Appendix_F.6_EconomicTables

advertisement

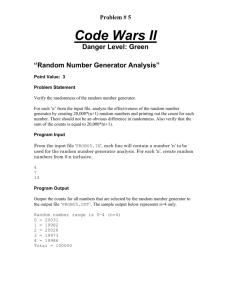

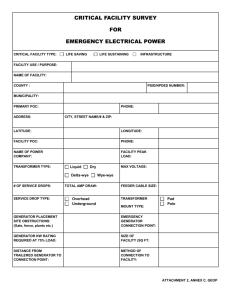

Draft Appendix F.6- RMATS Economic Comparison Tables Purpose The purpose of the economic comparison tables is to compare the value of resource and transmission expansion alternatives on a screening study basis. The comparison takes into account the production (fuel and other variable O&M) costs of each alternative, the capital investment requirements in new resources and transmission, and associated annualized fixed costs. The annualized costs of each alternative are then compared to Reference Cases to establish annual net savings or costs. Economic Comparison Tables The data in the economic comparison tables were developed in three steps: 1) determine production costs using ABB Market Simulator 2) determine total initial capital investment requirements; 3) calculate annualized costs associated with each required investment. Step 1: Production costs were determined using ABB Market Simulator and described in detail in Chapter 2. Step 2: Total initial capital investments requirements of each alternative are shown in the column labeled “Initial Investment” and are grouped into generating resource and transmission investments. Resource costs include wind, gas and coal capital investment amounts as well as associated transmission integration costs of the above mentioned resource additions in the Rocky Mountain States (Table F.6.1, lines 5:11). Table F.6. 1: Sample Table Initial Investment 1 2 3 4 5 6 In the case of Recommendation 2, the resource costs are adjusted downward to the extent that the Rocky Mountain region builds resources for export (Table F.6.1, line 12). Resource capital investment requirements are based on the development and construction cost estimates by resource category from draft Northwest Power and Conservation Council’s (NWP&CC) reports, “New Resource Characterization for the Fifth Power Plan” and from a California Energy Commission report on renewable resources. Transmission costs include capital investment amounts associated with transmission lines as well as any required customized equipment costs (Table F.6.1, 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 Production Costs (Fuel & Other VOM) Change from All Gas Case [Column A] Change from IRP- Based Case [Column B] Resource Costs: RM Resource Additions Capex Wind Gas thermal Coal thermal Incremental Transmission Integration Capex RM Resource Capex Sub Total Adj. Outside RM Resource Additions Capex Other RM Costs Incremental Capital Charge @ 10% Incremental Fixed O&M Wind "wear and tear" Subtotal Other RM Costs Adj. Other Costs Outside RM Total Resource Costs 3,766 373 7,857 311 12,306 (2,257) Transmission Costs: Incremental Line Capex Customized Equipment Capex RM Transmission Capex Sub Total 3,872 393 4,265 26 27 28 Incremental Fixed O&M Incremental Capital Charge @ 10% RM Transmission Costs 4,265 29 30 Annualized Costs 22 23 24 25 31 32 Total Initial Investment Annual Net (Savings)/Cost from All Gas Case 34 Annual Net (Savings)/Cost from IRP- Based Case 14,315 33 Appendix F 78 Draft lines 21:24). Transmission costs were estimated on a line by line basis using historical data and professional judgment of the members of the RMATS Resource and Transmission Addition Work Groups. Step 3: Annualized costs associated with each alternative are shown in the column labeled “Representative Year”. In this column, the production costs developed by ABB Market Simulator (as described in Chapter 2) are combined with annual fixed costs associated with the total investment requirements of each alternative. Table F.6. Sample Table The production costs are fuel and other variable O&M and are compared to the Reference case’s production costs (Table F.6.2, lines 1:3). Annualized fixed costs include resource and transmission capital charges associated with initial investment and fixed O&M (Table F.6.1, lines 13:19 and lines 26:28). 