Farm Financial Assessment - Companion Guide

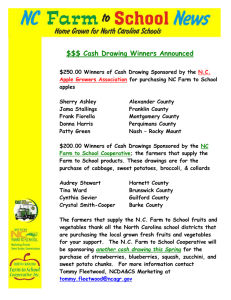

advertisement