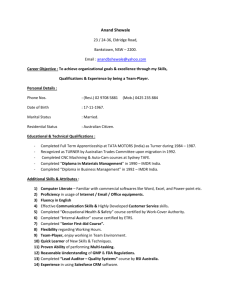

The Undisclosed Principal to a Land Contract

advertisement

When Dr Jekyll Turns out to be Mr Hyde – The Undisclosed Principal to a Land Contract and Section 52? Amanda Stickley The action for misleading or deceptive conduct is increasing in its application with the development that silence may amount to a breach of s 52 Trade Practices Act 1974 (Cth). The use of an agent is common practice in commercial transactions, and in some situations a party will be an undisclosed principal to avoid having their true identity revealed. This is accepted under the common law as a recognised category of agency. However, under the provisions of the legislation, it would appear possible that a corporation as an undisclosed principal to a contract, may be engaged in misleading or deceptive conduct. This paper intends to focus on the use of the undisclosed agency in land transactions. The scope for the future development of the action for misleading or deceptive conduct is as wide as the language of s 52 in its primary and extended operation... Justice French, ‘The Action for Misleading or Deceptive Conduct: Future Directions’ in Misleading or Deceptive Conduct: Issues and Trends.1 Introduction There can be no doubt as to the widening impact of the Trade Practices Act 1974 (Cth) on commercial dealings in setting standards for the conduct of trade and commerce. This has led to much debate concerning how the common law and the legislation interrelates. Of particular note is the effect of s 52 on the traditional general law. Such areas as tort, contract, passing off and defamation have all experienced the far reaching effect of the provision prohibiting misleading or deceptive conduct. As French J wrote in 1989, “[s 52's] limits are yet to be reached”. 2 This appears to be true as the Federal Court continues to expand the concept of what amounts to misleading or deceptive conduct. Of note is the relevance of s 52 to land contracts. 3 It is now well established that a vendor who makes misrepresentations as to the use of land can be found guilty of misleading and deceptive conduct.4 A further development in the last decade is the concept that silence can be misleading or deceptive conduct in breach of s 52 of the Trade Practices Act 1974 (Cth).5 Actions for non-disclosure in respect of land contracts have so far only been brought by purchasers against vendors. However, the words of s 52 do not prohibit an action for misleading or deceptive conduct being brought against a purchaser. What are the rights of a vendor against a purchaser whose silence has induced the vendor to enter into a land contract that otherwise the vendor would not have done so? This situation could arise where the vendor has objections to selling the property to a certain person or corporation. The purchaser could employ an agent to overcome this obstacle without revealing the existence of the agency relationship. The utilisation of an agent for such objectives is a common and accepted commercial practice. QUT, Faculty of Law. 1C Lockhart (ed), Federation Press, Sydney, 1996, p 283. 2'A lawyer’s guide to misleading or deceptive conduct’ (1989) 63 ALJ 250 at 250. See also, C Lockhart (ed), Misleading or Deceptive Conduct: Issues and Trends, op cit, Chpt 10. 3See D Skapinker, ‘The impact of the Trade Practices Act on land transactions’ (1996) 4 APLJ 107. 4Myers v Trans Pacific Pastoral Co Pty Ltd (1986) ATPR 40-672; Elders Trustee & Executive Co Ltd v E G Reeves Pty Ltd (1987) 78 ALR 193; Alliota v Broadmeadows Bus Service Pty Ltd (1988) 65 LGRA 362. 5Rhone-Poulenc Agrochimie SA v UMI Chemical Services Pty Ltd (1986) 12 FCR 477; Henjo Investments Pty Ltd v Colliers Marrickville Pty Ltd (1988) 79 ALR 83. The Law of Agency An agent creates legal relations between a principal and a third party. The agency exists when one party is authorised by the other to act on their behalf in respect of acts that affect their rights and duties in relation to third parties. The existence of the agency may be openly acknowledged, or the agent may enter into the contract without revealing that they are contracting on behalf of another. At common law, the latter situation falls within the doctrine of the undisclosed principal. The doctrine of the undisclosed principal In ordinary agency, where the principal and the existence of the agency relationship are disclosed, the agent is merely the instrument through which the principal becomes a party to the contract. Therefore, the principal acquires rights and liabilities under the contract. 6 Where the principal is undisclosed, to all intents and purposes, the agent is the party to the contract who will assume the rights and liabilities. The doctrine of the undisclosed principal is at variance with one of the fundamental rules of the law of contract.7 The rule of privity of contract allows only the parties to the contract to acquire rights and liabilities under that contract. Under the doctrine of undisclosed principal, the principal may be sued or may sue on the contract that is made by its agent, despite the fact that upon strict interpretation, the agent is the contracting party and the undisclosed principal is a third party to that contract.8 Commentators have suggested that the basis of the doctrine is similar to assignment, without the evidence of a transfer, the undisclosed principal being the implied assignee of the agent.9 Bowstead suggests that the doctrine developed simply for commercial convenience, 10 and is now firmly established despite being criticised as “unsound”, “unjust” and “inconsistent with elementary principles”.11 In Armstrong v Stokes, Blackburn J stated in respect of the legality of the doctrine: It has often been doubted whether it was originally right to hold so: but doubts of this kind come now too late.12 As in any agency relationship, for the undisclosed principal to sue or be sued on the contract, the agent must have acted within its authority in entering into the contract. The authority can be either express or implied.13 The agent of an undisclosed principal will be personally liable under the contract to the vendor, as the agent has contracted personally.14 The agent loses the right to sue if the principal intervenes on the contract. Therefore, both the agent and the undisclosed principal may sue and be sued on the contract.15 Upon the vendor discovering the existence of the undisclosed principal, the vendor has the option to choose between the agent or the principal to enforce the rights under the contract.16 If the vendor seeks to enforce the contractual rights or liabilities 6G Fridman, The Law of Agency, 6th ed, Butterworths, Sydney, 1990, p 229 Frederick Pollock characterised the doctrine as “inconsistent with the elementary doctrines of the law of contract”: Notes (1887) 3 LQR 359 referring to Isaac Cooke & Sons v Eshelby (1887) 12 App Cas 271. 8Andrews v Nominal Defendant (1968) 89 WN (Pt 2) (NSW) 113 at 124. See F Reynolds, Bowstead on Agency, 15th ed, Sweet & Maxwell, London, 1985, p 313. 9A Goodhart & C Hanson, ‘Undisclosed principals in contract’ (1931) 4 Camb LJ 320 at 351-352: “... the doctrine of the undisclosed principal is perhaps best considered as a primitive and highly restricted form of assignment...”