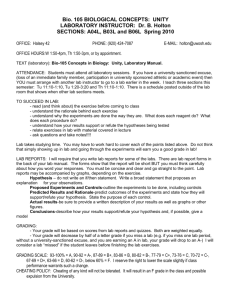

GOOG (GOOGLE INC)

advertisement

Name _____________________________ Last 4 (PSU ID) ________ First 2 letters of last name _____ Homework Assignment #1 – Econ 351 –Fall 2014 –PLEASE STAPLE, DUE, WEDNESDAY, 9/17/2014 AT THE BEGINNING OF CLASS: NO LATE HWS ACCEPTED. YOU MUST USE THIS AS A TEMPLATE – HIT ENTER TO MAKE SPACE FOR YOUR ANSWERS Please be a neat as possible, especially with graphs and please show all work. 1) (40 points total) Use the information in the following 3 Tables to answer the following questions. As is normal, we assume away all transactions costs. TABLE 1 GOOG (GOOGLE INC) 364.72 +11.00 Feb 06, 2009 @ 11:20 ET Bid 364.72 Ask 364.82 Size 2x1 Vol 2039260 Calls Last Sale Net Bid Ask Vol Open Puts Int Last Net Sale Bid Ask Vol Open Int 09 Feb 350.00 (GGD BJ-E) 21.70 +8.40 21.30 21.60 181 8056 09 Feb 350.00 (GGD NJ-E) 6.60 -3.90 6.50 6.70 178 1815 09 Feb 360.00 (GGD BL-E) 14.75 +6.55 14.50 14.80 384 5936 09 Feb 360.00 (GGD NL-E) 9.80 -5.60 9.70 9.90 481 1478 09 Feb 370.00 (GGD BN-E) 9.15 +5.05 9.00 9.30 501 5414 09 Feb 370.00 (GGD NN-E) 14.90 -7.50 14.30 14.50 46 569 09 Feb 380.00 (GOP BP-E) 5.15 +3.15 5.20 5.30 296 4972 09 Feb 380.00 (GOP NP-E) 20.10 -9.20 20.20 20.60 93 228 09 Mar 350.00 (GGD CJ-E) 28.75 +6.20 29.50 29.90 31 4685 09 Mar 350.00 (GGD OJ-E) 15.60 -3.90 14.70 15.00 20 1932 09 Mar 360.00 (GGD CL-E) 23.00 +5.60 23.30 23.60 38 3017 09 Mar 360.00 (GGD OL-E) 18.80 -5.00 18.40 18.70 22 09 Mar 360.00 (TBZ CL-E) 0 09 Mar 370.00 (GGD CN-E) 17.85 +5.25 17.80 18.20 22 3710 09 Mar 370.00 (GGD ON-E) 24.60 -5.30 23.00 23.30 11 859 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0 0 0 09 Mar 360.00 (TBZ OL-E) 0 09 Mar 370.00 (TBZ ON-E) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 631 0 09 Mar 370.00 (TBZ CN-E) 0.0 0.0 0 0 09 Mar 380.00 (GOP CP-E) 13.20 +4.30 13.30 13.50 38 2395 09 Mar 380.00 (GOP OP-E) 28.40 -8.40 28.30 28.70 6 1057 09 Mar 380.00 (TBZ CP-E) 0 0.0 0.0 0.0 0.0 0 0 09 Mar 380.00 (TBZ OP-E) 0.0 0.0 0.0 0.0 0 TABLE 2 GOOG (GOOGLE INC) 370.97 -7.80 Feb 10, 2009 @ 10:44 ET Bid 371.03 Ask 371.15 Size 1x1 Vol 1362459 Calls Last Net Sale Bid Ask Vol Open Puts Int 09 Feb 360.00 (GGD BL-E) 17.90 -6.00 18.30 18.70 37 5473 09 Feb 360.00 (GGD NL-E) Last Sale Net Bid Ask Vol Open Int 7.35 +1.95 7.20 7.40 338 2975 09 Feb 370.00 (GGD BN-E) 12.20 -4.80 12.10 12.60 131 5283 09 Feb 370.00 (GGD NN-E) 11.60 +3.40 11.00 11.40 728 2052 09 Feb 380.00 (GOP BP-E) 7.35 -3.75 7.60 7.90 250 5469 09 Feb 380.00 (GOP NP-E) 16.90 +4.40 16.30 16.70 96 