Mexican Foreign Trade

advertisement

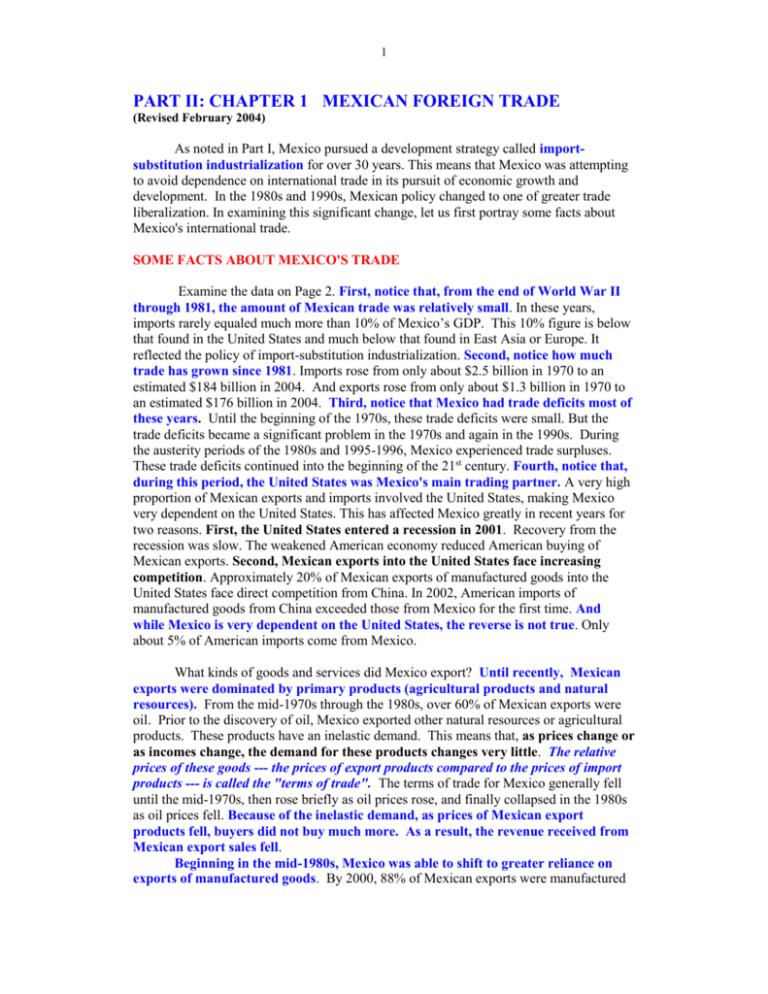

1 PART II: CHAPTER 1 MEXICAN FOREIGN TRADE (Revised February 2004) As noted in Part I, Mexico pursued a development strategy called importsubstitution industrialization for over 30 years. This means that Mexico was attempting to avoid dependence on international trade in its pursuit of economic growth and development. In the 1980s and 1990s, Mexican policy changed to one of greater trade liberalization. In examining this significant change, let us first portray some facts about Mexico's international trade. SOME FACTS ABOUT MEXICO'S TRADE Examine the data on Page 2. First, notice that, from the end of World War II through 1981, the amount of Mexican trade was relatively small. In these years, imports rarely equaled much more than 10% of Mexico’s GDP. This 10% figure is below that found in the United States and much below that found in East Asia or Europe. It reflected the policy of import-substitution industrialization. Second, notice how much trade has grown since 1981. Imports rose from only about $2.5 billion in 1970 to an estimated $184 billion in 2004. And exports rose from only about $1.3 billion in 1970 to an estimated $176 billion in 2004. Third, notice that Mexico had trade deficits most of these years. Until the beginning of the 1970s, these trade deficits were small. But the trade deficits became a significant problem in the 1970s and again in the 1990s. During the austerity periods of the 1980s and 1995-1996, Mexico experienced trade surpluses. These trade deficits continued into the beginning of the 21st century. Fourth, notice that, during this period, the United States was Mexico's main trading partner. A very high proportion of Mexican exports and imports involved the United States, making Mexico very dependent on the United States. This has affected Mexico greatly in recent years for two reasons. First, the United States entered a recession in 2001. Recovery from the recession was slow. The weakened American economy reduced American buying of Mexican exports. Second, Mexican exports into the United States face increasing competition. Approximately 20% of Mexican exports of manufactured goods into the United States face direct competition from China. In 2002, American imports of manufactured goods from China exceeded those from Mexico for the first time. And while Mexico is very dependent on the United States, the reverse is not true. Only about 5% of American imports come from Mexico. What kinds of goods and services did Mexico export? Until recently, Mexican exports were dominated by primary products (agricultural products and natural resources). From the mid-1970s through the 1980s, over 60% of Mexican exports were oil. Prior to the discovery of oil, Mexico exported other natural resources or agricultural products. These products have an inelastic demand. This means that, as prices change or as incomes change, the demand for these products changes very little. The relative prices of these goods --- the prices of export products compared to the prices of import products --- is called the "terms of trade". The terms of trade for Mexico generally fell until the mid-1970s, then rose briefly as oil prices rose, and finally collapsed in the 1980s as oil prices fell. Because of the inelastic demand, as prices of Mexican export products fell, buyers did not buy much more. As a result, the revenue received from Mexican export sales fell. Beginning in the mid-1980s, Mexico was able to shift to greater reliance on exports of manufactured goods. By 2000, 88% of Mexican exports were manufactured 2 Table 1: Mexico Trade: 1938-1988(Millions of dollars) Imports Exports Surplus (Deficit) 1949 514.4 701.1 186.7 1950 555.7 493.4 (62.3) 1951 822.2 591.5 (230.7) 1952 807.4 625.3 (182.1) 1953 807.5 559.1 (248.4) 1954 788.7 615.8 (172.9) 1955 883.7 738.6 (145.1) 1956 1,071.6 807.2 (145.1) 1957 1,155.2 706.1 (264.4) 1958 1,128.7 709.1 (419.6) 1959 1,006.6 723.1 (283.5) 1960 1,186.4 738.7 (447.7) 1961 1,132.6 603.5 (335.1) 1962 1,143.1 906.5 (236.6) 1963 1,239.7 944.1 (295.6) 1964 1,439.1 1,026.7 (412.4) 1965 1,559.6 1,126.4 (433.2) 1966 1,602.1 1,169.9 (432.2) 1967 1,736.8 1,102.9 (633.9) 1968 1,917.3 1,165.1 (752.2) 1969 1,988.8 1,341.8 (647.0) 1970 2,500.5 1,289.6 (1,210.9) 1971 2,432.6 1,365.6 (1,067.0) 1972 2,963.7 1,666.4 (1,297.3) 1973 4,165.7 2,071.7 (2,094.0) 1974 6,545.1 2,853.2 (3,691.9) 1975 7,128.8 3,062.4 (4,066.4) 1976 6,679.7 3,655.5 (3,024.2) 1977 6,022.5 4,649.8 (1,372.7) 1978 8,336.5 6,063.1 (2,273.4) 1979 11,979.7 8,817.7 (3,162.0) 1980 18,832.3 15,134.1 (3,698.2) 