Paper 1 - Department of Agricultural Economics

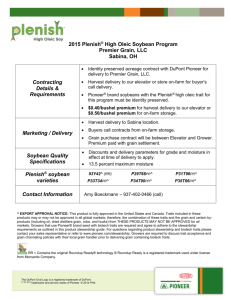

advertisement

REVISTA MEXICANA DE AGRONEGOCIOS AN ECONOMIC ANALYSIS OF UNIT-TRAIN FACILITY INVESTMENT 1 Phil Kenkel , Shida Rastegari Henneberry 2. Abstract The development by the railroads of more favorable rates for multi-car shipments (unit-trains) has led grain cooperatives and other agribusiness firms consider investing in high-speed rail load-out facilities. In this study the profitability of an investment in a unit-train load-out facility is analyzed, considering various scenarios regarding grain throughput volumes, unit rate transportation savings, discount rates, and grain cleaning costs. The results show that investment in a 110-car unit-train facility is profitable for a typical country wheat elevator, given the transportation cost savings/price premiums of $.093 or higher per bushel. The breakeven grain volume was approximately 90% of the full capacity. Subject Area: Agribusiness and Finance Keywords: Unit-train transportation, agribusiness finance, grain marketing efficiency, wheat transportation * The authors are Professor and Bill Fitzwater Endowed Cooperative Chair and Professor of Agricultural Economics at Oklahoma State University. Constructive input of Haerani Agustini, graduate research assistant, is gratefully acknowledged. This research was partially funded through a grant from the Oklahoma Wheat Commission and the National Institute for Commodity Promotion Research and Evaluation, and Hatch Projects H-2491 and H-2537 of the Oklahoma State University Agricultural Experiment Station. 1 2 Professor & Bill Fitzwater Endowed Cooperative Chair. kenkel@okstate.edu Professor. Department of Agricultural Economics. srh@okstate.edu 1 Cuarta Época. Año X. Volumen 19. julio-diciembre 2006. Introduction The historical role of country elevators within the wheat commodity marketing system was grain assembly. Country elevators received grain from producers and assembled it to ship to terminal elevators by truck or rail car. As the marketing system evolved, country elevators competed chiefly through increased efficiency in grain handling and transportation. This quest for economies of scale and scope led to increased firm size through both acquisitions and consolidations. In the past, the structure of the grain marketing system consisted of three or more tiers of firms: a large number of local country elevators which assembled grain, regional terminal elevators which consolidated grain from the local country elevators, and the final tier of export elevators. In recent years, demand and supply factors have worked together in diminishing the role of regional elevators in grain consolidation and increasing the role of local elevators in direct shipments of wheat to domestic and foreign end users. On the supply side, a variety of factors, including increased marketing expertise of local elevator merchandisers, advances in information technology, and deregulation of rail rates have contributed to this decentralization of the grain marketing system (Dahl). With this decentralization, an increasing volume of grain is moving from its point of production (or from a gathering point near the point of production) to the domestic user or export point, without passing through a terminal elevator. The development by the railroads of more favorable rates for multi-car shipments has contributed to this trend. On the demand side, with increased integration of world grain markets, U.S. producers (in particular wheat producers) are faced with growing competition from other grain suppliers. Grain buyers, especially those for higher protein wheat, demand consistency and quality in addition to competitive prices. The increasing demand for quality has been attributed to many factors including the growth in disposable incomes that has resulted in consumers becoming more sophisticated in their purchases. Another factor that has contributed to the increased demand for quality and consistency has been the mechanization of milling and end-product manufacturing, including those in developing countries. This automation and technological advancement requires consistent inputs for proper end-product characteristics. Market privatization that has taken place over the last two decades has also had a significant impact on demand for high quality wheat. In contrast to government buyers, private buyers are profit motivated. In order to maximize the quality of their end products, they are willing to invest in product-specific characteristics (Oades). Private buyers demand higher quality grain and many prefer sourcing of wheat by production region in supplying countries to meet their standards of quality and consistency. Additionally, in many developing countries, consumers are moving from corn-based diets to wheat-based diets. This trend has further increased the role of private millers in international wheat purchases. 