. 10F Reynolds, Bowstead on Agency, op cit, p 313. 11Stoljar, The Law of Agency: Its History and Present Principles, Sweet & Maxwell, London, 1961, p 203. 12(1872) LR 7 QB 598 at 604. 13 However, unlike ordinary agency, an undisclosed principal cannot ratify the acts of an agent: Keighley, Maxstead & Co v Durant [1901] AC 240. 14Williams v Bulat [1992] 2 QdR 566 at 567; Dyster v Randall & Sons [1926] 1 Ch 932 at 938. 15Short v Spackman (1831) 2 B & Ad 962; Hersom v Bernett [1955] 1 QB 98; Mooney v Williams (1906) 3 CLR 1. 16There is no duty imposed on a vendor dealing with an intended purchaser to make inquiries as to the 7Sir against the agent, the agent will be personally liable.17 Application of the Principles to Land Contracts From the case law, a vendor who is wishing to avoid a contract on the grounds that the undisclosed principal was not the party the vendor intended to enter into contractual relationship with, they will have to establish that the identity of the agent or the undisclosed principal is material to the transaction.18 The fact that the vendor did not wish to enter into a contract with the undisclosed principal, will not be a material element of the contract, unless the vendor contracted with the agent due to some personal attribute of that agent. It is difficult to see how the identity of an agent would be a material element in the contract for the sale of land. As argued by Stoljar, a land contract does not involve an ongoing personal relationship between the vendor and the purchaser. 19 This appears to be the approach taken by the court in Williams v Bulat.20 If then, in land contracts, the identity of the purchaser is unlikely to be a personal consideration, does an agent, as a purchaser, owe any obligation of disclosure to the vendor? Obligations Between Vendor and Purchaser In land contracts, the obligations of the vendor are well established. 21 The obligations of the purchaser of land are far less onerous. In Coaks v Boswell, the Earl of Selbourne LC stated: Every...purchaser is bound to observe good faith in all that he says and does, with a view to the contract, and (of course) to abstain from all deceit, whether by suppression of truth, or by suggestion of falsehood. But inasmuch as a purchaser is (generally speaking) under no antecedent obligation to communicate to his vendor facts which may influence his own conduct or judgment when bargaining for his own interest, no deceit can be implied from his mere silence as to such facts, unless he undertakes or professes to communicate them. 22 His Lordship went on further to say that a purchaser who intentionally misleads the vendor on any material point, will be guilty of fraud and the contract could be set aside. 23 Therefore, if an agent misrepresents to the vendor who they are acting for, the contract could be avoided by the vendor. In Archer v Stone,24 the defendant asked the plaintiff if he was acting for a particular third party. The plaintiff replied untruthfully that he was not. North J held that the misrepresentation had induced the defendant to enter into the contract and therefore specific performance could not be granted. existence of an agency relationship. In Sebright v Hanbury [1916] 2 Ch 245 it was held that the vendor of land was not entitled to interrogate the defendant to ascertain whether he was acting for an undisclosed principal. 17Under the laws of agency, an agent acting within its authority would be entitled to an indemnity from the principal. 18See Smith v Wheatcroft (1878) 9 ChD 223; Said v Butt [1920] 3 KB 497; Dyster v Randall & Sons [1926] 1 Ch 932; Williams v Bulat [1992] 2 QdR 566. 19Compare with the entering into a lease. A lease involves continuing obligations and the personality of the lessee would be of importance, disentitling an undisclosed principal to intervene on the contract: Carberry v Gardiner (1936) 36 SR (NSW) 559. 20[1992] 2 QdR 566. See A Milin, ‘Undisclosed principals and unacceptable purchasers of land’ (1994) 7 JCL 76. 21For example, the obligation not to make misrepresentations as to the use of the land; the obligation in respect of defects in title. 22(1886) 11 App Cas 232 at 235-236. 23Ibid at 236. 24(1898) 78 LT 34. If [the agent] tells a lie relating to any part of the contract or its subject matter, which induces another person to contract to deal with his property in a way he would not do if he knew the truth, the man who tells the lie cannot enforce his contract. 25 None of the cases involving the doctrine of the undisclosed principal to a land contract discuss the obligations of the purchaser to a vendor. An agent and principal are in a recognised fiduciary relationship. For an agent to reveal the existence or identity of its undisclosed principal would be a breach of the agent’s fiduciary duty. An agent, therefore, does not have the obligation to disclose the existence of the agency to the vendor, even if the agent were aware of the vendor’s objection to contracting with the undisclosed principal. But is this duty of confidence on the part of the agent applicable when the agent is, upon strict interpretation, the actual purchaser? Duncan and Jones suggest that an agent does not have a legal obligation to disclose the agency, unless it is a material element in the vendor’s acceptance. 26 As to whether the agency is a material element in the vendor’s acceptance, presumably it would need to be a personal consideration, that is, an attribute of the agent that induces the vendor to enter into the contract.27 As discussed above, this would be difficult to prove in relation to land contracts. The fact that the vendor has objections to contracting with the undisclosed principal does not make the identity of the purchaser material. It is argued that it is only in respect of personal contracts, that the identity of the purchaser would be a material element.28 Position of the Agent of the Undisclosed Principal at Common Law At common law, the agent of an undisclosed principal is not guilty of any sharp practice or misleading conduct. In Williams v Bulat,29 Ambrose J made reference to the fact that it was not unusual in business for a purchaser to keep their identity hidden by engaging an agent for the purpose of negotiating a lower price. In that case, the reason for using an agent was solely to avoid paying an inflated price for the property, the defendants being willing to sell to anyone else at a lower price.30 The doctrine of the undisclosed principal, despite being harshly criticised, is accepted as part of the law of agency, justified on the grounds of commercial convenience or even economic grounds to overcome strategic bargaining practices. The Real Estate Agent It is usual in land contracts for the vendor to appoint a real estate agent to locate a purchaser for the property. The real estate agent is subject to many duties, owed to the vendor as principal, arising from the fiduciary relationship between the parties. As Cardozo stated in Meinhard v Salmon: The rule of undivided loyalty is relentless and supreme.31 The duty of the real estate agent, stated broadly, is to act in good faith in the best interests of the vendor. Under the laws of agency, an agent is bound to keep the principal informed about matters which would be of concern to the principal. 