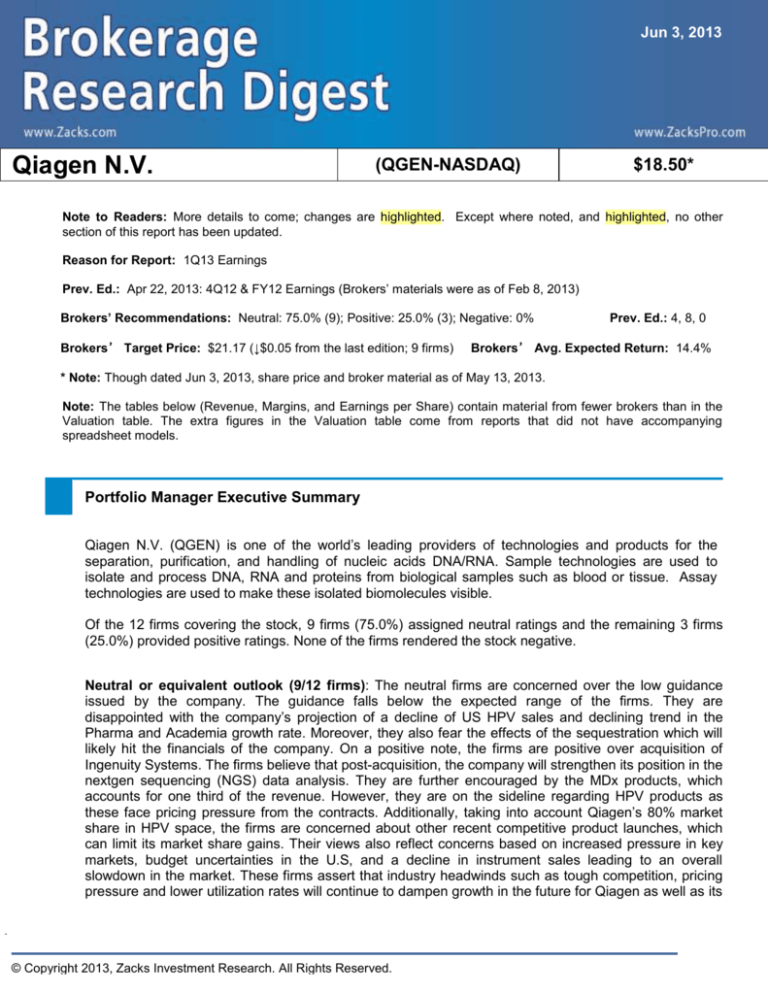

Jun 3, 2013

Qiagen N.V.

(QGEN-NASDAQ)

$18.50*

Note to Readers: More details to come; changes are highlighted. Except where noted, and highlighted, no other

section of this report has been updated.

Reason for Report: 1Q13 Earnings

Prev. Ed.: Apr 22, 2013: 4Q12 & FY12 Earnings (Brokers’ materials were as of Feb 8, 2013)

Brokers’ Recommendations: Neutral: 75.0% (9); Positive: 25.0% (3); Negative: 0%

Brokers’ Target Price: $21.17 (↓$0.05 from the last edition; 9 firms)

Prev. Ed.: 4, 8, 0

Brokers’ Avg. Expected Return: 14.4%

* Note: Though dated Jun 3, 2013, share price and broker material as of May 13, 2013.

Note: The tables below (Revenue, Margins, and Earnings per Share) contain material from fewer brokers than in the

Valuation table. The extra figures in the Valuation table come from reports that did not have accompanying

spreadsheet models.

Portfolio Manager Executive Summary

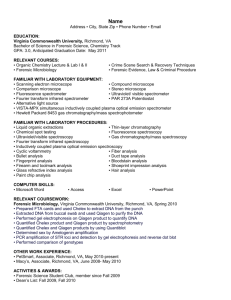

Qiagen N.V. (QGEN) is one of the world’s leading providers of technologies and products for the

separation, purification, and handling of nucleic acids DNA/RNA. Sample technologies are used to

isolate and process DNA, RNA and proteins from biological samples such as blood or tissue. Assay

technologies are used to make these isolated biomolecules visible.

