Institutional Policy: Cost Sharing Commitments to Sponsored Projects

advertisement

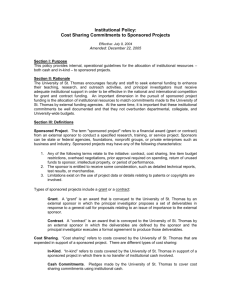

Cost Sharing Commitments to Sponsored Projects This document is a draft that was issued August 1, 2005. Section I: Purpose and Rationale This document states Eastern Illinois University’s policy on cost sharing. The policy is effective for proposals submitted and awards received on or after DATE, 2005. The policy was developed for the following purposes: 1. To provide guidance regarding the circumstances in which cost sharing is permitted by Eastern; including what kind of services, expenditures, or assets may be cost shared. 2. To provide information to the Eastern community regarding the contractual, financial, and administrative consequences of cost sharing. 3. To establish procedures which give the Eastern the ability to demonstrate to sponsoring agencies that the University has fulfilled any cost sharing commitments it has made as a condition of obtaining external sponsorship. Eastern encourages faculty and staff to seek external funding to enhance their teaching, research, and outreach activities, and principal investigators must receive adequate institutional support in order to be effective in the national and international competition for grant and contract funding. An important dimension in the pursuit of sponsored project funding is the allocation of institutional resources to match commitments made to Eastern by external funding agencies. At the same time, it is important that these institutional commitments be well documented and that they not overburden budgets at the level of department, college, or University. Section II: Definitions Cost Sharing. “Cost sharing” is the portion of project or program costs that are not provided by the sponsor. There are different types of cost sharing: In-Kind. “In-kind” refers to costs incurred in support of a sponsored project in which there is no transfer of institutional cash involved. In-kind contributions may come from Eastern or from a third party. Cash Commitments. Pledges made by Eastern to cover cost sharing commitments using institutional cash. Mandatory. Cost sharing that is required by the sponsor as a condition for funding. Voluntary. Cost sharing that is not required by the sponsor as a condition for funding. Committed. Mandatory or voluntary cost sharing that is pledged in the proposal and stated in the award documents. Uncommitted. Voluntary cost sharing that is not pledged in the proposal or stated in the award documents. Includes commitments that exceed those that were pledged in the original proposal. Reportable. Committed cost sharing that must be documented by Eastern and reported to the sponsor. Non-reportable. Committed cost sharing that must be documented by Eastern but need not be reported to the sponsor. Only voluntary uncommitted cost sharing fits this description. Section III: When to Commit to Cost Sharing Eastern should minimize cost sharing on sponsored projects. When constructing a budget for a grant or contract proposal, the principal investigator must consider all of the resources necessary to carry out the proposed project and: Commit all mandatory cost sharing (whether cash or in-kind), document the internal budgetary sources of these commitments, and obtain a signature from a person authorized to commit the resources. This is reportable cost-sharing. (Note: documentation supporting 3rd party contributions must also be secured by A-110 guidelines that include use of fair market value when assessing the in-kind contribution and obtaining letters of commitment from third parties.) Voluntary committed cost sharing (whether cash or in-kind) should be avoided when it is not required and minimized when it is required. Use of cost sharing as a strategy for enhancing the competitiveness of a proposal is recommended only if there is good reason to do so. The reason is that cost sharing, when reported to the federal government is considered research and is included in the university’s research base when calculating F&A rate. Increasing the amount of committed cost sharing increases Eastern’s research base and thus lowers the F&A rate during the proposal and negotiation of a new rate. This is reportable cost sharing. Document no more voluntary uncommitted cost sharing (whether cash or in-kind) at a level than is necessary to carry out the project. Add additional voluntary uncommitted cost sharing only if there is a good reason to do so. This is non-reportable cost-sharing. Section IV: Criteria for Valid Cost Sharing To qualify as cost sharing, costs must be all of the following: allowable and allocable under OMB Circulars A-21 and A-110, as well as the terms of the sponsored agreement; verifiable through effort reports or other appropriate documentation; clearly identified in Eastern’s financial accounting system necessary and directly related to the project objectives; The costs must not be: included as cost sharing for any other project or paid by the sponsor under another award (Federal funds must not be used as cost sharing on another federal project without prior approval). Section V: Allowable Forms of Cost Sharing Expenses Costs treated as direct costs on sponsored agreements may be used to meet a cost sharing obligation. Costs included in F&A costs may not. The following is a partial list of allowable forms of cost sharing: Direct expenses Effort of the PI and/or employees committed to sponsored agreements, including their associated benefits costs Tuition, fees, and stipends related to work performed by graduate students on sponsored agreements Cost of equipment purchases when the purchase of equipment is necessary for, and dedicated to, the successful completion of the project. (Note that equipment purchased late in the project may not be allowable.) Existing equipment made available for, but not dedicated to, the performance of sponsored agreements is not considered cost sharing. laboratory supplies travel Unrecovered F&A costs Waived or reduced F&A costs. This is the difference between the applicable negotiated F&A cost rate and the amount of F&A costs awarded by the sponsor. This amount may be used as cost sharing if approved by the sponsor. When direct expenses are cost shared, the associated F&A rate is automatically cost shared. Examples of expenditures which may not be used as cost sharing Expenditures normally treated as F&A, such as administrative salaries and office supplies Unallowable costs, such as alcoholic beverages, entertainment, etc. Section VI: Prioritizing Commitments of