2 REVISTA MEXICANA DE AGRONEGOCIOS Considering that over fifty percent of U.S. wheat production is exported, gaining competitiveness in the global markets is an important determinant of U.S. wheat producers’ revenues. Product differentiation and timely delivery are crucial in maintaining and increasing U.S. market shares (Vachal, et al.). Unit-train shipments allow U.S. exporters to rapidly accumulate sufficient grain to load vessels. By originating all of the grain in a single region, the exporter can supply a large amount of wheat that is consistent in quality, differentiated from the wheat produced in other regions, and is timely delivered to the buyers. In their quest for efficiency and increased profitability, local elevators and other grain handling firms continue to evaluate unit-train load-out projects. Many unit-train projects are owned by cooperative grain handling firms. The profitability of cooperative unit-train project directly impacts the return of the participating grain producers. Therefore, information about the return on investment for unit-train Load-out projects and the factors that influence profitability is of great interest to grain marketing agribusiness firms and to grain producers. The objective of this study is to evaluate the profitability of wheat unit-train load-out facilities. To accomplish the objective of this study, first a feasibility analysis of a 110-car unittrain facility is conducted considering annual fixed- and variable-costs involved in building and operating a load-out facility and under baseline assumptions regarding other variables. In order to determine how feasible investment in unit-train facilities might be under varying market conditions, profitability analysis under various scenarios were conducted. These scenarios involved varying assumptions regarding discount rates, transportation cost savings, grain volumes handled, percentage of grain needed to be cleaned, and the initial infrastructure costs. It is important to note that this study uses actual construction and operating costs from a recent unit-train load-out project in Oklahoma. This load-out project currently ships wheat to both, the Gulf for overseas export and directly to Mexican flourmills. Grain Shipping Structure Shipments from the elevator to the buyer can be made via single-car (normally involving 1-24 cars), multi-car (normally involving 25-49 cars), or unit-car (normally either 50, 75 or 110-car) trains, and shuttle-trains (Vachal and Bitzan, 2000). Shuttle-trains are dedicated 110-car unit-trains that operate on a fixed, predetermined schedule. The most advantageous shuttle-train rates require a minimum of 20 trips per year. The minimum and maximum number of cars included in each shipment type may vary slightly by rail carrier and commodity. Singlecar and multi-car grain shipments are generally bound for domestic destination, while unittrains and shuttle-trains are generally bound for larger domestics processors and export facilities and have to meet certain defined origin destination. 3 Cuarta Época. Año X. Volumen 19. julio-diciembre 2006. Rail grain rates differ by market, commodity, and shipment size. There is a consistent rate savings in shipping via larger-car trains. While the exact limits vary by rail carrier, trains in the 100- to 110-car range usually represent the maximum size for a train. The unit-car rate reflects the saving in loading/unloading, switching, and waiting time that the rail carriers experience when they do not have to consolidate grain cars with other users in assembling an optimal length train. In a situation not uncommon to airline travelers, a variety of rail rates may be effect for shipment to the same destination on a particular day. Published tariff rates are offered directly by the rail carrier and generally do not include an on-time delivery guarantee. Shippers can also contract for on-time delivery guarantees at an additional premium. Guaranteed rail freight rates also trade on the secondary market with premium and