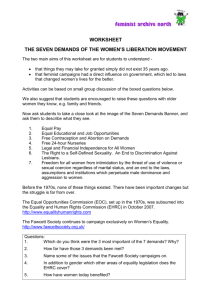

Promoting equality in pay

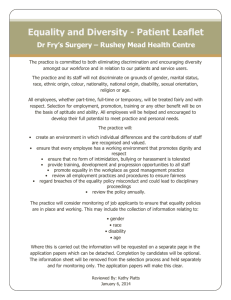

advertisement