Chapter Seven

advertisement

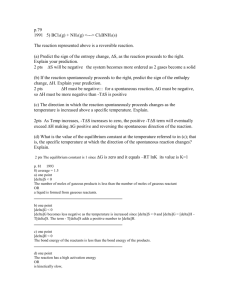

Chapter Seven Option Greeks Multiple Choice 1. Jones and Smith each own 100 shares of ZYX stock (currently selling for $60). Jones writes a MAY 65 call, while Smith writes a MAY 70 call. These are the only ZYX option positions the two people have. Which of the following statements is most correct? a. Jones has a higher position delta in ZYX. b. Smith has a higher position delta in ZYX. c. Jones and Smith have the same position delta in ZYX. d. You cannot determine which person has the highest position delta in ZYX without more information about ZYX stock. ANSWER: B 2. Jones and Smith each own 100 shares of ZYX stock (currently selling for $60). Jones writes a MAY 65 call, while Smith writes a MAY 70 put. These are the only ZYX option positions the two people have. Which of the following statements is most correct? a. Jones has a higher position delta in ZYX. b. Smith has a higher position delta in ZYX. c. Jones and Smith have the same position delta in ZYX. d. You cannot determine which person has the highest position delta in ZYX without more information about ZYX stock. ANSWER: B 3. Jones and Smith each own 100 shares of ZYX stock (currently selling for $60). Jones writes a MAY 65 put, while Smith writes a MAY 70 put. These are the only ZYX option positions the two people have. Which of the following statements is most correct? a. Jones has a higher position delta in ZYX. b. Smith has a higher position delta in ZYX. c. Jones and Smith have the same position delta in ZYX. d. You cannot determine which person has the highest position delta in ZYX without more information about ZYX stock. ANSWER: B 4. Which of the following statements is true? a. Theta is positive for all option positions. b. Gamma is always opposite in sign to theta. b. Delta is positive for all call option positions. b. Common stock has a delta of zero. ANSWER: B 98 Chapter 7. Option Greeks 5. The biggest single disadvantage of writing puts is a. positive gamma. b. the risk of a stable market. b. high transaction costs. b. the risk of a falling market. ANSWER: D 6. Which of the following probably has the lowest delta? a. write in-the-money calls b. write puts b. buy calls and write calls with a higher striking price b. buy out-of-the-money puts and write puts with a higher striking price ANSWER: A 7. Which of the following statements is true? a. Stock has a positive gamma. b. Time value can only increase. b. The delta of an in-the-money call increases with time. b. Stock has a negative theta. ANSWER: C 8. Which of the following strategies probably has the highest delta? a. Buy a call, write a call with a higher striking price. b. Buy a call, write a put. b. Write a call, write a put. b. Write a call, buy a put. ANSWER: B 9. A person expects the market to decline sharply in the near future. This person wants a. positive delta, positive gamma. b. positive delta, negative gamma. b. negative delta, positive gamma. b. negative delta, negative gamma. ANSWER: D 10. Which of the following conceivably could be a delta neutral position? a. long APR 40 calls b. long APR 40 calls, long MAY 45 calls b. long APR 40 calls, short MAY 45 puts b. long APR 40 calls, short MAY 45 calls ANSWER: D 99 Chapter 7. Option Greeks 11. Which of the following statements is true regarding an in-the-money call option, everything else being equal? a. As time passes its delta will approach one. b. As time passes its value will approach zero. c. As time passes its theta will remain constant. d. As time passes its intrinsic value will decline. ANSWER: A 12. Delta is the a. theoretical value of an option. b. expected change in the option value as the underlying asset price changes. c. intrinsic value of the option. d. influence of dividends on the option value ANSWER: B 13. Delta enables the portfolio manager to determine a. the number of options necessary to mimic the returns of the underlying security. b. the number of options necessary to reduce the risk of the underlying portfolio by half. c. the number of options necessary to double the portfolio return per unit of risk d. the standard deviation of the portfolio returns. ANSWER: A 14. For a call option, delta is always a. greater than one. b. less than one. c. less