1981 23,929.6 19,419.6 (4,510.0) 1982 14,437.1 21,229.7 6,792.6 1983 7,720.5 21,398.7 13,678.2 1984 11,254.3 24,094.6 12,840.3 1985 13,460.4 21,783.4 8,323.0 1986 11,384.4 15,759.3 4,374.9 1987 12,200.0 20,600.0 8,400.0 1988 18,800.0 20,900.0 2,100.0 1991 50,300 41,200 (9,500) 1992 64,000 46,200 (17,800) 1993 65,400 51,800 (13,600) 1994 79,300 60,800 (18,500) 1995 72,500 79,500 7,000 1996 89,500 96,000 6,500 1997 109,800 110,000 200 1998 125,200 118,000 (7,200) 1999 141,900 136,400 (5,400) 2000 174,500 166,400 (8,100) 2002 168,700 160,800 (7,900) 2003es170,000 164,500 (5,500) 2004es184,400 176,000 (8,400) U.S. Share (%) Imports Exports 86.8 78.6 84.3 86.3 81.5 70.4 82.7 78.5 77.1 72.2 80.4 60.1 79.3 60.6 78.3 65.1 77.1 64.3 76.9 61.5 72.9 60.7 72.1 61.4 69.8 62.6 68.2 62.6 68.4 64.7 68.4 60.9 65.7 57.4 63.8 55.7 62.8 56.1 62.9 59.8 62.4 58.1 63.6 60.7 61.4 61.5 60.3 70.1 59.5 62.5 62.2 58.1 62.7 61.3 62.5 62.1 62.9 66.7 60.5 69.4 62.2 68.6 67.6 64.7 66.1 53.9 59.7 53.3 60.1 58.1 68.7 58.2 69.8 61.4 65.3 66.6 69.2 69.1 74.2 75.4 74.7 76.7 74.1 73.1 77.2 81.4 78.1 77.4 78.2 80.1 80.4 81.7 3 goods. But Mexico is still highly dependent on exports of just a few products. As of 2003, 34% of Mexico’s exports of manufactured goods were in electronics, 32% were in automobiles, and 25% were in textiles. What kinds of goods and services did Mexico import? Traditionally, most Mexican imports had been raw materials or capital goods for industry. Only a small amount of imports had been consumer goods. As of 1994, these numbers had changed very little; in that year, 71% of Mexican imports were raw materials for industry, 17% were capital goods, and only 12% were consumer products. MEXICAN TRADE POLICIES As noted above, the Mexican import substitution strategy that was in existence from the 1950s until the beginning of the 1980s had been designed to protect Mexican producers against foreign competition. In that strategy, exports were seen as necessary only to earn the money to be able to import the capital goods and the raw materials necessary for industrialization. Imports were limited to those capital goods and raw materials through a system of licenses and high tariffs. The protected market was designed to give Mexican producers the time to grow so that they could become competitive with American, European, and Japanese manufacturers. This strategy was not much different from that pursued by Japan or most other Latin American countries in the 1950s and 1960s. Early in the 1980s, Mexico considered joining the General Agreement on Tariffs and Trade (GATT). GATT was based on the principle of expanding world trade through the reduction of tariffs and other trade barriers. Joining GATT would have allowed Mexico to have greater access to foreign markets. But it would also have required Mexico to eliminate its licenses and significantly reduce its tariffs. The Mexican government decided against applying for membership in the GATT. This decision reflected the political forces in Mexico at the time; those members of the business elite who were allied with the PRI were the ones who would have been most hurt by having to face the competition of foreign companies. As discussed in Part I, under pressure from the IMF and the United States government following the debt crisis of 1982, Mexico shifted away from its import-substitution industrialization policies and toward a policy of freer trade (called "liberalization"). The use of licenses to limit imports was gradually reduced until licenses were finally eliminated completely by 1994. Tariffs were reduced significantly. Most of Mexico's industries were opened to foreign investors (see the next chapter). The peso was allowed to continually depreciate to levels set by free markets. In 1986, Mexico reversed its decision and joined the GATT. Thus, Mexico agreed to become subject to GATT rules. Mexico hoped that this decision would lead to an increase in its exports. In 1987, Mexico entered into its first trade liberalization agreement with the United States (see below) and unilaterally set its tariff rate at a maximum of 20%. Despite the liberalization, Mexico had to find some way to limit its imports in order to use the dollars it earned from its exports to pay its international debt. Since it could no longer limit imports by licenses or by tariffs, Mexico tried to limit imports by what is called “austerity”. Austerity involved reducing total spending in Mexico by raising taxes, decreasing government spending, and decreasing the money supply. These policies caused reduced spending by Mexican citizens for both imported and domestic products. 