NOTICE OF EXTRAORDINARY GENERAL MEETING Notice is

NOTICE OF EXTRAORDINARY GENERAL MEETING

Notice is hereby given of an Extraordinary General Meeting of the Angmering-on-Sea Lawn

Tennis Club to be held at the Clubhouse on

Monday, 24

th

February 2014 at 8.00 pm

The Chairman and Management Committee of AOSLTC have agreed to convene an EGM to present the benefits of “Gift Aid” to members and to request their approval to include it in the upcoming membership renewal process.

NB This only applies to the 2 Adult membership categories and does not involve any increase to the already agreed subscription rates.

Further information is attached after the Agenda.

AGENDA

1. Welcome from the Chairman

2. Apologies

3. Discussion about the benefits of the “Gift Aid” Scheme

4. Proposals:

1) To agree the Voluntary Contribution required to fund capital expenditure for the future development of the Tennis Club. (This does not include the capital required to replace tennis courts which is included in the standard subscription).

2) To agree to reclaim the Gift Aid tax on the Voluntary contribution from HMRC from

April 2014 onwards.

3) To agree to back date the claim for Gift Aid tax to August 2010 (which we are allowed to do).

Sue Johnson, Hon Secretary

27/1/2014

GIFT AID SCHEME.

The Management Committee have agreed to put the following proposal to the Tennis Club membership:

To specify an element of VOLUNTARY CONTRIBUTION within the existing membership subscription. The

Tennis Club could then claim Gift Aid on this proportion in order to be able to increase its “Sinking Fund” for the future development of its buildings and land.

The object is to provide funds for future use and at the same time, through the Gift Aid scheme, to claim from HMRC, 25% of all qualifying Voluntary Contributions, in accordance with their rules in dealing with

Charities and Community Associations of Sports Clubs (CASC). This is very beneficial to all sports clubs and is being taken up by an ever increasing number as knowledge of this becomes more widely known. This will not put any extra cost on to any member.

We are able to claim tax back on all voluntary contributions from all members who pay income tax. We cannot claim tax back on contributions made by members who do not pay tax in the year.

We have been in touch with both the HMRC and the Accountants acting on behalf of the LTA and both have agreed that we are permitted to introduce a scheme for “Gift Aid” whereby we are able to claim tax on any gift aided payments, and furthermore we are able to back date the claim 4 years.

HMRC. (Help Sheet 7) states that “clubs are able to set their own membership fee levels but HMRC would look closely at any club that reduced its fees significantly and requested a balance between old and new fees. Most clubs will need to make sure that the membership fees at least cover the running costs.

“Your club could then suggest a voluntary donation on top of the membership fee and this would qualify for gift aid”.

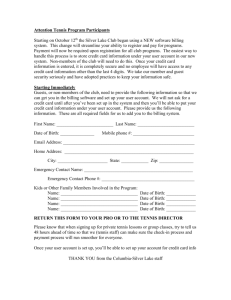

In order to claim gift aid we would need to ensure that all existing adult members are made aware and that they agree to make a voluntary contribution; and if we are to claim back the previous 4 years they would need to sign an appropriate gift aid declaration for past present and future gift aid subscriptions.

New adult members must be informed that the standard subscription is £196 and that we would appreciate a voluntary donation of £84 to go towards the future development of the Tennis Club, in accordance with

Tennis Club Practice.

Voluntary Contribution .

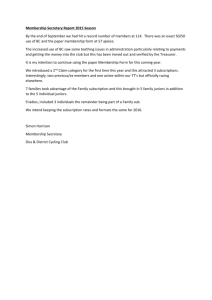

The other clubs that we have researched appear to set various levels of Voluntary contribution some state

£50, which seems quite reasonable; but we have noticed that the membership forms they use could be interpreted wrongly by the HMRC as they do not use the wording voluntary contribution in the correct way or they just split their subscription into 2 halves. One club we have come across uses the whole of their subscription as a voluntary contribution. We do not believe any of these are correct as they fall foul of the intentions of the HMRC wording. We must ensure that we try and get this right and have the right rationale in arriving at a reasonable level of voluntary contribution.

We believe that we might be able to set a higher voluntary rate based on the following:

A) The Standard Rate is set at £196 per annum (this is the current intermediate rate)

B) The Adult Rate is £280.

