Common Legal Principles of Advanced Regulatory

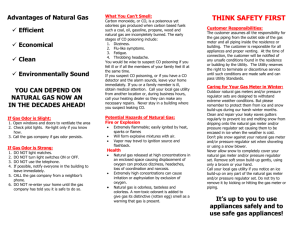

advertisement