Summary: West Virginia Adjustable Rate Note - ARM 5-1

advertisement

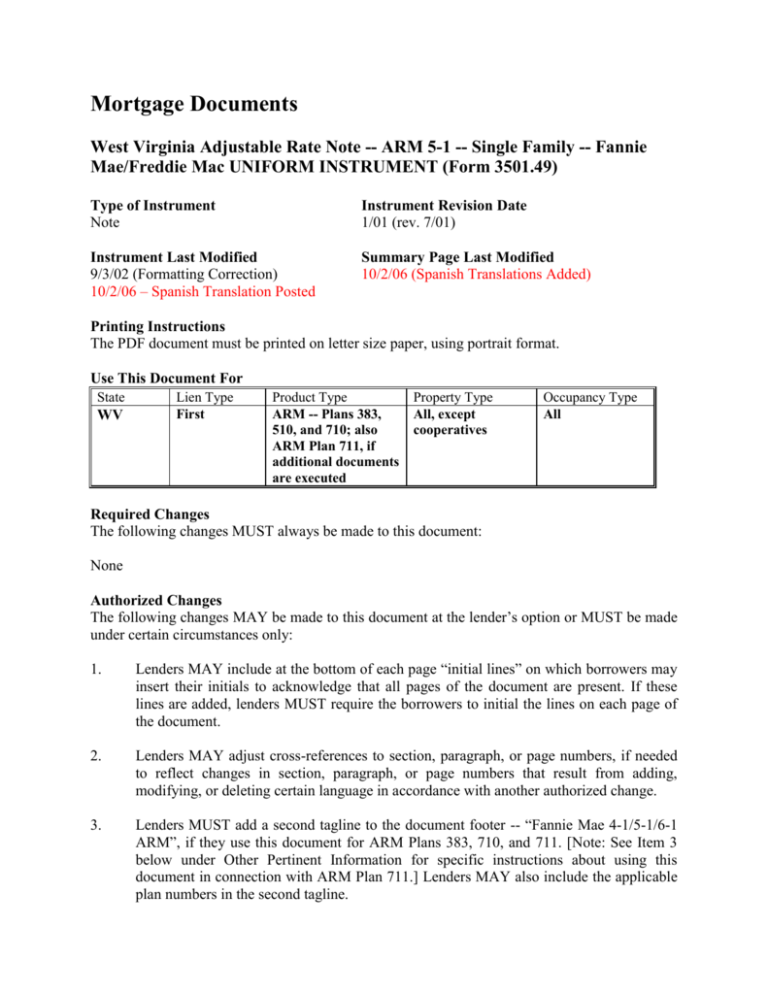

Mortgage Documents West Virginia Adjustable Rate Note -- ARM 5-1 -- Single Family -- Fannie Mae/Freddie Mac UNIFORM INSTRUMENT (Form 3501.49) Type of Instrument Note Instrument Revision Date 1/01 (rev. 7/01) Instrument Last Modified 9/3/02 (Formatting Correction) 10/2/06 – Spanish Translation Posted Summary Page Last Modified 10/2/06 (Spanish Translations Added) Printing Instructions The PDF document must be printed on letter size paper, using portrait format. Use This Document For State WV Lien Type First Product Type ARM -- Plans 383, 510, and 710; also ARM Plan 711, if additional documents are executed Property Type All, except cooperatives Occupancy Type All Required Changes The following changes MUST always be made to this document: None Authorized Changes The following changes MAY be made to this document at the lender’s option or MUST be made under certain circumstances only: 1. Lenders MAY include at the bottom of each page “initial lines” on which borrowers may insert their initials to acknowledge that all pages of the document are present. If these lines are added, lenders MUST require the borrowers to initial the lines on each page of the document. 2. Lenders MAY adjust cross-references to section, paragraph, or page numbers, if needed to reflect changes in section, paragraph, or page numbers that result from adding, modifying, or deleting certain language in accordance with another authorized change. 3. Lenders MUST add a second tagline to the document footer -- “Fannie Mae 4-1/5-1/6-1 ARM”, if they use this document for ARM Plans 383, 710, and 711. [Note: See Item 3 below under Other Pertinent Information for specific instructions about using this document in connection with ARM Plan 711.] Lenders MAY also include the applicable plan numbers in the second tagline. 4. Lenders MAY add the following disclosure notice above or below the Borrower signature lines, if they originate mortgages pursuant to the regulations of the Comptroller of the Currency: Notice: The initial index value for this loan is ______%. [Spanish Translation] Aviso: El valor del índice inicial de este préstamo es ____%. 5. Lenders MAY modify Section 11. Uniform Secured Note by replacing the last sentence of the first paragraph with the following sentence and adding the subsequent language as a new paragraph before the existing second paragraph: …………………………………………………………….…Some of those conditions read as follows: Transfer of the Property or a Beneficial Interest in Borrower. As used in this Section 18, “Interest in the Property” means any legal or beneficial interest in the Property, including, but not limited to, those beneficial interests transferred in a bond for deed, contract for deed, installment sales contract or escrow agreement, the intent of which is the transfer of title by Borrower at a future date to a purchaser. [Spanish Translation] .... .... .... .... .... .... .... ....A continuación se describen algunas de esas condiciones: Traspaso de la Propiedad o de un Interés Beneficioso en el Deudor. Conforme se utiliza en la presente Sección 18, “Interés en la Propiedad” significa cualquier interés legal o interés beneficioso sobre la Propiedad, incluidos, pero no limitados a, los intereses beneficiosos transferidos por un acuerdo de transferencia futura de título, contrato de transferencia de título condicional, contrato de venta en cuotas o acuerdo de depósito en reserva, en virtud del cual se pretende la transferencia de título en una fecha futura, del Deudor a un comprador. 