852 09 Feb 390.00 (GOP BR-E) 4.35 -2.25 4.40 4.60 48 3943 09 Feb 390.00 (GOP NR-E) 24.00 +5.20 23.10 23.60 27 391 09 Mar 360.00 (GGD CL-E) 33.30 0.0 27.90 28.30 0 3277 09 Mar 360.00 (GGD OL-E) 16.10 +2.00 16.70 17.10 2 976 09 Mar 360.00 (TBZ CL-E) 0.0 0 0 0 0.0 0.0 0.0 0 09 Mar 360.00 (TBZ OL-E) 0.0 0.0 0.0 0.0 09 Mar 370.00 (GGD CN-E) 22.00 -5.00 22.10 22.50 18 3571 09 Mar 370.00 (GGD ON-E) 21.30 +3.25 20.90 21.20 13 1635 09 Mar 370.00 (TBZ CN-E) 0.0 0.0 0.0 0.0 0 0 09 Mar 370.00 (TBZ ON-E) 0.0 0.0 0.0 0.0 0 0 09 Mar 380.00 (GOP CP-E) 18.20 -2.85 17.10 17.50 29 2667 09 Mar 380.00 (GOP OP-E) 26.30 +3.70 25.80 26.20 24 1158 09 Mar 380.00 (TBZ CP-E) 0.0 0.0 0.0 0.0 0 0 09 Mar 380.00 (TBZ OP-E) 0.0 0.0 0.0 0.0 0 0 09 Mar 390.00 (GOP CR-E) 13.85 -2.85 12.90 13.20 10 2722 09 Mar 390.00 (GOP OR-E) 30.05 0.0 31.50 31.90 0 1173 09 Mar 390.00 (TBZ CR-E) 0.0 0 0.0 0.0 0.0 0.0 0 0 09 Mar 390.00 (TBZ OR-E) 0.0 0.0 0.0 0 1 TABLE 3 GOOG (GOOGLE INC) 358.04 0.0 Feb 12, 2009 @ 07:20 ET Bid 350.00 Ask 361.99 Size 1x1 Vol 0 Calls Last Open Net Bid Ask Vol Puts Sale Int Last Open Net Bid Ask Vol Sale Int 09 Feb 340.00 (GGD BE-E) 22.20 0.0 0.0 0.0 0 6062 09 Feb 340.00 (GGD NE-E) 3.70 0.0 0.0 0.0 0 4079 09 Feb 350.00 (GGD BJ-E) 13.45 0.0 0.0 0.0 0 7255 09 Feb 350.00 (GGD NJ-E) 6.50 0.0 0.0 0.0 0 4171 09 Feb 360.00 (GGD BL-E) 8.40 0.0 0.0 0.0 0 5426 09 Feb 360.00 (GGD NL-E) 10.95 0.0 0.0 0.0 0 2512 09 Feb 370.00 (GGD BN-E) 4.30 0.0 0.0 0.0 0 6163 09 Feb 370.00 (GGD NN-E) 17.00 0.0 0.0 0.0 0 2939 09 Mar 340.00 (GGD CE-E) 32.40 0.0 0.0 0.0 0 1339 09 Mar 340.00 (GGD OE-E) 13.70 0.0 0.0 0.0 0 1850 09 Mar 350.00 (GGD CJ-E) 23.90 0.0 0.0 0.0 0 4392 09 Mar 350.00 (GGD OJ-E) 16.60 0.0 0.0 0.0 0 4891 09 Mar 360.00 (GGD CL-E) 19.80 0.0 0.0 0.0 0 3195 09 Mar 360.00 (GGD OL-E) 21.45 0.0 0.0 0.0 0 1198 09 Mar 360.00 (TBZ CL-E) 0 0 0.0 0.0 0.0 0.0 0 09 Mar 360.00 (TBZ OL-E) 0.0 0.0 0.0 0.0 0 09 Mar 370.00 (GGD CN-E) 14.45 0.0 0.0 0.0 0 3768 09 Mar 370.00 (GGD ON-E) 25.80 0.0 0.0 0.0 0 1525 09 Mar 370.00 (TBZ CN-E) 0 0 0.0 0.0 0.0 0.0 0 09 Mar 370.00 (TBZ ON-E) 0.0 0.0 0.0 0.0 0 a). ( 5 points) Referring to Table 1, why the difference in the premiums on a Feb 360 call vs. the Feb 370 put? Be very specific. THE 360 CALL IS ONLY $4.72 IN THE MONEY WHERE THE 370 PUT IS $5.28 IN THE MONEY AND THUS, THE PREMIUM ON THE PUT IS HIGHER THAN THE PREMIUM ON CALL ($1490 VS. $1475 RESPECTIVELY). You and a friend are not sure of the direction Google is going to go so you both decide to play what is known in option talk as straddle(s). You decide to