discounts reflecting the supply of users desiring to source or divest of rail freight contracts. The tariff rate differential between single car and unit car rates is generally also reflected in the guaranteed and auction market rates (USDA, 2004). Published tariff rates provide the most convenient measure of the unit car rate differential. August 3, 2004 tariff rates from the Northern Santa Fe Rail Road for grain shipments from Central Oklahoma to the Texas Gulf indicated a rate of 48.7¢/bushel for 1-25 car shipments. The unit-train (110 car) rate was 36.8¢/bushel or 11.9¢/bushel below the single car rate (bnsf.com). Kenkel and Anderson (2002) identified similar unit-train freight rate advantages. They estimated unit car savings for Oklahoma country elevator locations to Gulf markets ranging from 5-15 cents per bushel ($1.80 to $5.5/tonne) relative to single-car rates. This rate structure provided country elevators with the incentive to modernize their load-out facilities and for investments that lend themselves to systems efficiencies. To qualify for favorable rates, the elevator must be able to load a 110-car train (approximately 360,000 bushels or 9,800 tonnes) in a set maximum amount of time, usually 12-14 hours. Because of these throughput requirements, along with associated infrastructure changes involving buildings and equipment needed for blending, weighing, cleaning and grading; a unit-train load-out facility involves a large investment (up to $6 million dollars). While rate savings provide an incentive for investment in unit-trains, the adoption of unit-train shipping by wheat elevators has been slower that those for corn and soybean shippers. Many reasons have been given for this slow adoption rate, including domestic millers not being equipped to rapidly unload unittrain shipments. In addition to the lack of ability and desire of customers to accept unit-train shipments, the competitive costs of truck and barge transportation have also been key considerations in unit-train facility investment (Vachal, et al.). 4 REVISTA MEXICANA DE AGRONEGOCIOS Related Literature and the Contribution of this Study In a previous study of unit-train profitability, Vachal et al. examined the feasibility of unit-train load-out facilities for hard red spring wheat elevators in the Northern Plains. The authors analyzed several scenarios including a “greenfield” start-up scenario in which all grain receiving, storage and load-out infrastructure had to be constructed and several other scenarios involving smaller investment and lower grain throughput. The authors identified four key factors to be considered: production density, dependence on rail marketing, railroad spreads, and desire of customers to use unit-train shipments. The results of this study show that elevators handling over 10 million bushels could afford to make a $2 million investment in a 110-car unit-train load-out project. It was also concluded that the benefit/cost relationship would vary with each elevator’s unique cost situation. The current study builds to this line of important research in several areas. While the previous study was based on hard red spring wheat in the Northern Plains, this study investigates reprehensive costs and returns for hard red winter (HRW) wheat elevators in the Southern Plains. This study also provides a more systematic analysis of the impact of various cost factors on unit-train project profitability. Another factor, not addressed in the North Dakota study, is the incorporation of fixed and variable costs associated with grain cleaning into the feasibility analysis. Grain cleaning is an important part of marketing cost to country elevators. Wheat purchasers that are equipped to receive unit-train shipments typically require dockage levels below 5%. Unit-train load-out managers typically find that they must clean at least a portion of their wheat inventories to meet these levels. Most HRW wheat elevators remove measure and account for the amount of non-wheat material (dockage) when calculating the net weight credited to the producer. Elevators typically do not implement price discounts (cleaning fees) until dockage levels exceed 5%. Elevators cleaning wheat, in order to gain access to more favorable markets, must therefore absorb the costs of electricity and labor used to clean wheat and the value of the good wheat that is inadvertently lost during the cleaning process. In a 1994 study, Adam, Kenkel and Anderson estimated these costs at 4-6¢ per bushel, depending on the type of machine used. Antidotal evidence from conversations with elevator managers suggests that managers have not always taken into account the impact of grain cleaning costs, when evaluating the profitability of unit-train load-out facilities. This study considers the cost of wheat cleaning in the unit-train feasibility analysis. 