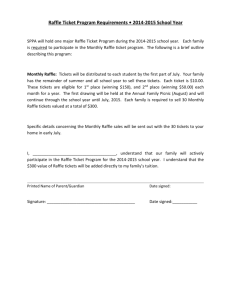

Rules for Raffle Ticket Sellers

advertisement

Rules for Raffle Ticket Sellers Virginia 2009 Raffle Ticket sellers must agree to follow and enforce the following rules in order to sell Car Raffle Tickets. All raffle ticket sale proceeds, ticket stubs and unsold tickets must be delivered to nearest ACS office, Relay for Life event or Relay for Life meeting by close of business 5/29/09. Your closest ACS office is 1445 E Rio Road Suite 104 Charlottesville, VA 22911. Only registered Team Captains or registered participants may sign out the raffle tickets for sale. Team Captain/participant must account for all tickets signed out or will be held financially accountable: o Ticket stubs and the funds o Unsold tickets (ticket + stub) The American Cancer Society will invoice you for outstanding tickets. Raffle tickets may not be sold or delivered by mail or internet. Tickets are signed out in multiples of 25 tickets only. Team captains/participants may not sign out more tickets until all outstanding tickets are sold or accounted for. Selling price of each raffle ticket is $5.00. Raffle money will be considered team money and can be credited to the team or individual. Payment for raffle tickets may be made by cash or check payable to “American Cancer Society”. o Checks for raffle ticket purchases cannot be combined with registration, team money or other revenue sources. o Checks written for raffle tickets may only be written by the purchaser of the ticket who holds the ticket stub. (Tickets sellers must not convert cash received from sale of raffle tickets to personal checks.) You must turn in raffle ticket sales proceeds separate from all other money. The sold ticket stubs and money must be submitted in an ACS-provided raffle envelope with a separate raffle only Team Accounting Sheet. ACS employees, RFL Chairs, and RFL committee members are not eligible to win. Winner must be at least 18 years old. Winner need not be present to win. ACS will pay the winners state and federal withholding tax. All IRS requirements must be satisfied before the prize can be awarded. Raffle tickets are not tax-deductible contributions.