NATIONAL LISBON PROGRAMME OF CYPRUS

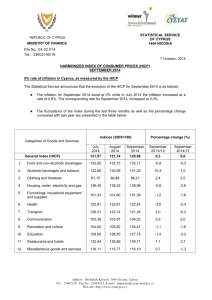

advertisement