5 Cuarta Época. Año X. Volumen 19. julio-diciembre 2006. Methods of Analysis The methods used in this study to evaluate the feasibility of investing in a unit-train facility by an exporting elevator, are described in this section. Investment in a unit-train facility is expected to improve the revenues received from wheat sales by enabling the elevator to receive a price premium for direct shipments and/or by transportation cost savings. Direct shipments have opened up more price-favorable markets to grain elevators, compared to the traditional channels of wheat marketing where the grain is shipped to a port to be mixed with other HRW wheat from other areas. By representing a particular production region with specific grain characteristics (source differentiation), grain marketed via unit-train shipments has entailed a price premium. More specifically; in cases where weather and/or agronomic practices result in grain with desired end-user characteristics, wheat buyers (such as Mexican flour Millers) have offered premiums to unit-train shippers. Other than receiving a higher price, a second benefit stems from the transportation cost savings arising from large shipments. This benefit is the difference in unit-train rail rates to a particular market relative to the next best transportation alternative. The alternative transportation could be rail transportation at smaller car rates, or truck transportation. These alternative modes of transportation, compared to unittrains, normally entail higher cost of shipping per unit of grain transported. The total benefit for the elevator from shipping wheat through a unit-train versus marketing it through traditional channels is expressed as: (1) Bt = Qt (PUT- PTR)t + Qt (TS)t Where B is the difference between total revenue from selling wheat through the unit-train and selling through the traditional channels. Traditional channels are considered to be shipments via smaller-car trains or trucks. Q is the quantity of wheat available for shipment. PUT is the price received from the unit-train buyer, PTR is the traditional channel market price (P UT-PTR is referred to as “price premium” throughout this study), and TS is the transportation cost savings per bushel from using a unit-train compared to alternative modes of shipping. In other words; B measures the net price advantage and transportation cost savings per bushel of wheat shipped by a unit-train, compared to selling wheat via other marketing channels and transportation modes. The total cost of constructing and operating the unit-train load-out facility is assumed to be: (2) Ct = CIt + CAt + CVt Where CI represents the original infrastructure investment costs which is assumed to occur, by its entire amount, in year zero (at the beginning of the life of the project); C A represents the annual fixed operating costs of the load-out infrastructure, occurring every year and over the life of the project; and Cv represents the annual variable operating costs of grain handling. A more detailed breakdown of cost estimates within these categories is provided in the data section. 6 REVISTA MEXICANA DE AGRONEGOCIOS In this study, three measures are used for evaluating the return to an elevator’s investment on a unit-train load-out facility: net present value (NPV), benefit-cost ratio (B/C), and internal-rate-of-return (IRR). The calculation of net present value (NPV) of the profit on investment is as given by Gittinger (1982): N (3) NPV t 1 where Bt Ct (1 i) t Bt is the same as was defined earlier; Ct is the total construction and operating costs of the load-out facility and grain handling, as defined in (2) above; ) i is the discount rate (the risk adjusted cost of capital); and N is the number of years that the investment is expected to last. Positive NPV’s indicate investment profitability, while negative values present nonprofitability. The benefit to cost ratio (B/C) is calculated as: N (4) B/C Bt (1 i) t 1 N Ct (1 i) t 1 t t A greater than one B/C indicates investment profitability. The definitions of variables are the same as above. A third measure of profitability of investment is the