4 The Mexican trade liberalization and resulting increased role of exports in Mexican development changed the relationship between Mexico and the United States. As noted above, a high percent of Mexican exports are sold in the United States. Beginning in the 1980s, some American companies felt threatened by the sales of Mexican products in the United States. This led to some trade disputes between the two countries. Mexico also felt threatened by its fear of rising trade protectionism in the United States and by American trade agreements with Canada and with Israel. In 1987, there was a trade agreement between the United States and Mexico to create a framework for trade discussions and resolution of disputes. Beginning in 1990, President Salinas requested discussions with the United States to create a North American Free Trade Agreement (NAFTA). THE NORTH AMERICAN FREE TRADE AGREEMENT (NAFTA) In August of 1992, the United States, Mexico, and Canada signed the agreement to form a North American Free Trade Area (NAFTA). In a Free Trade Area, there are no tariffs or other duties between the countries. In the 1992 agreement, all tariffs and duties are to be phased-out over 15 years. (65% of American goods gained tariff-free access to Mexico within 5 years.) The agreement is historic; there has never been such an agreement between countries with such disparate standards of living. The agreement involved almost 400 million people and one-third of world Gross Domestic Product. (A Free Trade Area should not be confused with a Common Market; a Common Market includes a Free Trade Area, but also adds a common external tariff. A Free Trade Area also is not an Economic Union. An Economic Union includes a common market but also adds labor mobility between the countries and a common money. In NAFTA, there is no common external tariff, no agreement about labor mobility, and no common money.) President George H. W. Bush signed the agreement in December of 1992. President Clinton supported the agreement after it was enhanced with some side agreements relating to labor and to the environment (see below). Congress passed the agreement in the fall of 1993. The Free Trade Area began January 1, 1994. The agreement is still a source of considerable controversy in the United States and in Mexico. The main purpose of the free trade agreement was to expand trade and foreign investment in Mexico. We will consider the effect on investment in the next chapter. As a result of NAFTA, between 1993 and 2000, Mexico lowered its average tariff against American products from 13.8% to 2.4%. About half of all American goods sold in Mexico are now completely tariff-free. This has definitely expanded trade, as intended. Between 1993 and 2000, trade between the United States and Mexico more than tripled – from $85.3 billion to $263.5 billion. Trade between Mexico and Canada also tripled in this period. Mexican goods increased their share of all purchases by Americans from 7% in 1993 to 11% in 2000. In this period, Mexico displaced Japan as the second leading trade partner of the United States. Table 2: Year 1993 1994 1995 1996 1997 1998 1999 2000 American Imports from Mexico 40.0 49.5 62.1 74.3 86.0 94.5 109.7 135.9 American Exports to Mexico (Billions of Current Dollars) 45.3 54.8 53.8 67.5 82.0 93.5 105.2 127.6 5 Agriculture One area of concern for both countries has been agriculture. For political reasons, agriculture has been a highly subsidized and protected industry in many countries. The United States had low tariffs (4% average in 1990, covering 25% of agricultural imports from Mexico) but many non-tariff barriers on agricultural products. Mexico had higher tariffs (11%) and import licensing requirements for many agricultural products (representing over 50% of American agricultural exports to Mexico). Farming provided the livelihood for 26% of the Mexican labor force. Thus, Mexico had an interest in slowing the liberalization of agricultural trade. Under the NAFTA, half of American agricultural goods exported to Mexico immediately became tariff-free. Other tariffs are to be phased out over 15 years. If imports do cause an enormous burden of adjustment, tariffs are allowed to rise. In the United States, grain farmers and livestock producers could gain as the market for their products expand. Grain (especially corn) farmers in Mexico could lose; these are the small and poor farmers in the south. Other the other hand, in the United States, fruit and vegetable farmers could lose as imports from Mexico increase. (Those who grow citrus in Florida are expected to lose more than