32 To fulfill this duty, the real estate agent 25Ibid at 35. W Duncan & S Jones, Sale of Land in Queensland, 4th ed, LBC Information Services, Sydney, 1996, p 36. 27Greer v Downs Supply Co [1927] 2 KB 28. In that case the third party contracted with the agent solely for personal reasons (to obtain a set-off to settle a debt owed by the agent) and the undisclosed principal was debarred from intervening on the contract. 28See B Markesinis & R Munday, An Outline of the Law of Agency, 3rd ed, Butterworths, London, pp 174176. 29[1992] 2 QdR 566 at 571. 30See also R Barnett, ‘Squaring undisclosed agency with contract theory’ (1987) 75 Cal L Rev 1969 at 1976-1977, a vendor would otherwise seek to gain advantage from the purchaser’s known financial position. 31(1928) 62 ALR 1 at 7. 32Neeson v Wrightson NMA Ltd (1989) ANZ ConvR 605 at 609, citing with approval Bowstead on Agency, 12th ed, Sweet & Maxwell, London, 1985, p 147. 26See must disclose to the vendor all matters that may affect the vendor’s judgment in relation to the land transaction. In Georgrieff v Athans, Waters J stated in respect of information as to the financial standing of the purchaser: ...I would deem it [the real estate agent’s] duty to convey to the vendor any material, information or advice which the vendor should know in order to guide him in transacting the business in progress. 33 As to what are matters which would affect the vendor’s judgment, the rule is that a real estate agent should disclose what a reasonable agent would consider material in the ordinary course of business.34 The real estate agent is required to make full disclosure of all offers made to purchase the property. There must be full and accurate disclosure of all material facts to the vendor before obtaining consent to enter into the contract of sale. This duty of disclosure continues until the completion of the contract.35 Should the real estate agent become aware that the purchaser being dealt with is in fact acting as an agent for an undisclosed principal, the real estate agent would be under a duty to disclose that information to the vendor. The identity of the purchaser would be information which “the vendor should know in order to guide him in transacting the business in progress”.36 This would be even more applicable if the real estate agent was aware that the identity of the purchaser was a material element of the contract for the sale of the property. 37 Section 52 Trade Practices Act 1974 (Cth) Section 52(1) of the Trade Practices Act 1974 (Cth) (hereinafter referred to as ‘the Act’) provides: A corporation shall not, in trade or commerce, engage in conduct that is misleading or deceptive, or is likely to mislead or deceive. The section is directed at foreign corporations, trading and financial corporations formed within Australia, bodies corporate incorporated in a Territory and any holding company of the preceding.38 By virtue of the operation of s 6, the application of s 52 extends to persons in specific circumstances. Section 52 will apply to natural persons where: (i) the person engages in conduct in the course of interstate trade or commerce with a Territory or the Commonwealth, or in trade or commerce with a place outside of Australia;39 (ii) the person engages in conduct in the course of telephone, telegraphic, or postal services or telephone or radio broadcasts;40 33(1981) 26 SASR 412 at 415. v Wrightson NMA Ltd (1989) ANZ ConvR 605 at at 609; Payne & Co v Lewis [1917] WN 195. 35Blundell & Brown Ltd v Gathergood (1989) ANZ ConvR 599. 36Georgrieff v Athans (1981) 26 SASR 412 at 415. 37If the real estate agent is working for both the vendor and the purchaser, there will be a conflict of fiduciary duty owed by the agent to both of its principals. In Kelly v Cooper [1992] 3 WLR 936, the House of Lords held that estate agents must be free to act for several competing principals and will not be subject to an obligation to disclose information to one principal when it would constitute a breach of the fiduciary duty owed by the agent to another principal. See A Lang, Estate Agency Law and Practice in New South Wales, 5th ed, Law Book Co, Sydney, 1994, p367. 38Trade Practices Act 1974 (Cth), s 4(1) definition “corporation”. 39Ibid, s 6(2). 40Ibid, s 6(3). 34Neeson (iii) the person engages in conduct in the course of advertising for business or professional services.41 The section applies to corporations which engage in “trade or commerce”.42 Conduct in the course of negotiations is within the ambit of the section. But the private sale of goods or land is not.43 As to whether the conduct in question is misleading or deceptive, it is determined objectively in view of the existing circumstances.44 It is not necessary to establish that there was any intention to mislead or deceive.45 Conduct which can be characterised as inducing or capable of inducing error will be characterised as misleading or deceptive. 46 The Act provides that a remedy may be obtained against the person who has contravened the Act and any person who is “involved in the contravention”. 47 A person is defined to be “involved in the contravention” if they have knowledge of the facts which constitute the contravention of the Act.48 All States have enacted legislation mirroring the Commonwealth Act, the remedies being limited to “consumers”. In Queensland, s 6 of the Fair Trading Act 1989 defines “consumer” to include: (i) a person who acquires an interest in land otherwise than for a business carried on by that person; (ii) a person who acquires an interest in land for a business if the interest in land is not more than $40,000; or (iii) a corporation which acquires an interest in land for less than $40,000. Due to this restricted definition of “consumer”, it is more likely that an action brought in relation to a land contract, will not come under the Fair Trading legislation of the States, but recourse will have to be to the Federal Act. Section 52 and the Common Law As an increasing number of cases were brought under s 52, there was much debate as to whether the Act imposes a code of conduct in commercial dealings that alters the common law. The case law has now established that s 52 imposes a “broadly stated standard of commercial probity”.49 Section 52 does not alter the common law by imposing a duty of disclosure, but it does impose a code of conduct. As to what is the standard of conduct imposed, in General Newspapers Pty Ltd v Telstra Corporation it was observed that: [Section 52] does not require arms’ length negotiations to be completely open or require full disclosure at all times. The 41Ibid, s 6(4). words “trade or commerce” are used in the same wide understanding as in s 51(i) of The Constitution Act 1901 (Cth): Concrete Constructions (NSW) Pty Ltd v Nelson (1990) 169 CLR 594 at 602. Note that despite the omission of the phrase “trade or commerce” in s 6(3) and (4), a natural person must be engaged in trade or commerce to be in breach of s 52. 43O’Brien v Smolongov (1983) 53 ALR 107. 