Of the 12 firms covering the stock, 9 firms (75.0%) assigned neutral ratings and the remaining 3 firms

(25.0%) provided positive ratings. None of the firms rendered the stock negative.

Neutral or equivalent outlook (9/12 firms): The neutral firms are concerned over the low guidance

issued by the company. The guidance falls below the expected range of the firms. They are

disappointed with the company’s projection of a decline of US HPV sales and declining trend in the

Pharma and Academia growth rate. Moreover, they also fear the effects of the sequestration which will

likely hit the financials of the company. On a positive note, the firms are positive over acquisition of

Ingenuity Systems. The firms believe that post-acquisition, the company will strengthen its position in the

nextgen sequencing (NGS) data analysis. They are further encouraged by the MDx products, which

accounts for one third of the revenue. However, they are on the sideline regarding HPV products as

these face pricing pressure from the contracts. Additionally, taking into account Qiagen’s 80% market

share in HPV space, the firms are concerned about other recent competitive product launches, which

can limit its market share gains. Their views also reflect concerns based on increased pressure in key

markets, budget uncertainties in the U.S, and a decline in instrument sales leading to an overall

slowdown in the market. These firms assert that industry headwinds such as tough competition, pricing

pressure and lower utilization rates will continue to dampen growth in the future for Qiagen as well as its

th

© Copyright 2013, Zacks Investment Research. All Rights Reserved.

peers. However, any increase in the company’s market share might be comforting for these firms.

Therefore, they believe that Qiagen’s moderate growth rate will fail to boost investor confidence.

Positive or equivalent outlook (3/12 firms): In spite of the company falling marginally short of the

estimates and lowering of its guidance, positive firms are encouraged by the company’s product line in

future. The firms believe that the product line will act as a catalyst for the company’s growth.

Additionally, they firmly believe that the latent TB testing (QuantiFERON) and QIAsymphony uptake will

continue driving the company’s revenue. The firms are also positive on KRAS tests, as well as, HPV

products. Though HPV products are on a declining trend in the U.S., on an international basis, the

product has been performing strongly. They expect Qiagen to exhibit further growth by QIAsymphony

placements and with product offerings such as the QIAensemble series in fast growing markets. They

are also encouraged with the strategic acquisitions executed by Qiagen, the most recent one being

Ingenuity Systems. These firms are also bullish as they expect expansion in newer markets to drive

growth in the long-term. The firms believe that after a year of underperformance compared to its

competitors, the company’s cost cutting initiatives along with the potential for capital deployment will

improve Qiagen’s performance going ahead.

Jun 3, 2013

Overview

Based in Venlo, the Netherlands, Qiagen N.V. (QGEN or the company) is a leading provider of

innovative technologies and products for pre-analytical sample preparation and molecular diagnostics

solutions. It has developed a comprehensive portfolio of more than 500 proprietary, consumable

products, and automated solutions for sample collection. The company specializes in nucleic acid and

protein handling, separation, and purification. It also supplies diagnostic kits, tests, and assays for

human and veterinary molecular diagnostics. The company also offers customized services such as

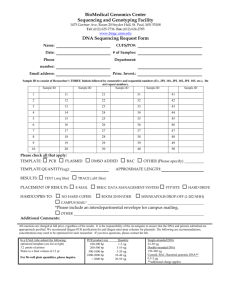

whole genome amplification services, deoxyribonucleic acid (DNA) sequencing, and non-cGMP DNA

production on a contract basis. Qiagen has subsidiaries in the U.S., Germany, U.K., Switzerland,

France, Japan, China, Australia, Canada, Norway, and several other countries with good sales potential.

Qiagen has established a presence in China with about 350 employees. In 2011, it created a new

subsidiary in India, one of the world’s fastest-growing healthcare markets. The company derives bulk of

its revenue from Europe, the U.S, and Japan. Its website is www.qiagen.com.

On May 3, 2012, Qiagen acquired Boston-based privately-owned company AmniSure International.