those who grow citrus in California because Mexican imports will compete mainly in the winter months.) Fruit and vegetable farmers in Mexico would correspondingly gain; these are the richer, commercial farmers in the north. Even though the tariffs have not yet been fully eliminated, both American agricultural exports to Mexico and Mexican agricultural exports to the United States approximately doubled between 1993 and 2000. Automobiles The NAFTA provisions for automobiles were fully implemented by 2003. Mexico’s automobile industry has become much more competitive as a direct result of NAFTA. By 2000, Mexico was producing almost 2 million vehicles (up from 600,000 in 1993) and exporting about 1.5 million of them, as well as 3 million engines (exporting over 2 million). Mexico specializes in small and midsize cars, light trucks, and auto parts. (In 2000, General Motors produced 444,000 vehicles in Mexico, Ford produced 404,000 vehicles, and Daimler Chrysler produced 280,000 vehicles.) Nissan, Volkswagen, Honda, and BMW also have production plants in Mexico. These plants are considered some of the most competitive plants in the world. Mexican exports of vehicles and auto parts more than tripled between 1993 and 2000, with 90% of these exports going to the United States. (15% of all automobiles imported into the United States, and 25% of all auto parts, now come from Mexico.) The vehicle and auto parts industry now accounts for 20% of all of Mexico’s exports and provides job to over 500,000 people. A trade issue of concern to automobile companies involved rules of origin. The concern was that other countries (especially Japan) could ship goods through Mexico (or have a small portion of the good produced in Mexico) in order to avoid American and Canadian tariffs on Japanese automobiles. In the NAFTA, it was agreed that cars and light trucks must have 62.5% of the value of their parts and labor be North American in order to qualify for the tariff-free status. These provisions greatly angered the Japanese. But these rules of origin have been a main reason for non-American companies (such as BMW and Honda) establishing manufacturing plants in Mexico and building vehicles using parts made in North America. (A similar rules of origin provision was adopted for textiles: tariff-free status is granted only to goods made with yarn and fabric produced in America, Canada, or Mexico. See below.) 6 Textiles and Electronics By 2000, Mexico replaced China as the leading exporter of textile and apparel products to the United States. United States – Mexico trade in textiles nearly quadrupled from just over $4 billion in 1993 to $15.3 billion in 2000. This resulted because all textile products had obtained tariff-free status by 1999. Mexico’s textile industry grew very fast so that by 2000, it included nearly 1,200 plants and employed almost 286,000 workers. Since the NAFTA, Mexico has also become the main trading partner of the United States in electronics. In 1993, American exports of electronics and computer products faced and average tariff in Mexico of 13% while such Mexican exports faced an average American tariff of 1.6%. By 2003, both tariff rates were zero. As a result, trade in electronics and computer products between the two countries has grown greatly. By 2000, there were 570 plants in Mexico in the electronics sector, employing about 350,000 workers. Tijuana has become the leading area for television set production, producing about 25 million sets each year. Guadalajara is a major area for production of computer parts, many of which are exported to California. Production has advanced well beyond the low-wage, labor-intensive assembly that was seen in earlier years. Arguments Against the NAFTA The NAFTA has been very controversial. In this section, let us summarize some of the main arguments used by opponents of the agreement. (1) First, many opponents of NAFTA focus on the losses of jobs and the decline in wages. There has been great concern about the effects of a NAFTA on the American labor market. Because the NAFTA was expected to increase American exports to Mexico more than American imports from Mexico, it was expected to create between 126,000 and 180,000 more new jobs than would be lost. With a labor force of over 140,000,000, this change is very small --- less than 0.1%! If one focuses only on those jobs that would be lost because of Mexican imports, the estimates ranged from 10,000 as a minimum to 500,000 as a maximum. This loss of jobs would occur over several years, reducing the burden of adjustment. But, to those who will lose their jobs, this is no