44Taco Co of Australia Inc v Taco Bell Pty Ltd (1982) 42 ALR 177; Parkdale Custom Built Furniture Pty Ltd v Puxu Pty Ltd (1982) 149 CLR 191. 45Hornsby Building Information Centre Pty Ltd v Sydney Building Information Centre Pty Ltd (1978) 140 CLR 216 at 223; Parkdale Custom Built Furniture Pty Ltd v Puxu Pty Ltd (1982) 149 CLR 191 at 197. 46Parkdale Custom Built Furniture Pty Ltd v Puxu Pty Ltd (1982) 149 CLR 191 at 198; Rhone-Poulenc Agrochimie SA v UMI Chemical Services Pty Ltd (1986) 12 FCR 477. 47Trade Practices Act 1974 (Cth), ss 82 and 87. 48Ibid, s 75B. Yorke v Lucas (1985) 158 CLR 661 at 670. 49Justice French, ‘The Action for Misleading or Deceptive Conduct: Future Directions’ in C Lockhart (ed), Misleading or Deceptive Conduct: Issues and Trends, op cit, p 283. See Brown v Jam Factory PtyLtd (1981) 53 FLR 340 at 348; Concrete Constructions (NSW) Pty Ltd v Nelson (1990) 169 CLR 594 at 604. 42The particular facts of the case must be considered in the light of the ordinary incidents and character of the commercial behaviour.50 The obligation to disclose material matters in the course of negotiation is considered by the courts on a case by case basis. Whether conduct in commercial transactions, that under the general law is merely considered to be ordinary business practice is caught by s 52, is dependent on the circumstances. At common law, parties to a commercial dealing who are at arms’ length have no duty of disclosure.51 In Poseidon Ltd v Adelaide Petroleum NL,52 it was held that s 52 did not challenge the usual practices of commercial negotiation, but that the bargaining process is not a licence to deceive. It is common in negotiations that one party will possess information which, if the other party had knowledge of, may cause the other party to alter their negotiating stance. In the recent case of Walker Corporation Ltd & Anor v Australia NID Pty Ltd & Ors,53 a vendor orally agreed to sell real estate to a purchaser, but before contracts were exchanged, the vendor received a higher offer and contracted with the new purchaser. The original purchaser claimed that the vendor was guilty of misleading or deceptive conduct by silence in failing to inform them that it was considering another offer for the property. The court held that the mere act of the vendor agreeing to sell when it had already orally agreed to sell for a lesser sum, would not ordinarily be a breach of s 52, as the vendor was not bound to sell to the original purchaser. The court made reference to the accepted commercial dealings in such situations: Although s 52 must be applied according to the words which it uses and ought not be read down by reference to principles of common law or equity, a judgment as to what is and what is not deceptive conduct ought not be made without regard to relevant relationships established by principles of law applying in commercial transactions.54 Silence in Negotiations Failing to disclose information may to amount to misleading or deceptive conduct. Silence will only be in breach of s 52 when the person who has failed to make the disclosure is aware or has knowledge of the information which has been omitted. The silence in respect of a fact is “conduct” as defined under the Act, if the failure to disclose involves some actual or deemed decision making.55 Pengilly suggests that silence will infringe s 52 in negotiations upon: 50(1993) (i) failure to disclose the whole truth and thereby creating an erroneous impression by what is disclosed; (ii) active concealment of a fact, giving rise to an impression that such a fact does not exist; (iii) failure to correct a false statement, thereby implying it is true; or (iv) failure to disclose facts when there is an obligation to do so in the circumstances.56 117 ALR 629 at 642. v Ausintel Investments Australia Pty Ltd (1990) 97 FLR 458. 52(1991) 105 ALR 25. 53(1995) NSW ConvR 55-758. 54Ibid at 55,826. 55Trade Practices Act 1974 (Cth), s 4 definition of “conduct” includes the refusal to do an act. See Spedley Securities Ltd (in liquidation) v Bank of New Zealand (1991) ATPR 41-143. 56W Pengilley, ‘“But you can’t do that anymore!”- The effect of section 52 on common negotiating 51Lam Mere silence by itself does not constitute misleading or deceptive conduct. 57 It is only when coupled with the surrounding circumstances, silence may be misleading or deceptive. In RhonePoulenc Agrochimie SA v UMI Chemical Services Pty Ltd, Lockhart J stated: ...when all the relevant circumstances of a case are analysed silence of the alleged contravener may be the critical matter upon which reliance is placed to establish misleading or deceptive conduct.58 The courts are not restricted to finding there has been misleading or deceptive conduct by the failure to disclose information merely to situations where there is a common law duty of disclosure.59 As Bowen CJ stated in Rhone-Poulenc Agrochimie SA v UMI Chemical Services Pty Ltd: The notion of relationships giving rise to an obligation to make disclosure is one which may well prove useful in determining some of the cases which may arise under section 52....However, the Court will not be restricted to cases where such a relationship has already been held to exist at common law or in equity. The Court is likely to be faced with situations under section 52 between particular parties, where it will feel bound to hold that such an obligation to disclose arises from the circumstances. 60 Section 52 does not impose a duty to disclose all information. 61 No obligation of absolute good faith is imposed. However, if information is disclosed it must be considered adequate in the circumstances to allow a properly informed decision to be made.62 In Kimberley NZI Finance Ltd v Torero Pty Ltd, French J held: ...unless the circumstances are such to give rise to the reasonable expectation that if some relevant fact exists it would be disclosed, it is difficult to see how mere silence could support the inference that the fact does not exist.63 In determining whether silence is misleading or deceptive, the test applied by the courts is whether the circumstances are such to give rise to a reasonable expectation that if some material or relevant fact existed, it would be disclosed.64 As noted by Harland,65 the court’s approach to the issue of whether silence can be misleading still leaves it open as to how readily a reasonable expectation of disclosure will be inferred. Reasonable expectation of disclosure In the context of commercial negotiations it can be discerned from the cases that a number of judges are opposed to s 52 imposing unduly restrictive inhibitions. In Lam v Ausintel Investments Australia Pty Ltd, 66 it was discussed that imposing disclosure obligations on parties negotiating techniques’ (1993) 1 TPLJ 113 at 121. 57Brophy v NIAA Corporation Ltd (in liq) (1995) ATPR 41-399; Demogogue v Ramensky (1992) 39 FCR 31. 58(1986) 12 FCR 477 at 504. 59Henjo Investments Pty Ltd v Collins Marrickville Pty Ltd (1988) 79 ALR 83 at 95; Commonwealth Bank of Australia v Mehta (1991) 23 NSWLR 84 at 88. 60(1986) 12 FCR 477 at 490. 61Fraser v NRMA Holdings Ltd (1995) 127 ALR 543. 62Ibid at 555. 63(1989) ATPR(Digest) 46-054 at 53,193. 