Through the acquisition, Qiagen will have access to AmniSure’s proprietary diagnostic test AmniSure

assay, which determines rupture of fetal membranes (ROM) in pregnant women.

Zacks Investment Research

Page 2

www.zackspro.com

The analysts identified the following factors for evaluating the investment merits of Qiagen:

Key Positive Arguments

Key Negative Arguments

The firms believe that growth will be regained by positive Qiagen experiences tough competition in various key markets

uptake of the QIAsymphony RGQ instrument and the from major giants like Sigma-Aldrich corporation, Roche

QIAensemble series.

Diagnostics GmbH and Gen-Probe Inc.

All of these

competitors are in continuous process of seeking regulatory

approvals for their respective products, a successful execution

of which may affect growth of Qiagen.

Qiagen is acquiring several companies to expand its

product portfolio, the latest being Ingenuity Systems.

Moreover, it creates innovative technologies to address

new markets with substantial potential. These new

markets include functional genomics, proteomics,

molecular diagnostics, and gene therapy, which are

expected to grow rapidly in the future.

The gradual improvement in domestic HPV testing volume

even amidst a tough macro-economic scenario is

encouraging

The high growth in the DNA/RNA isolation and purification

market attracts a number of competitors, which could be a

threat to Qiagen.

The company is expanding into new markets, which in turn,

could lead to substantial increase in expenses and risks.

Note: The company’s fiscal references coincide with the calendar year.

Jun 3, 2013

Long-Term Growth

The key attraction of Qiagen's business model is the impressive resilience of its organic growth. Within

Qiagen's "4 P" framework (Prevention, Profiling, Point of Care and Personalized Healthcare), HPV

testing belongs to the prevention category (cervical cancer). Profiling includes amongst other things,

testing for infectious diseases. Point of Care testing will help to expand into less sophisticated emerging

markets and includes testing of HPV and hospital acquired infections (HAI). Personalized healthcare is

an area that Qiagen is currently trying to build into an industry-leading business.

Qiagen has taken advantage of its almost monopolistic position in nucleic acid handling and purification

domain to drive sales growth in emerging high-growth areas such as molecular diagnostics (usually

pathogen testing) and applied testing (such as forensics). The molecular diagnostics market is expected

to remain the major growth driver going forward. The company’s initiatives (e.g. personalized

healthcare) to build on its position in the growing molecular diagnostics market, not only strengthens its

market position, but also allows it to leverage its existing global sales and marketing infrastructure.

However, for the past few quarters, the company has been experiencing softer growth due to budget

constraints at hospitals, looming regulatory reforms, and possible business risks surrounding gene

patents. In addition, recent sales results were disappointing owing to weak organic sales growth in a

challenging academic environment both in North America and Europe. Yet, the firms consider these

challenges to be short lived and expect the company to gain traction in the near term.

Qiagen’s long-term business strategy involves entering into strategic alliances as well as marketing and

distribution arrangements with academic, corporate and other partners relating to the development,

commercialization, marketing and distribution of certain existing and potential products. Qiagen has

historically expanded its reach and technological portfolio through acquisitions and alliances, and is

looking for continued investment in the future. Its acquisition strategy remains focused and consistent,

looking to add complementary technologies, new commercial capabilities and/or extend geographical

reach. Additionally, Qiagen is also working on a number of partnerships with the pharmaceutical

industry, particularly in the area of oncology. The firms view Qiagen as a good long-term player in

genetic analysis (research and applied markets) as well as molecular diagnostics (clinical market).

Jun 3, 2013

Zacks Investment Research

Page 3

www.zackspro.com

Target Price/Valuation

Rating Distribution

Positive

Neutral

Negative

Avg. Target Price

Digest High

Digest Low

No. of the analyst with Target

Price/Total Analyst

Upside from current

Maximum Upside from current

Minimum Downside from current

25.0%↓

75.0%↓

0.00%

$21.17↓

$26.00

$18.00

9/12

14.4%

40.5%

2.7%

Risks to attainment of the price target include softness in customer budgets (e.g. public funding, hospital

capital equipment budgets), market share erosion, and less-than-anticipated penetration in the HPV

market, dilutive acquisitions, integration risks, and currency fluctuations.

