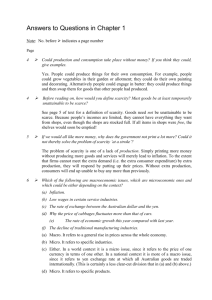

Answers to even-numbered questions

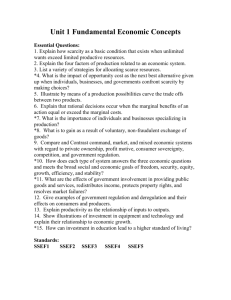

advertisement