play a short straddle and your friend decides to play a long straddle. Please answer the following questions. b) (5 points) Referring to Table 1, suppose you played a short straddle by writing one March 360 call and one March 360 put. What is the optimal spot price at expiration and why? Explain exactly what would happen at expiration given the optimal spot price at expiration. THE OPTIMAL PRICE AT EXPIRATION IS $360 OR 'AT THE MONEY .' WHEN BOTH OPTIONS EXPIRE AT THE MONEY, THE WRITER WHO IS PLAYING THE SHORT STRADDLE SIMPLY GETS TO KEEP BOTH PREMIUMS = $1475 FOR CALL AND $980 FOR PUT. THE OPTIONS ARE WORTHLESS TO THE PERSON WHO BOUGHT THEM SINCE THEY ARE AT THE MONEY. c) (5 points) Referring to Table 1, your friend decides to play a long straddle by buying one March 360 call and one March 360 put. What is the optimal spot price at expiration and why? Explain exactly what would happen at expiration given the optimal spot price at expiration. THINK OF EXTREMES HERE - EITHER ZERO OR INFINITY. INFINITY IS WAY BETTER - YOU WOULD EXERCISE THE CALL BY BUYING ONE HUNDRED SHARES OF GOOGLE AT STRIKE PRICE = $360 AND SELL A 100 SHARES AT INFINITY!!! IF YOU CONSIDER ZERO AS THE OPTIMAL SPOT PRICE, YOUR PROFITS ARE LIMITED - BUY AT ZERO (OR DARN CLOSE TO IT) AND USE PUT TO SELL 100 SHARES AT $360 = $36,000 MINUS THE PRICE OF THE OPTIONS THAT YOU BOUGHT TO PLAY THE LONG STRADDLE. 2 d) (10 points - 5 for correct calculations and 5 for intuition) Given your short straddle bet as above, would it be better to close your position in Table 2 or Table 3? Show all work. Explain the intuition. YOU COLLECT THE PREMIUMS IN TABLE 1 = $2300 + $1880 = $ 4,180 CLOSE ON TABLE 2 BUY CALL AT $3330 AND PUT AT $1610 = $4940 LOSS OF $ 760 CLOSE ON TABLE 3 BUY CALL AT $1980 AND PUT AT $2145 = $4125 PROFIT OF $55 WHEN PLAYING A SHORT STRADDLE I AM HOPING FOR LOW VOLATILITY - I WANT THE SPOT TO REMAIN NEAR OR AT THE MONEY SO I CAN COLLECT TERM PREMIUMS. CONSIDERING TABLE 2, THE SPOT MOVED FAR FROM THE MONEY (HIGHLY VOLATILE) AND I LOST BIG TIME ON THE CALL I WROTE, NOT GOOD. ITS A MUCH HAPPIER STORY WHEN CONSIDERING TABLE 3 WHERE THE SPOT IS VERY CLOSE TO THE MONEY, CLOSER TO THE MONEY RELATIVE TO WHEN I WROTE THEM. I CLOSE AT TABLE THREE AND MAKE A PROFIT AND BENEFITED FROM THE LOW VOLATILITY e) (10 points - 5 for correct calculations and 5 for intuition) Given the long straddle played by your friend, would it be better to close his/her position in Table 2 or Table 3? Show all work. Explain the intuition. BUY THE OPTIONS AT TABLE 1 - COST = $2300 + $1,880 = $ 4, 180 CLOSE ON TABLE 2 SELL CALL AT $3330 AND PUT AT $1610 = $4940 PROFIT OF $760 CLOSE ON TABLE 3 SELL CALL AT $1980 AND PUT AT $2145 = $4125 LOSS OF $55 WHEN PLAYING A LONG STRADDLE I AM HOPING FOR HIGH VOLATILITY - I WANT THE WINNING BET TO MAKE MORE ($) THAN THE LOSING BET LOSES. CONSIDERING TABLE 2, THE SPOT MOVED FAR FROM THE MONEY (HIGHLY VOLATILE) AND I WON BIG TIME ON THE CALL I BOUGHT (PROFIT OF $1030) AND ONLY LOST $270 ON MY PUT. WHEN CONSIDERING TABLE 3, THE SPOT IS VERY CLOSE TO THE MONEY, CLOSER TO THE MONEY RELATIVE TO WHEN I BOUGHT THEM, NOT GOOD WHEN I AM BETTING ON HIGH VOLATILITY. WHEN I CLOSE AT TABLE 3 I MAKE A LOSS, MY WINNING BET WON LESS THAT MY LOSING BET LOST (MADE $ 265 ON PUT BUT LOST $ 320 ON CALL) f) (5 points) How your answers in d) and e) are related. What characteristic of options markets applies here? Explain. ZERO SUM GAME - IF THEY BOTH CLOSE ON TABLE 2, THE WRITERS LOSS IS THE BUYERS GAIN AND IF THEY CLOSE ON TABLE 3, THE WRITERS GAIN IS THE BUYERS LOSS. 3 2. (35 points total) Use the following 3 tables to answer the questions that follow. In this example, you are betting on Apple Computer (AAPL). We assume away all transactions costs and as always, use the ‘last sale’ column for your calculations. Table 1 AAPL Spot 86.07 +0.69 Jan 29, 2007 @ 14:02 ET (Data 15 Minutes Delayed) Calls Last Sale Bid 86.07 Ask 86.08 Size 6x5 Vol 23250849 Net Bid Ask Vol Open Puts Int Last Sale Net Bid Ask Vol Open Int 07 Feb 80.00 (QAA BP-E) 6.90 +0.40 6.70 6.90 518 10949 07 Feb 80.00 (QAA NP-E) 0.45 -0.15 0.45 0.50 993 67909 07 Feb 85.00 (QAA BQ-E) 3.30 +0.35 3.10 3.30 2312 32373 07 Feb 85.00 (QAA NQ-E) 1.80 -0.45 1.85 1.90 791 54682 07 Feb 90.00 (QAA BR-E) 1.15 +0.05 1.10 1.20 2620 63672 07 Feb 90.00 (QAA NR-E) 4.60 -0.80 4.80 4.90 1553 29167 07 Feb 95.00 (QAA BS-E) 0.35 68004 07 Feb 95.00 (QAA NS-E) 8.90 -0.80 9.00 9.20 32 16568 07 Mar 80.00 (QAA CP-E) 8.20 +0.10 8.10 8.20 1896 07 Mar 80.00 (QAA OP-E) 1.53 -0.07 1.50 1.55 80 14199 07 Mar 85.00 (QAA CQ-E) 5.10 +0.40 4.90 5.00 109 7754 07 Mar 85.00 (QAA OQ-E) 3.20 -0.30 3.20 3.40 86 12829 07 Mar 90.00 (QAA CR-E) 2.80 +0.30 2.65 2.75 939 11529 07 Mar 90.00 (QAA OR-E) 5.90 -0.53 6.00 6.10 90 6339 07 Mar 95.00 (QAA CS-E) 1.40 +0.10 1.30 1.35 707 22854 07 Mar 95.00 (QAA OS-E) 9.70 41 831 -- 0.30 0.40 2284 15 -- 9.70 9.80 Table 2 AAPL Spot 84.15 pc Feb 07, 2007 @ 05:33 ET (Data 15 Minutes Delayed) Calls Bid 84.24 Ask 84.39 Size 1x1 Vol 0 Last Sale Net Bid Ask Vol Open Int Puts Last Sale Net Bid Ask Vol Open Int 