Debate Begins on Physician Payment Reform

advertisement

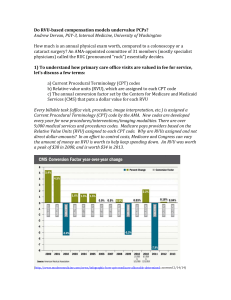

Debate Begins on Physician Payment Reform Over the past several weeks, Congress and the Bush Administration have been discussing various aspects of physician payment reforms. Much of this has been reported to the HBMA membership. In addition several Congressional hearings on the topic, CMS announced that they will be proposing significant changes in the values assigned to hundreds of CPT codes under the Resources Based Relative Value Scale payment methodology. While no major reforms in physician payments are expected to be adopted before the end of 2006, changes could still occur – but at a price. In mid-July, an Energy and Commerce Health Subcommittee hearing reviewed the cuts in Medicare payments for medical imaging services included in the Deficit Reduction Act (DRA). The principle DRA change would cap payment for imaging services provided in a physician’s office at the same level as what Medicare would pay if the image was performed in a hospital outpatient department. It has been reported that in some cases, this would result in reductions in the neighborhood of 30 to 40 percent. Next, the Subcommittee looked at issues involving the flawed fee schedule update process called the Sustainable Growth Rate (SGR) formula. According to CMS, the SGR formula is projecting a 4.4 percent reduction in the Conversion Factor used to determine the cash value of the Relative Value Units (RVUs) assigned to every CPT code. Unless Congress intervenes to prevent the cuts, the payment reduction will go into effect January 1, 2007. This was followed by a lengthy hearing on the concept of incorporating Pay For Performance (P4P) into the physician payment process. Although few specifics are available, the concept here is that physicians who provide high quality services would receive higher payments than those whose care is determined to be inferior. Not to be left out, CMS announced recently that they had completed a thorough review of the RVUs assigned to hundreds of CPT codes. According to the June 29 Federal Register Notice. These revisions to work RVUs are proposed to be effective for services furnished beginning January 1, 2007. These revisions reflect changes in medical practice, coding changes, new data on relative value components, and the addition of new procedures that affect the relative amount of physician work required to perform each service as required by the statute. While the policy discussions were interesting and informative, there was little discussion about how changes in Medicare payment policy might affect the Medicare Trust Fund. Such discussions are essential because under the parliamentary rules governing Congressional debate on entitlement programs such as Medicare, any change in policy that affects expenditures that have not been budgeted, cannot be considered unless the proposal is deemed “revenue neutral” by the Congressional Budget Office (CBO). As a practical matter, this means is that if a Member of Congress wants to have legislation considered that would cause Medicare to spend more money in a particular area (i.e. eliminating the SGR reduction) then that legislation can only be considered if there are corresponding cuts elsewhere in the Medicare program so that there is no change in aggregate spending for Medicare. Current estimates show that eliminating the SGR cuts would increase Medicare Part B expenditures by $10 Billion over the next 5 years. So in order for Congress to consider legislation that would prevent the SGR reduction from taking place on January 1, 2007, corresponding cuts of $10 Billion will have to be made on other Medicare payments to offset this increase. Similarly, repealing the imaging cuts mandated by the DRA would have to be “offset” by cuts in some other area of the Medicare program to stay within the 2007 budget. It has been estimated that the DRA imaging cuts will “save” Medicare approximately $2.5 Billion over the next five years. If CMS makes an administrative change in Medicare that affects Medicare expenditures by more than $20 Million, the agency must propose offsets so that the policy is “revenue neutral”. Much public fanfare accompanied CMS’s announcement that based upon the RVU evaluation process, the Evaluation and Management (E&M) codes (99201 – 99215) were, on average going to rise by more than 30 percent of the CMS recommendations were adopted. Specifically, CMS noted that, “the work component for RVUs associated with an intermediate office visit, the most commonly billed physician’s service, will increase by 37 percent. The work component for RVUs for an office visit requiring moderately complex decision-making and for a hospital visit also requiring moderately complex decision-making will increase by 29 percent and 31 percent respectively.” What drew far less public attention was the acknowledgement that in order to raise some codes, CMS would have to propose reductions in other codes to offset the E & M increase. According to the press release announcing the proposed changes, “The proposed notice revises work RVUs for over 400 services to better reflect the work and time required of a physician in furnishing the service, which can include not just procedures performed, but also the services involved in evaluating a patient’s condition, and determining a course of treatment (known as ‘evaluation and management’ services).” Of the 400 proposed revisions put forward by the Relative Value Update Committee (RUC), CMS accepted the recommendations for the work value for 299 codes (the RUC recommendation could be higher, lower or stay the same). CMS disagreed with the RUC’s recommendations with regard to 123 codes. Of the codes in which CMS disagreed, CMS is proposing a higher work value for 3 codes, maintaining the current work RVU for 48 codes, and a lower work value for 72 codes. Although anyone may comment on the physician work value recommendations, it is expected that only those organizations representing physician specialties affected by the changes will have the ear of CMS.