Cost Sharing Eastern should commit cost sharing resources as a way to enhance the competitiveness of grant proposals submitted to external agencies by our faculty and staff. In light of the fact, however, that institutional resources are limited, it is important to allocate cash and in-kind commitments according to a set of transparent priorities: Absolute Priority (requests for cost sharing must meet this priority) Proposed projects must be consistent with the academic mission and short-, medium-, and long-range strategic goals of the academic home of the principal investigator in particular and Eastern as a whole. Higher Priority Requests Projects for which grant funding is requested from an external agency that requires or strongly encourages institutional cash and/or in-kind matching funds in its published solicitation; Projects for which there would not be adequate funding without the infusion of institutional cash or in-kind matching funds; Projects that position a faculty member or Eastern to produce additional and more competitive proposals in the future; Projects whose anticipated benefits are accrued across disciplinary and collegiate borders; Projects that seek to build broader institutional capacities and position additional faculty and staff members to pursue grant seeking more effectively; Projects that directly engage more than one faculty or staff member; and, Projects that build on current faculty research or broader institutional initiatives and promise to advance that research or those initiatives in new and dramatic ways. Lower Priority Requests Projects focused on issues for which the faculty or staff member has little demonstrable expertise or previous experience; Projects whose anticipated benefits will be primarily accrued by individuals, organizations, or communities external to Eastern; Projects for which funding is being sought from an agency that does not require or explicitly recommend the investment of institutional matching funds as a strategy for enhancing the competitiveness of a grant proposal; Projects already deemed competitive without the commitment of institutional matching funds; and, Projects whose anticipated benefits to Eastern are limited or transitory and promise no longerterm impact on the research, teaching, or outreach missions of the University. Section VII Documentation of Cost Sharing When cost sharing or matching is accepted by the sponsor, it becomes a commitment of the University. Throughout the project’s life, the principal investigator and the administrating unit must maintain sufficient documentation to substantiate the actual cost sharing contribution and make those records available to the funding agency, should the agency require them. The specific type of documentation required is determined by the nature of the award, the type of cost sharing, the terms of the sponsored agreement, and other circumstances of the award. When the effort of an Eastern employee is committed to an award as cost sharing, Eastern is bound to contribute the effort and to track, record, and report the associated expenditures. Cost sharing must be recorded each semester on the employee’s effort report. Effort reports are produced automatically for any employee who devotes effort to a sponsored project. Equipment may be cost shared only if title to the equipment is in the University’s name and it was acquired with non-federal funds. The department must maintain documents proving that federal funds were not used to acquire the equipment. In lieu of committing equipment for cost sharing, the Principal Investigator could characterize the equipment in the proposal as: "available for the performance of the sponsored agreement at no direct cost to the sponsor." Eastern may offer as cost sharing: (a) time and effort and, (b) goods and service and (c) facilities, contributed by third parties such as a subcontractor under its prime award. The Principal Investigator is responsible for securing records of and reporting such third party cost sharing. If a potential subcontractor makes a cost sharing commitment which appears in the budget of the proposal, the subcontractor is required to maintain records and report the cost sharing in its financial reports to the University. This requirement should be part of the terms and conditions on any subcontract agreement issued by the University. If cost sharing is provided by a third party who is not a subcontractor, the Principal Investigator must provide documentation proving the value of the contributions if the contributions are not cash. Section VIII Accounting Procedures When a proposal is submitted, all cost sharing must be clearly identified in terms of both the dollar value and the account from which the dollars will come. At the time a grant account is created, a companion cost-sharing account will be created. Cost sharing money will be transferred to this companion account. Cost sharing expenses will be charged against this cost sharing account. Funding for cost-shared faculty effort, in particular, should be charged against the companion account for the appropriate effort percentages and time period. During the period of performance, cost-shared effort that was specified in a proposal or award, or contributed effort of 5% or greater should be charged to the appropriate companion account. The amount initially calculated as cost sharing will not be changed during the life of the project unless there is a significant change in the amount of the cost shared effort. Contributed effort less than 5% which was not specifically committed in a proposal or award should not be classified as cost sharing on Effort Reports and should not be charged to the companion account. As mentioned in section VII, the department should maintain individual documentation and records of cost sharing expenditures for each grant. At the end of each effort reporting period (Fall, Summer, and Spring semesters), Accounting will generate for each department a report that lists all cost sharing expenditures by grant during the period. This report will be known as the “Cost Share Certification.” The department chair or director is responsible for determining that the percentage of time devoted to a project by faculty or staff is reasonable and that no individual’s total level of effort exceeds 100%. The signature of the department chair or director on Cost Share Certifications will serve as evidence of review and approval of the commitment. Completed Cost Share Certification forms will be returned to the Office of Grants and Research, where they will be filed.