Winding up

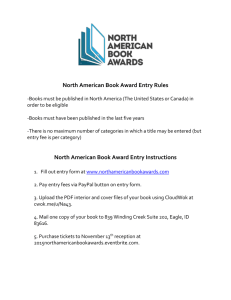

advertisement