consolation. Job losses cause considerable pain specifically to those people who are least able to adjust. In a policy created in the early 1990s, American workers who lost jobs because of NAFTA became eligible for employment services, training, and income support for up to 78 weeks. Despite that, those workers displaced by NAFTA probably experience a considerable period of unemployment that ends when they finally take new jobs at considerably reduced pay. As explained earlier, the American industries that lose jobs because of NAFTA are the labor-intensive manufacturing industries, such as textiles and apparel, and labor-intensive agricultural goods, such as sugar, fruits, and vegetables. Most job losers are non-collegeeducated workers who tend to be paid relatively low wages. Most job gainers are more educated workers whose wages are higher. But the striking conclusion of the vast majority of studies indicated that the effects on the American labor market would be very small. This should not be too surprising considering that American tariffs against Mexican products were not very high to begin with. (2) In a related argument, opponents argued that NAFTA ultimately would reduce American international competitiveness. NAFTA, they argued, would allow companies to continue with a strategy of production that relies on low-wage labor. If the low-wage labor were not available, it is possible that the companies would develop new machines and new technologies to be able to continue production. These new machines 7 and new technologies would make workers more productive and therefore lead to increasing real wages. (3) Another argument against NAFTA involved labor practices in Mexico. It was argued that Mexico allows "sweatshop" conditions and therefore gains its labor market advantage in an unacceptable way. Mexican labor laws protecting worker rights are about as strong as the American laws. For example, Mexican workers average 42 - 43 hours per week. They are also entitled to 6 days of paid vacation and 7 official paid holidays. The hours requirement does not seem to be abused. But overall the enforcement of Mexican labor laws has been very weak. For example, small shops and factories ignore the child labor laws; at least 10 million children work part or full-time. And companies employing more than 300 workers are required to set up health clinics at company expense. But many do not do so. The need for Mexico to increase its inadequate enforcement of labor standards was the subject of one of the side agreements that President Clinton negotiated. The North American Agreement on Labor Cooperation (NAALC) was established to monitor labor issues and address complaints about non-enforcement of labor laws. (4) Another argument used by opponents of NAFTA was that the agreement would contribute to worsening environmental problems. The argument was that many American companies would locate in Mexico in order to escape from American environmental laws. As with worker protection laws, Mexican environmental laws are not significantly different from those of the United States. However, Mexican environmental laws are often poorly enforced due to a lack of enforcement personnel and to corruption. In recent years, Mexico has increased its efforts at environmental protection. From 1992 to 1995, the Mexican government spent $500 million for sewage plants, solid waste disposal, and nature preserves along the border. Mexico agreed to halt production of the CFCs that contribute to global warming by the same deadline as the United States. All new investments in Mexico that involve dangerous substances must now have environmental impact statements. The budget for enforcement of environmental laws was increased nearly 700%. Almost 1000 plants have been shutdown, nearly 100 permanently, because of noncompliance with the environmental laws. Mexico's environmental enforcement agency (SEDESOL) was absorbed into the Secretariat for Social Development, giving it greater powers. It should be stressed, however, that for American companies to locate in Mexico to take advantage of weak enforcement of environmental laws, three conditions must be met. First, costs of meeting American environmental laws must be high in relation to the total cost of production (otherwise, it is not worth the cost of the move). Second, the industry must already have significant trade protection (otherwise the companies would already have located plants in Mexico). And third, the company must be able to relocate production relatively easily. The amount of production that meets these conditions is likely to be