64Demogogue Pty Ltd v Ramensky (1992) 110 ALR 608; Warner v Elders Rural Finance Ltd (1993) ATPR 41-238; General Newspapers Pty Ltd v Telstra Corporation (1993) 117 ALR 629. 65D Harland, ‘The statutory prohibition of misleading or deceptive conduct in Australia and its impact on the law of contract.’ (1995) 111 LQR 100 at 116. 66(1989) 97 FLR 458. commercial contracts would be contrary to the ordinary practice and expectations. Uncertainty still exists as to what extent the courts will go in setting a minimum standard of commercial probity as the common law does not limit the scope of the section. 67 So what circumstances give rise to a reasonable expectation of disclosure? From the recent decisions of Demogogue Pty Ltd v Ramensky 68 and Warner v Elders Rural Finance Ltd,69 it is clear that the role of the common law in relation to disclosure is merely an aid to interpreting the surrounding circumstances. 70 Black CJ stated in Demogogue Pty Ltd v Ramensky: Although “mere silence” is a convenient way of describing some fact situations, there is in truth no such thing as “mere silence” because the significance of silence always falls to be considered in the context in which it occurs. That context may or may not include facts giving rise to a reasonable expectation, in the circumstances of the case, that if particular matters exist they will be disclosed.71 The courts may be influenced by the following factors in determining under what circumstances a reasonable expectation arises:72 (i) relationships of proximity between the parties;73 (ii) knowledge of the relevant information; (iii) materiality of the undisclosed information;74 (iv) failure to disclose resulting in injustice to one party;75 and (v) the nature of the information. A reference to the circumstances of the case is referable to the common law on a factual level. No general test can be devised as each case must be determined on its merits as guided by the above factors. Any inequality in knowledge, experience and bargaining power would be important in determining what expectations are reasonable. 76 Reasonable Expectation in Negotiation of a Land Contract To establish that the agent has engaged in misleading or deceptive conduct by failing to disclose the agency, the circumstances must be such to give rise to a reasonable expectation on the behalf of the vendor, that the agency or the identity of the undisclosed principal would be revealed. As discussed above, the existence of a reasonable expectation must be determined by the nature of the information and the surrounding circumstances. 67See D Clough, ‘Misleading and deceptive silence: Section 52, confidentiality and the general law’ (1994) 2 TPLJ 76 at 79. 68(1992) 110 ALR 31. 69(1993) ATPR 41-238. 70D Clough, ‘Misleading and deceptive silence: Section 52, confidentiality and the general law’, op cit at 8889. 71(1992) 110 ALR 608 at 610. 72 D Skapinker, ‘The imposition of a positive duty of disclosure under section 52 of the Trade Practices Act 1974 (Cth)’ (1991) 4 JCL 75. 73For example the relationship between directors and shareholders of a company: Fraser v NRMA Holdings Ltd (1995) 127 ALR 543. 74In Henjo Investments Pty Ltd v Collins Marrickville Pty Ltd (1988) 79 ALR 83, the vendor of a restaurant breached s 52 by not disclosing that the premises were licenced to hold a lesser number of people than the seating indicated. 75In Demogogue Pty Ltd v Ramensky (1992) 110 ALR 31, the fact that the party entered into a contract induced by misleading and deceptive conduct was sufficient for an action for damages under s 87. 76See A Robertson, ‘Silence as misleading conduct: Reasonable expectations in the wake of Demogogue Pty Ltd v Ramensky’ (1994) 2 CCLJ 1. Relationship of proximity between the parties A vendor and an agent acting for an undisclosed principal are not in a fiduciary relationship. In ordinary commercial dealings involving land contracts, the parties are at arms’ length and would have conflicting interests. Therefore, there is no requisite proximity between the parties that would give rise to an obligation to disclose information during negotiations. Knowledge of the relevant information To be in breach of s 52, the agent must be aware of the information which is not disclosed. Obviously the agent has knowledge of the existence of the undisclosed principal. If the agent has no knowledge of the reason for the principal remaining unacknowledged, the agent cannot be guilty of deliberately misleading the vendor on a material point. If the vendor does not communicate to the agent any objections as to who purchases the land, the agent could not be aware that the identity of the purchaser is a material element to the vendor’s acceptance of the offer to purchase. Materiality of the information The identity of the purchaser must be a material element of the contract. Applying the principles from the common law cases on undisclosed principals, the vendor would need to establish that it was induced to enter into the land contract by the identity of the agent. Proof would be needed to establish that the vendor would not have entered into the contract with anyone else on the same terms as were agreed with the agent.77 This would be difficult to prove in respect of land contracts as there is no personal, ongoing relationship between a vendor and a purchaser. But it must be kept in mind that s 52 is not dependent on the common law principles. If the agent is aware that the vendor would be opposed to selling the land to the undisclosed principal, the courts could find that this makes the identity of the purchaser a material element to the contract. Resulting injustice to one party On strict interpretation, the use of an agent is not fraud, giving rise to unilateral mistake. The agent does not make any false representations to the vendor as to its identity. If an undisclosed principal engages an agent, in order to overcome the vendor’s opposition to selling the land to it, the vendor ends up in a contractual relationship with a party that it had no dealing with and no intention of contracting with. Being induced to enter into a contract by misleading or deceptive conduct could be considered sufficient injustice.78 Nature of the information The agent owes a duty of confidentiality to the undisclosed principal, due to the fiduciary relationship between the parties. The existence and the identity of the undisclosed principal is confidential information and an agent would be in breach of its duty if it disclosed that information without the authority of the principal. Can a vendor have a reasonable expectation of disclosure of confidential information? The cases show that although confidential information may be material to the applicant, the characterisation of the information as confidential indicates that there can be no reasonable expectation of disclosure between experienced commercial parties. 79 In Kabwand Pty Ltd v National Australia Bank Ltd, 80 it was held that there was no duty on a bank to disclose to a third party information concerning a customer of the bank. This was cited with approval in Winterton Constructions Pty Ltd v Hambros Australia Ltd, 81 a case in which the 77Dyster v Randall & Sons [1926] 1 Ch 932; Williams v Bulat [1992] 2 QdR 566. Pty Ltd v Ramensky (1992) 110 ALR 31. See fn 105. 