1 2 3 4 5 6 7 8 9 10 11 12 Annual capital charges are shown as a percentage of the initial investment. In general, annual capital charge is calculated by discounting back at the rate of the cost of capital inflation adjusted (real) streams of depreciation, return on capital, property and income taxes, interest, replacements and administrative and general costs over the depreciable life of the asset. In this analysis, the capital charge is assumed to be 10% of the initial investment for both generation and transmission resources based on research by Cambridge Energy Research Associates (CERA) (Table F.6.1, line 14 and 27). 13 14 15 16 17 18 19 20 21 22 23 24 Production Costs (Fuel & Other VOM) Change from All Gas Case [Column A] Change from IRP- Based Case [Column B] Resource Costs: RM Resource Additions Capex Wind Gas thermal Coal thermal Incremental Transmission Integration Capex RM Resource Capex Sub Total Adj. Outside RM Resource Additions Capex Other RM Costs Incremental Capital Charge @ 10% Incremental Fixed O&M Wind "wear and tear" Subtotal Other RM Costs Adj. Other Costs Outside RM Total Resource Costs Representative Year 18,458 (2,560) (1,588) 1,231 245 94 1,570 (254) 1,316 Transmission Costs: Incremental Line Capex Customized Equipment Capex RM Transmission Capex Sub Total 25 26 27 28 Incremental Fixed O&M Incremental Capital Charge @ 10% RM Transmission Costs 29 30 Annualized Costs 85 427 512 1,828 31 32 Total Initial Investment Annual Net (Savings)/Cost from All Gas Case 34 Annual Net (Savings)/Cost from IRP- Based Case (986) (525) 33 Fixed O&M amounts are calculated separately for each type of resource based on estimates provided by NWP&CC (Table F.6.1, line 15). In the case of wind resources, a “wear and tear” impact on non- wind resources was included (line 16). Transmission fixed O&M is assumed to be 20% of the annual capital charge based on a recent transmission study by CERA. (Table F.6.1, line 26). Resource and transmission capital charges and fixed O&M were combined to produce annualized costs of each alternative (Table F.6.1, line 30). The production costs as well as Appendix F 79 Draft annualized fixed costs associated with each alternative were compared to Reference Cases and other alternatives to obtain annual net savings and confirm economic viability. Distribution of Economic Gains and Losses The economic comparison tables show the costs and savings on an aggregate, interconnectionwide basis. The question then becomes where the economic gains and losses may fall within the West. Table F.6.3 below takes a first look at the spatial distribution of costs and savings by regional area and by load (consumers) and generator category. These tables are predicated on LMPs, which are driven by loads, fuel prices, generation levels, and other variables at the nodal level. (See Chapter 2 for a discussion of LMPs.) LMPs are transitory, and arguably they are insufficient for predicting where benefits will fall. The distributions reflect fuel and other VOM on an economic modeling basis. They do not include capital & fixed O&M costs. Effectively, the distributions assume a real-time competitive market in which pricing is on an hourly, LMP basis. In fact, state regulatory treatment of these gains and losses could change the mix between loads and generators substantially. The net impact on a region can be estimated by subtracting the Generator Gross Margin column from the Load column LMP is the Load Cost divided by GWhEssentially this is the average regional LMP for the year LMP is the Generator Revenue divided by GWh- Essentially this is the average regional LMP for the year Table F.6. 