internal rate of return (IRR). IRR represents the discount rate that sets the NPV equal to zero. To evaluate profitability, a project’s IRR is compared with the firm’s discount rate (risk adjusted cost of capital). If the IRR is greater than the firm’s discount rate, then it is concluded that the investment is profitable. Non-profitability is concluded if the opposite is true. Sources of Data In this study, the base-line investment and operation costs were obtained from a recent unit-train load-out project in Oklahoma. The project involved the construction of over 3 miles of railroad track, the addition of a 250,000-bushel concrete storage tank, the renovation of an existing concrete elevator and the construction of a high-speed elevator leg, in-line scale, loadout platform and reclaim augers. The cooperative also elected to install a 10,000-bushel/hour grain cleaner at a cost of over $100,000. The project involved a total investment of close to $2 million. The baseline initial investment and annual costs are provided in Table 1. While actual investment and operating costs vary for each particular firm, the data is thought to be representative of recent unit-train projects that use existing storage structures. 7 Cuarta Época. Año X. Volumen 19. julio-diciembre 2006. Annual operating costs consist of fixed and variable costs associated with the load-out operation. Fixed costs include insurance, taxes, and administrative expenses. In keeping with the principles of NPV, B/C and IRR calculations, interest and depreciation costs are not included as annual costs. Annual depreciation is not included because the initial investment amount is reflected as an outflow in year 0. Interest costs are not included because the interest effect is captured through the discount rate. A profile of annual fixed costs is provided in Table 2. Variable costs include those related to grain handling such as: wages, electricity, fuel, grain cleaning costs, and grain inspection and sampling fees. The overtime cost occurs because the firm must load the train within the prescribed 14 hour time period. A summary of variable costs is provided in Table 3. The operating costs reported by the Oklahoma elevator case example were similar to those reported by Vachal et al. (1999) and appear to be representative for typical 110-car unit-train load-out facilities. Results The baseline assumptions for the profitability analysis are summarized in Table 4. The baseline in this study is a facility that ships twenty-four 110-car trains each year, each 110car train holding 360,000 bushels, for a total grain throughput of 8.6 million bushels. The total investment cost was $2 million, which is representative of a project utilizing existing grain storages and grain receiving systems. The baseline investment assessment assumed that the unit-train project generated a combined transportation rate savings and price advantage of $.10 per bushel. It was further assumed that five percent of the grain required cleaning. The baseline discount rate was 10%. The results of the investment analysis, using baseline assumptions, are provided in Table 5. The investment analysis indicated that a unit-train loadout project had a positive net present value of $364,573 ($.042 per bushel of annual throughput) at baseline assumptions. The project NPV represents the increase in value to the elevator firm from initiating the unit-train project; or in the case of a cooperative elevator, to the producer, over the life of the project. It is worth pointing out that the $.042 per bushel net present value does not imply that the elevator could raise producer grain prices by $.04 per bushel on an annual basis. Instead, the $0.04 per bushel figure represents the net present value of the benefit over the life of the unit-train project. The feasibility analysis showed a benefit to cost ratio of 1.08 and an internal rate of return of 14.86%, given the baseline assumptions given in Table 4. Sensitivity Analysis In addition to the analysis of the baseline scenario, sensitivity analysis was conducted to determine the impact of varying discount rates, per-bushel transportation cost savings, grain throughput volumes, and percentage of grain cleaned; on the project profitability. As is standard practice in this type of analysis, all cost and throughput parameters were set at base line levels while the impact of changing the parameter of interest was determined. 