79Winterton Constructions Pty Ltd v Hambros Australia Ltd (1992) 111 ALR 649; Brophy v NIAA Corporation Ltd (in liq) (1995) ATPR 41-399; Kabwand Pty Ltd v National Australia Bank Ltd (1989) ATPR 40-950. 80(1989) ATPR 40-950. 81(1992) 111 ALR 649. 78Demogogue respondent, a merchant bank, did not inform the appellant that the property developer, a client of the respondent’s, with whom the appellant was contracting was not financially stable. The appellant claimed that the respondent had engaged in misleading or deceptive conduct by failing to inform them that no further funds would be released to the property developer. Hill J held that the circumstances did not involve the law imposing an obligation on the respondent to disclose to the appellant the change in the financial conditions of its client. His Honour stated: ...a borrower is entitled to expect (even if it is not an implied term of the contractual arrangement) that his financier will keep confidential matters concerning the borrower’s financial affairs. To impose upon a lender such an obligation to communicate to a person whom it knows to be under contractual obligations with the borrower, would impose an intolerable burden upon the financier and could be most damaging to its borrowers. 82 In General Newspapers Pty Ltd v Telstra Corporation, Davies and Einfeld JJ stated in regard to confidential information: Commercial people understand, or should understand, that they will not ordinarily be informed of information which is regarded as confidential...The common understanding of commercial people must therefore be taken into account in determining what is misleading or deceptive or likely to be so.83 It was held that although the respondent was aware of the information and that it had not been disclosed, the surrounding circumstances did not give rise to a reasonable expectation. The respondent had told the appellant that their name would be placed on a tender list for printing contracts. The respondent did not disclose that it was negotiating the renewal of the contracts with its current printers and that in fact tenders would not be called for. The court held that because the appellant had not indicated to the respondent that it was relying on being placed on the tender list, the respondent was not placed in the position of being obliged to respond. The appellant could not have an expectation of disclosure in such circumstances. Although the facts of the case did not involve any common law duty of confidentiality, the information that negotiations were taking place with the current contractors was clearly confidential to the respondents. The confidentiality of the information was treated by the court as a highly important facet of the circumstances rather than invoking a general law rule. 84 But the court did suggest that an expectation of disclosure could arise, despite the confidentiality of the information, if the appellant had indicated that it was acting in reliance on the respondent’s actions. The fact that the appellant and the respondent were experienced commercial entities placed them on equal standing. Therefore, what the appellant expected to be disclosed was not reasonable in view of their knowledge and experience in commercial transactions. The confidentiality of the information is merely another fact of the case, although an important one, that needs to be considered in determining whether the conduct has been misleading or deceptive.85 If there is a common law duty of confidentiality, this should make it more difficult to establish that a party has engaged in misleading or deceptive conduct, when compared to the circumstances of cases where there is no such duty. 86 The decision in Demogogue Pty Ltd v Ramensky87 clearly establishes that there is no link between the common law principles and an action under s 52. The courts may look to the common law on a factual level, but the Act stands 82Ibid at 667-668. 117 ALR 629 at 641. 84See D Clough, ‘Misleading and deceptive silence: Section 52, confidentiality and the general law’ , op cit at 91. 85S Christensen, ‘The Effect of the Trade Practices Act 1974 on Non-Disclosure’ in T Cockburn & L Wiseman (eds), Disclosure Obligations in Business Relationships, Federation Press, Sydney, 1996, p 113. 86D Clough, ‘Misleading and deceptive silence: Section 52, confidentiality and the general law’, op cit at 99. 87(1992) 110 ALR 608. 83(1993) independent of the common law principles. Therefore the fact that the information that has not been disclosed is subject to a fiduciary duty of confidentiality, may not be an adequate defence to any charge of misleading or deceptive conduct. Application of s 52 to the Undisclosed Agency Relationship There have been no reported cases involving an action brought against a purchaser under s 52, but such actions are not barred. The provision will apply if the purchaser is a corporation, or is a natural person within the extended operation of the Act under s 6, and the purchase of the land is either for resale in trade or commerce, or is for business purposes as a capital acquisition.88 Due to the ever increasing application of s 52 and the acknowledgement that silence may be in contravention, it is feasible that the common practice of employing an agent may give rise to a claim for misleading or deceptive conduct. In acting as an agent for an undisclosed principal in a land contract, the agent is in fact the purchaser. Under the common law principles, as stated in Coaks v Boswell,89 a purchaser is generally under no obligation to disclose to the vendor facts that may influence the vendor’s conduct or judgment, when bargaining for their own interest. Therefore there is no common law duty of disclosure. For an agent to be guilty of misleading or deceptive conduct by refraining from identifying the agency relationship, the agent would need to be aware that the identity of the purchaser is an element considered important to the vendor. This could give rise to a reasonable expectation that the identity of the true purchaser would be disclosed. The knowledge that the vendor has an expectation of disclosure may arise from the context of the negotiations or from any inquiries that the vendor makes. The relationship between a vendor and a purchaser gives rise to certain assumptions concerning the dealings between the parties. In Colliers Jardine (NSW) Pty Ltd v Balog Investments Pty Ltd,90 a vendor appointed a real estate agent to sell a hotel. The vendor did not inform the agent that there was a right of first refusal and that the vendor was merely using the agent to assess the market value of the property. The court held that as the right of first refusal was something unusual, the vendor’s conduct in remaining silent amounted to an indication that the transaction was an ordinary one, when in fact it was not. The failure to disclose the unusual information was held to be misleading. The issue, as to whether the agent’s silence in respect of the identity of the undisclosed principal is misleading or deceptive, will be determined with reference