07 Feb 75.00 (QAA BO-E) 9.40 pc 0 0 0 8423 07 Feb 75.00 (QAA NO-E) 0.10 pc 0 0 0 18792 07 Feb 80.00 (QAA BP-E) 4.70 pc 0 0 0 11589 07 Feb 80.00 (QAA NP-E) 0.40 pc 0 0 0 63849 07 Feb 85.00 (QAA BQ-E) 1.40 pc 0 0 0 44992 07 Feb 85.00 (QAA NQ-E) 2.10 pc 0 0 0 59271 07 Feb 90.00 (QAA BR-E) 0.30 pc 0 0 0 75026 07 Feb 90.00 (QAA NR-E) 6.00 pc 0 0 0 31047 07 Mar 75.00 (QAA CO-E) 10.20 pc 0 0 0 519 07 Mar 75.00 (QAA OO-E) 0.55 pc 0 0 0 7528 07 Mar 80.00 (QAA CP-E) 6.00 pc 0 0 0 3501 07 Mar 80.00 (QAA OP-E) 1.50 pc 0 0 0 20313 07 Mar 85.00 (QAA CQ-E) 3.10 pc 0 0 0 13643 07 Mar 85.00 (QAA OQ-E) 3.60 pc 0 0 0 16993 07 Mar 90.00 (QAA CR-E) 1.40 pc 0 0 0 17418 07 Mar 90.00 (QAA OR-E) 7.70 pc 0 0 0 6193 4 Table 3 AAPL Spot 89.07 -0.44 Feb 25, 2007 @ 07:23 ET (Data 15 Minutes Delayed) Calls Bid 89.00 Ask 89.05 Size 222x3 Vol 18512199 Last Sale Net Bid Ask Vol Open Int Puts Last Sale Net Bid Ask Vol Open Int 07 Mar 80.00 (QAA CP-E) 9.50 pc 0 0 0 7128 07 Mar 80.00 (QAA OP-E) 0.18 pc 0 0 0 28225 07 Mar 85.00 (QAA CQ-E) 5.00 pc 0 0 0 31825 07 Mar 85.00 (QAA OQ-E) 0.69 pc 0 0 0 32518 07 Mar 90.00 (QAA CR-E) 1.80 pc 0 0 0 63517 07 Mar 90.00 (QAA OR-E) 2.55 pc 0 0 0 12632 07 Mar 95.00 (QAA CS-E) 0.50 pc 0 0 0 36470 07 Mar 95.00 (QAA OS-E) 6.10 pc 0 0 0 4840 07 Apr 80.00 (QAA DP-E) 10.50 pc 0 0 0 22325 07 Apr 80.00 (QAA PP-E) 0.85 pc 0 0 0 33147 07 Apr 85.00 (QAA DQ-E) 6.90 pc 0 0 0 40127 07 Apr 85.00 (QAA PQ-E) 1.90 pc 0 0 0 52241 07 Apr 90.00 (QAA DR-E) 3.70 pc 0 0 0 67784 07 Apr 90.00 (QAA PR-E) 4.00 pc 0 0 0 29874 07 Apr 95.00 (QAA DS-E) 1.90 pc 0 0 0 67807 07 Apr 95.00 (QAA PS-E) 7.20 pc 0 0 0 19907 a) (5 points) Use Table 1 to answer this question. Suppose you purchase a Feb 80 call and exercise it immediately, how much money would you make or lose? Show all work. COST OF OPTION (PREMIUM) = $ 690, BUY 100 SHARES AT $80 = $8,000 TOTAL COST = $8,690 SELL AT SPOT = 100 x $86.07 = $8,607 = REVENUE LOSS = $83 b) (5 points) Use Table 2 to answer this question. Assume that we freeze the spot as it is in Table 2, Feb 07, until the March options expires. On the same diagram, plot the evolution of the term premium for the March 85 put and the March 90 put. Please label your diagram completely making sure you clearly indicate which option each line represents. 