Consolidated Financial Statements After Acquisition

advertisement

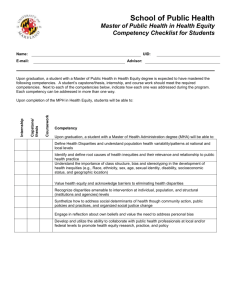

CHAPTER 4 CONSOLIDATED FINANCIAL STATEMENTS AFTER ACQUISITION Revise the section on page 119 “Complete Equity Method on Books of Investor” as follows: Complete Equity Method on Books of Investor The complete equity method is usually required to report common stock investments in the 20% to 50% range, assuming the investor has the ability to exercise significant influence over the operating activities of the investee. In addition, a parent company may use the complete equity method to account for investments in subsidiaries that will be consolidated. This method is similar to the partial equity method up to a point, but it requires additional entries in most instances. Continuing the illustration above, assume additionally that the $800,000 purchase price exceeded the book value of the underlying equity of S Company by $100,000; and that the difference was attributed half to goodwill ($50,000) and half to an excess of market over book values of depreciable assets ($50,000). Under new FASB regulations, goodwill would be capitalized and not amortized. The additional depreciation expense implied by the difference between market and book values, however, must still be accounted for. The depreciation of the excess, if spread over a life of ten years, would result in a charge to earnings of $5,000 per year. This charge has the impact of lowering the equity in subsidiary income, or increasing the equity in subsidiary loss, recorded by the parent. The entries for the first three years under the complete equity method are: GRAY BOX for Parent Company Entries Year 1 – P’s Books Investment in S Company Cash To record the initial investment. Investment in S Company Equity in Subsidiary Income .9($90,000) To record equity in subsidiary income. 800,000 800,000 81,000 81,000 Equity in Subsidiary Income 5,000 Investment in S Company ($50,000/10) To adjust equity in subsidiary income for the excess depreciation Cash Investment in S Company To record dividends received .9($30,000). 5,000 27,000 27,000 Note: The entries to record equity in subsidiary income and dividends received may be combined into one entry, if desired. Year 2 – P’s Books Equity in Subsidiary Loss Investment in S Company To record equity in subsidiary loss .9($20,000). 18,000 18,000 Equity in Subsidiary Income 5,000 Investment in S Company ($50,000/10) To adjust equity in subsidiary loss for excess depreciation 5,000 Cash Investment in S Company To record dividends received .9($30,000). 27,000 27,000 Year 3 – P’s Books Investment in S Company Equity in Subsidiary Income To record equity in subsidiary income .9($10,000). 9,000 9,000 Equity in Subsidiary Income 5,000 Investment in S Company ($50,000/10) To adjust equity in subsidiary income for excess depreciation Cash Investment in S Company To record dividends received .9($30,000). 5,000 27,000 27,000 After these entries are posted, the investment account will appear as follows: INVESTMENT IN S COMPANY (COMPLETE EQUITY METHOD) Year 1 Cost Year 1 Equity in subsidiary income 800,000 81,000 Year 1 Balance 849,000 Year 1 Additional depreciation Year 1 Share of dividends declared 5,000 27,000 Year 2 Equity in Subsidiary Loss 18,000 Year 2 Additional depreciation 5,000 Year 2 Share of dividends Declared 27,000 Year 2 Balance Year 3 Equity in Subsidiary Income 799,000 9,000 Year 3 Balance 776,000 Year 3 Additional depreciation 5,000 Year 3 Share of Dividends Declared 27,000 The additional entry to adjust the equity in subsidiary income for the additional depreciation in Year 1 may be viewed as reversing out a portion of the income recognized; the result is a net equity in subsidiary income for Year 1 of $76,000 ($81,000 minus $5,000). In Year 2, however, since the subsidiary showed a loss for the period, the additional depreciation has the effect of increasing the loss from the amount initially recorded ($18,000) to a larger loss of $23,000. A solid understanding of the entries made on the books of the investor (presented above) will help greatly in understanding the eliminating entries presented in the following sections. In some sense these entries may be viewed as “undoing” the above entries. It is important to realize, however, that the eliminating entries are not “parent only” entries. In many cases an eliminating entry will affect certain accounts of the parent and others of the subsidiary. For example, the entry to eliminate the investment account (a parent company account) against the equity accounts of the subsidiary affects both parent and subsidiary accounts. Some accounts do not need eliminating because the effects on parent and subsidiary are offsetting. For example, in the entries above, we saw that the parent debited cash when dividends were received from the subsidiary. We know that cash on the books of the subsidiary is credited when dividends are paid. The net effect on cash of the consolidated entry is thus zero. No entry is made to the cash account in the consolidating process. See Figure 4-1 for a comparison of the three methods on the books of the parent. Insert Figure 4-1 here Figure 4-1 Comparison of the Investment T accounts (Cost vs. Partial Equity vs. Complete Equity Method) Cost Method Investment in S Company - Cost Method Year 1 Acquisition cost Year 1 and 2 Balance 800,000 800,000 Year 3 Subsidary liquidating dividend Year 3 Balance 791,000 9,000 Partial Equity Method Investment in S Company - Partial Equity Method Year 1 Acquisition cost Year 1 Equity in subidary income Year 1 Balance Year 2 Balance Year 3 Equity in subidiary income 800,000 81,000 Year 1 Share of dividends declared 854,000 Year 2 Equity in subidiary loss Year 2 Share of dividend declared 809,000 9,000 Year 3 Share of dividend declared Year 3 Balance 791,000 27,000 18,000 27,000 27,000 Complete Equity Method Investment in S Company - Complete Equity Method Year 1 Acquisition cost Year 1 Equity in subidary income Year 1 Balance Year 2 Balance Year 3 Equity in subidary income Year 3 Balance 800,000 81,000 Year 1 Additional Depreciation Year 1 Share of dividend declared 849,000 Year 2 Equity in subidary loss Year 2 Additional Depreciation Year 2 Share of dividend declared 799,000 9,000 Year 3 Additional Depreciation Year 3 Share of dividend declared 776,000 5,000 27,000 18,000 5,000 27,000 5,000 27,000 End of Chapter 4 Exercises: Modify Exercise 4-1, as follows: Exercise 4-1 Parent Company Entries; Liquidating Dividend Percy Company purchased 80% of the outstanding voting shares of Song Company at the beginning of 1999 for $387,000. At the time of purchase, Song Company's total stockholders' equity amounted to $475,000. Income and dividend distributions for Song Company from 1999 through 2001 are as follows: 1999 2000 2001 Net income (loss) Dividend distribution $63,500 25,000 $52,500 50,000 ($55,000) 35,000 Required: Prepare journal entries on the books of Percy Company from the date of purchase through 2001 to account for its investment in Song Company under each of the following assumptions: A. Percy Company uses the cost method to record its investment. B. Percy Company uses the partial equity method to record its investment. C. Percy Company uses the complete equity method to record its investment. The difference between cost and the book value of equity acquired was attributed solely to an excess of market over book values of depreciable assets, with a remaining life of ten years. Note: The solution to this exercise should be the same as in the 1st edition Solutions Manual, except that “amortization of goodwill” notations are replaced by “excess depreciation.”