8 REVISTA MEXICANA DE AGRONEGOCIOS Discount Rates As the discount rate, or cost of capital, goes up; the NPV and the B/C ratio are expected to go down. The discount rate used in investment analysis should reflect the firm’s interest costs and an appropriate risk premium. The impact of discount rate on the profitability analysis of the 110-car unit-train project is provided in Table 6. As the table indicates, the unit-train load-out project is profitable at the 10% baseline or lower discount rates. Furthermore, the analysis shows that the unit-train project would not be profitable for elevators with a risk adjusted interest cost of over 14.86%. Transportation Cost Savings/ Price Premiums Decreases in transportation costs and increases in selling prices have an identical impact on an elevator’s grain marketing margin. Unit-train elevators often experience both of these advantages because of the lower rail rates associated with unit-train shipments and because of price premiums received at more favorable destination markets. For simplicity purposes the term transportation cost savings is used to describe the joint impact of these two similar factors. As mentioned earlier, unit-train transportation savings/price premiums generally range from $.05 to $.15per bushel, depending on the rail carrier and a particular elevator’s next best transportation and marketing alternative. Elevators shipping via dedicated shuttle-trains typically receive an additional savings of approximately $.03/bushel over unittrain rates. The impact of varying transportation cost savings on unit-train load-out profitability is summarized in Table 7. The analysis shows that the minimum or “break-even” transportation cost savings/price premium needed, assuming all other parameters are at baseline values, is $.093 per bushel. More specifically, if an elevator were able to obtain a transportation savings (including price premiums) of $.15per bushel, the project would have a net present value of over $2.3 million or $.265 per bushel of annual throughput. Grain Volume Table 8 shows the impact of grain volumes (annual throughput through the load-out facility) on profitability. As it would be expected for any project with a high portion of total costs as fixed costs, and consistent with findings from previous studies; the results of this study confirm grain throughput as being one of the key factors influencing the feasibility of unit-train investments. . The break-even grain volume is 90.56% of baseline capacity or approximately 7.489 million bushels per year. Moreover, our analysis indicates that an elevator that only achieves 90% of its projected capacity through the unit-train facility would experience a negative net present value of almost $23,000. As in the previous studies, these results highlight grain throughput as one of the key factors influencing unit-train project feasibility. 9 Cuarta Época. Año X. Volumen 19. julio-diciembre 2006. Grain Cleaning The impacts of grain cleaning costs on the unit-train investment are summarized in Table 9. Assuming baseline levels for all other parameters, our analysis indicates that a facility could clean up to 18.7% of its grain and still maintain a positive NPV. The importance of grain cleaning to a particular elevator would depend on the crop quality characteristics in the local production area, the elevator’s grain grading accuracy, and the elevator’s schedule of dockage and foreign material discounts on producer delivered grain. Conceivable, an elevator could charge sufficient discounts on producer delivered grain to recover all of the costs in cleaning. In practice, competitive pressures often make it difficult for elevators to implement price discounts that fully compensate them for grain cleaning costs. Investment Cost Investment cost for a 110-car unit-train load-out project varies across firms. This is expected to be particularly true for projects that are constructed in conjunction with existing receiving and storage facilities. The impact of project infrastructure cost on load-out profitability is summarized in Table 10. The results illustrate that, with other assumptions at baseline, unit-train load-out facilities are feasible only for elevators that can achieve a total investment cost of $2,364,572 or less. The pattern of results in Table 9 can be inferred from the calculated net present value at the baseline investment cost. However, because some cost such as property taxes and insurance were assumed to vary with investment level, it was necessary to explicitly