5 (25 points for completely labeled graph – 5 points off for each blemish!) Suppose you are bullish on Apple and purchase ten Feb 80 calls (use Table 1). As we did in class, graphically illustrate the profit/loss function of the Feb 80 calls that you purchased on Jan 29 (Table 1), clearly labeling the out of the money spot, at the money spot, in the money spot, and the break even point (this is all relative to the Feb 80 call in Table 1). Label the horizontal line in your graph as spot at expiration and have the vertical axis as the profit/loss under each scenario (just like we did in class). Please consider the following 3 scenarios: Scenario 1): the spot price of Apple stays the same as in Table 1 and your options expire. Locate this point on your diagram as point A, clear labeling the profit or loss associated with this scenario. Show all work. Scenario 2): the options expire with the spot price of Apple on Table 2 and your position is closed (either you exercise your options, sell them, or rip them up, which ever is best for you). Locate the specific profit or loss on your diagram and label as point B. Show all work. Scenario 3): the options expires with the spot price of Apple on Table 3 and your position is closed (either you exercise your options, sell it, or rip them up, which ever is best for you). Locate the specific profit or loss on your diagram and label as point C. Show all work. 6 3. (45 points total) Use the following 3 tables to answer the questions that follow. In this example, you are betting on Google (GOOG). We assume away all transactions costs and as always, use the ‘last sale’ column for your calculations. Table 1 GOOG (GOOGLE INC) 370.97 -7.80 Feb 04, 2009 @ 10:44 ET Bid 371.03 Ask 371.15 Size 1x1 Vol 1362459 Calls Last Net Sale Bid Ask Vol Open Puts Int Last Sale 09 Feb 360.00 (GGD BL-E) 17.90 -6.00 18.30 18.70 37 5473 09 Feb 360.00 (GGD NL-E) Net Bid Ask Vol Open Int 7.35 +1.95 7.20 7.40 338 2975 09 Feb 370.00 (GGD BN-E) 12.20 -4.80 12.10 12.60 131 5283 09 Feb 370.00 (GGD NN-E) 11.60 +3.40 11.00 11.40 728 2052 09 Feb 380.00 (GOP BP-E) 7.35 -3.75 7.60 7.90 250 5469 09 Feb 380.00 (GOP NP-E) 16.90 +4.40 16.30 16.70 96 852 09 Feb 390.00 (GOP BR-E) 4.35 -2.25 4.40 4.60 48 3943 09 Feb 390.00 (GOP NR-E) 24.00 +5.20 23.10 23.60 27 391 09 Mar 360.00 (GGD CL-E) 33.30 0.0 27.90 28.30 0 3277 09 Mar 360.00 (GGD OL-E) 16.10 +2.00 16.70 17.10 2 09 Mar 360.00 (TBZ CL-E) 0.0 0 0 0 09 Mar 370.00 (GGD CN-E) 22.00 -5.00 22.10 22.50 18 3571 09 Mar 370.00 (GGD ON-E) 21.30 +3.25 20.90 21.20 13 1635 09 Mar 370.00 (TBZ CN-E) 0.0 0 1173 09 Mar 390.00 (TBZ CR-E) 0.0 0 0 0 09 Mar 390.00 (TBZ OR-E) 0.0 0.0 0.0 0 0 0.0 0.0 0.0 31.50 31.90 0.0 0.0 0.0 976 09 Mar 390.00 (GOP CR-E) 13.85 -2.85 12.90 13.20 10 2722 09 Mar 390.00 (GOP OR-E) 30.05 0.0 0 09 Mar 380.00 (TBZ OP-E) 