Recent Events

On Apr 29, 2013, Qiagen reported its 1Q13 results. Highlights are as follows:

The company reported EPS of $0.08 in 1Q13 compared with $0.12 in 1Q12. However,

adjusted EPS came in at $0.23, flat y/y.

In 1Q13, revenues increased 2% y/y to $303.6 million (up 3% at constant exchange rates or

CER).

For 2Q13, the company expects the adjusted net sales to grow by approximately 1-2% at

CER while EPS to be around $0.25.

For FY13, the company projected the adjusted net sales to grow by approximately 5% CER,

while the adjusted EPS to be $1.13. The guidance includes the dilution of $0.03 per share on

account of Ingenuity acquisition. This guidance can be compared to previously guided EPS

range of $1.16 and $1.18.

Revenue

In 1Q13, Qiagen reported net revenue of $303.6 million, up 2% y/y (up 3% at CER). Growth in revenue

is attributable to the growth molecular diagnostics and applied testing customer classes. However, was

offset by less growth in Academia and Pharma segments. Currency movement offset the sales growth

by 1 percentage point.

The Zacks Digest average net revenue in 1Q13 was approximately in line with the company’s report.

Zacks Investment Research

Page 4

www.zackspro.com

Region-wise sales

In 1Q13, in terms of geographic regions, sales in the Americas grew at 2% CER. Growth in the

molecular diagnostics was offset by lower sales in Academia and Pharma. Net sales in the Middle East,

Africa and Europe increased 4% at CER. Growth in the region is attributable to higher sales of

QuantiFERON latent TB test. Contributions were seen from Germany, the U.K., Turkey and Italy. In

Asia-Pacific and Japan, sales increased 3% at CER. Double-digit growth rate was witnessed in India

and China; however, sales were more or less flat in South Korea. Growth in Japan was modest singledigit.

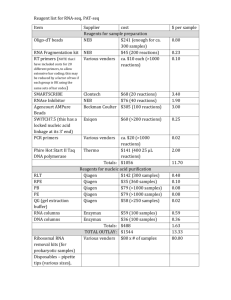

Provided below is a summary of total revenue as compiled by Zacks Digest:

$ in

million

Digest

Average

Digest

High

Digest

Low

YoY

Growth

1Q12A

2012A

1Q13A

2Q13E

3Q13E

4Q13E

2013E

2014E

2015E

$296.4

$1,254.4

$303.7

$311.1↓

$320.7

$368.3↓

$1,304.2↓

$1,382.5↓

$1,474.6

$296.4

$1,254.5

$304.0

$313.0↓

$324.0

$374.5↓

$1,314.3↓

$1,398.0↓

$1,491.3

$296.0

$1,254.0

$303.6

$308.6↓

$317.4

$353.0↓

$1,292.0↓

$1,352.0↓

$1,455.0

12.2%

7.2%

2.5%

1.3%↓

5.4%

6.2%↓

4.0%↓

6.0%↑

6.7%

Outlook: For 2Q13, the company expects the adjusted net sales to grow at approximately 1% – 2%

while for FY13, the company expects revenue to increase around 5% from previously provided range of

5% and 6%. The projection of 5% sales growth includes negative affect of reduced government funding.

Segment Details

Qiagen’s revenues can be differentiated into Consumables and Automated Instruments.

Consumables (89% of total revenues in 1Q13)

Qiagen continues to expand in the consumables market by offering solutions such as plasmid DNA and

RNA purification and stabilizations, genomic and viral nucleic acid purification, nucleic acid transfection,

polymerase chain reaction (PCR) amplification, reverse transcription, DNA cleanup after PCR and

sequencing, DNA cloning and protein purification. Its largest selling consumable product is the digene

HC2 HPV Test, a signal amplified test regarded as the “gold standard” in testing for high-risk strains of

the HPV, the prime cause of cervical cancer in women. Qiagen is focused on developing new products

for nucleic acid-based molecular diagnostics. The company’s consumable manufacturing facilities are

located in Germany, China, the UK and the U.S. Currently, Qiagen offers 500 core consumable

products.