to the usual commercial practice and expectations in such relationships. In negotiations of commercial dealings, it is usual for one party to possess information that, if the other party knew, may cause the other party to change its negotiating stance. It is not unusual in the commercial world for purchasers to engage agents to act on their behalf for the purpose of keeping their identity secret in order to negotiate a more favourable transaction. Therefore, the use of an agent without disclosing the agency is not an unusual circumstance, as there was in Colliers Jardine (NSW) Pty Ltd v Balog Investments Pty Ltd.91 It is possible for an agent of an undisclosed principal to have engaged in misleading or deceptive conduct by failing to disclose the existence of the agency and the identity of the principal. The circumstances must be such that the vendor had a reasonable expectation that the identity of the true purchaser would be disclosed and the vendor relied on the agent’s silence. If the agent has been absolutely silent as to the agency relationship and has done nothing more, there has 88M Richardson & P Williams (eds), Law and the Market, Federation Press, Sydney, 1995, p 197. 11 App Cas 232 at 235-236. 90(1995) ATPR(Digest) 46-140. 91Ibid. In Demogogue Pty Ltd v Ramensky (1992) 110 ALR 608, it was held that the fact that vehicle access to property was by licence over Crown land, not over land owned by the body corporate, was an unusual circumstance that required disclosure. Failing to inform the purchaser of this unusual circumstance was misleading. 89(1886) been no infringement of s 52.92 Examples As there have been no cases under s 52 claiming a breach by an agent in acting for an undisclosed principal, it is useful to apply the principles derived from the case law to some factual situations. The Parties: Vendor of land (V). Undisclosed Principal (UP), actual purchaser of the land. Agent Pty Ltd (A Pty Ltd) acting as agent for undisclosed principal. V enters into a contract for the sale of land with A Pty Ltd. V has no objections to selling the land to UP. At common law: It is an accepted commercial practice to use an agent without revealing the agency relationship. The identity of the purchaser is not material to V and therefore the contract could not be avoided. V would be willing to contract on the same terms with any other purchaser. Under the Act: In this situation, V could not claim to have been misled or deceived. The identity of the purchaser is not a material element to the contract and there are no circumstances giving rise to an expectation that the agency would be disclosed. The silence of the agent is not misleading or deceptive conduct. V contracts with A Pty Ltd and would not contract on the same terms if contracting with UP, but does not inform A Pty Ltd of this objection. At common law: From the case law, the fact that V would not enter into the contract on the same terms with UP as it did with A Pty Ltd, does not render the identity of the purchaser a material element of the contract.93 V has contracted with A Pty Ltd on terms it would be willing to contract with in respect of other purchasers, but just not UP. The contract would be valid. Under the Act: If A Pty Ltd has no knowledge of V’s objections to contracting with UP, A Pty Ltd cannot know that V would expect the information to be disclosed. V has not indicated that it is relying on A Pty Ltd’s silence as to the existence of the agency. Therefore, the conduct cannot be characterised as misleading or deceptive. Having regard to the usual commercial practices, the courts state that total disclosure in negotiation is not imposed by s 52. 94 The fact that V would not contract on the same terms with UP as it would with another, does not establish that the identity of the purchaser is a material element to the contract. A Pty Ltd would not be in breach of s 52. V would not enter into a contract with UP on any terms. V does not reveal this opposition to A Pty Ltd. At common law: The identity of the purchaser is not a personal consideration because it is only UP that V would refuse to contract with. To avoid the contract, V would need to prove that it agreed to the contract due to the identity of A Pty Ltd, and would not have entered into the contract with anyone else on the same terms. This would be difficult to prove in relation to a land contract. On 92General Newspapers Ltd v Telstra Corporation (1993) 177 ALR 629; Kimberley NZI Finance Ltd v Torero Pty Ltd (1989) ATPR (Digest) 46-054. 93Dyster v Randall & Sons [1926] 1 Ch 932; Williams v Bulat [1992] 2 QdR 566. 94Lam v Ausintel Investments Australia Pty Ltd (1989) 97 FLR 458; Poseidon Ltd v Adelaide Petroleum NL (1991) 105 ALR 25. the face of it, V could not avoid the contract. Under the Act: A Pty Ltd’s liability is dependent upon V having a reasonable expectation of disclosure. If V has not informed A Pty Ltd of its objections to contracting with UP, there has been no reliance by V upon A Pty Ltd’s silence and, hence, the circumstances do not give rise to such an expectation. As in General Newspapers Pty Ltd v Telstra Corporation,95 V has not indicated to A Pty Ltd that it is acting in reliance on the representation that A Pty Ltd is the actual purchaser. V would not contract with UP on any terms and informs A Pty Ltd of this. At common law: V would need to prove that it contracted with A Pty Ltd because of some personal consideration of A Pty Ltd’s attributes. If V would contract to sell the property to another on similar terms, the contract could not be avoided. If V enquires as to whether A Pty Ltd is acting for UP and A Pty Ltd denies the agency, the contract could be set aside. The misrepresentation by A Pty Ltd has induced V to enter into a contract it would otherwise not have. It is not necessary for V to prove damage. 96 Under the Act: Regard would be had to the usual business practices and the nature of the information. As noted earlier “[n]o one expects all the cards to be on the table.”97 For there to be a reasonable expectation of disclosure, the information must be material to V.98 In this situation, it could be argued that by informing A Pty Ltd of its objections to contracting with UP, there is a reasonable expectation by V that A Pty Ltd would disclose the identity of the actual purchaser if that fact existed. Despite the confidentiality of the information, if V could prove that it had indicated to A Pty Ltd that it was relying on A Pty Ltd being the purchaser, A Pty Ltd could be in breach of s 52 by failing to respond.99 The failure to respond would create circumstances allowing V to assume that if A Pty Ltd was acting for UP, it would be disclosed. The fact that the information is confidential would be considered as an important fact of the case by the court. The confidentiality arises from the fiduciary relationship between A Pty Ltd and UP. This would have strong impact upon any obligation to disclose the agency to V.100 It is submitted that as the confidentiality arises from a fiduciary relationship, the courts would be reluctant to find that a vendor could have a reasonable expectation of disclosure of the confidential information. If V informs A Pty Ltd that it would not sell the property to “just anyone”, but does not indicate that it would not sell to UP in particular, A Pty Ltd is put on notice that V regards the identity of the purchaser as important. It could be argued that this is sufficient to support a reasonable expectation by V that the true identity of the purchaser would be revealed. A Pty Ltd is aware of V’s expectations and is placed in the position of having to respond. V is relying on A Pty Ltd being the purchaser as opposed to someone else. It is possible that in either of these situations, A Pty Ltd would be expected to disclose the identity of the purchaser in response to V’s information concerning its willingness to enter into the contract. Once V establishes that it is relying on A Pty Ltd’s silence in relation to the identity of the purchaser, A Pty Ltd would need to disclosed its true capacity. But, an overarching consideration in assessing whether there is a reasonable expectation on the behalf of V is the 95(1991) 117 ALR 629. v Stone (1898) 78 LT 34. 