calculate the profitability measures shown in Table 10 at the alternative investment cost levels. Summary and Conclusions The U.S. grain industry is undergoing structural change. Grain handling firms are consolidating and larger local elevators have taken on the role of shipping directly to domestic and foreign end users. Grain marketing firms are also pursuing transportation and logistic efficiencies and are using source differentiation to obtain market premiums. Unit-train shipments may provide a competitive advantage by reducing transportation costs and achieving marketing premiums relative to traditional marketing channels. These advantages may generate a market premium for producers; both through the elevator bid price and, in the case of cooperative elevators, through increased patronage refunds. However, unit-train facilities require large amounts of baseline initial investment and annual costs. An important question to be answered is whether the investment in unit-train facility is profitable. This study, using data from an elevator in Oklahoma, evaluated the feasibility of investing in a unit-train facility; under various scenarios involving varying discount rates, transportation cost savings, grain volume handled, percentage of grain cleaned, and investment costs. 10 REVISTA MEXICANA DE AGRONEGOCIOS The analysis indicated that investment in a 110-car unit-train load-out facility appears to be profitable for a typical country wheat elevator. The analysis identified grain volume and transportation rate savings/price premiums as major factors influencing profitability. The results indicated that unit-train elevators need to achieve transportation savings/price premiums of over $.093per bushel to re-coup investment costs. If the continued growth of unit-train grain shipments causes railroads to be less aggressive in offering rate savings, this could be a source of risk for unit-train projects. The results also indicated that grain volume is another key factor influencing unit-train facility profitability. At the baseline transportation saving premium of $.10/bushel a unit-train facility must operate at over 90% capacity to remain profitable. Given the year-to-year variation in grain production, these results indicate that unit-train projects are only appropriate for elevators with average throughputs substantially above the amount required for the unit-train facility. This analysis also investigated a factor that has not been considered in previous research: the impact of grain cleaning costs on unit-train project profitability. While grain cleanliness is likely to continue to be an important marketing issue, the analysis indicated that the percentage of grain cleaned had only a moderate impact on profitability. 11 Cuarta Época. Año X. Volumen 19. julio-diciembre 2006. References: 21st Century Alliance Press Release, Alliance Announces 21st Century Grain Processing Cooperative,1997. 21st Century Alliance Grain Processing Cooperative, What is the GPC? Internet site: www.hpi.com/wsdocs/kawg/alliance/GPC.htm, 1998. Adam, B. P. Kenkel and K. Anderson. “The Economics of Cleaning Winter Wheat for Export: An Evaluation of Proposed Federal Clean Grain Standards” Journal of Agricultural and Resource Economics, 19(2) 280-298, 1994. Burlington Northern and Santa Fe Rail Road Company. Internet site: www.bnsf.com Dahl, R. P. “Structural Changes and Performance of Grain Marketing Cooperatives,” Staff Paper P90-54, Department of Agricultural and Applied Economics, University on Minnesota, October 1990. Gittinger, J. Price. Economic Analysis of Agricultural Projects, EDI series in Economic Development. 2nd Edition, completely revised and expanded. Baltimore: Published for the Economic Development Institute of the World Bank (by) Johns Hopkins University Press, 1982. Kenkel, P. and K. Anderson. “Trends in Oklahoma Grain Production and Grain Transportation on the McClellan-Kerr Waterway System.” Working Paper, Department of Agricultural Economics, Oklahoma State University, Stillwater, Oklahoma, June 27, 2002. Larue, B. “Is Wheat a Homogeneous Product?” Canadian Journal of Agricultural Economics, V39,n1 (March 1991):103-17. Oades, J. “U.S. Wheat Associates, Portland, Oregon.” Paper presented at the 1997 Agricultural Transportation and Logistics Conference. Fargo, North Dakota, March 1997. Schnake, L. D. and C. A. Stevens, Jr. Inland Grain Elevator operating Costs and Capital Requirements, 1982. Agricultural Experiment Station, Kansas State University, Manhattan, 66506, Bulletin No. 644, October 1983. Tolliver, D. and J. Bitzan. Analysis of Revenues and Costs for Wheat Shipments Originated in North Dakota on the BNSF Railroad. Upper Great Plains Transportation Institute. North Dakota State University, March 2002. USDA, “Competitive Agricultural Systems in a Global Economy,” Agricultural Science and Education Impact, Washington, DC, USDA, 2000. USDA Grain Transportation Report-Transportation and Marketing, Agricultural Marketing Service. Internet site: http://www.ams.usda.gov/tmdtsb/grain/index.htm August 2004. Vachal, K., J. Bitzan, D. Tolliver and B. Baldwin. 