0.0 0.0 0 0.0 0 0 09 Mar 370.00 (TBZ ON-E) 0.0 0.0 0.0 0.0 0 0.0 1158 0.0 0.0 0.0 09 Mar 380.00 (GOP CP-E) 18.20 -2.85 17.10 17.50 29 2667 09 Mar 380.00 (GOP OP-E) 26.30 +3.70 25.80 26.20 24 0.0 0.0 0 09 Mar 360.00 (TBZ OL-E) 0 0.0 0.0 0.0 0 09 Mar 380.00 (TBZ CP-E) 0.0 0.0 0.0 0.0 Table 2 GOOG (GOOGLE INC) 353.72 +10.72 Feb 06, 2009 @ 16:19 ET Bid 352.36 Ask 352.87 Size 4x1 Vol 7228281 Calls Last Sale Net Bid Ask Vol Open Puts Int 09 Feb 340.00 (GGD BE-E) 19.70 +5.90 19.70 20.60 618 6708 09 Feb 340.00 (GGD NE-E) Last Net Sale Bid Ask Vol Open Int 7.05 -3.85 6.90 7.20 1058 1948 09 Feb 350.00 (GGD BJ-E) 13.30 +4.70 13.20 13.50 762 7832 09 Feb 350.00 (GGD NJ-E) 10.50 -5.00 10.20 10.70 434 1181 09 Feb 360.00 (GGD BL-E) 8.20 +3.20 8.20 8.60 742 5867 09 Feb 360.00 (GGD NL-E) 15.40 -5.00 14.70 15.50 186 09 Feb 370.00 (GGD BN-E) 4.10 +1.25 4.40 4.70 558 5037 09 Feb 370.00 (GGD NN-E) 21.80 -7.20 20.80 21.70 80 451 09 Mar 340.00 (GGD CE-E) 29.00 +5.20 28.30 29.30 49 1325 09 Mar 340.00 (GGD OE-E) 16.20 -3.00 15.40 16.00 26 1481 09 Mar 350.00 (GGD CJ-E) 22.55 +4.65 22.30 23.20 78 4633 09 Mar 350.00 (GGD OJ-E) 19.50 -4.60 19.20 19.90 60 1820 09 Mar 360.00 (GGD CL-E) 17.40 +3.10 17.00 17.70 120 2685 09 Mar 360.00 (GGD OL-E) 23.80 -5.30 23.80 24.50 34 591 09 Mar 360.00 (TBZ CL-E) 0.0 0.0 0 0 09 Mar 370.00 (GGD CN-E) 12.60 +1.50 12.60 13.20 132 3634 09 Mar 370.00 (GGD ON-E) 29.90 -2.00 29.10 30.00 9 859 09 Mar 370.00 (TBZ CN-E) 0 0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0 0 0 09 Mar 360.00 (TBZ OL-E) 0 09 Mar 370.00 (TBZ ON-E) 0.0 0.0 0.0 0.0 0.0 961 0.0 0.0 7 Table 3 GOOG (GOOGLE INC) 364.72 +11.00 Feb 10, 2009 @ 11:20 ET Bid 364.72 Ask 364.82 Size 2x1 Vol 2039260 Calls Last Sale Net Bid Ask Vol Open Puts Int Last Net Sale Bid Ask Vol Open Int 09 Feb 350.00 (GGD BJ-E) 21.70 +8.40 21.30 21.60 181 8056 09 Feb 350.00 (GGD NJ-E) 6.60 -3.90 6.50 6.70 178 1815 09 Feb 360.00 (GGD BL-E) 14.75 +6.55 14.50 14.80 384 5936 09 Feb 360.00 (GGD NL-E) 9.80 -5.60 9.70 9.90 481 1478 09 Feb 370.00 (GGD BN-E) 9.15 +5.05 9.00 9.30 501 5414 09 Feb 370.00 (GGD NN-E) 14.30 -7.50 14.30 14.50 46 569 09 Feb 380.00 (GOP BP-E) 5.15 +3.15 5.20 5.30 296 4972 09 Feb 380.00 (GOP NP-E) 20.10 -9.20 20.20 20.60 93 228 09 Mar 350.00 (GGD CJ-E) 28.75 +6.20 29.50 29.90 31 4685 09 Mar 350.00 (GGD OJ-E) 15.60 -3.90 14.70 15.00 20 1932 09 Mar 360.00 (GGD CL-E) 23.00 +5.60 23.30 23.60 38 3017 09 Mar 360.00 (GGD OL-E) 18.80 -5.00 18.40 18.70 22 631 09 Mar 360.00 (TBZ CL-E) 0 0 09 Mar 370.00 (GGD CN-E) 17.85 +5.25 17.80 18.20 22 3710 09 Mar 370.00 (GGD ON-E) 24.60 -5.30 23.00 23.30 11 859 09 Mar 370.00 (TBZ CN-E) 0.0 0.0 0.0 0 0 0.0 0.0 0.0 09 Mar 380.00 (TBZ CP-E) 0.0 0.0 0.0 0 0 09 Mar 380.00 (TBZ OP-E) 0.0 0.0 1057 0 0 09 Mar 370.00 (TBZ ON-E) 0.0 6 0.0 0 0 09 Mar 360.00 (TBZ OL-E) 0 0.0 0.0 0 0.0 0.0 0.0 0.0 09 Mar 380.00 (GOP CP-E) 13.20 +4.30 13.30 13.50 38 2395 09 Mar 380.00 (GOP OP-E) 28.40 -8.40 28.30 28.70 0.0 0.0 0.0 0.0 0.0 You are bearish on Google and are contemplating three bearish bets: 1) shorting 100 shares of Google, 2) buying Google option puts, 3) writing Google option calls. Please show all work. a) (5 points) Suppose you short 100 shares of Google (Table 1) and close your position at Table 2. What is your profit/ loss? In your answer, be sure to explain the mechanics of shorting a stock. WHEN SHORTING STOCKS, YOU BORROW THEM, SELL THEM IMMEDIATELY AND YOUR DEBT IS IN STOCKS - YOU WANT PRICES TO FALL SO THAT YOU CAN BUY THEM BACK AT A LOWER COST, SQUARE UP YOUR DEBT, AND KEEP THE PROCEEDS AS PROFIT. TOTAL REVENUE 100 X $ 370.97 = $37,097 BUY BACK SHARES (COSTS) 100 X $353.72 = $35,372 PROFIT = $ 1,725 b) (5 points) Rather than shorting Google, you decide to buy a Feb 370 put (Table 1) and close on Feb 6 (Table 2). What is your profit/loss and rate of return? COST OF PUT $1,160 SELL PUT = $ 2,180 PROFIT = $ 1,020 RATE OF RETURN = $ 1,020 / $1,160 = 87.93% c) (5 points) You write a Feb 370 call (Table 1) and close on Feb 6 (Table 2). What is your profit/loss.? COLLECT PREMIUM = $ 1,220 BUY BACK OPTION TO CLOSE = $ 410 PROFIT = $ 810 8 (30 points total) In the space below, we are going to plot two profit functions on the same graph: one for the buyer of the Feb 370 put and one for the writer of the Feb 370 put. We open these positions on Feb 4 (Table 1). Scenario 1): the spot price of Google stays the same as in Table 1 and the option expires. Locate these two points (one for buyer of put and one for writer of put) and label as points A, clearly labeling the profit or loss for each. Show all work. Scenario 2): the spot price of Google stays the same as in Table 2 and the option expires. Locate these two points (one for buyer of put and one for writer of put) and label as points B, clearly labeling the profit or loss for each. Show all work. Scenario 3): the spot price of Google stays the same as in Table 3 and the option expires. Locate these two points (one for buyer of put and one for writer of put) and label as points C, clearly labeling the profit or loss for each. Show all work. Be sure to label the break even point. 9