6. Lenders may insert a Notice on the Note if the Notice is required by applicable law for the type of transaction. Other Pertinent Information Any special instructions related to preparation of this document, use of special signature forms, required riders or addenda, etc. are discussed below. 1. If the borrower is an inter vivos revocable trust, we may require: a special rider, a different signature form for the trustee signature, and a special signature acknowledgment for the settlor/credit applicant(s). Lenders are responsible for making any modifications, including the use of different terminology, needed to conform to the signature forms customarily used in West Virginia and will be held fully accountable for the use of any invalid signature form(s). - Each of the trustees must sign this document in a signature block substantially similar to the following, which should be inserted in the Borrower signature lines. ___________________________, Trustee of the __________________________ Trust under trust instrument dated ___________________________, for the benefit of _____________________________ (Borrower). [Spanish Translation] ___________________________, Fiduciario del Fideicomiso _____________________ de conformidad con el instrumento de fideicomiso de fecha ________, en beneficio de __________(Deudor). 2. Lenders should insert in the first blank of the first sentence in Section 4(D). Limits on Interest Rate Changes an interest rate that is equal to the sum of the initial start rate for the mortgage and the applicable annual interest rate adjustment cap (which is 1% for ARM Plans 383, 510, 710, and 711). Then, in the second blank of the sentence, lenders should insert an interest rate that is equal to the initial start rate for the mortgage less the applicable annual interest rate adjustment cap (which is 1% for ARM Plans 383, 510, 710, and 711). However, if this difference is less than the specified mortgage margin, lenders should insert the specified mortgage margin in the second blank of the first sentence. Lenders should insert in the blank in the last sentence an interest rate that is equal to the sum of the initial start rate for the mortgage and the applicable lifetime interest rate adjustment cap (which is 4% for ARM Plan 383, 5% for ARM Plan 510, and 6% for ARM Plans 710 and 711). 3. When completing Section 7(A). Late Charges for Overdue Payments, lenders should specify the maximum late charge percentage allowed by state law, if that amount is less than the late charge we require (as specified in the Servicing Guide). In no instance should lenders specify a late charge greater than our required late charge percentage. 4. Lenders may also use this note to document a convertible ARM Plan 711; however, if they do so, they must also have the borrower execute the following riders to the security instrument -- a Multistate Adjustable Rate Rider (Form 3108) and a Multistate Adjustable Rate Rider - Fixed Rate Option Addendum (Form 3109) -- and an addendum to the note - Fixed Rate Option Addendum (Note) (Form 3256).