110+ car marketing: An Alternative for Shipping Hard Red Spring Wheat. Ag Transportation News, Upper Great Plains Transportation Institute, North Dakota State University, May 1999. 12 Cuarta Época. Año X. Volumen 19. julio-diciembre 2006. TABLES Table 1. Baseline Infrastructure Investment Cost for the Case-selected 110car Unit-train Load-out Facility Rail Trackage and Switches Conveyance and load-out systems Cleaning equipment Storage facility upgrades Switch Engine Truck scale up-grade Total $1,000,000 $400,000 $100,000 $250,000 $150,000 $100,000 $2,000,000 Table 2. Annual Fixed Operating Costs for the Case-selected 110-car UnitTrain Load-out Facility % of Property Baseline Cost Plant Salary and Benefits NA $145,050 Insurance .88% $17,500 Maintenance 1.25% $25,000 a Property Tax 2% $32,000 Supplies and Miscellaneous NA $34,000 a Property tax based on buildings and track improvements only. 13 Cuarta Época. Año X. Volumen 19. julio-diciembre 2006. Table 3. Variable Costs for the Case-selected 110-car Unit-train Load-out Facility Item Per unit cost Baseline Cost Overtime $450/train $10,800 Grain Inspection $800/train $19,200 $675/train $16,200 $.01/bushel $86,000 $.055/bushel $23,650 Grain Inspection Overtime Electricity Grain Cleaningb (labor, electricity and shrinkage) b Baseline grain cleaning costs assume cleaning 5% of grain throughput. Table 4. Baseline Assumptions for the Analysis of a 110-car Unit-Train Load-out Facility Total Investment $2,000,000 Annual Grain Volume 8,600,000 bushels Transportation cost/market premium $.10/bushel Discount rate 10% Percentage of Grain Cleaned 5% 14 REVISTA MEXICANA DE AGRONEGOCIOS Table 5. Profitability Analysis for a 110-car Unit-train Load-out Facility Net Present Value (total) Net Present Value (per bushel) Benefit to Cost Ratio Internal Rate of Return $364,573 $.042 1.08 14.86% Table 6. The Impact of Discount Rates on Profitability of a 110-car Unit-Train Load-out Investment Benefit to Cost Internal Rate of Net Present Value Ratio Return 3.00% $1,218,683.17 1.20 14.86% 5.00% $921,638.37 1.16 14.86% 10.00% $401,030.00 1.08 14.86% 15.00% $(8,307.09) 0.99 14.86% 18.00% $(172,181.10) 0.95 14.86% 20.00% $(262,720.66) 0.92 14.86% Discount Rate 15 Cuarta Época. Año X. Volumen 19. julio-diciembre 2006. Table 7. The Impact of Transportation Cost Savings on Profitability of a 110-car Unit-Train Load-out Investment Transportation Cost Savings $0.08 Net Present Benefit to Cost Internal Rate of Value Ratio Return $(596,213.98) 0.86 0.56% $ 0.10 $364,572.88 1.08 14.86% $ 0.12 $1,325,359.73 1.29 26.13% $ 0.14 $2,286,146.59 1.51 36.23% Table 8. The Impact of Grain Volumes on Profitability of a 110-car UnitTrain Load-out Investment Percent of Capacity 80% Grain per Year Net Present (Millions Bushels) Value 6.880 $(399,695.77) Benefit to Cost Ratio 0.91 Internal Rate of Return 4.01% 85% 7.310 $(205,940.36) 0.95 7.02% 90% 7.740 $(22,937.94) 0.99 9.68% 95% 8.170 $170,817.47 1.04 12.34% 100% 8.600 $364,572.88 1.08 14.86% 105% 9.030 $558,328.29 1.12 17.29% 110% 9.460 $752,083.70 1.17 19.64% 16 REVISTA MEXICANA DE AGRONEGOCIOS Table 9. The Impact of Grain Cleaning on Profitability of a 110-car UnitTrain Load-out Investment % Grain Cleaned Net Present Value Benefit to Cost Ratio Internal Rate of Return 5.00% $364,572.88 1.08 14.87% 10.00% $232,464.69 1.05 13.12% 15.00% $100,356.49 1.02 11.39% 20.00% $(31,751.70) 0.99 9.55% 25.00% $(163,859.89) 0.96 7.64% Table 10. The Impact of Project Cost on Profitability of a 110-car UnitTrain Load-out Investment Total Project Infrastructure Costs Net Present Value Benefit to Cost Ratio Internal Rate of Return $1,800,000 $580,584.05 1.14 18.41% $2,000,000 $364,572.88 1.08 14.87% $2,200,000 $148,561.70 1.03 11.84% $2,400,000 $(67,449.47) 0.99 9.22% $2,600,000 $(283,460.65) 0.94 6.90% 17 Cuarta Época. Año X. Volumen 19. julio-diciembre 2006. 18