Acct 2101 - Georgia State University

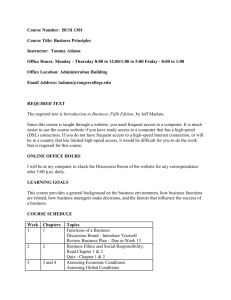

advertisement

Azerbaijan University School of Business Acct 2101 Principles of Accounting Fall 2010 Instructor: Zaur Ahmadov, PhD Phone: (+994 50) 223 60 78 E-mail: zaurahmad@gmail.com Class time: Saturday 12:00-15:00 Office hour: By appointment Course description: Basic structure of accounting; accounting cycle for a service and a merchandising concern; notes, deferrals, and accruals; receivables; inventory, and plant assets; accounting systems and concepts; liabilities; equities; and investments. The first course in accounting is very important to all who take it, whether they plan to become professional accountants or to use accounting information in non-accounting careers. We hope the course meets your educational needs, engenders accurate perception of the broad role of accounting in modern economies, and assists you in making well-informed career choices. Course Objectives: The primary objective of this course is to introduce students to the language of business as expressed by accounting information, which will include development of a familiarity with the information contained in the financial statements and development of skills in using this information to make sound business decisions. Course outcome The overall objective for this course is for you to learn about accounting as an information development and communication function that supports economic decision making. To this end, upon completion of the course you should: - have a broad view of accounting's role in satisfying society's need for information and its function in business, in government, in other organizations, and in public accounting. - gain an overview of the accounting profession, encompassing its history, its ethics, its public responsibilities, and its international dimensions as well as an appreciation of the role of auditing in enhancing the credibility of publicly reported information. - understand the basic features of accounting and reporting by organizations, including the principles underlying the integrity and effectiveness of accounting information systems. 1 - understand fundamental accounting concepts in addition to the elements of financial statements. These concepts include accountability, estimation, accounting judgment, the qualitative characteristics of accounting information, choice in accounting measurement, and the ethics of reporting. - understand that some accounting systems are more effective than others in given circumstances and that the decision usefulness of information produced by an accounting system depends on its design and choices among information capturing, analysis, and reporting options. Textbooks: Course Materials - Financial Accounting, by Porter and Norton, 4th edition, South-Western Thomson Learning; Financial Accounting: Tools for Business Decision Making, 4th Ed. Kimmel, Weygandt, Kieso www.prinsiplesof accounting.com Teaching methodology: Lecture and Demonstration/Performance. The instructor will stress certain points and elabrate on others. You should not expect the instructor’s lecture to substitute for individual reading of the assigned text materials or to cover all the chapter material. In addition, certain problems and exercises will be worked on the chalkboard or electronic media to demonstrate one approach to solving the problem. You should then complete a similar problem to capture the concept in your mind. COURSE REQUIREMENTS . Examinations/Quizzes : Will consist of true/false, multiple-choice, matching, problem solving, or any combination thereof. Quizzes will typically be graded in class. There will likely be a few “pop” quizzes designed to reinforce important concepts and reward students for regular attendance. Participation/In-Class Work : Includes regular on-time attendance, discussion of class material, appropriate note taking, in-class activities, and respectful behavior (raising your hand if you want to contribute to class discussion, refraining from side conversations, etc). If a student regularly disrupts the class (by coming late, leaving early, carrying on sideconversations or otherwise detracting from the learning environment) that student may lose up to 15% of their final grade. 2 Makeup : Quizzes may not be made up, but you may drop your lowest quiz. No makeup exams are administered during the semester. However, if you miss an exam you may take one makeup with the final. However, the makeup is typically more difficult than the original. Students with serious and compelling circumstances may receive special consideration. You would avoid being late, walking in and out in the middle of the meeting for any reason, or leaving early. You would avoid whispering and laughing with the person sitting next to you. You would listen attentively, probably take notes, and manage your face and posture to convey interest and competence. GRADING: You are expected to attend all scheduled classes. Attendance will be taken daily and will influence your grade. Grades will be based on the following: 3 Quizzes before Mid-Term 15 points 4 Quizzes after Mid-Term 20 points Participation 15 point Mid-Term Exam 20 points Final Exam 30 points __________________________________________________________________________ Total 100 points The final grading scale will be as follows: A+, A, A-, B+, B, B-, C+, C, C-, D+, D, D-, F. Scores AKTS scores A+ = 97 – 100 A = 93 – 96 A- = 90 – 92 B+ = 87 – 89 B = 83 – 86 B- = 80 – 82 C+ = 77 – 79 A = 90 – 100 B = 80 – 89 3 C = 73 – 76 C- = 70 – 72 D+ = 67 – 69 D = 63 – 66 D- = 60 – 62 F = 0 – 59 C = 70 – 79 D = 60 - 69 E = 50 – 59 Fx = 40 – 49 F = 0 – 39 IX. COURSE SCHEDULE Class Chapter Quiz 1 Chapters 1 2 Chapter 2 3 Chapter 3 4 Chapters 4 Quiz #1 (Chapter 1,2,3) 5 Chapters 5 Quiz #2 (Chapters 3,4) 6 Chapter 6 Quiz #3 (Chapters 4,5) 7 Chapters 7 Mid-Term Exam 8 Chapter 8 9 Chapter 9 10 Chapters 10 Quiz #4 (Chapters 8,9) 11 Chapters 11 Quiz #5 (Chapters 10) 12 Chapter 12 Quiz #6 (Chapters 11) Chapter 13 Quiz #7 (Chapters 12) 13 Final Exam COURSE OUTLINES 4 Chapter 1 AN INTRODUCTION TO FINANCIAL STATEMENTS