3: Economic Gross Gains & Losses Table Load Region Rocky Mountain Northwest Canada Mexico California Desert Southwest Total Total energy demanded by loads represented in GWh Appendix F GWh 161,635 193,131 142,702 19,848 335,938 162,512 1,015,766 LMP 48.24 49.22 48.83 48.20 51.47 49.02 49.70 Total generator production costincludes fuel and other VOM Generator Cost (MM) 7,797 9,505 6,968 957 17,291 7,967 50,484 The hourly demand at each load node times the hourly LMP ($), summed for the year. GWh 195,545 201,812 146,257 25,404 221,372 225,373 1,015,763 LMP 47.10 48.67 48.63 47.75 52.04 48.36 49.00 Revenue (MM) 9,209 9,821 7,113 1,213 11,521 10,899 49,777 VOM (MM) 2,361 2,404 1,996 879 6,117 6,024 19,780 Gross Margin (MM) 6,848 7,418 5,117 334 5,404 4,875 29,997 The hourly generation at each generator node times the hourly LMP, summed for the year. Total energy generated in GWh Revenues minus VOM= Generator Gross Margin Load Minus Generator 949 2,088 1,850 623 11,887 3,091 20,488 Load Cost minus Generator Gross Margin, used to calculate total benefits in Chapter 3 80 Draft Tables B.6.4 – B.6.7 display the gross amounts used to calculate the regional gains and losses in Chapter 3. For example, to calculate the Load Benefit for the Rocky Mountain Region in Table 3.7 (chapter 3), subtract the Rocky Mountain Load Cost in Table B.6.4 ($7,797 Million) from the Rocky Mountain Load Cost in Table B.6.7 ($7,920 million). This yields a load benefit of $123 million. Table F.6. 4: Recommendation 1 Load Region Rocky Mountain Northwest Canada Mexico California Desert Southwest Total GWh LMP 161,635 193,131 142,702 19,848 335,938 162,512 1,015,766 48.24 49.22 48.83 48.20 51.47 49.02 49.70 Generator Cost (MM) 7,797 9,505 6,968 957 17,291 7,967 50,484 GWh 195,545 201,812 146,257 25,404 221,372 225,373 1,015,763 LMP 47.10 48.67 48.63 47.75 52.04 48.36 49.00 Revenue (MM) 9,209 9,821 7,113 1,213 11,521 10,899 49,777 VOM (MM) 2,361 2,404 1,996 879 6,117 6,024 19,780 Gross Margin (MM) 6,848 7,418 5,117 334 5,404 4,875 29,997 Load Minus Generator 949 2,088 1,850 623 11,887 3,091 20,488 Table F.6. 5: Recommendation 2 Load Region Rocky Mountain Northwest Canada Mexico California Desert Southwest Total GWh 161,635 193,131 142,702 19,848 335,938 162,512 1,015,766 LMP 43.57 46.88 47.52 47.24 49.71 47.32 47.45 Generator Cost (MM) 7,042 9,053 6,781 938 16,699 7,689 48,202 GWh 217,225 196,704 144,743 25,173 216,187 215,731 1,015,762 LMP 41.75 46.38 47.34 46.84 49.75 46.73 46.33 Revenue (MM) 9,070 9,123 6,852 1,179 10,755 10,081 47,060 VOM (MM) 2,340 2,178 1,919 867 5,562 5,592 18,458 Gross Margin (MM) 6,729 6,945 4,933 312 5,193 4,489 28,602 Load Minus Generator 313 2,108 1,847 626 11,505 3,200 19,600 Table F.6. 6: IRP Based Reference Case Load Region Rocky Mountain Northwest Canada Mexico California Desert Southwest Total GWh 161,635 193,131 142,702 19,848 335,938 162,512 1,015,766 LMP 48.21 49.55 48.97 48.24 51.63 49.08 49.84 Generator Cost (MM) 7,793 9,570 6,988 957 17,345 7,976 50,629 GWh 190,671 202,593 146,500 25,421 224,726 225,851 1,015,762 LMP 47.30 49.02 48.77 47.79 52.19 48.39 49.19 Revenue (MM) 9,018 9,931 7,144 1,215 11,728 10,930 49,966 VOM (MM) 2,465 2,435 2,007 880 6,214 6,046 20,046 Gross Margin (MM) 6,554 7,496 5,137 335 5,514 4,884 29,920 Load Minus Generator 1,239 2,075 1,851 622 11,831 3,091 20,709 Table F.6. 7: All Gas Reference Case Load Region Rocky Mountain Northwest Canada Mexico California Desert Southwest Total Appendix F GWh 161,635 193,131 142,702 19,848 335,938 162,512 1,015,766 LMP 49.00 49.88 49.08 48.17 51.74 49.02 50.07 Generator Cost (MM) 7,920 9,634 7,004 956 17,381 7,966 50,862 GWh 188,658 203,853 146,785 25,432 224,434 226,603 1,015,765 LMP 48.58 49.38 48.86 47.72 52.29 48.32 49.52 Revenue (MM) 9,165 10,066 7,171 1,214 11,736 10,950 50,303 VOM (MM) 3,300 2,488 2,019 880 6,256 6,075 21,018 Gross Margin (MM) 5,865 7,578 5,152 333 5,480 4,875 29,284 Load Minus Generator 2,055 2,055 1,852 623 11,901 3,091 21,577 81