Business Studies in Action: HSC Course 3rd edition

Business Studies in Action: HSC Course 3

rd

edition

Chapter summaries

Topic 5: Global business

Chapter 22 Managing global business

There are a number of private and government organisations (Austrade) that offer assistance with a particular aspect of managing a global business.

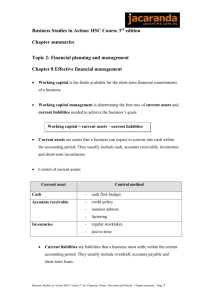

1. Financial management of a global business involves methods of payment, currency exchange fluctuations, credit risks and insurance.

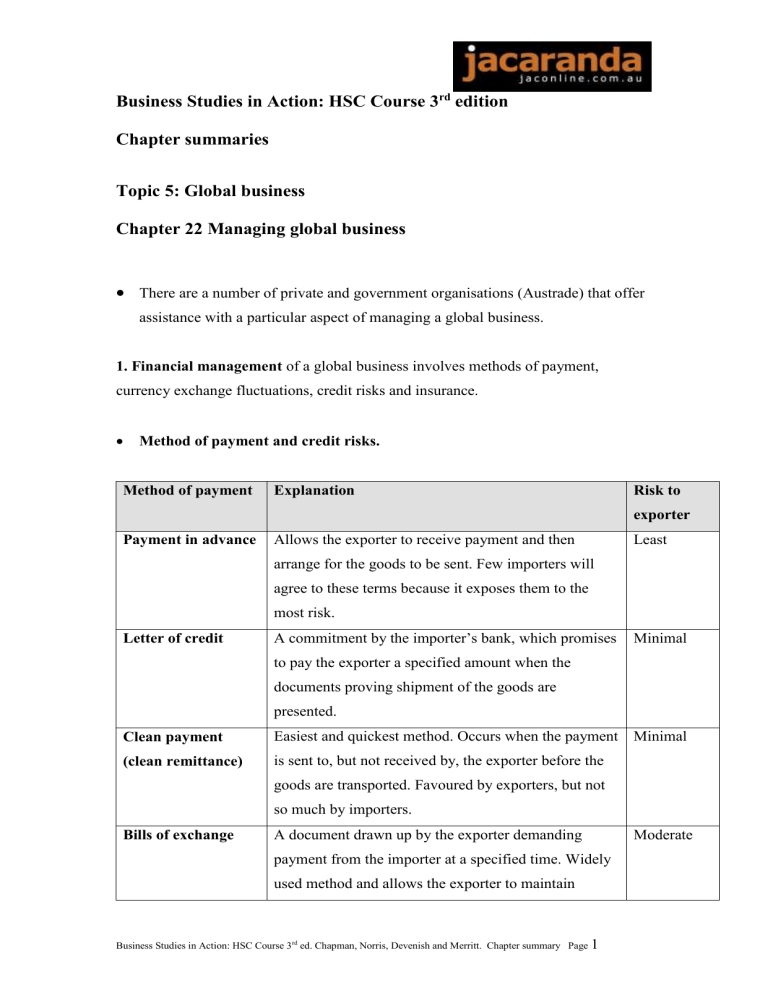

Method of payment and credit risks.

Method of payment Explanation Risk to exporter

Least Payment in advance Allows the exporter to receive payment and then arrange for the goods to be sent. Few importers will agree to these terms because it exposes them to the

Letter of credit most risk.

A commitment by the importer’s bank, which promises to pay the exporter a specified amount when the

Minimal documents proving shipment of the goods are presented.

Clean payment

(clean remittance)

Bills of exchange

Easiest and quickest method. Occurs when the payment Minimal is sent to, but not received by, the exporter before the goods are transported. Favoured by exporters, but not so much by importers.

Moderate A document drawn up by the exporter demanding payment from the importer at a specified time. Widely used method and allows the exporter to maintain

Business Studies in Action: HSC Course 3 rd ed. Chapman, Norris, Devenish and Merritt. Chapter summary Page

1 Page 1

Open credit

(account) control over the goods until payment is either made or guaranteed. Two types: bills against payment and bills against acceptance .

