jenny

advertisement

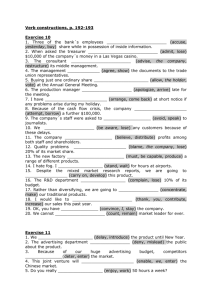

Jenny Tsai Majmudar and Ciancarelli Inc. sell a line of high-end designer swimwear through retail outlets in exclusive resorts throughout the Mediterranean. Ten years of quarterly sales data (in numbers of swimsuits sold per quarter) are given in Exhibit 1, together with corresponding data for three other variables believed to affect sales volume: Season of the year. M&C believe that sales are lower during the winter months, which has made sales forecasting difficult in the past. Jenny Tsai, V.P. of Sales and Marketing at M&C, feels that any forecasting method based simply on average quarterly sales is doomed to failure, because the Winter quarter (January through March) “skews the average downward”. Advertising expenditure. The data file includes advertising expenditures in dollars per quarter. M&C has a long-term relationship with the advertising design firm of Feldman, Griffinger and Cox (FGC). M&C has been thinking recently of severing this relationship, because (they claim) there is little apparent relationship between advertising expenditures and unit sales within any three-month period. In fact, Jenny Tsai has estimated that sales actually go down when advertising expenditures are above average (“The correlation is friggin’ minus 30 percent!” she says). Ben Cox, assistant account executive at FGC, argues that it usually takes about three months for the effects of advertising campaigns to be felt in the retail stores: “Our services are in fact very cost-effective for M&C”. GDP % Change. Paul Bogorad, Chief Economist for the Upscale Lingerie and Swimwear Association, has long argued that this particular market segment is particularly susceptible to fluctuations in the GDP of Western European nations. He has devised an index that measures this construct for the purposes of market forecasting, but it has yet to gain wide acceptance among marketing executives. Jenny Tsai has been particularly skeptical: “I never know what Bogorad is talking about with that GDP nonsense; for all I know he is completely wrong. I feel like our customers are affluent enough that short-term economic conditions don’t make any difference whether they buy a new swimsuit or not.” Time. Jenny Tsai thinks there is a long-term trend in the sales of M&C swimwear. “Our sales do go up and down on a seasonal basis, but the overall pattern is that sales are increasing every year on the average.” Questions (a) Create a time-series chart of sales, and write something intelligent about what you see with respect to Jenny’s statements about seasonality and a long-term upward trend in sales. (b) Make any data transformations you think will be necessary to test the hypotheses proposed by Jenny, Ben, and Paul. Explain carefully what you did and why. Show a few rows of your data set here. For example, time may be operationalized with the first quarter (Winter of 1992) = 1, the second quarter (Spring of 1992) = 2, the third quarter (Summer of 1992) = 3, and so forth until the last quarter (Fall of 2001) is equal to 40. Therefore, the first quarter of 2002 would be assigned a “Time” of 41, the second quarter of 2002 would be assigned a “Time” of 42, etc. (c) Create a correlation matrix of all the transformed variables and paste it here. (d) Create a regression model to answer the questions below, showing the steps you used to create it and summary measures of all the intermediate models. Clearly identify which model you consider to be the “best”, and state why it is best. Paste the output from your “best” model here, and provide notes to explain any data transformations you have performed. Managerial Statistics 2 Prof. Juran (e) What do you think about Jenny Tsai’s speculation that sales are significantly lower, on the average, in the Winter quarter? Give solid statistical evidence to support your conclusion, including p-values where appropriate. (f) Is Ms. Tsai correct in her proposition that there is a significant long-term upward trend in unit sales? Give solid statistical evidence to support your conclusion, including p-values where appropriate. (g) What do you think about Ben Cox’s claim that the prior quarter’s advertising expense is a better predictor of unit sales than the current period expense? Give solid statistical evidence to support your conclusion, including p-values where appropriate. (h) Conduct a test of the significance of the Bogorad GDP index for the purposes of forecasting M&C sales. What do you think? Give solid statistical evidence to support your conclusion, including p-values where appropriate. (i) What is the estimated return on investment for the money M&C spends on advertising if each swimsuit sold yields $15 net profit? Give a 95% confidence interval for this effect. (Ignore any time value of money.) Managerial Statistics 3 Prof. Juran (j) Using the best information you have available, give 95% prediction intervals for unit sales in all four quarters of the year 2002, assuming that GDP growth is 3% in each quarter and that the advertising budget is $10,000 per quarter. Managerial Statistics 4 Prof. Juran