small. Of 442 American industries, only 11 meet the first two conditions. Of these, industries such as steel, petroleum refining, and chemicals are not easily relocated. Thus, the cost of American environmental regulations is NOT likely to be a significant incentive for relocation to Mexico. (5) Opponents of NAFTA also worried about food safety standards, which are much higher in the United States. Under the NAFTA, the United States may prohibit imports of fruits and vegetables from Mexico that do not meet American standards. Some argue that this raises the possibility of setting the standards so high that environmental standards are in fact a form of trade protection. In 1996, there was a major dispute over the 8 importation of avocados from Mexico. American avocado producers claimed that Mexican avocados brought with them a disease that could destroy local crops. Mexican producers believed that their avocados were safe and saw the American claim as a form of trade protection. (6) Finally, opponents of NAFTA worried about infrastructure along the border (roads, railways, airports, and so forth). The increase in trade creates bottlenecks along the border. A North American Development Bank was created in 1994 with $3 billion in capital, provided by both the United States and Mexico, to provide financing for border projects. There was discussion of an international airport along the border (Twinports), but this idea was rejected. The United States Environmental Protection Agency committed $177 million in 1996 for border projects. And in the fall of 1996, the Final Border XXI Program Framework document was released. This identified environment priorities of the border, divided them geographically, and attempted come up with implementation plans. There certainly are major environmental issues between the United States and Mexico. For one, spilled sewage and pollutants from washed streets and yards in Mexico continually have forced the closing of beaches in San Diego County. In response, an International Wastewater Treatment Plant was completed in 1996. For another, because they still use leaded fuel, Mexican automobiles crossing the border into San Diego County contribute an estimated 12% of all air pollution in San Diego County. While these issues are important, it is not clear that any of them (except for the increased traffic at the border) are related specifically to the NAFTA. It is likely that these issues would be with us whether NAFTA had been passed or not. Effects of the NAFTA on San Diego Like all border areas, San Diego had much at stake with the passage of the NAFTA. San Diego's economy, especially the service industries, was stimulated by the increase in trade with Mexico. These industries include accounting, advertising, financial services, engineering, law, and construction. San Diego also benefited from the increase in tourism in Mexico. And, over the next 25 years, if the NAFTA leads to increased economic growth in Mexico, it could reduce the number of undocumented immigrants in San Diego County. On the other hand, there are problems for San Diego from the agreement. Some industries will be adversely affected; especially important is San Diego's agricultural industry, which specializes in fruits and vegetables. Trucking may also be hurt by the increased ability of Mexican trucking companies to haul in the United States. (Some people argue in addition that Mexican trucks are less safe on the road than American trucks.) And many blue-collar workers in manufacturing could face job losses. In addition, since most new production will be concentrated in the border area (until Mexico's transportation system in the interior improves substantially), there is a potential for increased environmental problems in the border area --- sewage, air pollution, hazardous waste disposal, and so forth. And there are likely to be greater transportation bottlenecks (on highways, airports, and border crossings) as the amount of traffic rises substantially. Effects of NAFTA on Mexico The NAFTA has increased the importance of trade for Mexico greatly. With NAFTA, Mexican businesses gained a secure access to the American and Canadian markets. In 1980, trade accounted for about 11% of Mexican GDP. By 2000, this had risen to 32%. 