97Poseidon Ltd v Adelaide Petroleum NL (1991) 105 ALR 25 at 26. 98Fraser v NRMA Holdings Limited (1995) 127 ALR 543. 99General Newspapers Pty Ltd v Telstra Corporation (1993) 117 ALR 629. 100See Kabwand Pty Ltd v National Australia Bank Ltd (1989) ATPR 40-950; Brophy v NIAA Corporation Ltd (in liq) (1995) ATPR 41-399. 96Archer relative experience of the parties. If V and A Pty Ltd each possess commercial experience, the existence of the information that would be regarded as confidential in negotiations would be known to both parties. It would not be reasonable for V to expect that A Pty Ltd would breach its fiduciary duty owed to UP. However, if V is inexperienced in comparison to A Pty Ltd, the courts could merely regard the confidentiality of the information as another fact, not as a defence to the non-disclosure. Summary Claims brought under s 52 are determined on a case by case basis. Clough suggests that the court’s approach of taking into account the circumstances of each case is broad ranging and flexible and ... requires the courts to examine the circumstances of each case on its merits with the guidance of the [general principles which have been the subject of judicial development], rather than be ruled by the categories and limitations of fiduciary duties.101 To make a successful claim for breach of s 52, a vendor would bear the onus of proving that the silence of the agent in the circumstances prior to the completion of the land contract amounted to misleading or deceptive conduct. The vendor would need to prove: (i) that the agent was aware that the vendor was opposed to contracting with the undisclosed principal; (ii) the identity of the purchaser was a material fact to the vendor; (iii) there was a reasonable expectation that the identity of the true purchaser would be disclosed; (iv) that there was reliance on the silence as to the identity of the true purchaser; (v) that it was led into error by the agent’s conduct. Liability Section 82 of the Act allows a person who has suffered loss or damage by conduct of another, in contravention of Part IV or V of the Act, to recover damages against that person. The operation of the provision extends to allow the claimant to seek damages against any person involved in the contravention, by virtue of s 75B. If a claim for damages is brought against a natural person as a “person involved in the contravention”, it is not sufficient to show that they were the principal on whose behalf the misleading or deceptive conduct was carried out.102 To be a person involved in a contravention, that person must have knowledge of the essential elements constituting the contravention. 103 Should the undisclosed principal be held to be “involved in a contravention”, it is only the liability for the contravention that is imposed on the principal, they are not deemed to be in contravention of the Act themselves. If the undisclosed principal is a corporation, any misleading or deceptive conduct engaged in by its agent, is deemed by s 84(2) to have been engaged in by the corporation. In an action for damages, it would be unnecessary for the vendor to establish that the corporation had knowledge of the conduct which constituted a breach of s 52. It is an issue whether a vendor who has entered into a contract for the sale of land has in fact suffered any loss or damage. If the vendor would have sold to the undisclosed principal at a higher price, this could not be classified as damage. And if the vendor would not have sold to the 101D Clough, ‘Misleading and deceptive silence: Section 52, confidentiality and the general law’, op cit at 81. 102Keen Mat Corporation Pty Ltd v Labrador Park Shopping Centre Pty Ltd (1985) 61 ALR 504. 103York v Lucas (1985) 158 CLR 661 at 670. undisclosed principal on any terms, but would have sold to another, no loss has been suffered by the vendor. Therefore, a vendor would need to claim damages under s 87, the more liberal remedy provision of the Act. To succeed in damages under s 87, the vendor needs to prove that it suffered, or is likely to suffer, loss or damage. In Demogogue Pty Ltd v Ramensky,104 the court held that the disadvantage of being bound by a contract, induced by misleading or deceptive conduct, is sufficient loss or damage for the purposes of s 87. Therefore, a vendor who has been induced by an agent’s misleading or deceptive conduct to contract for the sale of land has suffered loss or damage for the purposes of relief under s 87. A vendor who is able to prove misleading or deceptive conduct would also be entitled to apply to have the land contract set aside under s 87(2). The court is empowered to declare the whole or any part of a contract void ab initio. Conclusion It must only be a matter of time before the courts are faced with a claim for breach of s 52 by an agent acting for an undisclosed principal in a land contract. As French J writes: ...some of the areas [of s 52's] growth...hold the promise of interesting and intellectually challenging issues for resolution by the courts in the years ahead.105 Although the courts claim that reference will be had to the common law and the usual commercial practices, the case by case approach leaves it open for an agent acting for an undisclosed principal to be found guilty of misleading or deceptive conduct. Applying s 52 independent of the common law duties allows the existence of a fiduciary duty, such as the duty of confidence, to be taken into account merely as another circumstance of the case. Although the obligation of confidence would be regarded as an important factor, the very broadly stated test of “reasonable expectation” enables the court to find that the failure to disclose the identity of the true purchaser amounts to misleading or deceptive conduct. The reasonable expectation test is open to interpretation, and “has the capacity to find its way up by capillary action wherever there is room for it to move.”106 104(1992) 110 ALR 608 French, ‘The Action for Misleading or Deceptive Conduct: Future Directions’ in C Lockhart (ed), Misleading or Deceptive Conduct: Issues and Trends, op cit, p 305. 106Ibid, p 288. 105Justice