than one and greater than zero. d. less than or equal to zero. ANSWER: A 15. For a call option, delta _____ as the striking price _____. a. increases, increases b. decreases, increases c. increases, approaches the stock price d. decreases, approaches the stock price ANSWER: B 16. For at-the-money European puts and calls on the same stock, a. the put delta is always less than the call delta. b. the put delta is always equal to the call delta. c. the put delta is always greater than the call delta. d. the put delta is always less than or equal to the call delta. ANSWER: A 100 Chapter 7. Option Greeks 17. A portfolio contains 10,000 shares of XYZ stock; the portfolio manager writes 10 XYZ calls. If the call delta is 0.455, what is the position delta? a. 455 b. 545 c. 9,545 d. Cannot be determined ANSWER: C 18. A portfolio contains 1,000 shares of XYZ stock; the portfolio manager buys 10 XYZ puts. If the put delta is –0.220, what is the position delta? a. 220 b. 780 c. 10,220 d. Cannot be determined ANSWER: B 19. An ABC JUN 45, European style call has a delta of 0.445; what is the delta of an ABC JUN 45 put? a. 0.445 b. 0.555 c. –0.555 d. –0.445 ANSWER: C 20. All of the following will lower position delta except a. buying puts b. buying calls c. writing calls d. selling stock ANSWER: B True/False 1. Vega measures the sensitivity of the option premium to changes in the anticipated volatility of the underlying asset. ANSWER: T 2. Vega is the most linear of the option pricing model derivatives. ANSWER: T 101 Chapter 7. Option Greeks Short Answer/Problem Use R = 3%, S = 354, and σ = 20% in Problems 1 and 2. 1. Using the CBOE Options Calculator, prepare a delta table for 90-day, American style options with striking prices of 350, 355, and 360. ANSWER: Call Delta Put Delta Striking Price 355 0.540 0.471 350 0.594 0.415 360 0.485 0.528 2. Repeat Problem 1 for European exercise style. ANSWER: Call Delta Put Delta Striking Price 355 0.538 0.462 350 0.594 0.406 360 0.482 0.518 3. Fill in the blanks with the appropriate letter: ANSWER: Positive delta, positive gamma Positive delta, negative gamma Negative delta, positive gamma Negative delta, negative gamma B a) long put C b) long call A c) short put D d) short call 4. Suppose you buy 25 90-day 350 call contracts and write 25 90-day 360 call contracts. What is your a. position delta? b. position gamma? c. position theta? 102 Chapter 7. Option Greeks ANSWERS: a. Position delta: 350 Calls: 25 x 100 x 0.594 = 1,485.0 360 Calls: 25 x 100 x 0.485 = 1,212.5 272.5 b. Position gamma: (using the CBOE options calculator) 350 Calls: 25 x 100 x 0.011 = 27.5 360 Calls: 25 x 100 x 0.011 = 27.5 0 c. Position theta: (using the CBOE options calculator) 350 Calls: 25 x 100 x (0.092) = 230 360 Calls: 25 x 100 x (0.092) = 230 0 5. After 15 days, the stock price has increased by 3%. Update the following position statistics. a. Position delta b. Position gamma c. Position theta New derivatives: Option 350 call 360 call ANSWERS: a. Delta 0.709 0.599 Gamma 0.01 0.011 Theta 0.093 0.103 Position delta: 350 Calls: 25 x 100 x 0.709 = 1,772.5 360 Calls: -25 x 100 x 0.599 = 1,497.5 275 b. Position gamma: (using the CBOE options calculator) 350 Calls: 25 x 100 x 0.010 = 25.0 360 Calls: -25 x 100 x 0.011 = 27.5 2.5 c. Position theta: (using the CBOE options calculator) 350 Calls: 25 x 100 x (-0.093) = 232.5 360 Calls: -25 x 100 x (-0.103) = 257.5 25 103 Chapter 7. Option Greeks 6. Suppose someone owns 5,000 shares of a $60 stock. They also have written 25 of the $70 calls, 25 of the $65 calls, and have purchased 75 of the $60 puts. Write a paragraph about the position risk. That is, explain the consequences of a large market movement up or down. ANSWER: If the market declines substantially, the calls go to zero, which is okay. The stock is protected by the puts, plus there are an additional 25 long put contracts. This portfolio would benefit substantially from a large decline in the stock price. If the market advances, the stock will be called away and the puts will expire worthless. There will not be a disastrous loss, but there will be no profit either. 7. Suppose you wanted to spend $20,000 on a delta neutral 355 straddle with 90-day options. (See the initial conditions above.) Based on Black-Scholes values, how many put and call contracts would you buy? ANSWER: The theoretical call and put values are $14.84 and $13.46, respectively. 