Allows the importer to access the goods, with a promise to repay at a later date.

Most

Hedging reduces the risk of currency fluctuations.

A spot exchange occurs when two parties agree to exchange currency and finalise a deal immediately. Spot exchange rates: the value of one currency in another currency on a particular day.

Hedging (natural and financial instrument – derivatives) can be used to minimise the risk of having to accept an unfavourable exchange rate.

Derivatives are financial instruments that may be used to lessen the risk of currency fluctuations. There are three main derivatives:

(i) Forward exchange contract: a contract to exchange one currency for another currency at an agreed exchange rate on a future date.

(ii) Options contract: gives the buyer (option holder) the right, but not the obligation, to but or sell foreign currency at some time in the future.

(iii) Swap contract: an agreement to exchange currency in the spot market with an agreement to reverse the transaction in the future.

Insurance: protection against default of payment, product damage and financial risks.

Obtaining finance.

(i) Domestic capital market: Australian banks and financial institutions.

(ii) International capital market: international financial institutions.

(iii) Eurocurrency market: nominating a currency of choice – US dollar,

Deutschmark, British pound, Japanese yen.

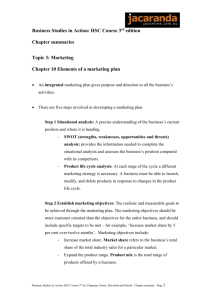

2. Marketing management. A global business must modify its marketing plan to suit overseas markets.

Business Studies in Action: HSC Course 3 rd ed. Chapman, Norris, Devenish and Merritt. Chapter summary Page

2 Page 2

Market research to determine:

economic capabilities of host country.

market potential for a product.

social, cultural and political features.

Global branding: worldwide use of names, symbols and logos. Helps global recognition irrespective of language.

A standardised marketing mix can be adopted based on an identical product being sold worldwide. A differentiated approach uses a customised marketing plan to suit the host country’s local needs.

3. Operations management. To remain competitive, businesses are forced to find ways to reduce costs of production and improve their products.

Sourcing decisions are a business’s decisions about whether it should make or buy the resources that are needed to create its products.

Reasons to make (vertical integration) Reasons to buy (outsourcing)

Greater control

Lower costs

Protect technology

Improve scheduling

-

-

-

Greater flexibility

Lower risk

Lower costs

Superior technology

Transnational corporations can establish a global web , a network of cost-effective production sites located around the world usually in low-wage countries.

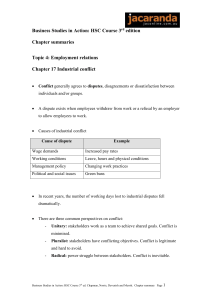

4. Employment relations management. The quality, quantity and composition of the available labour force are important considerations.

As a business expands globally it must adapt its organisational structure .

Business Studies in Action: HSC Course 3 rd ed. Chapman, Norris, Devenish and Merritt. Chapter summary Page

3 Page 3

Businesses may adopt one of three methods to staff overseas operations:

(i) home country: citizens of the TNC’s own country

(ii) host country: citizens of the overseas country

(iii) third country: citizens of neither the home nor host country.

Need for an understanding of the different labour laws, wages and working conditions between countries. Shortages of skilled labour overcome by recruiting expatriates. Non-managerial staff are normally host country nationals.

Staffing system: concerned with the selection of employees for particular jobs.

One of three approaches:

(i) Ethnocentric: key management staff are relocated from the home country.

(ii) Polycentric: host country employees are recruited.

(iii) Geocentric: the best employees available are selected irrespective of nationality.

Management strategies should be constantly evaluated to determine their degree of success.

Evaluation involves:

Measure actual performance.

Compare against planned performance and goals.

Take corrective action if performance is unacceptable.

A business should constantly scan the business environment and modify existing strategies in response to market and technological changes. Example: market saturation and e-commerce.

Business Studies in Action: HSC Course 3 rd ed. Chapman, Norris, Devenish and Merritt. Chapter summary Page

4 Page 4