Revenues from consumables increased 4% y/y at CER in 1Q13. The growth in the segment was

brought about by double-digit growth in Molecular Diagnostics and robust single-digit growth in Applied

Testing.

Automated Instruments (11% of total revenues in 1Q13)

The instruments market is widely diverse and includes analytical instruments (DNA sequencers, high

throughput screening systems, mass spectrometers, and chromatography equipment) and laboratory

equipment (freezers, centrifuges, water purification, and automated liquid handlers).

The instrumentation systems automate the use of sample and assay techniques into efficient solutions

for low, medium and high throughput scale laboratories. These systems enable customers to perform

Zacks Investment Research

Page 5

www.zackspro.com

nucleic acid sample preparation, assay setup, target detection and other laboratory tasks. Products in

this segment include QIAsymphony, Rotor-Gene Q, QIAensemble, PyroMark, QIAcube, QIAxcel

and ESE-Quant Tube Scanners. The company’s instrument manufacturing facilities are located in

Switzerland.

Qiagen focuses on four principal segments or customer classes for sample and assay technologies,

which include Molecular Diagnostics, Applied Testing, Pharma/Biotech and Academia/Government.

Instrumentation revenues decreased 3% y/y at CER in 1Q13. The drop in the segment’s revenues is

attributable to decline in the Pharma and low Applied Testings segments. However, the weakness was

partially offset by increase in Pharma. QIAsymphony automation platform continued its strong

performance.

Molecular Diagnostics (50% of sales):

The Molecular Diagnostics segment (50% of total sales in 1Q13) registered a 11% y/y increase in sales

at CER in 1Q13. Growth in this segment brought about by double-digit growth rate in consumables,

however, was offset by QIAsymphony placements. Sales of QuantiFERON-TB test for latent

tuberculosis (TB) grew by robust 20% at CER in U.S. and Europe. However, weakness was brought

about weak sales in HPV Testing owing to pricing pressures. Sales in HPV declined by 2% at CER.

Revenues from products under Profiling increased by double-digits on the back of growth in

QIAsymphony automation platforms.

Applied Testing (8% of sales):

The Applied Testing segment consists of forensic (including bio security), food testing and veterinarian

testing where Qiagen is a market leader. The Applied Testing segment contributed 8% of total sales in

1Q13.

Sales derived from applied testing were up 5% y/y at CER in 1Q13 primarily driven by strong single-digit

sales growth in veterinary medicine, human identification/forensics and food safety. The European

horsemeat scandal provided additional growth and awareness about benefits of molecular testing

capabilities by the company’s products.

Pharma/Biotech (18% of sales): Qiagen is a supplier for pharmaceutical and biotechnology

companies. Drug discovery and development efforts increasingly employ genomic information, both to

guide research in diseases and to differentiate the patient populations most likely to respond to

particular therapies. Approximately half of Qiagen’s sales in this customer class support research, while

the remaining half of sales support clinical development processes, including the stratification of patient

populations based on genetic information.

Qiagen’s total revenues in 1Q13 declined 4% at CER. Growth in the Asia-Pacific / Japan was offset by

the low earnings in the EMEA and Americas region. Restructuring activity and site consolidation resulted

in the decline of revenue.

Management continues to anticipate robust growth in development-related pharmaceutical sales, offset

by weak demand for research-related products. In the coming years, the company expects a wave of

newly discovered biomarkers and companion diagnostics to transform the treatment of an increasing

number of diseases.

Academia/Government (24% of sales): Qiagen provides sample and assay technologies to leading

research universities worldwide. Many academic laboratories continue to utilize manual, labor intensive

methods for nucleic acid separation and purification. Recognizing the opportunity to replace traditional

methods with reliable, fast, highly reproducible, and high-quality nucleic acid extraction and purification

technologies, Qiagen has concentrated its product development and marketing efforts toward industry

and academic research markets.

