance is not a problem. The first-best

period-two spot contract will be accepted by the agent.

When un2(n) > un1(n) for all n R+ and x 2 x1 R is large9, the agent prefers the periodone contract and the principal is better off accommodating. Anticipating the principal will

accommodate, the agent will ask for the first-period contract. If the principal chooses to offer

the first-best period-one spot contract in the first-period, he will also use it in the second

period because of the agent’s resistance. Alternatively, he may want to offer other spot

contracts in both periods to minimize the damage from the agent’s resistance. Either way, his

payoff will be less than the payoff when the agent cannot resist.

If the principal and the agent can commit to a long-term relationship and the principal can

commit to a long-term contract he offers, the principal can solve this problem by decreasing

the amount of cash payment in the first-period and increasing the amount of cash payment in

the second-period, as shown in Appendix 2. Another way to solve this problem is to use

informal compensation, as discussed below.

9

When un2(n) > un1(n) for all n R+ and 1P > 2P, we have uˆ n 2 (n $ ) uˆ n1 (n $ ) for all n$ R+, which

implies that fn2$* > fn1$* and that the right-hand-side of (4.1) is positive. Condition (4.1) is true when

x 2 x1 R is large.

32

4.3 Informal Cash Compensation

In practice, formal pay is more rigid and more difficult to change. For example, unions exist

in many organizations so that a large number of employees can join forces to resist