9 Trade was a major factor in the recovery Mexico experienced from the very severe recession of 1995. In that recession, Real GDP fell 6.2% and over one million jobs were lost. Yet, Mexico recovered quickly, with Real GDP rising 5.2% in 1996, 7% in 1997, 4.8% in 1998, 3.8% in 1999, and 6.9% in 2000. Half of Mexico’s growth of Real GDP is attributed to exports. Between August of 1995 and August of 1999, Mexico generated about two million new jobs. Half of these were related directly or indirectly to exporting. And real wages rose much faster in those Mexican industries that produced for export. According to one estimate of the early 1990s, the NAFTA would lead to the creation of more than 600,000 jobs in Mexico over ten years (an increase of 2% in the number of jobs). It was estimated that real wages of Mexican workers might rise as a result of NAFTA, but that this would be very small at best. Low-skilled workers were expected to benefit in Mexico, either from more jobs being available or from higher wages. It was expected that higher-skilled workers in Mexico would be hurt by the competition with the United States. However, it seems that the reverse has occurred. The increased foreign direct investment has increased the demand for skilled labor and therefore has increased the relative wages of skilled Mexican workers. (Foreign-owned maquiladoras pay unskilled workers 3% less than domestically-owned firms but pay their skilled workers 21% more.) The wages of urban Mexican workers who have completed no more than six years of school have fallen considerably compared to the wages of urban Mexican workers who have continued education beyond high school. So the opening to the international economy has widened wage inequality in Mexico as it has in the United States. In Mexico, as in the United States, certain industries used to pay wages to their less skilled workers that exceeded the productivity of those workers (these extra wages are called “rents”.). They could do so because those companies were shielded from competition and were therefore extracting excess profits (that is, some of the excess profits were shared with workers). But tariff reductions were greatest for those Mexican industries that used less skilled labor. So the opening of international trade seems to have increased competition and lessened the ability of companies to pay wages that exceed the productivity of the less skilled workers. The same phenomenon has occurred in the United States. The opening of international trade also seems to have shifted the location of industrial activity in Mexico. In 1980, 46% of Mexico’s manufacturing labor force was located in and around Mexico City. Only 21% was located along the Mexico – United States border. By 1998, the share in Mexico City had fallen to 23% while the share along the border had risen to 34%. Wages have risen most in those areas of Mexico near the border and have not risen much in those areas of Mexico far from the border. Besides less skilled workers, there are other Mexican "losers" from NAFTA. Many businesses are not able to compete with the American imports or with the Americanowned companies in Mexico. This is especially so for Mexican bankers. And when agriculture is fully liberalized, many small farmers will not be able to compete with the American grain producers. The NAFTA requires considerable adjustment within Mexico as well as within the United States. In addition, there is fear within Mexico for Mexican cultural identity. The official position is that Mexican culture and national identity are solidly embedded in the population; they will not be threatened by greater interaction with the United States. Many Mexicans question this official position. 10 Summary If one believes the majority of studies, it does appear that there have been net benefits to the United States and to Mexico from the NAFTA (i.e., the benefits exceed the costs for the nation as a whole). The NAFTA contributed slightly to an increase economic growth and probably created more jobs than were lost. But there are problems with the NAFTA as well. The burden of adjustment is substantial and falls disproportionately on low-wage, unskilled workers in both countries. And there is potential for greater environmental problems. Despite the problems, Mexico has attempted to expand its international trade. By 2000, Mexico had free trade agreements with nine Latin American countries. In the 1990s, trade between Mexico and Chile rose 661% and trade between Mexico and Costa Rica rose 381%. A Mexico – European Free Trade Agreement has been agreed upon. Mexican tariffs against European Union products are to be eliminated by 2007. Mexico has also established free trade agreements with the European Free Trade Area (Iceland, Liechtenstein, Norway, and Switzerland) and with Israel. So it seems clear that the globalization of the Mexican economy is likely to continue. Footnotes for the data are available upon request.