Describe the primary forms of business organization. The users and uses of accounting information. Explain the three principal types of business activity. Describe the content and purpose of each of the financial statements. Explain the meaning of assets, liabilities, and stockholders’ equity, and state the basic accounting equation. Chapter 2 Analysis of Financial Statements Identify the sections of a classified balance sheet. Identify and compute ratios for analyzing a company's profitability. Explain the relationship between a retained earnings statement and a statement of stockholders' equity. Identify and compute ratios for analyzing a company's liquidity and solvency using a balance sheet. Helps users see if company has enough assets to pay debts. Can determine the shortterm and long-term claims on total assets Chapter 3 THE ACCOUNTING INFORMATION SYSTEM Analyze the effect of business transactions on the basic accounting equation. Explain what an account is and how it helps in the recording process. Define debits and credits and explain how they are used to record business transactions. Identify the basic steps in the recording process. Explain what a journal is and how it helps in the recording process. Explain what a ledger is and how it helps in the recording process. Explain what posting is and how it helps in the recording process. Explain the purposes of a trial balance. Chapter 4 ACCRUAL ACCOUNTING CONCEPTS Explain the revenue recognition principle and the matching principle. Differentiate between the cash basis and the accrual basis of accounting. Explain why adjusting entries are needed and identify the major types of adjusting entries. Prepare adjusting entries for prepayments. Prepare adjusting entries for accruals. Describe the nature and purpose of the adjusted trial balance. Explain the purpose of closing entries. Describe the required steps in the accounting cycle. Chapter 5 MERCHANDISING OPERATIONS AND THE MULTIPLE-STEP INCOME STATEMENT 5 Identify the difference between a service enterprise and a merchandising company. Explain the recording of purchases under a perpetual inventory system. Explain the recording of sales revenues under a perpetual inventory system. Distinguish between a single-step and a multiplestep income statement. Determine cost of goods sold under a periodic system. Explain the factors affecting profitability. Chapter 6 REPORTING AND ANALYZING INVENTORY Describe the steps in determining inventory quantities. Explain the basis of accounting for inventories and apply the inventory cost flow methods under a periodic inventory system. Explain the lower of cost or market basis of accounting for inventories. Compute and interpret the inventory turnover ratio. Describe the LIFO reserve and explain its importance for comparing results of different companies. Chapter 7 INTERNAL CONTROL AND CASH Identify the principles of internal control. Explain the applications of internal control to cash receipts. Explain the applications of internal control to cash disbursements. Prepare a bank reconciliation. Explain the reporting of cash. Discuss the basic principles of cash management. Identify the primary elements of a cash budget. Chapter 8 REPORTING AND ANALYZING RECEIVABLES Identify the different types of receivables. Explain how accounts receivable are recognized in the accounts. Describe the methods used to account for bad debts. Compute the interest on notes receivable. Describe the entries to record the disposition of notes receivable. Explain the statement presentation of receivables. Describe the principles of accounts receivable management. Identify ratios to analyze a company's receivables. Describe methods to accelerate the receipt of cash from receivables. Chapter 9 REPORTING AND ANALYZING LONG-LIVED ASSETS 1. Describe how the cost principle applies to plant assets. 2. Explain the concept of depreciation. 3. Compute periodic depreciation using the straight-line method, and contrast its expense pattern with those of other methods. 4. Describe the procedure for revising periodic depreciation 6 5. 6. 7. 8. Explain how to account for the disposal of plant assets. Describe methods for evaluating the use of plant assets. Identify the basic issues related to reporting intangible assets. Indicate how long-lived assets are reported on the balance sheet. Chapter 10 REPORTING AND ANALYZING LIABILITIES 1. 2. 3. 4. Explain a current liability and identify the major types of current liabilities. Describe the accounting for notes payable. Explain the accounting for other current liabilities. Identify the types of bonds. Prepare the entries for the issuance of bonds and interest expense. 5. Describe the entries when bonds are redeemed. 6. Identify the requirements for the financial statement presentation and analysis of liabilities. Chapter 11 REPORTING AND ANALYZING STOCKHOLDERS’ EQUITY Identify and discuss the major characteristics of a corporation. Record the issuance of common stock. Explain the accounting for the purchase of treasury stock. Differentiate preferred stock from common stock. Prepare the entries for cash dividends and understand the effect of stock dividends and stock splits. Identify the items that affect retained earnings. Prepare a comprehensive stockholders' equity section. Evaluate a corporation's dividend and earnings performance from a stockholder's perspective. Chapter 12 STATEMENT OF CASH FLOWS Indicate the usefulness of the statement of cash flows. Distinguish among operating, investing, and financing activities. Explain the impact of the product life cycle on a company's cash flows. Prepare a statement of cash flows using the indirect method. Use the statement of cash flows to evaluate a company. Chapter 13 FINANCIAL ANALYSIS: Understand the concept of sustainable income. 7 Indicate how irregular items are presented. Explain the concept of comprehensive income. Describe and apply horizontal analysis. Describe and apply vertical analysis. Identify and compute ratios used in analyzing a company’s liquidity, solvency, and profitability. Understand the concept of quality of earnings. 8