Zacks Investment Research

Page 6

www.zackspro.com

Sales to industry and academic customer groups declined 4% y/y at CER. Decline in the growth is

attributable to low sales of both consumables and instruments. The instruments and consumable sales

declined on the back of concerns of reduced government funding. Fears of implementation of U.S.

government sequestration, which started in March, also added to the concerns. Europe and AsiaPacific/Japan, apart from China, witnessed lower sales. The company estimates that the cut in the

government funding environment might adversely affect the FY13 sales by at least 1 percentage point.

Recent Updates

On May 24, 2013, SIP Biotech Development Co., Ltd. (BioBAY) entered into a joint venture with

QIAGEN to open QIAGEN (Suzhou) Translational Medicine Center, a translational medicine R&D

Corporation. This aims to create companion diagnostics, increase discovery and validate biomarkers for

the Chinese markets.

Ingenuity acquisition: On Apr 29, 2013, Qiagen acquired Calif.-based privately owned company,

Ingenuity Systems, Inc. Through the acquisition, Qiagen will have access to Ingenuity’s proprietary

Ingenuity Knowledge Base and software applications, which is an advanced knowledge system and

analysis solution for complex biomedical information. However, financial terms of the deal were not

disclosed.

Qiagen claims that, with the Ingenuity products, the company will be able to widen its scope in the

rapidly growing market of sequencing with faster and efficient data analysis. Ingenuity stated that, while

an entire human genome sequence takes only 2 days to complete, the data analysis can take months

and years. However, the Ingenuity product line needs some time (may be some minutes) for data

interpretation.

Viewing the substantial potential of the molecular diagnostic market globally, Qiagen is currently

focusing on expanding its diagnostics products offering. The company currently derives around 50% of

its total revenue from this segment, which is likely to increase with this acquisition. Qiagen has acquired

several companies to expand its product portfolio, the significant ones are Cellestis and Ipsogen in

2011.

On Mar 30, 2013, Qiagen commercially released careHPV, approved on Nov 28, 2012, can screen for

high risk human papillomavirus (HPV) under low-resource clinical settings, such as electricity, water or

laboratories.

On Feb 13, 2013, Qiagen entered into an agreement with Eli Lilly and Company for commercialization

and development of companion diagnostics along with Lilly investigational and approved medicines

throughout therapeutic areas.

On Jan 7, 2013, Qiagen N.V. entered into three different agreements under which it obtained rights for

RET, ROS1 and DEPDC1 from Insight Genetics for lung cancer. Through this agreement, the company

will also allow the biomarkers to expand its pipeline of diagnostics for Personalized Healthcare

applications.

Zacks Investment Research

Page 7

www.zackspro.com

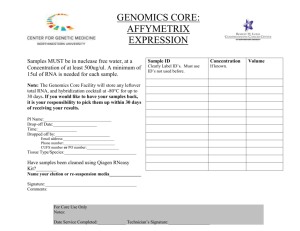

Provided below is a summary of segment revenue as compiled by the Zacks Digest:

Revenue

Segments ($

in million)

Total

Consumables

Total

Instruments

Others

1Q12A

2012A

1Q13A

2Q13E

3Q13E

4Q13E

2013E

2014E

2015E

$259.7

$1,084.8

$268.8

$269.8↓

$278.4

$315.5↓

$1,132.5↓

$1,201.3↓

$1,281.5

$35.7

$0.9

$169.1

$1.5

$34.8

$42.1↓

$42.5

$58.8↑

$178.1↓

$188.2↓

$197.5

Provided below is the graphical presentation of segment revenue:

Please refer to the Zacks Research Digest spreadsheet on Qiagen for more extensive revenue figures.

Margins

In 1Q13, reported gross margin increased 5.6% y/y. As a percentage of sales it was 65.9% compared

with 63.9% in 1Q12.

The Zacks Digest adjusted gross margin in 1Q13 was 72.0% compared with 70.7% in 1Q12.