1) 2) 3) 4) 5) 6) .540C - .471P = 0 $14.874 + $13.46P = $20,000 from 1), C = 0.8722P substitute 3) into 2) $14.84(.8722P) + $13.46P = $20000 P = 757.48 Substitute 5) into 1, C = 660.67 Rounding to whole contracts, P = 8 and C = 7. This overshoots the $20,000 mark somewhat, so it may be better to round one or both contracts down. 8. In Problem 7, suppose that after two days the stock has risen 7/8. Has the position delta increased, decreased, or remained the same? ANSWER: A rising underlying stock price will cause both the put and the call delta to increase. (The passage of time will have a modest effect of delta, but the stock change will overwhelm the time effect.) The position delta will increase. 9. A portfolio contains 125 contracts of XYZ JUN 50 call options (European style), which sell for $3 and have a delta of 0.520. How Many JUN 50 put contracts (selling for $2) must you buy to be approximately delta neutral? ANSWER: Call deltas = 125 x 100 x 0.520 = 6,500 Put delta = -0.480 6,500/0.480 = 13,542 135 contracts 104 Chapter 7. Option Greeks 10. A portfolio contains 2,500 shares of ABC common stock. You calculate the following information: Option JUL 40 call JUL 35 put Price 1 3/4 7/8 Delta 0.534 -0.312 Theta 0.03 0.02 You decide to write the JUL 40 calls and buy the JUL 35 puts so as to be approximately delta neutral AND so as to have essentially no cash outflow. How may of each option would you buy or write? (You are not concerned about whether the calls are covered or not.) ANSWERS: .534C - .312P + 2500 = 0 1.75C .875P = 0 1.75C = .875P C = 0.5P .534P (.5P) .312P + 2500 = 0 -.579P = 2500 P = 4317.79 C = 2158.89 P = 43 contracts and C = 22 contracts 11. Another portfolio contains 12,000 shares of ABC stock. How many JUL 40 call contracts must the portfolio manager write to remove half of the market risk of ABC stock? ANSWER: You need to remove 6,000 deltas. 6000/.534 = 11,236 112 contracts 12. Fill in the table with +, -, 0, or inconclusive: Delta Gamma Theta Buy 100 shares Buy 100 shares, write 1 call Buy 100 shares, write 1 put Write 1 call, write 1 put Buy 100 shares, buy 1 put 105 Chapter 7. Option Greeks ANSWER: Buy 100 shares Buy 100 shares, write 1 call Buy 100 shares, write 1 put Write 1 call, write 1 put Buy 100 shares, buy 1 put Delta + + Gamma 0 - Theta 0 + + - + Inconclusive - + + + - 13. A JAN 80 XYZ European call has a delta of 0.550 and a gamma of 0.0180. What are a) the position delta, and b) the position gamma of a long straddle composed of one call contract and one put contract? (No information is missing from this problem.) ANSWERS: a. 100 x 0.550 = 55.0 100 x (.550 – 1) = 45.0 10.0 b. 100 x 0.0180 = 1.80 100 x 0.0180 = 1.80 3.60 14. A 3-month call has a delta of 0.545. What is the approximate delta of a long straddle composed of ten of these call contracts and twelve put contracts? ANSWER: Calls: 10 x 100 x 0.545 = 545 Puts: 12 x 100 x (.545 – 1) = 546 1 15. A call option is currently in-the-money. Explain how its delta will change if a. time passes b. the underlying asset declines in value c. the stock splits two for one ANSWERS: a. It rises and approaches 1.0. b. It declines. c. No change 106 Chapter 7. Option Greeks 16. You hear someone say, “We do not write uncovered options, so our gamma is always positive.” Explain this statement, and state whether you agree or disagree with it. ANSWER: This statement is not true. If you write a covered call you will still have a negative gamma. Short options always have a negative gamma. 17. Portfolio A and portfolio B both have a positive delta and a negative gamma, but one is quite conservative while the other is quite speculative. Make up an example showing how this could be the case. ANSWERS: Write a put gamma < 0, delta > 0 This is speculative. Write a covered call gamma <0, delta > 0 This is conservative. 18. State whether the following statement is true or false, and explain: “In the long run, continuously writing covered calls reduces both the expected return and the risk of a stock position.” ANSWER: This is true. You simultaneously reduce downside risk and volatility, plus you forfeit large positive returns. 107