We would make the case that the Voluntary rate should be set at £84 (the difference between the

Intermediate Rate and the Adult Rate).

As you will appreciate we are stating that in effect the Intermediate members pay the correct rate to contribute to the annual running of the club, and that the full adult members already pay an uplift of £84 to cover the future development of the Tennis Club.

On the assumption that 180 of our adult members pay tax then we could have the following calculations

1) 180 x £50 at 25%. Tax refund from HMRC £2250. If we used an arbitrary figure!

2) 180 x £84 at 25%. Tax refund from HMRC £3780. Using the suggestion above.

We are keen to adhere to the spirit of the HMRC guidance on splitting our finances into two separate issues.

The first to run the club normally and the voluntary amount to set aside for the major building and ground works wanted to ensure the longevity of the Tennis Club for future generations.

Administration.

There will be a need for some internal administration forms to be completed and also HMRC schedules in order to reclaim the tax. We would hope that the form set out by HMRC will suffice, although we could use our own data base to create an appropriate form.

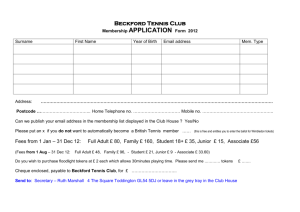

Ideally we should try and set the year commencing 1 st April 2014 under the new system and will issue membership renewal forms and new member forms showing the subscription rates and the Voluntary donation.

It may be wise to split our Profit and Loss account to show a clear demarcation between normal receipts and costs and the donations, which in turn may give us the opportunity to seek grants for special items, which at present are not available to us because we have £100,000 in the Bank. The change would now be classified as Voluntary donations set aside for the Major Capital work on the Pavilion and Land. Any ideas from members on how to deal with the technical aspects of Accounting for this; would be considered , you may

have come across this as professionals or in previous sports clubs.

Conclusion.

In essence the benefits of the scheme are clear and we believe that initially we should aim for £84 as the

voluntary contribution. No doubt this should be reviewed annually when we agree the annual subscription rates.

ANGMERING-ON-SEA TENNIS CLUB

GIFT AID QUESTIONS AND ANSWERS

How does Gift Aid for Sports Club work?

Individuals who are UK taxpayers can make contributions to sports clubs that have registered with

HM revenue and Customs as Community Amateur Sports Clubs (CASC) and using gift aid in the same way as they make gifts to Charities.

Why is it important?

By paying £84 voluntary donation your club can reclaim tax from HMRC at the rate of 25% of the sum paid.

Why do we not increase the voluntary donation amount so as to obtain a bigger reclaim?

To operate as a club, we have to charge a subscription to cover basic running costs. At present we are calculating that £196 of our subscription covers basic running costs, and that the voluntary element of £84 covers the funds needed sometime in the future to rebuild the ageing pavilion and other potential major expenditure on the grounds.

Are other clubs applying gift aid alongside subscriptions ?

Yes. This method of collection of subscriptions has been utilised by many sports clubs in recent years and is being actively promoted by both the ECB and HMRC as a positive way sports clubs can raise funds.

So the club receives more income .Will this be reflected in reduced subscriptions?

Subscriptions are set by all the Tennis Club members at each AGM, and there is no doubt that any extra funds received will have a positive effect. However, it should be noted that all club funds are re-invested for the benefit of the members now and to ensure that the future of the club is secure.

What if somebody pays the membership fee but not the voluntary donation. Are they still a member?

Yes. The donation is not compulsory. However we anticipate that members will pay all the subscription and the donation and that the members will understand the rationale behind the scheme. If members choose to pay only the normal subscription the Tennis Club would have to review it and return to the previous method of a flat rate subscription thereby reducing our total income by not claiming back 25% on the donation element. On top of that the setting of subscriptions will probably be higher as there will be no extra income to mitigate any increase.

We have suggested a set voluntary donation of £84. Is this amount set forever?

No. We have set the £84 as the initial amount, and subject to further investigation and accounting work, we may at some time in the future amend the amount, bearing in mind that we need to observe the basic rule set out by HMRC that we ensure that the subscription covers the cost of running the club.

If you have any queries on the Gift Aid scheme, please email Bill Regan, the Hon

Treasurer, at

bill2regan@gmail.com