Adjusted operating income in 1Q13 was flat y/y at CER to $78.4 million. The adjusted operating

margin declined 130 bps y/y to 25.8% in 1Q13.

Zacks Investment Research

Page 8

www.zackspro.com

The Zacks Digest operating margin in 1Q13 was 25.8% compared with 27.0% in 1Q13.

Outlook: For FY13, the company expects adjusted operating margin to be 29%. Ingenuity acquisition is

expected to adversely affect the adjusted operating margin by about 100 bps or 1 percentage points.

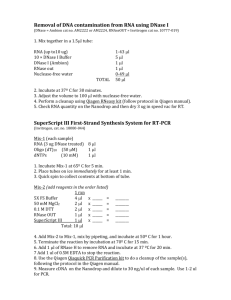

Provided below is a summary of margins as compiled by Zacks Digest:

Margins

Gross

Operating

Pre-tax

Net

1Q12A

70.7%

27.0%

25.6%

18.4%

2012A

71.4%

28.4%

26.4%

20.8%

1Q13A

72.0%

25.8%

23.7%

18.1%

2Q13E

71.5%

27.1%↓

24.7%↓

19.0%↓

3Q13E

71.9%

27.8%

25.9%

20.1%

4Q13E

72.2%

32.3%↑

29.1%↑

25.1%↑

2013E

72.0%↑

28.7%↓

26.5%↓

20.8%↓

2014E

72.1%

30.3%↑

27.9%↑

21.8%↓

2015E

72.3%

29.9%

28.1%

22.4%

Note: As per the Zacks Digest model, on a pro forma basis cost of goods sold (COGS) on a proforma

basis, is expected to increase 2.0% y/y in FY13 and 5.5% y/y in FY14; SG&A expense (excluding

ESOP) is expected to increase 4.0% y/y in FY13 and 5.1% y/y in FY14; and R&D expense is expected

to increase to 12.4% y/y in FY13 and increase 4.6% y/y in FY14. In comparison, revenue is expected to

increase 5.3% y/y in FY13 and 5.7% y/y in FY14.

Please refer to the Zacks Research Digest spreadsheet on QGEN for more extensive margin figures.

Earnings per Share

Qiagen’s 1Q13 EPS of $0.08 was lower than $0.12 in 1Q12. However, adjusting for certain one-time

items, EPS came in at $0.23 flat y/y.

The Zacks Digest average for 1Q13, EPS was in line with the company’s report.

Provided below is a summary of EPS as compiled by Zacks Digest:

EPS

Digest

Average

1Q12A

2012A

1Q13A

2Q13E

3Q13E

4Q13E

2013E

2014E

2015E

$0.23

$1.08

$0.23

$0.25↓

$0.27

$0.39↑

$1.13↓

$1.25↓

$1.36

$0.27

$0.39↑

$1.13↓

$1.26↓

$1.39

$0.27

$0.38↑

$1.12↓

$1.24↓

$1.33

Digest High

$0.23

$1.08

$0.23

$0.25↓

Digest Low

$0.22

$1.08

$0.23

$0.25↓

Outlook: In 2Q13, the company expects adjusted EPS to be $0.25. For FY13, the company changed

the adjusted EPS to $1.13 from previously guided range of $1.16 - $1.18. The guidance takes into

account $0.03 for ingenuity acquisition. The previous guidance took into account $0.01 - $0.02 per share

as an impact from the U.S. medical tax and high interest expenses.

Please refer to the Zacks Research Digest spreadsheet on QGEN for more extensive EPS figures.

Jun 3, 2013

Zacks Investment Research

Page 9

www.zackspro.com

StockResearchWiki.com – The Online Stock Research Community

Discover what other investors are saying about Qiagen N.V. (QGEN) at:

QGEN profile on StockResearchWiki.com

Analyst

Varun Parekh

Copy Editor

Anita Ganguli

Content Editor

No. of brokers reported/Total

brokers

Reason for Update

Urmimala Biswas

QCA

Rajiv Mukherjee

Lead Analyst

Urmimala Biswas

Zacks Investment Research

12/12

Earnings

Page 10

www.zackspro.com